How to Fill Out a W9: Step-by-Step Guide for 2025

A W-9 is a form used to make a written request to the IRS for confirmation of a person’s Taxpayer Identification Number (TIN).

If you’re a freelancer or independent contractor, you will most likely be asked to fill this out for any client who pays you for work performed, as it gives them the information they need to file a 1099 and other important tax documents.

In this article, we’ll look at the purpose and function of form W-9, how it differs from a W-4, and how to fill it out to ensure accurate, correct information under tax law.

Key Takeaways

- A W-9 form is an IRS tax form that a freelancer or contractor fills out.

- W-9 forms are required for all self-employed workers, like independent contractors, vendors, freelancers, and consultants.

- W-9 forms show whether the taxpayer is subject to backup withholding or is responsible for paying their own taxes.

- A W-9 is different from a W-4, as it is provided to independent contractors and freelancers rather than being filled out when an employee begins a new job with an employer.

- W-9 forms need to include specific information before you submit them to the IRS.

- Single-member LLCs and corporations will file W-9 forms differently.

Table of Contents:

- Who Is Required to Fill Out a W-9?

- How to Fill out a W-9

- How To Fill Out A W9 For An LLC

- What’s the Difference Between a W-9 and a W-4 Tax Form?

- Navigate Tax Time Effortlessly with Freshbooks

- FAQs About How to Fill Out a W9 Form

Who Is Required to Fill Out a W-9?

The W-9 form must be filled out by all kinds of self-employed workers, like independent contractors, vendors, freelancers, and consultants. This tax form allows businesses to keep track of their external workforce and helps the IRS ensure that freelancers are paying into social services.

As a contractor or freelancer, if you have completed jobs for multiple businesses, you may have to fill out multiple W-9 forms.

Apart from freelancers, professional consultants, trade workers, and independent contractors, the W-9 tax form must be completed for any income earned on mortgage interest paid by individuals, specific real estate transactions, and dividends paid to shareholders. Individuals receiving compensation for various financial transactions, including the collection of student loan interest, may also need to fill out a W-9 form.

How to Fill out a W-9

Now that you understand how form W-9 works and functions within the greater tax system, let’s take a look at how to fill out your form W-9 for federal tax purposes.

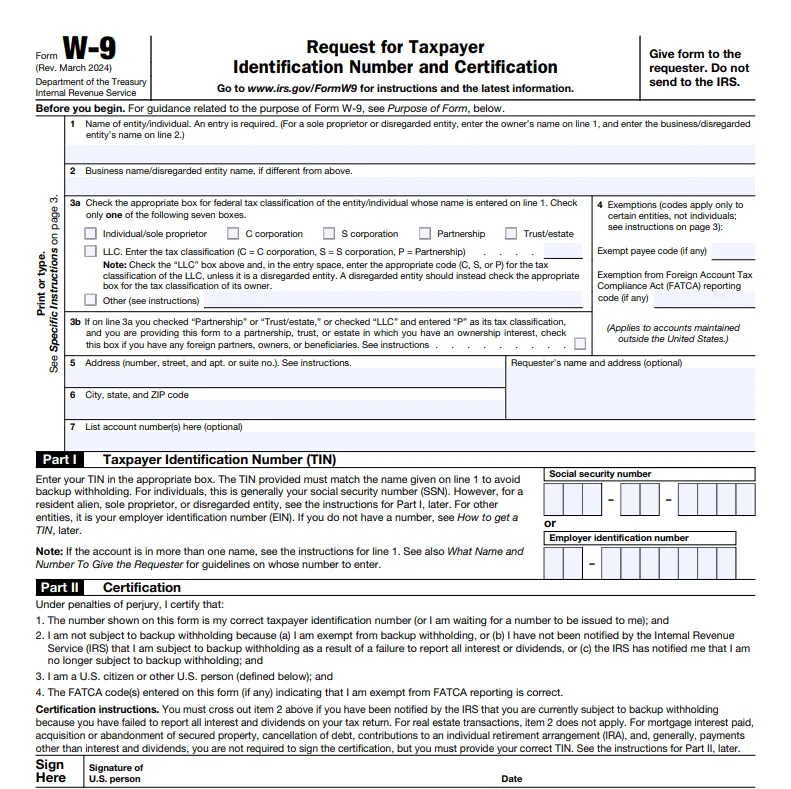

Line 1 – Name

Firstly, enter your full legal name at the top of the form. The name you print here must match the name shown on your federal income tax return.

Line 2 – Business name

On line 2, write your business name, trade name, DBA name, or disregarded entity name. If you do not own a business, leave this line blank.

Line 3 – Federal tax classification

Check the appropriate box to indicate the classification under which you (as an independent contractor) are considered for tax purposes.

Taxes for sole proprietorships and single-member LLCs are typically classified under the owner’s Social Security number, though you can obtain an EIN for any business structure.

If your business is an LLC or partnership with multiple members, use the adjacent blank space adjacent to the LLC box to add your LLC details: mark “P” if your LLC is treated as a partnership or a “C” or “S” (depending on the type of corporation in question) if your LLC is taxed as a corporation. If you leave this space blank, your LLC will be treated as a partnership.

Line 4 – Exemptions

Certain businesses and entities will need to use this section to report any exemptions, along with the relevant code indicating the reason.

If your business or entity is exempt from backup withholding, fill in the first line under line 4 with your relevant code. If your business is not exempt, however, the company that hired you will be required to withhold taxes from your net pay at a flat rate of 24%, which is sent to the IRS directly. This process is known as backup withholding.

Lines 5 and 6 – Address

Write your business address, including street name, number, and unit number if applicable, on line 5. Line 6 leaves space to enter the relevant city, state, and ZIP code.

Line 7 – Account information

Line 7 is optional and is there to provide the account number(s) of any accounts your employer might need, like your Taxpayer Identification Number (TIN), Employee Identification Number (EIN), Social Security Number (SSN), or your Individual Taxpayer Identification Number (ITIN).

Certify that everything you’ve entered on the form is correct and factual to the best of your knowledge. Read the instructions carefully to ensure you sign, date, and certify the W-9 correctly to prevent any unnecessary delays.

When you’re finished, return the form to the company or individual who issued it to you, not to the IRS.

How To Fill Out A W9 For An LLC

A single-member Limited Liability Company is considered a disregarded entity by the Internal Revenue Service for federal income tax purposes, so a sole member of an LLC must file taxes in the same way that sole proprietors do.

1. Enter your name and the legal name of your LLC on the first two lines of the W-9.

2. Enter the business address, city, state, and ZIP code.

3. Check the “LLC” box and in the right space, enter the appropriate tax classification code (C = C corporation, S = S corporation, P = Partnership).

4. Enter your Social Security number or the employee identification number (EIN) you’ve obtained in your capacity as a sole proprietor.

5. Sign the certification and submit the W-9 form to the requester.

Corporation or partnership

If the LLC is a corporation or partnership, follow the steps below:

1. Enter the name of the LLC as recorded in the tax documents. If the LLC has a secondary business name, enter it on the second line.

2. Check the “Limited Liability Company” box.

3. On the tax classification line, write a “P” for partnership, “S” for S Corporation, or “C” for the corporation.

4. Enter the business address, city, state, and ZIP code

5. Enter the employer ID number of the LLC

6. Sign and date the W-9 and submit it to the requester

Freelancers and contractors must fill out the W-9 form for every client they’ve worked for. Save a copy of the W-9 form for your own records so you can contact a client if you are missing a 1099-MISC or 1099-NEC come tax time. As a side note, 1099’s are not required if you are an S-Corp or C-Corp.

Also Read: What is My LLC Tax Classification

What’s the Difference Between a W-9 and a W-4 Tax Form?

Unlike a W-4, which is filled out when an employee begins a new job with an employer, a W-9 is provided to independent contractors and freelancers.

Because employers pay taxes out of their employee’s gross earnings, the W-4 is used to determine how much is withheld from your paychecks. Since companies do not withhold money from independent contractors for federal tax purposes, the W-9 form is used to confirm that the contractor or freelancer agrees that they are responsible for paying their own taxes out of their gross earnings.

Navigate Tax Time Effortlessly with Freshbooks

Understanding the details of your W-9 form makes tax time easier. FreshBooks is an all-inclusive, user-friendly, cloud-based accounting software solution designed to help contractors, sole proprietors, freelancers, and small businesses approach taxes with ease and confidence by managing and organizing tax time reporting, including W-9 forms.

With FreshBooks accounting software, you can keep track of vendor information, generate reports, and stay on top of tax compliance, keeping payments, tax forms, and other financial details organized throughout the year. Try FreshBooks for free today.

FAQs About How to Fill Out a W9 Form

Do you have any questions about filling out your W-9 or anything else to do with paying taxes as a contractor? Here are some commonly asked questions.

How much taxes will I pay on a W-9?

The exact amount you’ll pay in federal income taxes completely depends on your gross earnings for that year as an independent contractor. However, if you are subject to backup withholding, your payer will withhold 24% of your total earnings and send those funds directly to the IRS.

Is a W-9 the same as a 1099?

No, A W-9 (or multiple) is an essential step in filling out a 1099, however. Independent contractors fill out a W-9 form to confirm their tax obligations for each of their clients or customers, who will, in turn, use these tax forms to fill out their 1099. The 1099 form details the worker’s income for federal tax purposes and goes hand-in-hand with the W-9 form. To learn more about the 1099 form and the filing process, follow our guide titled How to File a 1099

Can you fill out a W-9 as an independent contractor without a business?

Yes. If you are an independent contractor without a business, you will still need to fill out a W-9 as an individual, a sole proprietor, or a single-member LLC. Simply fill under your name and SSN to file form W-9 without a business.

What happens if you don’t fill out a W-9?

Failing to fill out a W-9 can lead to ramifications from the IRS. If you fail or refuse to provide a filled-out W-9 form, you will be fined $50 for each failure. Furthermore, a payee who refuses to fill out a W-9 (or provides false information) will be subject to backup withholding, requiring the payer to withhold taxes at a rate of 24% on all future earnings.

How much does it cost to fill out a form W-9?

Filling out a W-9 form itself does not typically cost anything, as the form is provided by the Internal Revenue Service (IRS) and can be downloaded for free from their website. However, if you need assistance filling out the form, you may need to hire a tax professional or accountant, which could result in fees or charges.

Reviewed by

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

Tax Preparation Checklist: Information You Need Before Filing Taxes

Tax Preparation Checklist: Information You Need Before Filing Taxes Requirements for Tax Exemption: Tax-Exempt Organizations

Requirements for Tax Exemption: Tax-Exempt Organizations What Is FICA Tax? Understanding Payroll Tax Requirements

What Is FICA Tax? Understanding Payroll Tax Requirements Tax Depreciation: The Impact of Depreciation on Taxes

Tax Depreciation: The Impact of Depreciation on Taxes Tax Classifications for LLC: Everything You Need to Know

Tax Classifications for LLC: Everything You Need to Know How to Calculate Withholding Tax (4 Easy Steps)

How to Calculate Withholding Tax (4 Easy Steps)