Tax Classifications for LLC: Everything You Need to Know

Updated on March 28, 2019 | 7 min. read

🌟 KEY TAKEAWAYS

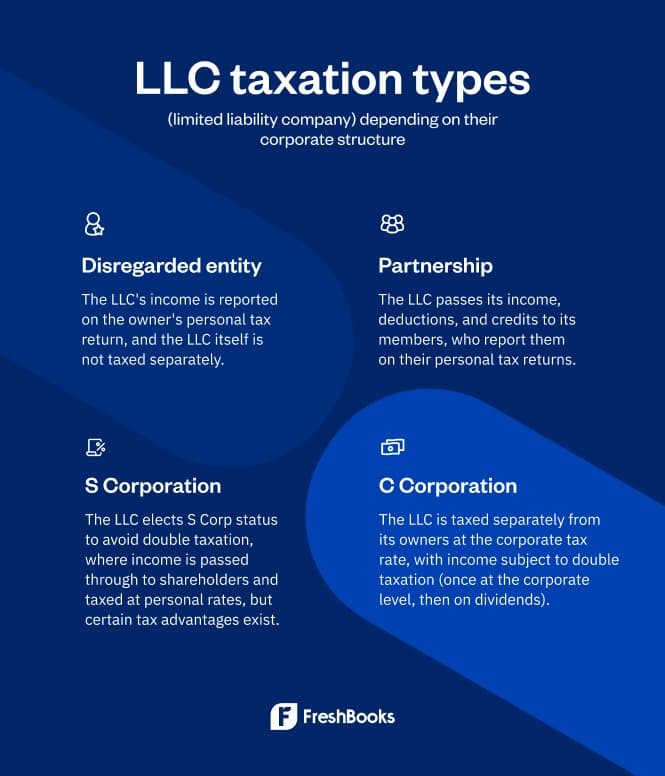

A Limited Liability Company has flexible tax classification options, so it can be taxed as any recognized business structure.

There is not a fixed tax rate for LLCs. Rather, the rate depends on whether the business is classified as a disregarded entity, a partnership, an S Corp, or a C Corp.

Limited Liability Companies (LLCs) are taxed by default as a disregarded entity (separate from its owner) unless classified as a Corporation.

The 3 factors influencing tax classification are how the business is structured, the level of liability protection you want, and the tax benefits you want to take advantage of.

The benefits of default tax classification are avoiding double taxation and saving time and money.

This guide will cover the default tax classifications for LLCs, the different tax structures they can choose (and the benefits of each option), and the key factors to consider when selecting a tax classification.

What is the LLC Default Tax Classification?

By default, a single-member LLC is taxed as a disregarded entity not separate from its owner (a sole proprietorship), while multiple-owner companies are taxed as a partnership by default.

The LLC pays income tax based on the ownership structure and the business type. The owner of an LLC is referred to as a member. If an LLC has 1 member, it’s known as a single-member LLC. Limited Liability Companies can also be owned by a corporation, a trust, and another LLC.

LLCs are usually classified as “pass-through” entities for tax reasons, meaning the business profits and losses will flow through to the personal tax return of each member. That’s the case even if the LLC is structured as a S Corporation.

An LLC can elect to be taxed as an S Corporation or a C Corporation. To be taxed as an S-Corporation, the LLC must file IRS form 2553. To be taxed as a C Corporation, the LLC must complete IRS form 8832.

What Taxes Does an LLC Pay?

There are 4 different Taxation types for LLC depending on their corporate structure.

1. Disregarded Entity

If the LLC is structured as a sole proprietorship for taxation, it’s treated as a disregarded entity by the IRS. A disregarded entity is a type of business that exists separately for the business and its owner for liability and legal purposes but not for taxation.

This means that the LLC’s income and expenses flow through to the owner’s personal tax return. The tax amount is calculated based on the owner’s tax rate

2. Partnership

If the LLC has more than 1 member, it’s taxed as a partnership by default. Similar to taxation as a sole proprietorship, the taxes incurred by a multi-member LLC pass directly through to those partners in the business.

The members file an information return on Form 1065 indicating the total profits and losses from the partnership. In addition, the members receive a Schedule K-1 tax form to report their portions of the profit or loss. This form is included with the member’s personal tax return. They are then taxed on their partnership percentage of the LLC’s profits and losses.

3. S Corporation

For tax purposes, businesses can choose to be classified as corporations. When an LLC chooses an S Corporation tax classification, all taxes resulting from business activities are passed through to the personal tax obligations of an LLC’s owners.

The S Corporation does not have to pay federal taxes on profits. This means that the S corporation owners can report the profits and losses of the LLC on their personal tax returns and not incur double taxation. The tax returns are filed on Form 1120-S and the owners receive Schedule K-1.

4. C Corporation

While it’s complex to structure your LLC as a C Corporation, there are advantages. When the LLC is taxed as a C Corporation, it means that the LLC is taxed directly as a separate business entity, so the taxes incurred by the business are not passed through to the owner’s personal taxes.

This structure separates the owner’s personal and business assets and allows businesses to take advantage of deductions.

However, double taxation is the biggest disadvantage of an LLC taxed as a C Corporation, as the LLC must file a business income tax return with the IRS (form 1120: U.S. Corporation Income Tax Return), and the owners must also file personal income taxes that include their wages and dividend payments.

Benefits of Default Tax Classification

The biggest benefits of default tax classification are:

- Avoiding Double Taxation: Your company’s taxes and your personal income tax return are not separate. This means you don’t have to worry about being taxed at both the corporate and personal levels in 1 calendar year.

- Saving Time: With the default classification, you will have less paperwork to do at tax time, so you can spend more time growing your business.

- Saving Money: Being taxed as both an individual and a business means that you pay for 2 tax return preparations, and you may end up paying more taxes. By using the default classification, you’ll avoid double taxation.

FreshBooks can help streamline and organize complex paperwork and give everything your accountant needs for taxes. Check out our easy-to-use accounting software today. Click here to sign up for your free trial.

Factors that Influence Tax Classification Selection

3 factors influence tax classification selection and they are:

- Business Structure and Ownership: The way a business is structured and owned, such as a sole proprietorship, partnership, corporation, or limited liability company (LLC), can impact its tax classification selection.

- Liability Protection: The level of liability protection a business desires, such as protection of personal assets from business debts and lawsuits, can influence its tax classification selection.

- Tax Benefits and Implications: The tax benefits and implications associated with each tax classification, such as the ability to deduct business expenses or pay lower tax rates, can also play a role in determining the best tax classification for a business.

What is the Tax Rate for LLCs?

There is no fixed tax rate for LLCs; rather, the rate depends on whether the business is classified as a disregarded entity, a partnership, an S Corporation, or a C Corporation.

As most LLCs, other than C Corporations, are pass-through entities, they don’t have tax liability themselves; the income generated by the entities is taxed on the individual’s federal income tax based on their tax bracket.

C Corporations, on the other hand, face corporate tax rates. Currently, the federal rate is 21%, and many states have additional corporate taxes. Profits and dividends distributed to members are also subject to capital gains tax.

Self-employment taxes may also be a factor for members, meaning if you’re an LLC member taxed as a sole proprietor or partner, you’ll pay the employer and employee portions of self-employment tax using IRS Form 1040.

Conclusion

Choosing the right tax classification is important for an LLC to optimize tax savings and compliance during tax time. If you’re a small business owner or LLC partner, you can use FreshBooks accounting software to streamline your tax process and maximize deductions. FreshBooks simplifies tax preparation by tracking expenses, organizing financial records, and generating detailed reports tailored to make filing your taxes easier than ever.

Sign up for a 30-day trial to try FreshBooks for free and find out how much easier doing your LLC taxes can be.

FAQs on Tax Classification for LLC

The following frequently asked questions will help you better understand LLC tax classifications and how they work.

What is the best tax classification for an LLC?

The best LLC tax classification will be the one that best fits the specific requirements of the company as well as your personal preferences. Other factors, such as personal income outside of the company, also play a major role in determining which tax structure will be the most effective.

Can I change my LLC tax classification?

Yes, you can change your LLC tax classification using IRS Form 2553 or 8832. It’s always smart to consult a tax professional for advice when changing LLC tax status to a C or an S, as they’ll help you choose the most financially beneficial classification for your business.

What is LLC tax classification on Form W-9?

Form W-9 is an Internal Revenue Service (IRS) form that LLCs must prepare for contracting parties at their request. Within that form, the LLC owner must specify its company’s tax classification for legal purposes. For detailed instructions on completing the W-9 form for an LLC, please consult our guide, ‘How to Fill Out a W-9 for LLC.

How do I know what classification my LLC is?

Unless you have elected to pursue an alternative classification, your LLC will either default to a Disregarded Entity (Sole Proprietorship) or a Partnership depending on the number of owners in your business.

How do I maximize my LLC tax deductions?

Maximizing tax deductions for LLC involves determining which tax classification best suits your company’s needs and business income. Depending on personal income, business income, and other factors, you have opted to remain in the default classification (Disregarded Entity, Partnership) or potentially elect to become an S or C Corporation.

How do LLC owners avoid taxes?

There is no way to avoid paying taxes. You can do some planning to lower the tax amount or postpone paying taxes.

What type of LLC pays the least taxes?

The way to pay the least amount of tax as a business owner will depend on many factors, like the revenue generated, the number of partners, and your income outside of the business.