What is Interest Expense?

Interest expense is the amount a company pays in interest on its loans when it borrows from sources like banks to buy property or equipment.

- What Is Interest Expense in Accounting?

- How Do You Find Interest Expense in Accounting?

- How Is Interest Expense Calculated?

1. What Is Interest Expense in Accounting?

Interest expense is the total amount a business accumulates (accrues) in interest on its loans. It’s the cost of borrowing funds, in short. Businesses take out loans to add inventory, buy property or equipment or pay bills.

Interest expense is important because if it’s too high it can significantly cut into a company’s profits. Increases in interest rates can hurt businesses, especially ones with multiple or larger loans.

Businesses with more assets are hit hardest by interest rate increases. For example, businesses that have taken out loans on vehicles, equipment or property will suffer most.

The Globe and Mail suggests talking to your lender about your debt repayment plan should interest rates rise. It may also be time to look at your business plan and make sure it can accommodate rate increases. Otherwise, staying profitable and growing your business could prove challenging.

2. How Do You Find Interest Expense in Accounting?

You can find interest expense on your income statement, a common accounting report that’s easily generated from your accounting software. Interest expense is usually at the bottom of an income statement, after operating expenses.

Sometimes interest expense is its own line item on an income statement. Other times it’s combined with interest income, or income a business makes from sources like its savings bank account.

If interest income and expense are combined, the line item can be called “Interest Income – net” or “Interest Expense – net.” The former is used if there’s more interest income than expense. The latter is used if there’s more interest expense than income.

For example, if a business pays $100 in interest on a loan and earns $10 in interest from a savings account, then there are more expenses than income and the line item could be “Interest Expense – Net” for $90.

3. How Is Interest Expense Calculated?

Interest expense is calculated using the following formula:

Average Balance of Debt x Interest Rate

For example, a business borrows $1000 on September 1 and the interest rate is 4 percent per month on the loan balance. The interest expense for September will be $40 ($1000 x 4%). The business then pays $500 on the loan on October 1. The interest expense for October will be $20 (500 x 4%).

That said, interest is also tax deductible. Let’s say a business has total annual earnings before tax of $100,000. If the tax rate is 30%, the owner would normally need to pay $30,000 in taxes. But, if they have an interest expense of $500 that year, they would pay only $29,500 in taxes.

Common Questions Related To “What Is Interest Expense in Accounting?”:

- What Is the Difference between Interest Expense and Interest Payable?

- Is Interest Expense an Asset?

- Is Interest Expense a Debit or Credit?

- Is Interest Expense an Operating Expense?

What Is the Difference between Interest Expense and Interest Payable?

Interest expense is an account on a business’s income statement that shows the total amount of interest owing on a loan.

Interest payable is an account on a business’s income statement that show the amount of interest owing but not yet paid on a loan.

Example

A small cloud-based software business takes out a $100,000 loan on June 1 to buy a new office space for their expanding team. The loan has 5% interest yearly and monthly interest is due on the 15th of each month. The business’s accounting year ends December 31.

Interest expense for the year will be $5000—the total amount incurred. However, the December payment won’t be made until January 15 of the following year. So that $416.67 ($5000 / 12) must be entered as interest payable, since it’s money owed but not yet paid.

Is Interest Expense an Asset?

Interest expense can be both a liability and an asset.

Prepaid interest is recorded as a current asset while interest that hasn’t been paid yet is a current liability. Both these line items can be found on the balance sheet, which can be generated from your accounting software.

Is Interest Expense a Debit or Credit?

Interest expense is a debit. This is because expenses are always debited in accounting. Debits increase the balance of the interest expense account. Credits usually belong to the interest payable account. Expenses are only credited when you need to adjust, reduce or close the account.

EXAMPLE 1

$100 in interest is paid on a loan in December 2017. The journal entry would show $100 as a debit under interest expense and $100 credit to cash, showing that cash was paid out. Another account would then be debited to reflect the payment.

EXAMPLE 2

A small cloud-based software business borrows $5000 on December 15, 2017 to buy new computer equipment. The interest rate is 0.5 percent of the loan balance, payable on the 15th of each month. The payment on January 15, 2018 will be $25.

The business hasn’t paid that the $25 yet as of December 31, but half of that expense belongs to the 2017 accounting period. To deal with this issue at year end, an adjusting entry needs to debit interest expense $12.50 (half of $25) and credit interest payable $12.50.

Is Interest Expense an Operating Expense?

Interest expense is not an operating expense. A non-operating expense is an expense that isn’t related to a business’s key day-to-day operations. Operating expenses include rent, payroll or marketing, for example.

For example, a small social media marketing company would need to pay its employees and pay for ads as part of its business. Paying for a loan is not directly part of its work. Only businesses like banks could consider interest expense directly part of their operations.

By reporting interest expense as a non-operating expense, it’s also easier to analyze a company’s financial position. Profit is calculated by first taking into account total operating expenses. Non-operating expenses are then deducted, which can quickly show owners how debt is affecting their company’s profitability. Obviously, companies with less debt are more profitable than companies with more debt.

RELATED ARTICLES

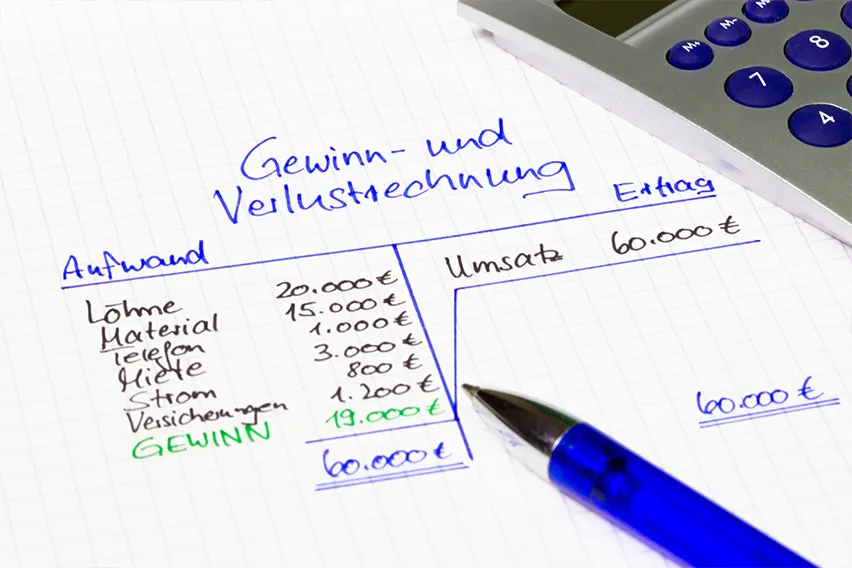

What Is a Profit and Loss Statement?

What Is a Profit and Loss Statement? What is a T Account?

What is a T Account? What Are Provisions in Accounting?

What Are Provisions in Accounting? Is Inventory a Current Asset?

Is Inventory a Current Asset? Operating Expenses (OpEx): Definition, Formula, and Example

Operating Expenses (OpEx): Definition, Formula, and Example What is the Difference Between Financial and Managerial Accounting?

What is the Difference Between Financial and Managerial Accounting?