Accept Payments Online and Get Paid 2x Faster

Grow your business when you accept online payments, automate bookkeeping, and simplify invoicing. Easy-to-use billing ensures you get paid faster, while transparent fees keep surprises to a minimum.

ONLINE PAYMENTS SAVE YOU MONEY AND GET INVOICES PAID FASTER

Based on 2022 invoicing data. On average, it takes 8 days less to get paid if an invoice is enabled to be paid online. Online payments get you paid up to 8 days faster

Based on 2022 invoicing data. Only 62% of invoices are paid within 30 days for those without online payments enabled, compared to 78% for those that are paid online. Online payments get 16% more of your invoices paid within 30 days

Source: Visa – Back to Business Study 2021. 85% of consumers expect to have an option to pay online, like FreshBooks Payments.

Improve Your Cash Flow With Online Payments

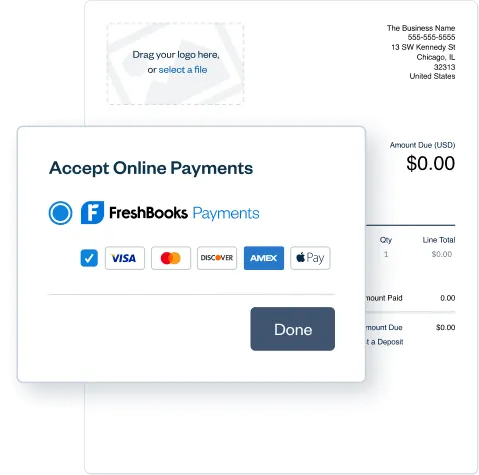

Online Payments Link Seamlessly With FreshBooks

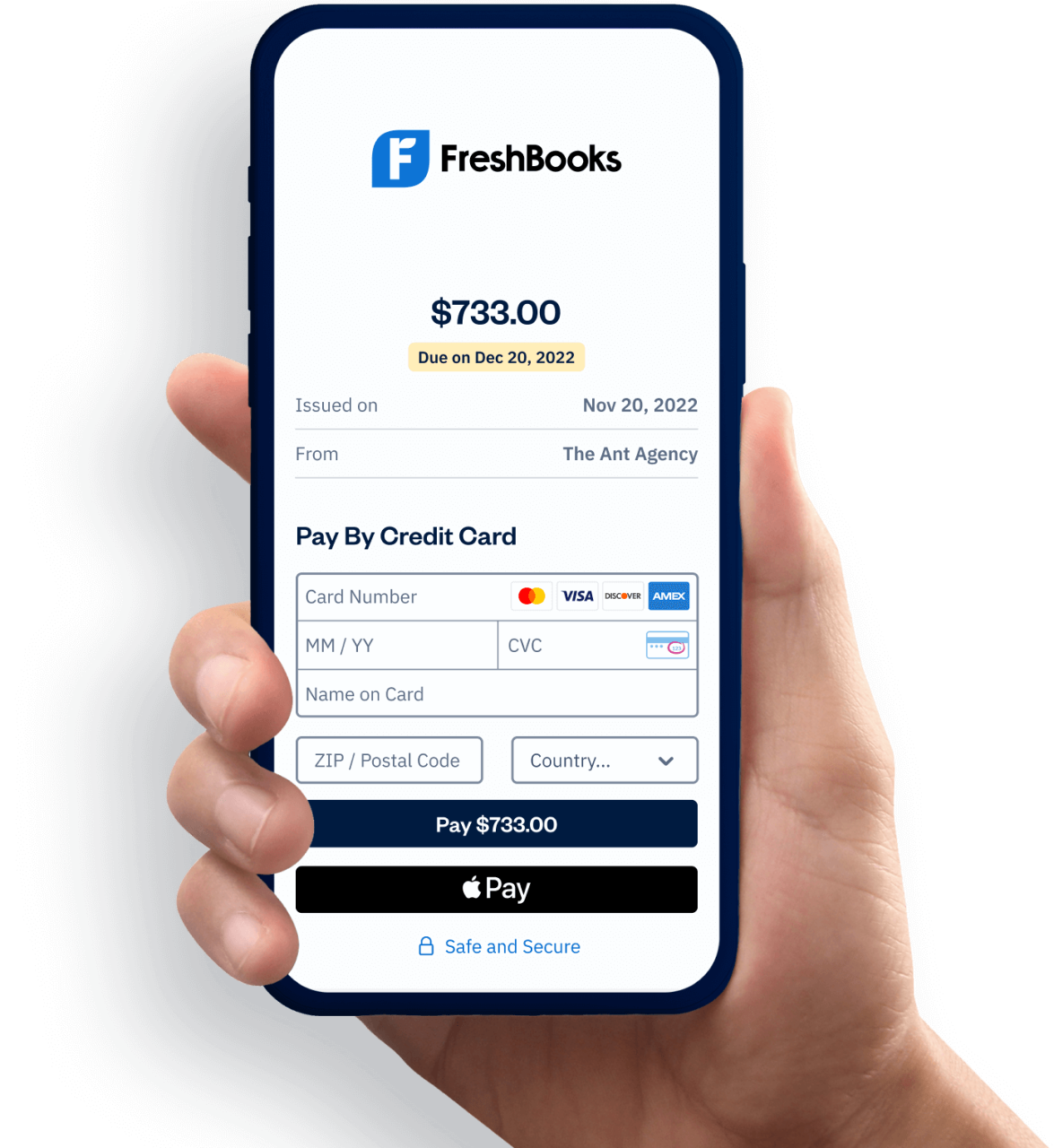

FreshBooks Payments lets your customers pay directly through invoices and automatically records each payment in your account. It’s fast, easy, secure, and perfectly integrated.

No setup, monthly or hidden fees:

2.9% + $0.30 per transaction on most cards

Bank Transfer (ACH): 1% bank transfer fees*

- Secure for you and your clients

- Accept all major credit cards

- ACH connects to most major banks in the U.S.

- No hidden fees

*ACH Only Available for US Customers

![]()

Competitive pricing with no hidden fees:

2.9% + $0.30 per transaction

- Trusted by millions of users around the world

- Accept Visa, Mastercard and American Express

- Accept Venmo and PayPal Credit

- Take payments in 25 currencies from 202 countries

More Payment Options for Improved Cash Flow

With a variety of payment methods and transparent fees, you’ll always know upfront what fees you’ll pay and how long the online payment processing will take.

💰 Interested in lower rates? Chat with an expert

Keep Your Revenue Safe

You don’t have to sacrifice your peace of mind for ease of use. Whether your clients are local or international, we ensure your money is safe with industry-leading security practices. Additionally, you can keep your revenue safe by not handling cash or checks.

Multiple Ways to Bill and Get Paid

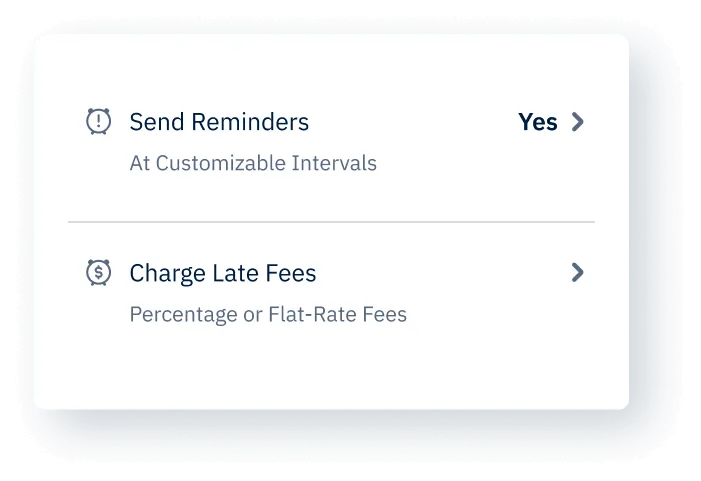

Chasing Clients for Payment is a Ton of Work

Create invoices in seconds and add payment options like payment reminders and automatic late fees right on your invoice for quick and easy payments.

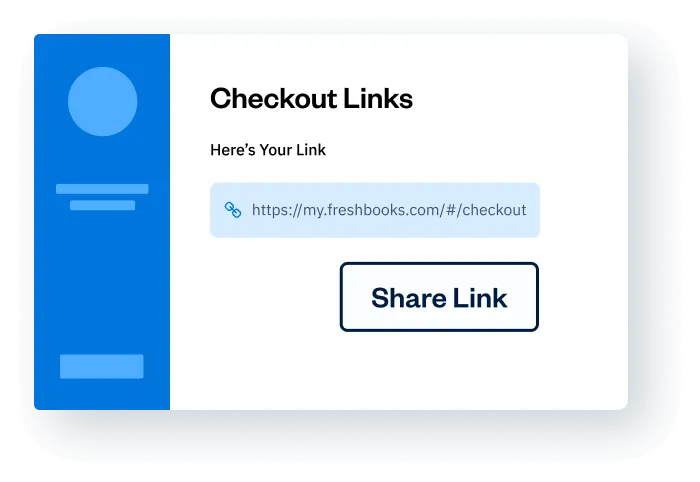

It’s hard to scale when you’re manually processing payments. Add Checkout Links to your website, social media, or emails to quickly collect payment for fixed-price items.

Get paid automatically when you set up recurring billing for repeat clients

Your Payment Options Could Be Costing You Money

- Limited payment options can cause inconvenience for clients. Allow clients to pay by various online payment methods, including credit card, Bank Transfer (ACH), or Apple Pay and increase the speed in which you get paid.

- Process payments directly with Advanced Payments, a FreshBooks add-on featuring a virtual terminal that securely stores credit card information. Learn More

- Clients can pay right from their mobile devices for even faster payments.

- Give clients more flexibility with partial payments or payment schedules.

We Think You’ll Love FreshBooks. But Don’t Just Take Our Word For It.

“What I really like about FreshBooks is that I don’t have to set up special accounts and buy additional hardware like a card reader for my guys to be able to take payments in the field”

“I send all my clients an invoice through FreshBooks and have them pay online. It’s a key task in my day that used to take me an hour or more, which I can now get done in half an hour or less.”

“You helped us scale globally, allowing us to use different methods of payments, invoicing, and recurring. Especially for a SaaS company, Recurring Invoicing and Payments are essential”

Frequently Asked Questions

Like in-person purchases, online payments allow you to process debit and credit card payments via a secure payment gateway. Your clients pay invoices using their chosen payment methods, and the payment processing system ensures your money is processed for a small fee and deposited into your bank account. You can also allow clients to make Partial Payments simply by enabling Online Payments (Partial Payments are an option on all future invoices you send).

The entire process takes a couple of business days, and if you use Online Payments, all transaction fees are automatically tracked in your account as Expenses.

Yes! Simply create a Recurring Template in your account and let FreshBooks remember to send out invoices on your behalf. The system keeps track of the payment method and information so clients can pay directly using their chosen payment option. Clients can even opt into Recurring Payments to have future invoices paid automatically.

Accepting payments online is vital for today’s small businesses. You can accept online payments through FreshBooks payment service providers, including Stripe, major credit cards, Apple Pay, and PayPal. FreshBooks also allows payment processing through Bank Transfers, also known as ACH.

FreshBooks employs industry-best online payment security practices through PCI (Payment Card Industry) compliance. The PCI Standard is mandated by credit card companies and administered by the Payment Card Industry Security Standards Council. Our payment processors (PayPal, Stripe, and WePay) employ strict PCI compliance and security measures.

There are several ways to accept payments online—and some are more convenient than others, both for you and your clients. Setting up debit card, credit card and ACH payments takes just a few minutes in FreshBooks, and once you’re set up, you can easily offer multiple online payment types for your clients.

Be wary of payment gateways that claim to be free. Often they come with hidden fees or monthly subscription costs. Allowing a variety of popular online payment methods, including credit or debit cards and Apple Pay, is an easy way to grow your business.

The lowest transaction fees are associated with Bank Transfers (ACH). Those typically have a 1% transaction fee, and you get paid twice as fast as getting paid by check.

Debit card payments can be set up through your FreshBooks account. PayPal and Stripe are the most popular payment service providers. They allow you to accept debit cards as payment, and the fees are the same as you’d pay with credit cards.

Bank Transfers, also known as Automated Clearing House (ACH) payments can be set up through your FreshBooks account. Bank Transfers connects financial institutions across the U.S. for seamless transfers. You will receive money faster, with lower transaction fees than other payment methods. You can read more about Bank Transfers here.