2025 Small business tax trends: Procrastinator or planner?

Discover what 1,300+ small business owners and freelancers really think about taxes in 2025. From confidence gaps to procrastination habits, find out the unfiltered truth about how entrepreneurs manage tax season—and why only 26% feel completely confident about their filings.

What small business owners & freelancers are really thinking (and not posting about on LinkedIn)

Let’s talk about everyone’s favorite topic: Taxes. Okay, maybe not favorite—unless you’re that friend who gets oddly excited about spreadsheets and has their receipts organized by color (we all know one). But for the rest of us mere mortals running businesses and freelance gigs, taxes are like that persistent notification you keep swiping away: Always there, slightly stressful, and impossible to ignore forever.

We wanted to know what’s really going on behind those humblebrag social posts about “crushing tax season,” so we asked actual humans—over 1,300 small business owners and freelancers—about their tax habits, fears, and secret organizational systems (or lack thereof).

Key takeaways from our 2025 survey:

- Confidence gap: Only 26% of small business owners and freelancers feel completely confident about their taxes.

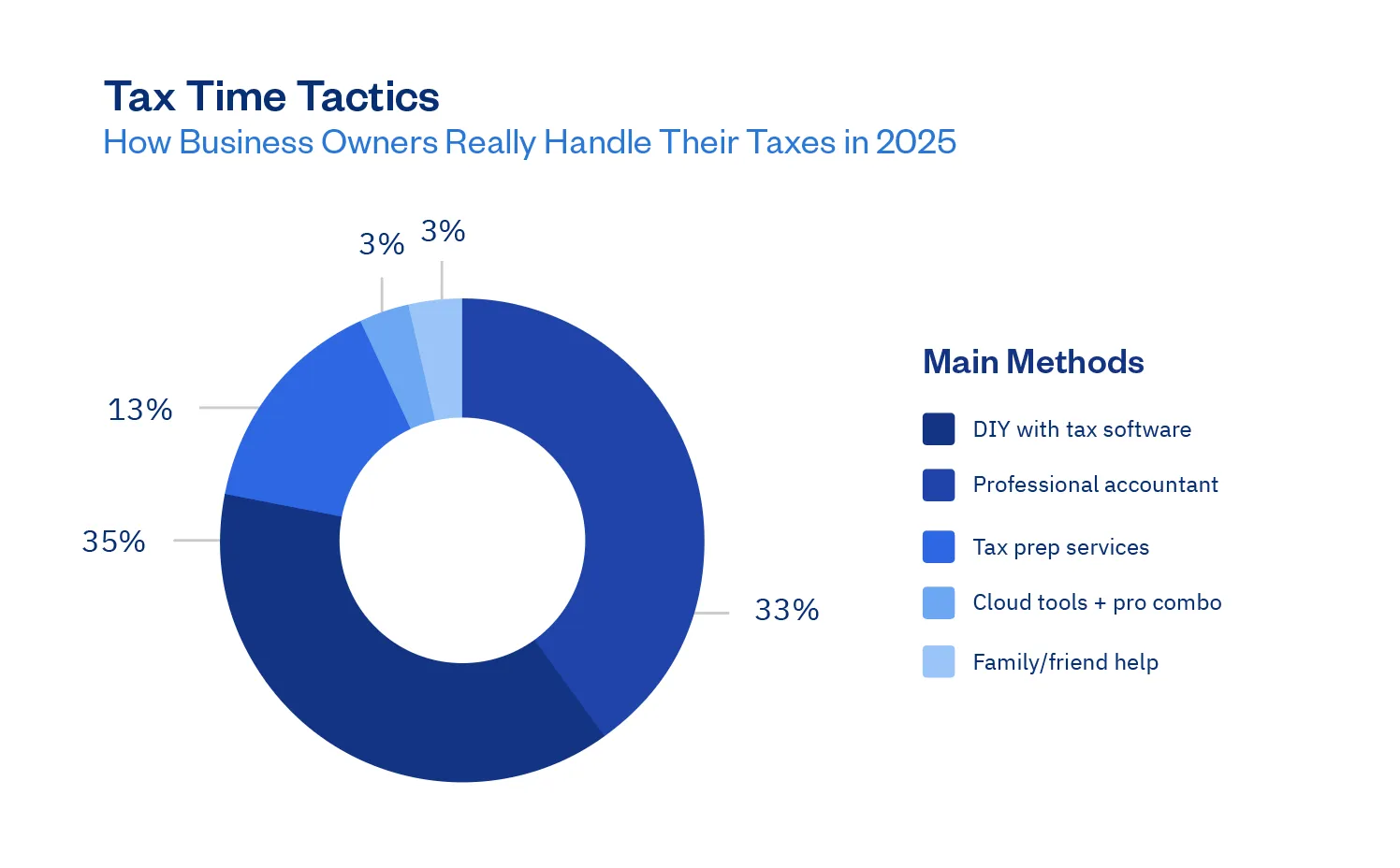

- Tax preparation methods: Small business owners and freelancers primarily manage their taxes through software (35%) or by hiring accountants (33%).

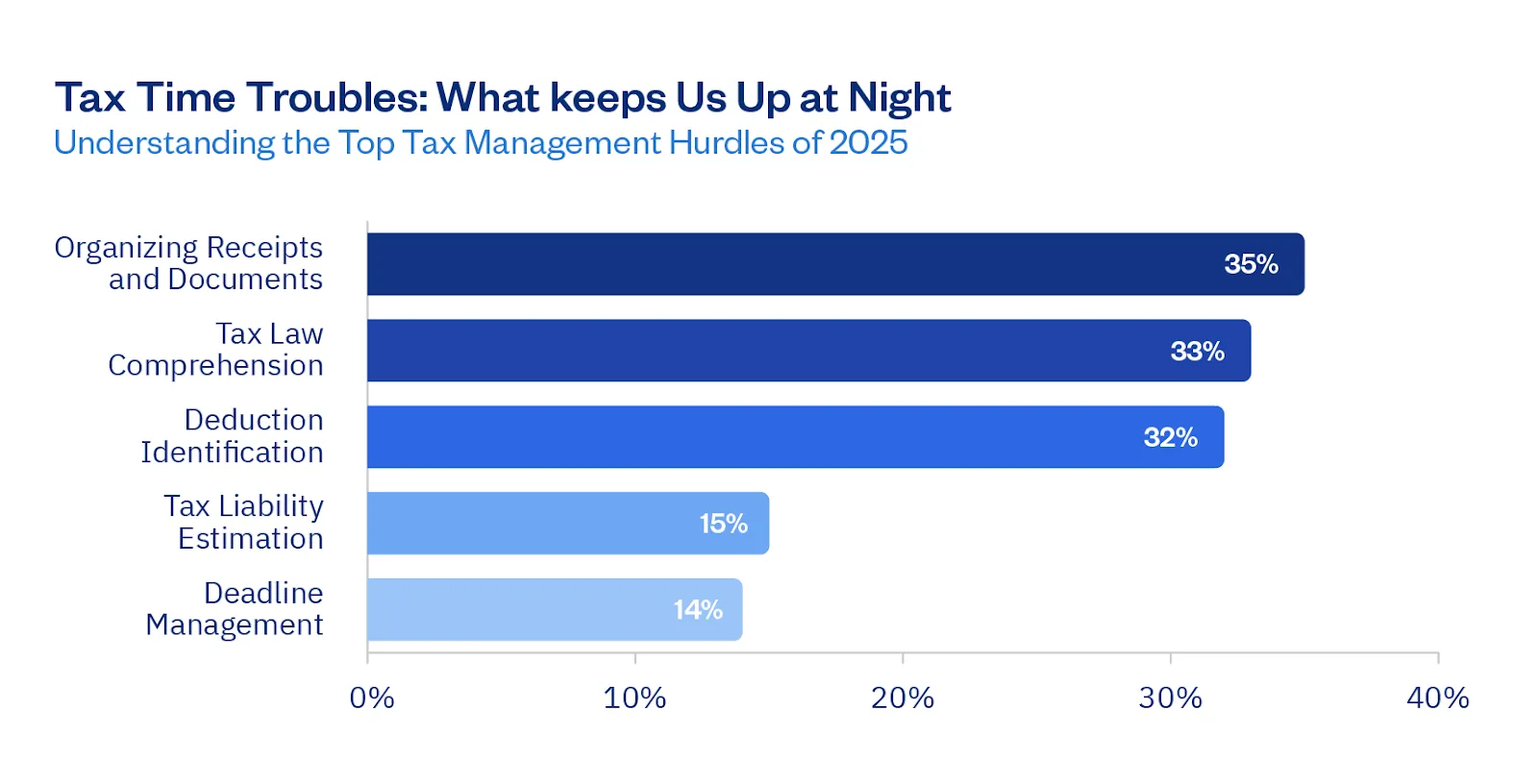

- Top challenges: The biggest tax-related headaches include organizing receipts (35%), understanding complex tax laws (33%), and identifying proper deductions (32%).

- Procrastination trends: While 78% claim to start tax preparation early, 51% of Gen Z self-employed individuals wait until the last minute.

- Tax compliance: Tax compliance is primarily motivated by fear, with 46% concerned about penalties and 37% worried about potential audits.

Who’s actually filling out these forms?

Picture your typical coworking space. About half the room (52%) is filled with small business owners and solopreneurs (you know, the ones with the fancy business cards). The other half (41%) are freelancers typing away on sticker-covered laptops.

Overview

- The confidence chronicles

- How are people actually getting this done?

- Software vs. Professional assistance: How entrepreneurs manage taxes

- Tax time troubles

- Playing “find the receipt” and understanding tax laws

- Generational differences in tax understanding

- The procrastination station & why we pay our taxes

- Procrastination patterns among different generations

- Fear-based compliance vs. Strategic planning

- The AI question: Robot tax accountants?

- Methodology

The confidence chronicles spoiler alert: Most of us are winging it

Key insights: Boomers show the highest tax confidence, with 73% reporting high or complete confidence (8-10), while Gen Z has a notably higher percentage in the low confidence category (22%) compared to other generations.

Here’s something that might make you feel better about that shoebox full of receipts under your desk: only 26% of people say they’re completely confident about their taxes. That’s right; most of us are in the same “I hope I did this right” boat.

The confidence gap gets even more interesting when you break it down by demographics:

- Gen Z (22% completely confident): Still figuring out how to adult

- Boomers (32% completely confident): Strutting around like tax pros

- Women vs. men: Women are feeling less sure (13% low confidence vs. 8% for men)

Time: The other thing we’re all spending too much of

Want to know how long people actually spend on taxes? Most self-employed folks (32%) spend 3-5 hours on their business taxes, about the same time it takes to binge-watch half a season of your favorite show. Freelancers tend to finish faster than business owners, probably because they have fewer “Is this a business expense?” moments to agonize over.

How are people getting this done?

From DIY digital solutions to professional number-crunchers, here’s how Americans are tackling the tax monster in 2025.

Key insights: The self-employed community is evenly matched between DIY approaches (35%) and professional help (33%), representing the two dominant tax management strategies in 2025.

The tools of the trade break down like this:

- 35% use tax software (because who doesn’t love a good dropdown menu?).

- 33% hire an accountant (aka adulting level: Expert).

- Gen Z is all about those tax prep services (20%), probably because they’ve never known a world without apps for everything.

Tax time troubles: The stuff that keeps us up at night

From the nightmarish scavenger hunt for missing receipts to deciphering tax laws that seem written by caffeinated squirrels, Americans’ midnight tax anxieties reveal the true cost of adulting—stress and confusion wrapped in a W-2.

Key insights: The top three challenges–document organization, understanding tax laws, and finding deductions–are nearly tied (32-35%), suggesting self-employed individuals struggle most with the complexity and administrative aspects of tax compliance.

Top tax headaches include:

- playing “find the receipt” (35%).

- trying to understand tax laws written apparently by chaos demons (33%).

- hunting for deductions like they’re Pokemon (32%).

Gen Z particularly struggles with deductions and tax laws, which makes sense because no one taught this in school (thanks).

The money question: What happens to those tax savings?

Ever wondered what happens to those precious tax dollars you manage to keep in your pocket? Let’s peek into America’s financial priorities, where your tax savings reveal more about your money personality than you might think.

When people manage to save on taxes:

- 38% pump it back into their business (responsible!).

- 34% save it for themselves (also responsible!).

- Gen Z is more likely to set aside money for future tax bills (36%) because they’ve learned from all our mistakes.

Why we pay our taxes (besides the obvious)

Key insights: While avoiding penalties is the primary motivator (46%), the relatively even distribution across all motivations suggests self-employed Americans are driven by a balanced mix of both negative consequences and positive benefits.

Fear remains the driving force behind tax filing, with 46% of Americans motivated by penalty avoidance and 37% dreading audits. Another 36% simply want peace of mind.

On the brighter side, there’s growing optimism about tax season—34% strategically file to maximize refunds, while 32% view filing as part of responsible financial management.

These numbers reveal our complex relationship with taxes: while fear dominates, many Americans are reframing tax filing as an opportunity rather than just an obligation.

The procrastination station

Good news: 78% of people start their taxes early! Bad news: the rest are probably reading this report right now instead of doing their taxes. 51% of Gen Z self-employed individuals wait until the last minute to prepare their tax materials, which is more likely than any other generation, because…youth.

Government resources: Are they helping?

Only 20% think government tax resources are comprehensive at both the federal and state levels. We’re not saying they’re written in ancient hieroglyphics, but… actually, that might be easier to understand.

The AI question: Robot tax accountants?

Opinions on AI doing our taxes are all over the place:

- 37% are unsure (same).

- 20% think it’ll make life easier.

- 23% think it’ll just add new complications.

- The rest are probably still trying to figure out if their chatbot can write off coffee.

What have we learned?

- The average self-employed person rarely feels like a tax expert (except maybe those accounting professionals, who seem to be an entirely different species altogether)

- Most people use software or professionals because DIY doesn’t mean do-it-alone

- Organization is everyone’s nemesis

- Fear of the tax man is still a better motivator than potential savings

- AI might help with taxes in the future, but for now, we’re all still figuring it out together

Tax season feels like stepping on a LEGO for most business owners, with only 26% feeling like tax pros. The good news? Whether you’re a “spreadsheet wizard” (35%) or need accountant help (33%), digital tools can transform your experience from existential dread to merely inconvenient. Early birds (78%) might be onto something—implement smart solutions now!

Bottom line: Most self-employed folks aren’t tax experts, organization is everyone’s curse, and we’re motivated more by fear than savings. But tax season doesn’t have to be your villain origin story. With the right digital sidekick and a collaborative accountant, you might find yourself among the confident 26% next year—or at least faking it convincingly!

Methodology:

FreshBooks designed and conducted an online survey of approximately 1,300 self-employed individuals, freelancers, and small business owners from the United States. Participants were sourced through an online panel representing a diverse range of small businesses across various industries, revenue levels, and employment sizes. The study examined tax preparation habits, challenges, and attitudes across demographic segments.

The survey’s margin of error is +/- 2.7% at 95% confidence.

Share: