U.S. Tax 101: What Is a W9 Form?

Businesses request W-9 forms from freelancers or contractors to ensure they have the correct information to prepare 1099-NEC forms.

Are you an independent contractor or freelancer who just landed your first client? Or are you a business owner who finally decided to outsource work to a freelancer or independent contractor?

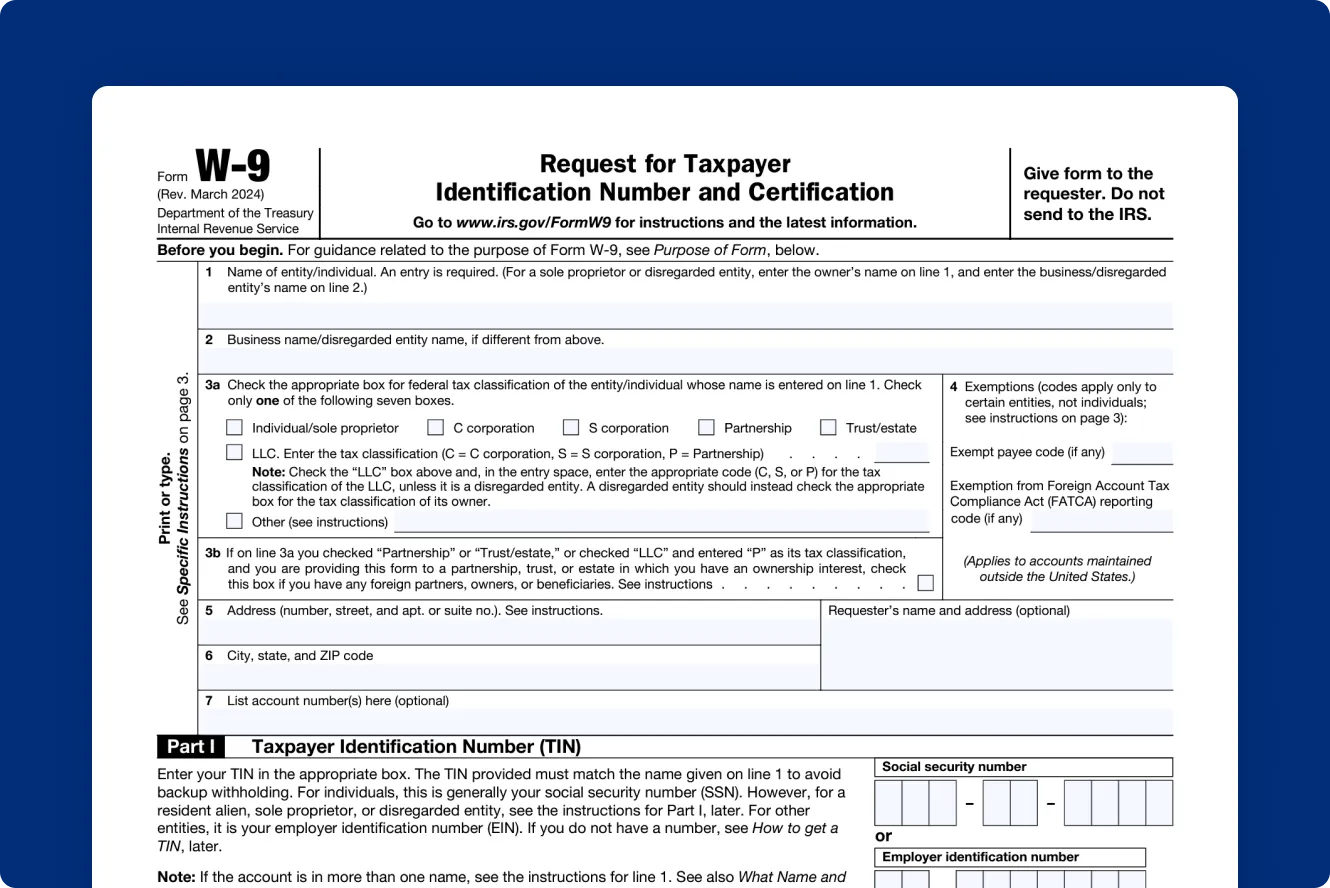

If so, you need to familiarize yourself with Form W-9, Request for Taxpayer Identification Number and Certification.

You might be thinking, “Not another tax form!” But don’t sweat it: Form W-9 isn’t nearly as complicated as many other Internal Revenue Service (IRS) forms or important tax documents.

So let’s take a deeper look at the subject.

Key Takeaways

- A W-9 form is used for taxpayer identification and certification when freelancers and independent contractors work for a business. The business owner needs this form to properly report certain payments to the IRS.

- This form requires your name, address, federal tax classification, SSN or EIN, and withholding requirements.

- The purpose of a W-9 IRS form is to ensure all parties are compliant with tax laws.

- A W-9 form is needed whenever the vendor is paid $600 USD or more in a year.

Table of Contents

- What Is a W-9 Form?

- W-9 Form Essentials for Independent Contractors and Freelancers

- W-9 Form Essentials for Business Owners

- FAQs on What Is a W-9 Form

What Is a W-9 Form?

To understand Form W-9, you first need to know about Form 1099-NEC.

The IRS uses 1099-NEC forms to make sure people properly report their non-employee compensation—i.e., income from freelancing or working as an independent contractor—on their income tax return.

When you work as an independent contractor or consultant and provide $600 or more in services to another company, the company is required to report the total amount paid on a 1099-NEC.

To prepare a 1099-NEC, the company needs your name, street address, and taxpayer identification number. When the business asks you to provide a W9, they simply ensure they have the correct taxpayer identification number and other information for preparing form 1099-NEC.

Companies used to report this income on Form 1099-MISC. That form is still used to report some miscellaneous income payments, such as rent and royalties. But the IRS started requiring companies to report non-employee compensation on 1099-NEC in 2021.

Related Articles

- U.S. Tax: What Is an IRS 1099-NEC Form?

- Top Traits for Your Tax Professional and How to Find a Good Accountant

- Your Complete Guide to U.S. Small Business Tax Credits

W-9 Form Essentials for Independent Contractors and Freelancers

If a company asks you to fill out a W-9, it’s likely because they plan on paying you for your services. Here’s what you need to know.

How to Complete Form W-9

Filling out Form W-9 is simple as far as tax forms go! Although the form is 6 pages long, 5 of those pages are instructions. You can probably complete the form in under 5 minutes.

If you’ll be working with several clients, it’s likely that each one of them will request a W-9. You do not need to complete a new W-9 form for every client.

Just keep a copy of the completed form on hand, and it will be ready to go in seconds if a new client asks for one.

For more details, read the guide to filling out Form W-9.

Who Shouldn’t Fill Out a W-9

Since Form W-9 includes sensitive information, like a Social Security number (SSN) or employer identification number (EIN), you should only fill one out if you know who is requesting it and why they need it.

You should also question completing a W-9 if you start a new job and your employer asks you to complete one. This could indicate that the company intends to pay you as an independent contractor rather than an employee and won’t withhold income or payroll taxes from your wages. This will become a problem for you when you file your income tax return.

Employees should fill out Form W-4, not Form W-9.

Do You Need to Update Your W-9?

You should update your W-9 form if your information changes, though some organizations may ask you to send a new signed form every year to ensure they have the most accurate information on file.

You may need to submit an updated W-9 if:

- your name or address has changed

- your federal tax classification has changed; for example, the structure of your business has moved from a sole proprietor to a limited liability company (LLC) or C corporation

- your employer identification number or business name has changed

- the IRS notifies you that you’re subject to backup withholding (we’ll cover backup withholding in more detail later)

If any of these apply, you can download a W-9 form from the IRS website, fill it out, and send it to your clients.

W-9 Form Essentials for Business Owners

Now, let’s answer a few questions for the other side of the transaction: the business owner or who needs to collect completed W-9 forms from independent contractors.

Do You Need to Request Form W-9?

If you hire independent contractors to work for you, it’s a good idea to have them fill out a W-9 before you pay them. Just download the form from the IRS website and ask them to complete and sign it.

You do not need to file Form W-9 with the Internal Revenue Service. Just keep it with your records and use it to prepare a 1099-NEC for any individual or business to which you paid $600 or more by cash or check during the year.

If you paid a contractor via credit card or a payment app like PayPal or Venmo, don’t send them a 1099-NEC. The credit card company or payment processor will send them a 1099-K form.

What If a Contractor Doesn’t Submit Their W-9?

Let’s say you paid your independent contractor $600 or more during the year and you either didn’t request a W-9 from them or, despite your request, they failed to complete it or provide you with their SSN or EIN.

In that case, you should document your repeated requests for the person’s taxpayer identification number (TIN). Then, you should still fill out and file a 1099-NEC with a notation that the contractor refused to provide a TIN.

You could be penalized for failing to include the required information on the 1099, but you may be able to get the penalty waived if you can prove that you made several attempts to obtain a TIN from the contractor.

If you make any future payments to the contractor, you should immediately begin backup withholding.

What About Foreign Vendors or Contractors?

If you hire foreign vendors or independent contractors, you don’t need to have them fill out a W-9. These entities need to fill out W-8 forms instead.

If you made enough reportable payments, you still need to send them a Form 1099-MISC or Form 1099-NEC at the end of the year.

Why Would a Vendor Request a W-9 Form?

It’s easy to understand why you might need W-9s from vendors so you can send them 1099s at year-end. But what if a vendor asks you to complete a W-9?

There’s one reason your vendor might ask you to complete a W-9 form: You’re buying goods and reselling them for a commission. For example, if you’re involved in a direct sales company like Mary Kay, Pampered Chef, or Tupperware, you might buy products from the company to resell or use as samples.

In that case, the company needs a W-9 from you because they’re paying you a commission. While they’re only required to send you a 1099-NEC if you made direct sales of $5,000 or more, some companies automatically request a W-9 from all sales reps before paying commissions to ensure they have the information they need to send 1099s to the ones that need them at year-end.

Receiving the 1099 ensures you have the right information to report those commissions on your income taxes.

What Is Backup Withholding?

The IRS requires backup withholding on payments to certain businesses or individuals. For example, if someone refuses to provide a correct taxpayer identification number (TIN) or fails to report (or underreports) interest or dividend income on their federal tax return, the IRS might notify them that they’re subject to backup withholding.

If you discover someone you’ve made reportable payments to is subject to backup withholding, you should immediately withhold taxes at a rate of 24% from any future payments. Send any taxes withheld from their payments to the Internal Revenue Service.

If the recipient wants to stop backup withholding, they need to correct the reason they’re subject to backup withholding with the IRS. This might involve providing a correct tax identification number, filing a missing tax return, or paying the amount due on underreported taxable income.

FAQs on What Is a W-9 Form

What type of vendor needs a W-9?

Businesses should provide W-9 forms to anybody they pay over $600 in one year for business purposes. This includes self-employed individuals, freelancers, people in a single-member LLC, and anybody who is paid to work for the company but is not an employee.

How much taxes will I pay on a W-9?

As an independent contractor or freelancer, the amount of income tax you’ll owe on income paid through a W-9 arrangement depends on several factors, including your income level, filing status, and the types of deductions and tax credits you can claim.

If this income is subject to backup withholding, a flat 24% will be withheld from your payments, but your actual tax liability may be more or less than this amount. When you file your tax return, you may need to pay more or you may receive a refund.

When is a W-9 not required?

An IRS form W-9 is not needed if the vendor or freelancer is paid less than $600 in one year or if payments exceeding that amount are not business-related.

What happens if a vendor does not provide a W-9?

A business is required to document all attempts to obtain W-9 information from the vendor (a minimum of three attempts). If your business fails to collect an IRS form W-9 form from a vendor, and you have paid them over $600 in one year, then you must correctly complete a 1099-MISC form for each vendor, with penalties ranging from $60 to $330 for missing forms. The vendor may face IRS penalties.

As a business owner, how do I know if I need a W-9 from a vendor?

If your payments to the vendor are under $600 in a calendar year, or your transactions are unrelated to your business or conducting a trade, then you do not need a form W-9. Any transactions over $600 that are business-related require a W-9. That said, collecting this IRS form from all vendors is a good idea.

How do I get a W-9?

You can download Form W-9 for free from the IRS website.

What is the purpose of a W-9?

Form W-9 serves as a way for independent contractors and businesses to provide their federal tax classification, taxpayer identification number and other information needed to fill out other federal income tax forms to another entity. This information is primarily used for completing information returns, like Form 1099-MISC or Form 1099-NEC for nonemployee compensation.

What is the difference between a W-8 and a W-9?

The main difference is who uses each form. A U.S. citizen or resident alien uses a W-9, while non-U.S. individuals and entities fill out a W-8 form to certify their foreign status for tax purposes. For a U.S. taxpayer, the W-9 form is the correct form to complete.

Reviewed by

Janet Berry-Johnson, CPA, is a freelance writer with over a decade of experience working on both the tax and audit sides of an accounting firm. She’s passionate about helping people make sense of complicated tax and accounting topics. Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others. You can learn more about her work at jberryjohnson.com.

RELATED ARTICLES

What Is a Tax Rebate? Everything You Need to Know

What Is a Tax Rebate? Everything You Need to Know Depreciation Recapture: What It Is and How to Calculate It

Depreciation Recapture: What It Is and How to Calculate It How Is Rental Income Taxed? Understand Rates and Deductions

How Is Rental Income Taxed? Understand Rates and Deductions Payroll Tax vs. Income Tax: What’s the Difference?

Payroll Tax vs. Income Tax: What’s the Difference? Sole Proprietorship Taxes: A Guide to Deductions and Filing

Sole Proprietorship Taxes: A Guide to Deductions and Filing Independent Contractor Taxes: A Complete Guide for 2025

Independent Contractor Taxes: A Complete Guide for 2025