Tax Deductions For Uber Drivers and Tax Filing Tips

A good understanding of your tax liabilities as an Uber driver can make a significant difference. As a US company, Uber must report their business-related expenses and payments to their contractors. Since you are an independent contractor, they are not required to withhold federal income taxes or Social Security and Medicare taxes, and you may wind up owing a significant amount of tax at the end of the year. This guide will review the applicable tax law, deductions, and filing tips applicable to Uber drivers.

Key Takeaways

- You can only deduct costs associated with the business use of your vehicle.

- Uber drivers are independent contractors, and no federal taxes are withheld from your pay by Uber.

- You are responsible for self-employment taxes on your gross income.

- You can deduct mileage, phone, tolls, car loan interest, and more.

- You must keep accurate logs and receipts and reference your Uber tax summary to prove your deductions.

Table of Contents

- Understand Your Uber 1099-K

- Use Schedule C

- Deductions for Mileage

- Cell Phone Expenses Deductions

- Other Tax Deductions for Uber Drivers

- Addressing Gas, Insurance, Car Payments, and Maintenance

- Tips for Efficiently Filing Taxes and Tracking Deductions

- Take Advantage of FreshBooks to Make Your Tax Preparation Easier

- FAQs About Tax Deductions for Uber Drivers

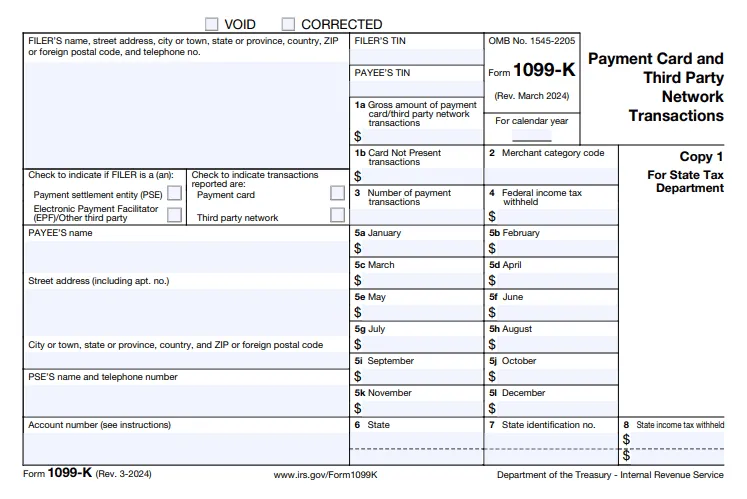

Understand Your Uber 1099-K

The IRS requires that third-party payment networks issue a 1099-K to anyone who is paid over $2,500 annually through digital means like credit, debit, or stored value cards, payment apps, or third-party payment networks in one or more transactions. This is part of the IRS’ phase-in plan to implement a reporting threshold for any transaction greater than $600 from a third-party payment platform.

The 1099-K reports on gross payments you received and should not report gifts or reimbursement of personal expenses you received from friends and family. Use this form to file taxes with your other tax records. This form is only for payments of goods and services paid through digital means. It is not a complete tax summary and does not record deductible business expenses or business tax deductions.

Rideshare businesses like Uber and Lyft must provide a 1099-K form to their drive partners by January 31 each year.

Form 1099-NEC and the former 1099-MISC are similar tax reports to the 1099-K. The 1099-NEC is for Non-Employee Compensation for promotion, referral, and other miscellaneous payments for independent contractors. 1099-Misc is for additional payments like prizes and legal settlements. You receive one or both of these forms if you have received $600 or more in these payments from one person or business.

Use Schedule C

Uber drivers are generally required to use Schedule C, Profit or Loss from Business, to report their income and expenses. Uber reports your income information to the IRS directly, meaning you don’t have to submit your actual 1099 tax forms when you file your tax return.

When you subtract your business expenses from your business income, the resulting number is your net income or loss, which is used to calculate the tax you will owe. This amount is entered on Schedule 1 of Form 1040. You also report this amount on Schedule SE, which is used to calculate Medicare and Social Security taxes, otherwise known as self-employment taxes.

Uber drivers can use Schedule C to list and deduct business-related expenses on their tax return. Some of these will also be listed on your Uber tax summary. These deductible expenses may include:

- Tolls

- Any self-employment tax you pay

- Vehicle maintenance costs

- Business portion of your cell phone bill

You can also deduct mileage on your vehicle from your income tax return as an Uber driver.

Deductions for Mileage

Tax deductions for rideshare drivers can include a mileage deduction. The IRS has a standard mileage rate (SMR) for the business use of your personal vehicle. In 2025, the standard rate is $0.70 per mile. These rates take into account market fluctuations. Generally, you can use the standard mileage deduction even if you receive reimbursement for your costs.

You can only use the SMR for a car you own. If you use it for a leased vehicle, you must use the SMR for the entire lease term and cannot switch to using the actual expense deduction.

If you qualify, you may choose between the standard mileage rate or actual vehicle costs associated with business use.

If you choose to use the standard mileage deduction, you cannot deduct actual costs of operating a vehicle, such as depreciation, lease payments, maintenance and repairs, gas, oil, insurance, or vehicle registration fees.

You cannot use the standard mileage rate if:

- You have fleet operations or use more than 5 cars at a time

- You claimed a depreciation deduction for the car using any method other than a straight line for the car’s estimated useful life

- You use the Modified Accelerated Cost Recovery System

- Claimed a section 179 deduction for the value of your vehicle

- Claimed special depreciation allowance on the car

- Claimed actual car expenses after 1997 for a car you leased

Alternatively, you can use the actual expense method on your tax return. This method allows you to deduct actual car expenses, including lease payments or depreciation, insurance, gas, oil, maintenance, and repairs. If you use your car for personal and business use, you can only submit a portion of these expenses for which you use the vehicle for business purposes. You can use the total and the business miles driven to calculate the business use percentage.

You must keep accurate and detailed records, whether you deduct the standard mileage rate or the itemized expenses from your net income. It can be a manual log, or you can use a mileage-tracking app.

If you qualify for both methods, it’s recommended that you calculate the deductions both ways to determine which method gives you a larger deduction when it’s time to pay taxes.

Cell Phone Expenses Deductions

Your cell phone is integral to your business as a self-employed worker with Uber. You use it to find routes, get fares, communicate with riders, give ratings, and more. The IRS recognizes your cell phone as an essential part of your business. Because of that, you can deduct some of the costs associated with a mobile phone, like depreciation, a portion of the bill, and a portion of the cost of the phone related to business use. For example, if the time you use your phone for business makes up 60% of your total phone use, you can deduct 60% of the bill and 60% of the cost of the phone.

Some rideshare drivers will purchase a second phone dedicated solely to their business. In this case, they can deduct 100% of the costs associated with their phone.

You cannot deduct any part of your cell phone costs related to personal use. It’s recommended that you get an itemized phone bill so you can prove your business-related deductions.

Other Tax Deductions for Uber Drivers

As an Uber driver, you are an independent contractor. Uber and Lyft do not provide a W-2 or withhold federal taxes from your earnings. As a result, you owe taxes when filing your federal income tax return. Taking advantage of tax write-offs for Uber and Lyft drivers can reduce the tax you owe for the year.

This guide has already discussed the largest tax deduction for rideshare drivers–the business use of a car. But what are some other tax deductions for drivers? You may be surprised to know that the following expenses are also tax deductible:

- USB cables, chargers, and similar car accessories

- Snacks and refreshments for your passengers

- Personal protective equipment (PPE) like face masks, shields and hand sanitizer

- Car washes and detailing costs

- Subscriptions to apps related to ridesharing, music, or mileage tracking

- The commissions and fees you pay to Uber

- Tolls and parking fees

- First aid kits

- Orthopedic seat and backrest purchased specifically for use while driving for Uber

It may be tax deductible if you purchase something and only use it while you are an Uber driver partner.

Whenever you make a purchase, you must keep your receipts and a log to prove the purchase is a business expense and, therefore, it is a reasonable deduction. You cannot deduct anything purchased for personal use.

You may be able to deduct the portion of home equity loan interest related to the business use of your car if you used a home equity loan to purchase your car. If you itemize your deductions, you can deduct the personal property tax on your vehicle (vehicle registration and licensing fees).

Claiming tax deductions as an Uber driver can all seem confusing and perhaps a little daunting. Learn how FreshBooks can take the pain out of tax preparation with this short video.

Addressing Gas, Insurance, Car Payments, and Maintenance

You can choose to deduct the actual car costs rather than use the standard mileage rate. If you decide to claim actual costs, these are some of the expenses you can deduct:

- Depreciation

- Lease payments

- Licenses

- Registration fees

- Insurance

- Gas

- Oil

- Repairs

- Tires

- Garage rent

- Tolls

- Parking fees

- Loan interest payments

- Personal property taxes paid on your car

- Casualty and theft losses not covered by insurance

Most of these costs are straightforward. If you use your vehicle for personal and business purposes, you can only deduct the percentage related to the business use of your vehicle. That percentage is calculated based on the miles you drive, not the total hours spent in the car. For example, if you drive 10,000 miles in a year and 6,000 is business mileage, you can deduct 60% of your applicable costs.

If you purchase a vehicle solely for business purposes, you can deduct 100% of the applicable costs.

Depreciation is one cost that can be difficult to calculate without the help of a tax professional. You can only deduct depreciation if you use your car for business more than 50%. You can recover the depreciation cost by deducting part of the depreciation over more than one year. Learn more about calculating depreciation for deduction purposes here.

Tips for Efficiently Filing Taxes and Tracking Deductions

The best way to file taxes and make deductions from self-employment income efficiently is to keep track of your deductions throughout the year rather than leaving it all to tax time. A good way to start doing this is by keeping a mileage log and a list of all tax deductions you plan to make (along with the necessary receipts), as well as referencing your Uber tax summary for more detailed insights.

Here are a few more ideas to help you approach taxes more efficiently this year:

- Create a system to track deductible business expenses—either create your own using spreadsheet software or try using specialized expense tracking software to make the process simpler.

- Open a separate bank account for your business to help differentiate personal and business finances.

- Check your Uber driver dashboard regularly for details on your Uber tax summary, annual income, tolls paid, and any other fees you can deduct as business expenses from your taxable income.

- Use a mileage tracker app to track your miles accurately throughout the year and claim mileage using the actual expense method, allowing you to claim more than the standard mileage deduction.

Take Advantage of FreshBooks to Make Your Tax Preparation Easier

For Uber drivers, maximizing tax deductions comes down to careful organization throughout the year. With the right system, you’ll find it easier to make the deductions you’re entitled to, saving you more money at tax time.

If you’re ready to improve your financial system, consider FreshBooks. Our cloud-based platform simplifies expense tracking, financial reporting, and tax preparation for freelancers and side hustlers, giving you the confidence and peace of mind you deserve as we get ready to pay taxes.

With FreshBooks, you’ll spend a fraction of the time preparing your tax return and maximizing your eligible deductions. Try FreshBooks for free!

FAQs About Tax Deductions for Uber Drivers

Tax advice on deductions for Uber drivers can be an extensive topic. FreshBooks has summarized some of the frequently asked questions below.

Can I deduct tolls and parking fees as an Uber driver?

You can deduct tolls and parking fees as an Uber driver. You must be traveling to pick up a fare or on a fare for the tolls to be eligible for deduction. If your vehicle is used for personal and business purposes, you can only deduct a portion of the parking fees related to your business.

How do I keep track of all my Uber driving expenses for tax deductions?

You can keep track of your driving expenses for deductions by using a spreadsheet, account book, log, or statement of expense to record your mileage and categorize your receipts manually. FreshBooks accounting software and mileage tracker app simplify the process so you can focus on your fares.

Can I deduct the cost of car accessories or decorations for passengers?

You can deduct the cost of some of the accessories for your car. They need to be purchased solely for business use. If they are for business and personal use, you can only deduct a percentage of the total cost related to the amount you use your vehicle for business.

Can you write off oil changes for Uber?

You can only write off oil changes for your Uber business if you are eligible to deduct the actual car costs. If you utilize the standard mileage rate for your deductions, you cannot deduct the costs of your oil changes. An oil change counts as maintenance.

Do I need gas receipts for taxes?

You need to keep your gas receipts if you are deducting the actual car costs rather than using the standard mileage rate for your deductions. If you deduct the actual car costs, then you can only deduct the cost of the portion of gas you use while driving for Uber.

Can an Uber driver write off a car purchase?

You can deduct the total cost of a car purchase if you purchased a vehicle solely for rideshare driving. If you purchased it for personal and business use, you can deduct the percentage of the cost equal to the percentage you use the vehicle for business.

More Useful Resources

Explore our diverse tax deduction guides catering to various niches. From small businesses to real estate agents, find valuable insights to optimize your tax savings.

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

14 Tax Write-Offs for LLC

14 Tax Write-Offs for LLC Top 11 Landlord Tax Deductions

Top 11 Landlord Tax Deductions 13 Tax Deductions For Independent Contractors

13 Tax Deductions For Independent Contractors 5 Tax Deductions For Students

5 Tax Deductions For Students Educator Expense Tax Deduction: Teacher Tax Deductions

Educator Expense Tax Deduction: Teacher Tax Deductions 20 Real Estate Agent Tax Deductions (2025)

20 Real Estate Agent Tax Deductions (2025)