Payroll Tax vs. Income Tax: What’s the Difference?

While both contribute to government revenue, they function very differently. Income tax is levied on your business’s profits, as well as on your personal income. Payroll tax, on the other hand, is specifically related to employee wages. Understanding this distinction is crucial for accurate financial planning, compliance, and ultimately, the financial health of your business.

The process of paying income and payroll tax is also different, making it important for employers and their employees to understand the difference. With a solid understanding of payroll tax versus income tax, including their differences and how you calculate each one, you’ll be able to better plan for tax season, ensure compliance, and save more money.

Key Takeaways

- Payroll taxes are deducted from an employee’s wage or salary by their employer to pay for Medicare, Social Security, and federal unemployment programs.

- The employee and the employer split Social Security and Medicare taxes (known as FICA, 7.65% each), while the employer alone pays Federal Unemployment Tax Act (FUTA) taxes and state unemployment taxes.

- Employers must use their employees’ W-4 forms, their salaries/wages details, and the current payroll tax rates to determine payroll taxes.

- The IRS applies income taxes to almost all sources of income, including wages, salaries, dividends, rental income, winnings, and more.

- Self-employed individuals must calculate and pay their own income and payroll taxes (FICA and FUTA).

- To calculate income taxes for an employee, you must determine their tax liability using the 2024 marginal tax brackets.

- The main differences between payroll tax and income tax are employee versus employer responsibility, government levies, usages of each tax, what income sources they are applied to, and the tax rates in place for each.

Table of Contents

- What Is the Difference Between Payroll and Income Taxes?

- What Are Payroll Taxes?

- What Are Income Taxes?

- Best Practices for Managing Payroll and Income Taxes

- How FreshBooks Simplifies Tax Management

What Is the Difference Between Payroll and Income Taxes?

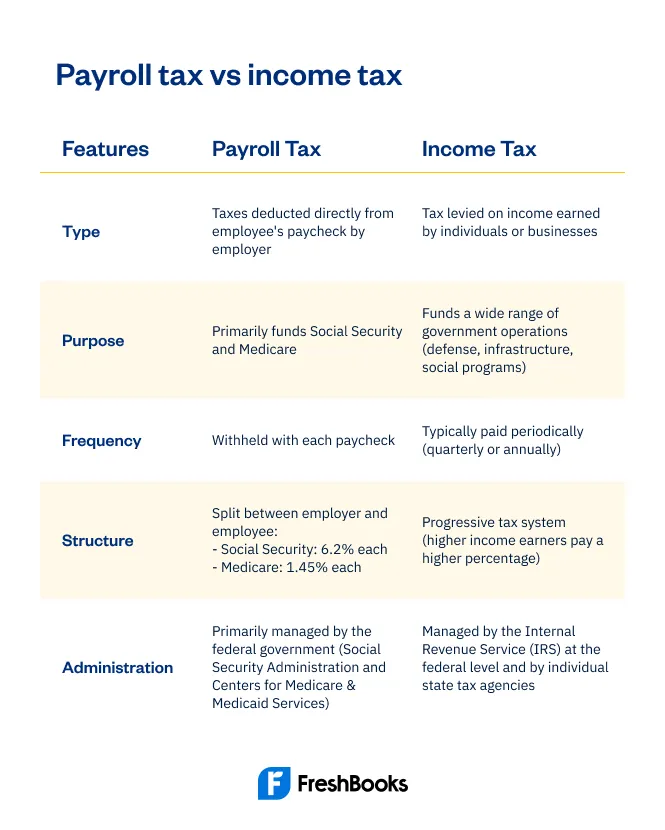

Payroll tax and income tax are distinct in several key ways, and understanding these differences is crucial for business owners to maintain compliance and financial stability. The main differences come down to who is responsible for paying them (employee vs. employer), what the taxes are levied on, and the specific tax rates applied.

Payroll and Income Tax Rates

| Comparison | Payroll tax | Income tax |

| Tax rates | 15.3%, plus any amounts for SUTA, which vary by state | 10% to 37%, depending on income level |

| Application | Applies only to wages and salaries | Applies to all sources of income |

| Calculation method | Based only on income | Based on income, filing status, deductions, and tax credits |

What Are Payroll Taxes?

Payroll taxes are federal and state-level taxes paid directly from an employee’s taxable compensation, such as wages or salary. They mainly pay for social programs provided by the federal government, like Medicare and Social Security, which offer financial aid to people who are retired or live with a disability.

Payroll taxes also go towards the Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA), which offer financial support to people who lose their jobs. Payroll taxes are calculated based on your wages, and the employee-paid portions are deducted directly from your wages—the exact amount depends on the information listed on your W-4 form, which you fill out when you begin work at a new job.

Who Is Responsible for Paying Payroll Taxes?

The employer and their employees split the payroll tax responsibility for Medicare and Social Security taxes (known together as the Federal Insurance Contributions Act, or FICA) 50/50. The employer remits FUTA and SUTA taxes.

If you’re self-employed, payroll and income taxes become the same thing and are known as self-employment taxes. In this case, you’re responsible for paying all of your own federal unemployment taxes, as well as SUTA and FICA taxes (though you can deduct 50% of FICA taxes paid later on).

How to Calculate Payroll Taxes

As an employer, you’ll need each employee’s Form W-4 and details on their salaries or wages to determine payroll taxes. The IRS updates payroll tax rates annually, so you’ll need to confirm the amounts you’re required to withhold each year. For 2024, the payroll tax rates are as follows:

- Social Security taxes: Part of FICA—the Social Security tax is 6.2% for employers plus 6.2% for employees

- Medicare taxes: Also part of FICA—the Medicare tax is 1.45% for employers plus 1.45% for employees

- Additional Medicare tax: 0.9% for employees whose wages exceed $200,000 per year

- FUTA taxes: 6% for employers for the first $7,000 per year paid to the employee (employers can reduce this amount with credit for state unemployment taxes up to 5.4%, bringing the FUTA tax rate down to 0.6% or a maximum of $42 per employee)

Depending on the location of your business, you might also have to pay for state unemployment insurance (SUTA taxes). Exact rates vary by state, but if you’re required to pay for them, you’ll be liable to pay 100% of them as the employer.

Example of Payroll Taxes

Let’s look at an example of how to determine payroll taxes for your employees. Let’s say you have an employee named Pete, whom you pay $65,000 per year. You pay Pete biweekly, which means he earns $2,500 in gross wages per paycheck. Here’s how you would calculate the amount of FICA taxes to withhold from each of Pete’s paychecks and send to the Internal Revenue Service:

- $2,500 gross wages per paycheck

- employee portion of Social Security tax at 6.2%: $2,500 x 0.062 = $155

- employee portion of Medicare tax at 1.45%: $2,500 x 0.0145 = $36.25

- total of the employee portion of FICA taxes: $36.25 + $155 = $191.25

- amount of FICA taxes to withhold from each of Pete’s paychecks: $191.25

However, there’s still another step: You must calculate your employer contributions to match Pete’s. For this example, we’ll assume your state charges a SUTA tax of 2.7% and that you have claimed state unemployment credits to reduce your FUTA tax rate to 0.6%:

- employer portion of Social Security tax at 6.2%: $2,500 x 0.062 = $155

- employer portion of Medicare tax at 1.45%: $2,500 x 0.0145 = $36.25

- FUTA tax of 0.6%: $2,500 x 0.006 = $15

- SUTA tax of 2.7%: $2,500 x 0.027 = $67.50

- contribution in payroll taxes for each of Pete’s paychecks until reaching the FUTA cap of $7,000 per year: $273.75

What Are Income Taxes?

Individuals, businesses, and most other entities pay the Internal Revenue Service income taxes to fund local, state, and federal government operations. Federal taxes fund a variety of things, from infrastructure to defense. The IRS considers almost all kinds of income taxable, including salaries, wages, interest, rental income, dividends, royalties, winnings from gambling or lottery, unemployment benefits, and earnings from any businesses you own.

In addition to federal taxes (which everyone must pay), almost all states charge state income tax, except for Alaska, Florida, Nevada, South Dakota, Texas, Tennessee, Washington, and Wyoming.

Income tax is usually withheld from employees’ paychecks automatically, contributing to confusion between payroll and income taxes. Whereas payroll tax is mainly set at fixed rates, income tax varies depending on your personal income tax rate. Different income amounts are broken up into brackets, each with a different federal income tax rate.

Who Is Responsible for Paying Income Taxes?

Primarily, it’s the employee’s responsibility to pay income tax, but their employers will withhold income taxes and send them to the Internal Revenue Service. This is true of all W-2 employees—your employer will calculate and withhold your federal (and, if applicable, state and local) income taxes from your paychecks.

The main difference is with self-employed individuals, such as independent contractors, sole proprietors, and business owners. If you’re self-employed, you’ll need to report your income, calculate your income tax liability, and pay it out of your savings—generally every quarter.

How to Calculate Income Taxes

The IRS uses a progressive tax system, which means the income tax rate varies depending on which income bracket you fall into. A lower rate applies to lower income levels, while a higher rate pertains to higher income. Furthermore, tax brackets vary depending on your filing status—whether you’re filing singly, married filing jointly, married filing separately, or as a head of household.

To calculate the federal income you’ll need to withhold as an employer, follow this process:

- Look at the federal income tax brackets for the 2024 tax year.

- Choose the wage bracket or percentage method to calculate federal income tax withholding.

- Collect information on employee pay frequency, total earnings per pay period, and Form W-4 details.

- Check if any of your employees are exempt from federal withholding and if you need to include any relevant information on tax credits or deductions in your withholding calculations.

You’ll also need to check with your state and local tax authorities to determine the rates and dollar amounts to withhold in local and state income taxes. These vary by location, so pay attention to the employer’s obligations for employment taxes in your area.

Example of Income Taxes

Let’s return to Pete’s example to explain how to calculate income tax withholdings. As mentioned, Pete makes $65,000 per year and will file singly. Although Pete’s total annual earnings exceed the lower threshold of the 22% tax bracket, he won’t be taxed 22% on all of his earnings—only on the amount exceeding the threshold ($47,151 for 2024) because the United States uses a progressive tax system. Here’s how you would calculate his income taxes:

- 10% of the first $11,600 of Pete’s annual pay: $11,600 x 0.1 = $1,160; plus

- 12% of the amount above $11,600 and below $47,151: $35,551 x 0.12 = $4,266.12; plus

- 22% of the amount above $47,151: $17,849 x 0.22 = $3,926.78

- $1,160 + $4,266.12 + $3,926.78 = $9,352.90

- total withheld from Pete’s wages for income taxes, not including any tax credits that he may claim: $9,352.90

Best Practices for Managing Payroll and Income Taxes

When doing your payroll, it’s essential to remember a few best practices to ensure an accurate and efficient process. Here’s what employers need to know about managing both payroll tax and income tax for their employees:

- Consider all withholdings: When calculating how much to deduct in payroll and income taxes from employee paychecks, you might have to factor in other withholdings, such as health insurance premiums or retirement plan contributions.

- Account for voluntary deductions: Your employees might opt to have additional money withheld from their paychecks, such as for employee contributions to a retirement plan, employee-paid premiums for health, dental, vision, or life insurance, union dues, and repayment of loans taken by an employee from their employer. Make sure to factor these additional deductions in, as some are tax-deductible contributions.

- Accurately classify workers: Ensure you’ve classified all your workers correctly as W-2 employees or independent contractors. For W-2 employees, you’ll incur payroll expenses (such as the Federal Insurance Contributions Act and Federal Unemployment Tax Act contributions). Independent contractors are solely responsible for their tax withholdings, and your only expense as their employer is the gross amount of their wages.

- Submit payroll tax forms accurately and on time: Employers must complete and submit several tax forms as part of their payroll process. These include Form 941 (reports federal income taxes and FICA taxes to the IRS—filed quarterly), Form 940 (your employer FUTA tax return—filed annually), Form W-3 (reports total wages and tax withholdings for all employees—filed annually), and Form 1096 (reports amounts paid to independent contractors—filed annually).

How FreshBooks Simplifies Payroll and Income Tax Management

Payroll and federal income tax management is a complex but vital task for employers. If you’re looking for a way to simplify this process, making it much more efficient while ensuring total accuracy and compliance, FreshBooks is here to help. FreshBooks payroll software makes managing income and payroll tax for all your employees easy, reducing manual administrative work and enhancing accuracy and compliance.

FreshBooks makes setting up your payroll account simple. It automatically synchronizes your books by creating transactions for each pay run, produces quick, accurate summaries of hours and earnings in previous payroll runs, and pays your team directly from your account. Plus, FreshBooks Payroll, powered by Gusto, files your payroll taxes automatically, saving you even more time.

FreshBooks expense tracking software also makes it simple to keep track of all payroll expenses throughout the year, saving your business more money and helping with the budgeting process. Find out why so many business owners trust FreshBooks for their tax management and payroll needs—try FreshBooks for free!

Reviewed by

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

Sole Proprietorship Taxes: A Guide to Deductions and Filing

Sole Proprietorship Taxes: A Guide to Deductions and Filing Independent Contractor Taxes: A Complete Guide for 2025

Independent Contractor Taxes: A Complete Guide for 2025 How to Become a Tax Preparer: A Complete Guide

How to Become a Tax Preparer: A Complete Guide Adjusted Gross Income: What It Is and How to Calculate

Adjusted Gross Income: What It Is and How to Calculate Indirect Tax: Definition, Types, and Example

Indirect Tax: Definition, Types, and Example Freelancer Taxes: Ultimate Guide for Tax Filling & Smart Savings

Freelancer Taxes: Ultimate Guide for Tax Filling & Smart Savings