Mileage Tax Deduction Rules 2025

Mileage tax deductions are available for taxpayers who use their vehicles for business purposes. Mileage tax deductions are a valuable tool for businesses and individuals, helping save money on transportation-related expenses throughout the tax year.

This tax break is calculated using the current IRS mileage rate, so you know how much money you can write off when you use your car for ordinary, necessary business use.

In this article, we’ll explore the rules for claiming the mileage deduction in 2025 and its limitations, including who is eligible, what the IRS mileage rates are, and how to calculate both mileage rates and actual expenses. Read on to learn how to maximize your tax savings while staying compliant with IRS guidelines.

Key Takeaways

- Mileage tax rates are determined by the IRS, allowing some people to deduct certain expenses related to driving for business work on their annual taxes.

- Business use of a vehicle is defined as any driving done between job sites or driving that is directly related to your work.

- In 2025, the IRS mileage rate is 70 cents per mile.

- The standard mileage method of tax deduction is a simple calculation where you multiply the number of miles driven by 70 cents to find your deduction amount.

- Use of the standard mileage rates is optional. Taxpayers may instead choose to calculate the actual costs of using their vehicle.

- The actual expenses method allows you to deduct all vehicle-related expenses, like gas, insurance, and repairs.

- Your deduction amount is also calculated based on the percentage of time your vehicle is in use for work-related activities vs. personal use.

- Keeping accurate records, driving logs, and receipts is critical when claiming business use of vehicle deductions on your taxes.

Table of Contents

- Who Can Take the Mileage Tax Deduction?

- 2025 IRS Mileage Rates

- How to Calculate Mileage for Taxes

- How To Claim Mileage on Taxes

- Limitations for Mileage Tax Deduction Claims

- Use FreshBooks To Simplify Your Tax Preparation

- FAQs about Mileage Tax Deduction

Who Can Take the Mileage Tax Deduction?

Since 2017, the only taxpayers eligible to claim the standard mileage tax deduction are self-employed individuals, small business owners, and employees who are driving for work-related purposes and are not reimbursed by their employers. If you want to claim this deduction, there are some qualifying criteria you need to meet. The most important one is that you must own or lease your vehicle, and you can only qualify for:

- Business-related travel for self-employed individuals

- Mileage related to medical appointments

- Mileage incurred while volunteering for a nonprofit

Self-employed people include:

- Independent Contractors

- Small Business Owners

- Delivery Drivers and ride-share drivers

- Sales Representatives

- Real Estate Agents

- Truck Drivers

You cannot claim for your daily travel to and from your workplace, nor can you claim for moving expenses.

2025 IRS Mileage Rates

The IRS has a standard mileage rate (SMR) for the business use of your personal vehicle. The rate for tax year 2025 is 70 cents per mile.

For medical expenses, you can claim 21 cents per mile driven and 14 cents per mile for volunteer work for charitable organizations.

These rates take into account market fluctuations and are revised regularly.

The mileage rate for business use is based on an annual study of the fixed and variable costs of operating a vehicle.

How to Calculate Mileage for Taxes

Taxpayers using the standard mileage rate for a vehicle they own and use for business must choose to use the rate in the first year the automobile is available for business use. Then, in later years, they can choose to use the standard mileage rate or actual expenses on their federal tax return.

If you qualify for both methods, it is recommended to calculate the deductions both ways to determine which method gives you a larger deduction.

Standard Mileage Rate

The IRS sets a fixed mileage rate annually, which is then multiplied by the total business miles driven to determine the deduction.

The mileage rate for business use is based on an annual study of the fixed and variable costs of operating a vehicle.

In 2025, the rate is 70 cents per mile, so, for example, if you drove your personal vehicle 2,000 miles for business purposes, you would use the following calculation:

2000 x $.70 = $1400

In this scenario, you could claim $1,400 total. While this is a simpler method of calculating how much you can deduct, every vehicle-related expense is rolled into this amount, so you can’t also claim wear and tear, gas, or any other deduction.

Actual Expenses

The actual expense method allows taxpayers to calculate deductions based on the actual costs incurred for operating the vehicle, including gas, maintenance, insurance, depreciation, lease payments, tolls, and parking.

You must also calculate the percentage of time you use your vehicle for business. If you use it 100% of the time for work-related driving, then you can deduct 100% of your expenses, but if you use it 30% of the time driving for your business and 70% for personal use, you can only deduct 30% of the expenses.

This method required detailed record keeping. If you choose this method, save every receipt related to the care and maintenance of your car throughout the year.

Knowing the rules and regulations surrounding the tax deductions for mileage can seem overwhelming. Learn how FreshBooks can take the pain out of tax preparation with this short video.

How To Claim Mileage on Taxes

Did you know you can claim mileage for volunteering? If you volunteer for a qualified charity, you can use the volunteer mileage rate of 14 cents per mile for your deduction. You can only claim mileage in the year you volunteered. You will need to provide detailed records to prove your claim.

You can also claim 21 cents per mile driven for medical reasons.

Unless you are a member of the armed forces, you cannot claim a deduction for moving expenses.

Limitations for Mileage Tax Deduction Claims

The IRS states that you cannot use the standard mileage rate if:

- You have fleet operations or use more than five cars at a time

- You claimed a depreciation deduction for the car using any method other than a straight line for the car’s estimated useful life

- You use the Modified Accelerated Cost Recovery System (MACRS).

- Claimed a section 179 deduction for the value of your vehicle

- Claimed special depreciation allowance on the car

- Claimed actual car expenses after 1997 for a car you leased

You can only use the SMR for deducting mileage for a car you own. If you use it for a leased vehicle, you must use the SMR for the entire lease term and cannot change to use the actual method in later years.

Employees can no longer claim unreimbursed business miles as a miscellaneous itemized deduction on their tax return.

Use FreshBooks To Simplify Your Tax Preparation

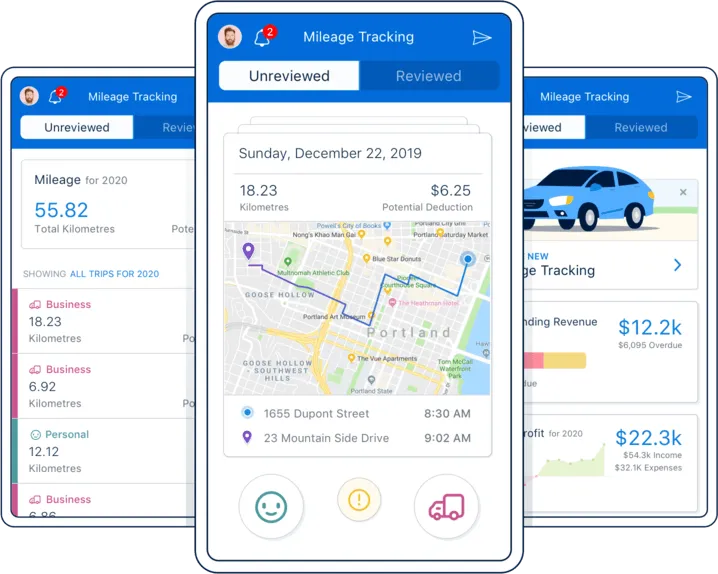

Accurate record-keeping is the key to simplifying your mileage tax deduction claims. FreshBooks makes tax time easier by automatically tracking mileage and organizing expense data for seamless tax preparation.

Explore FreshBooks today and maximize your deductions while staying compliant with IRS rules. Try FreshBooks for free to put your mind at ease when preparing your tax return, and find out for yourself how our accounting software helps small businesses like yours find their way to success.

Navigating the rules and regulations of tax credits and deductions can seem daunting, but it doesn’t have to be. FreshBooks offers guides for many tax relief topics. Learn more about Small Business Tax Deductions and start getting the most out of your money today.

FAQs about Mileage Tax Deduction

FreshBooks has summarized some of the frequently asked questions about mileage tax deductions below for quick reference. Have a look!

How many miles can you write off for taxes?

As long as you’re driving for business purposes and using the mileage deduction, you can write off every mile you drive. You’ll need to calculate the percentage of business use to know how much to deduct.

Is it better to claim mileage or actual expenses?

It depends on which method will give you a larger deduction. For example, if you’ve spent a lot of money on car maintenance, tolls, and other business-related vehicle expenses, you may want to claim actual expenses. If you’re looking for a simpler method, mileage may be better.

What vehicle expenses are tax deductible?

If you’re using the actual expenses method, you can deduct expenses like gas, oil, tires, repairs, insurance, registration fees, licensing fees, depreciation, parking fees, and tolls.

What is the difference between commuting miles and business miles?

Commuting miles are the miles driven to and from your job, which are not deductible. Business miles, on the other hand, are any miles you drive for work-specific purposes. Some examples include making deliveries, driving between job sites, or driving to a work meeting.

Is it better to claim mileage or gas on taxes?

If you use your vehicle for a substantial portion of your total mileage, it may be better to use the actual expense method because it allows you to calculate the gas costs and other itemized vehicle expenses.

If you use the standard mileage rate, you cannot also deduct actual expenses.

How does the IRS determine mileage?

The Internal Revenue Service calculates mileage reimbursement by examining the fixed and variable automobile operating costs. The IRS reexamines these costs each year, and new rates are issued. These rates apply to gasoline and diesel-powered vehicles and electric and hybrid automobiles.

Can I deduct mileage to and from work as an independent contractor?

You can only claim mileage to and from work if the workplace is a temporary location. This is common for tradespeople who regularly travel to other homes and job sites to perform their job.

What happens if you didn’t keep track of your mileage?

If you forgot to keep track of your mileage, you can still prove your claim with:

- A statement that includes specific information about the untracked mileage

- Provide sufficient supporting evidence through other sources

The FreshBooks mileage tracker app can help you stay on track with your mileage records.

Can I deduct mileage to and from work as an independent contractor?

You can only claim mileage to and from work if the workplace is a temporary location. This is common for tradespeople who regularly travel to other homes and job sites to perform their job.

What states require mileage reimbursement?

California, Illinois, and Massachusetts require employers to reimburse employees for business mileage. Employers can reimburse above or below the standard mileage deduction rate of 70 cents per mile. If they reimburse below the standard rate, the rate cannot be so low as to bring the wage below the state minimum wage.

More Useful Resources

- Requirements for Tax Exemption

- How Much Do You Have to Make to File Taxes?

- Are Closing Costs Tax Deductible?

- Are Funeral Expenses Tax Deductible?

- Sales Tax Deduction

- Are Home Improvements Tax Deductible?

- SALT Tax Deduction

- Mortgage Interest Deduction

- QBI Tax Deduction

- Educator Expense Tax Deduction

Reviewed by

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

7 Tax Deductions For W-2 Employees

7 Tax Deductions For W-2 Employees Sales Tax Deduction: What Is It and How Does It Work

Sales Tax Deduction: What Is It and How Does It Work 13 Truck Driver Tax Deductions You Need to Know

13 Truck Driver Tax Deductions You Need to Know 10 Tax Deductions for Seniors & Retirees

10 Tax Deductions for Seniors & Retirees QBI Tax Deduction: What It Is And How Does It Work

QBI Tax Deduction: What It Is And How Does It Work 11 Tax-Saving Strategies for High-Income Earners

11 Tax-Saving Strategies for High-Income Earners