Self-Employment Tax: Definition and How to Calculate It

Freelancers, contract workers, and other sole proprietorship owners enjoy the benefit of being their own boss. But, they’re also legally required to track and report their earnings and pay taxes on their income. The self-employment tax covers your Social Security and Medicare contributions, ensuring future benefits like retirement income and health insurance. As opposed to traditional employees, you are responsible for calculating and paying your own taxes.

In this guide, learn about self-employment tax and how to calculate it in a few straightforward steps.

Key Takeaways

- Self-employment tax (SE tax) funds government insurance for taxpayers.

- Self-employment tax includes Social Security tax and Medicare Tax.

- The 2024 Self-Employment tax rate is 15.3%.

- Up to half your SE tax is deductible on your income tax return.

- Pay your estimated SE tax in quarterly payments to avoid end-of-year penalties.

Table of Contents

- What Is Self-Employment Tax?

- Who Is Subject to Self-Employment Tax?

- Self-Employment Tax Rate For 2024

- How To Calculate Self-Employment Tax

- How To Pay Self-Employment Tax

- Self-Employment Tax vs. Income Tax

- Conclusion

- Frequently Asked Questions

What Is Self-Employment Tax?

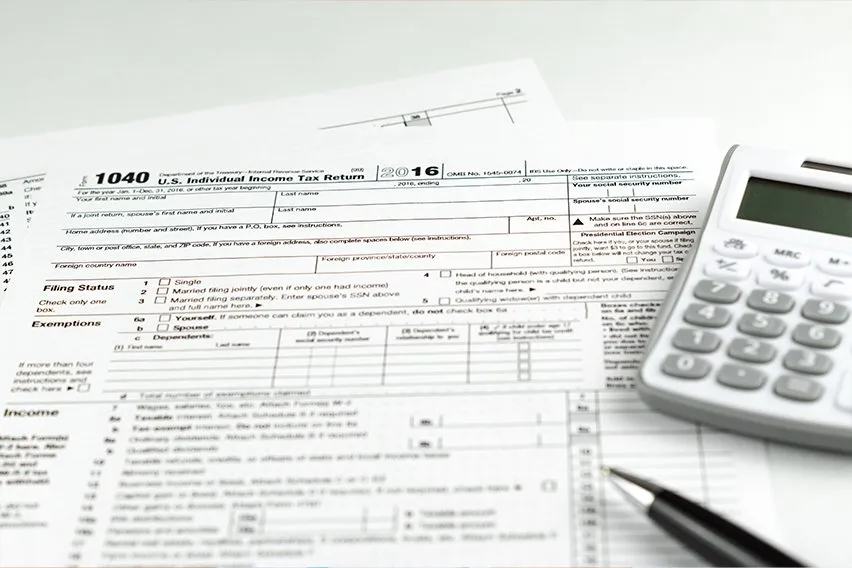

Self-employment (SE) tax is the tax you pay on your earnings if you work for yourself. The SE tax comes from the Self Employment Contributions Act (SECA). 1 Similar to wage or salary earners, it is the self-employment version of the FICA tax (Federal Insurance Contributions Act). 2 It’s a levy from the U.S. government to fund Medicare and Social Security insurance. Individuals who work for themselves calculate the tax using Schedule SE (Form 1040). 3

Who Is Subject to Self-Employment Tax?

Depending on your business structure and tax filing status, you may be required to pay self-employment tax. This is true if you meet one of the following criteria.

- You are a sole proprietor

- You own a single-member LLC

- You work as an independent contractor

- You are part of a legal business partnership

- You maintain active membership in a partnership LLC

You must pay self-employment tax if:

- Your net earnings from self-employment were $400 or more

- You had church employee income of $108.28 or more

Self-Employment Tax Rate For 2024

Self-employment tax is 15.3% for 2024. 1 It has held steady at this rate since 2013. That aggregate rate consists of a 12.4% Social Security tax and a 2.9% Medicare tax. There is a cap on the SE taxable earnings from self-employment income. For 2024, it’s $168,800.

Because these are revenues from self-employment, you pay the employer and the employee portion. Wage and salary earners have 7.65% or half of the total FICA tax withheld from their paychecks. This includes the 6.2% social security tax and 1.45% Medicare tax. 2 Their employer pays the other half.

As a self-employed individual, you can deduct half the cost of your SE taxes (the equivalent of the employer portion) when figuring out your adjusted gross income. This deduction only affects your income tax.

How To Calculate Self-Employment Tax

Calculating self-employment tax is an advantageous skill that better prepares you when it’s time to file your federal income taxes. Follow the steps below to get an estimate of what you owe. When in doubt, always consult a tax professional or accountant. Now, let’s learn how self-employment tax is calculated.

1. Calculate Net Earnings

To begin, calculate your net earnings for the year. For self-employed individuals, this amount is usually found by subtracting total expenses from gross income or sales.

Net Earnings = Gross Business Income – Total Business Expenses

For example:

If your gross business income is $120,000 and your business expenses are $18,000 then your net income is $102,000.

2. Understand the Self-Employment Tax Rate

While it may not apply for income tax purposes, only 92.35% of your self-employment earnings are subject to the 15.3% tax rate. If you choose to use an automatic calculator, or if you calculate your tax responsibility manually, keep this rule in mind.

$102,000 x 92.35% = $94,197

3. Apply the Tax Rate to Net Earnings

A quick online search will reveal several calculators you can use to estimate your self-employment tax responsibility. Fortunately, the equation is rather easy. You simply need to multiply your net earnings by the total self-employment tax rate of 15.3%.

Continuing with the above example, multiply the tax rate by your adjusted net earnings.

Adjusted Net Earnings * 15.3% (Tax Rate) = SE tax

$94,197 x 15.3% = $14,412.14 SE tax.

4. Social Security Earnings Exception

In 2024, only the first $168,600 in net earnings is subject to the Social Security portion of self-employment taxes. This is an increase from the year prior. You do not have to pay Social Security tax on your self-employed earnings above $168,600.

You do have to pay medicare taxes at 2.9% on earnings above $168,600 up to $200,000.

How To Pay Self-Employment Tax

Because US taxes are pay-as-you-go, it’s better to pay estimated self-employment taxes quarterly rather than annually to avoid penalties. Quarterly tax payments are especially shrewd if you expect to owe over $1,000 in federal income taxes or if you failed to pay at least 90% of the withholding and estimated tax for the current year.

Use your IRS Schedule C to calculate your net earnings and the IRS Schedule SE to calculate how much self-employment tax you owe.

You will still need to pay your federal and state taxes when you file your annual tax return.

Tax Deductions for Self-Employment

There are many deductions available to self-employed individuals that can reduce their tax liability. You can deduct up to half of your self-employment tax on your income taxes. Carrying on with the above example, you can deduct up to $7,206.

If you are diligent and manage any business income deductions well, you may significantly reduce your overall tax liability. This includes continuing education, home office equipment, expenses related to your website, and any expenditures incurred in operating your business.

Qualified Business Income Deduction

Owners of sole proprietorships, partnerships, S corporations, and some trusts and estates may be eligible for a qualified business income (QBI) deduction. The deduction allows eligible taxpayers to deduct up to 20 percent of their QBI.

Self-Employment Health Insurance Deduction

A deduction, for income tax purposes, is allowed to self-employed individuals or freelancers for the cost of health insurance. This deduction is taken into account when calculating net earnings from self-employment.

Self-Employment Tax vs. Income Tax

Self-employment tax is different from income tax, which includes both federal and state income taxes. When you are self-employed, you are responsible for paying both SECA and income taxes on your own.

Income tax is something that is generated for everyone who earns money, regardless of how they are employed.

Only self-employed individuals are subject to self-employment tax to pay their share of Social Security and Medicare taxes.

Conclusion

Understanding self-employment tax is essential for self-employed individuals. Knowing how to calculate your taxes and make estimated payments will help you avoid penalties and stay on top of your tax obligations. Self-employed taxpayers can also take advantage of a number of tax deductions that can significantly reduce their tax burden.

Use accounting software like FreshBooks to manage your business finances and simplify tax calculations. Try FreshBooks free by signing up today.

FAQs About Self-Employment Tax

Taxes for self-employment, Social Security, and Medicare are easy to navigate when you have straightforward information. We’ve summarized FAQs and their answers below to help make it even easier.

Who is exempt from self-employment tax?

You are exempt from paying the self-employment tax if you are self-employed and earn less than $400 a year or less than $108.28 as a church employee. If you have earnings from other sources that exceed this amount, you are not exempt from self-employment tax.

Do self-employed get Social Security?

Self-employed taxpayers can receive Social Security if they have worked and paid Social Security taxes for a certain length of time. How long depends on your age and will not exceed 10 years (40 credits). You can earn 1 credit for earnings of $1,730 up to 4 credits per year.

Can you have a 401k if you are self-employed?

You can open a solo 401(K) when you are self-employed if you don’t employ others. It can be a traditional or Roth plan. You can contribute as an employee or an employer. If you run a business with your partner, you can both invest.

Do self-employed pay federal income tax?

Yes, self-employed people have to pay federal income taxes. They also have to pay self-employment tax, which consists of Medicare and Social Security taxes. You’ll need to file quarterly estimated taxes and an annual income tax return. When you’re employed, your employer withholds these taxes from your wages.

How do I get my tax refund if I am self-employed?

Tax refunds are deposited directly to your bank account. The IRS usually takes 24 to 48 hours to accept e-file returns. They typically make a determination within 21 days and deposit the funds. After that, it can take up to 7 days for your banking institution to release your funds.

Article Sources

- IRS. “Self-Employment Tax (Social Security and Medicare Taxes)” Accessed Feb. 21, 2024

- IRS. “Topic no. 751, Social Security and Medicare Withholding Rates” Accessed Feb. 21, 2024

- IRS. “About Form 1040, U.S. Individual Income Tax Return” Accessed Feb. 21, 2024

Reviewed by

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

What is a W3 Tax Form and How to File One

What is a W3 Tax Form and How to File One What is a W-4 Form?

What is a W-4 Form? How to Fill Out a W-4 Form: A Step-By-Step Guide (2025)

How to Fill Out a W-4 Form: A Step-By-Step Guide (2025) W2 vs W4: The Difference Between W2 and W4 IRS Forms

W2 vs W4: The Difference Between W2 and W4 IRS Forms Top 12 Tax Deductions for Photographers (2025)

Top 12 Tax Deductions for Photographers (2025) Real Estate Tax Deductions Every Business Should Know

Real Estate Tax Deductions Every Business Should Know