Form 2553: Everything You Need To Know

When a business owner decides to register their small business as a corporation with the Internal Revenue Service, by default, it’s incorporated as a C corporation.

But, eligible businesses can file IRS Form 2553, and make an election to form an S corporation instead of a C corporation. This comes with significant tax benefits and other advantages that can save your company money.

S corporation status isn’t limited to only corporations. Limited liability companies (LLCs) can also be S corps. We’ll explain that a little later.

Here’s what we’ll cover:

What Is the Purpose of Form 2553?

What Are the Eligibility Requirements for an S Corporation?

How Do I Get a Copy of Form 2553?

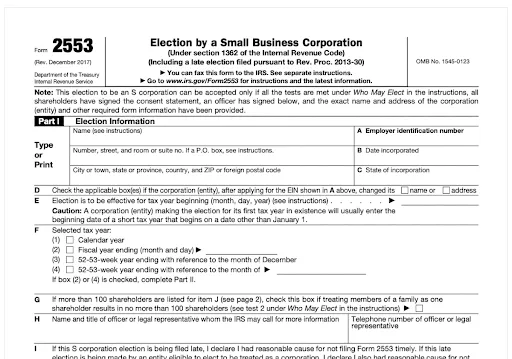

What Is the Purpose of Form 2553?

The purpose of Form 2553 is to allow certain small businesses to choose to be taxed as an S corporation. This is often called making an S-election.

The small businesses that can choose S corporation status include:

- Limited liability companies (LLC)

- Partnerships

- Small domestic corporations

Tax Benefits of S Corporation Status

The taxation of an S corp is more like a partnership than a corporation, and S corp election gives potential tax savings to small business owners.

Pass-Through Taxation

An S corp isn’t subject to double taxation the way C corporations can be. A C corp is generally taxed at the corporate level and again at the shareholder level if it pays out dividends.

So, a C corporation with $1,000 in net profits that have been distributed to shareholders will result in a corporate tax of approximately $210 (based on the current corporate tax rate of 21%). The shareholders will also pay individual income tax, which—depending on their personal tax rates—will be 10%–37% of their dividends.

But an S corporation isn’t required to pay taxes itself. Instead, profits and losses are passed directly to shareholders to report on their personal tax returns. This is why an S corp is called a pass-through entity.

Self-Employment Tax Savings

LLCs and partnerships enjoy additional tax advantages when they make an S-election.

By electing to be taxed as an S corporation, LLC members and partnership partners are no longer self-employed in the eyes of the IRS.

When you’re self-employed, all of your LLC or partnership’s net profits are subject to the 15.3% self-employment tax.

But as an S-corporation shareholder, you’re considered an employee and pay yourself a reasonable salary that’s subject to income tax, Social Security, and Medicare taxes. Shareholders are also allowed to take distributions from the S corporation that aren’t subject to Social Security or Medicare taxes—only income taxes.

What Are the Eligibility Requirements for an S Corporation?

Not every small corporation is eligible to elect S corporation status. These are some of the main eligibility requirements for making an S-election:

- Your company must be a domestic corporation

- The company can’t have more than 100 shareholders

- Your corporation can’t have any nonresident alien shareholders

- The corporation must not have more than one class of stock

- In most cases, the shareholders must be individuals, estates, and exempt organizations, and not corporate entities, bank or thrift institutions, or insurance companies

- All shareholders must consent to the S-election

- The corporation must file Form 2553 on time

While these are the main legal requirements, there are other guidelines S corps are required to follow that you can review in full on the IRS website.

When Should I File Form 2553?

Small businesses must file Form 2553 with the IRS within a specific time period to be considered for S corporation status, as mandated by law. Here are the details of when your business must file Form 2553:

- Form 2553 must be filed no later than 2 months and 15 days after the start of the tax year in which the S corporation will take effect. For most businesses, the tax year begins on January 1, so the filing deadline would be March 15 (outside of leap years).

- Form 2553 can be filed at any time in the tax year before the S corporation is to take effect. So, if you plan to elect for S corp status in 2025, you can file Form 2553 at any point in 2024.

If certain requirements for late elections are met, small businesses may file a late small business corporation election past the March 15 deadline. Requirements include:

- The corporation planned to file as an S corp by the intended effective date

- The only reason the corporation failed to qualify is that Form 2553 wasn’t filed on time

- The corporation has a reasonable explanation for missing the filing deadline

- All shareholders reported their income in line with the corporation’s intention to elect for S corp status, and the corporation has documentation to prove it

How Do I Get a Copy of My Form 2553?

If your business is approved as an S corporation, you must keep a copy of your Form 2553 in your records, because you’ll need the form to file your taxes.

If you misplace Form 2553, you must contact the IRS to request a new copy. Here’s how to get a copy of your Form 2553 so you can file taxes as an S corp:

- First, make sure you’re authorized to conduct business transactions on behalf of the corporation.

- Next, call the IRS Business and Specialty Tax line at 1-800-829-4933, which offers services to small businesses seeking tax assistance. Their hours of service are 7 am to 7 pm in your state time zone.

- Request a copy of Form 2553. You’ll need to confirm your identity by providing identifying information, including your corporation’s name and address, your name and role within the company, your Employee Identification Number (EIN), and the business’s contact details.

- When you receive the copy of your Form 2553, be sure to file it away with your other tax documents and corporate records so you can refer to it when needed.

FAQs About IRS Form 2553

How Long Is the S Corporation Election Process?

The IRS will let you know whether your S corp election has been accepted within 60 days after you file Form 2553. However, if you checked box Q1 in Part II requesting that the IRS send you a ruling letter, acceptance of Form 2553 can take an additional 90 days.

How Do I Know Whether My S Corp Status Was Approved?

After filing your Form 2553, the IRS will send a written ruling letter that notifies the corporation whether its S corporation election was approved or rejected.

Whose Authorization Is Needed to Make an S Corp Election on Form 2553?

In most cases, you need the consent of all shareholders who own stock in the corporation on the day the election is made, with some exceptions, as outlined in the instructions.

Can Form 2553 Be Filed Online?

No. The IRS requires that Form 2553 be submitted via mail or fax.

RELATED ARTICLES

What Is a 1120 Tax Form? Facts and Filing Tips for Small Businesses

What Is a 1120 Tax Form? Facts and Filing Tips for Small Businesses What Is Form 720? It’s a Hidden Tax

What Is Form 720? It’s a Hidden Tax Indirect Business Taxes: A Definition and Examples for Small Businesses

Indirect Business Taxes: A Definition and Examples for Small Businesses How Much Does a Small Business Pay in Taxes?

How Much Does a Small Business Pay in Taxes? How Much Do You Have to Make to File Taxes in 2025

How Much Do You Have to Make to File Taxes in 2025 How Much Cash Can You Deposit?

How Much Cash Can You Deposit?