Filing Business and Personal Taxes Separately: A Small Business Guide

Small business owners need to understand tax obligations, including when to file personal and business taxes separately. Deciding how to differentiate your tax filing is part tax strategy and part legal obligation. The choice often depends on your corporate structure (e.g., sole proprietorship, LLC, corporation, etc.), with various tax laws and advantages to consider for each one. With the right knowledge, you can maximize your financial efficiency while ensuring total compliance with tax law.

In this article, we’ll offer a detailed guide on the specific tax filing requirements and best practices for different business types, empowering you to make more informed financial decisions. Let’s take a look.

Key Takeaways

- You can only file your business taxes separately from your personal taxes if your company is a corporation.

- LLCs can opt to be taxed as a corporation, allowing them to be taxed separately from their owners.

- Sole proprietorships, self-employed people, single-member LLCs, and partnerships are subject to pass-through taxation, meaning the business and its owners are taxed together.

- C corporations and S corporations are taxed at the corporate level—corporation members do not combine business and personal taxes.

- Accounting software can help business owners separate and manage personal and business taxes for reduced tax liability and improved compliance.

Table of Contents

- Can I File My Personal and Business Taxes Separately?

- Can I File My LLC and Personal Taxes Separately?

- Conclusion

- FAQs On Filing Personal and Business Taxes

Can I File My Personal and Business Taxes Separately?

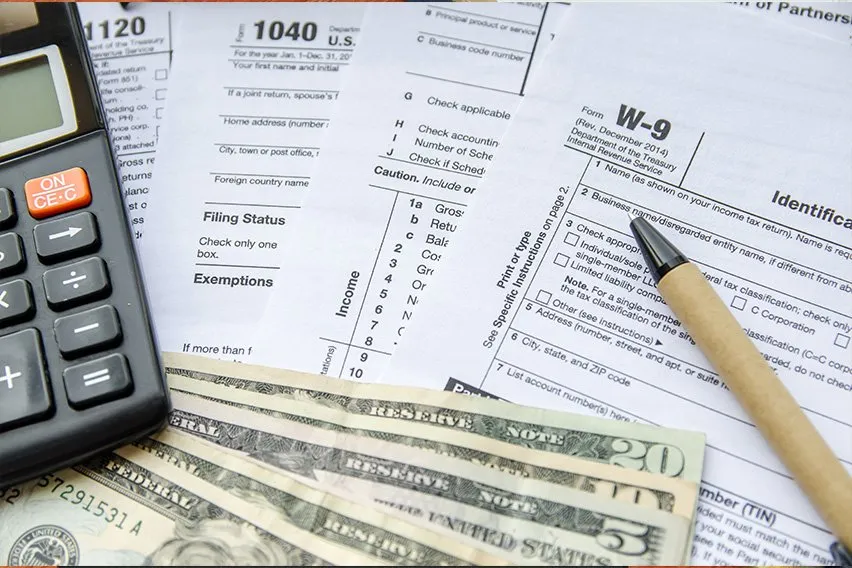

You can only file your personal and business taxes separately if your company is a corporation, according to the IRS. A corporation is a business that’s seen as an entity separate from its owner(s) and pays its own taxes. Corporations file their taxes using Form 1120.

Limited liability companies (LLCs) can also choose to be treated as a corporation by the IRS, whether they have one or multiple owners. In that situation, they must also file their taxes using Form 1120, which means the owners must file their personal and business taxes separately.

All other business structures must report their income or losses via the owner or owners’ personal tax returns on Form 1040. We’ll look at each structure’s tax reporting obligations below.

Need more time to file your taxes? Use tax Form 4868 or Form 7004 to apply for an extension.

Sole Proprietorships

A sole proprietorship is an unincorporated business that has a single owner. Sole proprietors report their business income or losses on their personal tax return by using Form 1040. They must also file Schedule C (Form 1040) to report the profit and loss from their business. Filing taxes as a sole proprietor is a fairly straightforward affair.

Self-Employed

The IRS considers people self-employed if they are sole proprietors (see above), independent contractors, or in business for themselves in any other way, even part-time.

The reporting rules are the same as with sole proprietors: report business profits and losses on your personal income tax return (Form 1040) as well as Schedule C. You can’t file your business taxes separately from your personal taxes.

Partnerships

A partnership is a business owned by two or more people. These people share in the profits and losses of the business and contribute labor, skill, property or money. Partners report their share of the business’s profits or losses on their personal income tax return (Form 1040), according to the IRS.

The partnership must also file an information return, Form 1065, which generates a Schedule K-1 for each owner. But the business itself doesn’t pay taxes based on this information return, the partners do via their personal tax return.

C Corporation

C corporations are considered separate tax-paying entities from their individual owners. This means C corporations must file and report business income separately from their owners. While C corporation business profits are taxed at the corporate level, their owners are required to pay personal tax on any distributions they receive.

In order to file a C corporation’s taxes, you’ll need to fill out and submit IRS Form 1120, U.S. Income Corporation Tax Return.

S Corporation

S corporations elect to pass all corporate income, losses, deductions, and credits through the corporation and onto their shareholders. This means that shareholders of S corporations must report this flow-through of income and losses on their personal tax returns. To file business taxes as an S corporation shareholder, you would first file Form 1120-S, U.S. Income Tax Return for an S Corporation. The S corporation will then issue you a Schedule K-1 (also known as Form 1065), which you report on your personal income tax return using Schedule E.

Can I File My LLC and Personal Taxes Separately?

Limited liability companies, or LLCs, are regulated by individual states. LLC owners are known as members, and most states only allow LLCs to have one. In most places, LLCs with two or more members are instead classified as partnerships unless they decide to be treated as a corporation for tax purposes. The IRS allows LLCs to elect how they are taxed, either with pass-through taxation or corporate taxation. Understanding LLC tax classifications can help you determine the best option for your business.

Pass-Through Taxation

By default, single-member LLCs are treated as an extension of the owner for tax purposes. This is known as pass-through taxation since the taxes ‘pass through’ the LLC and onto the owner(s). This means that in the eyes of the IRS, you and your LLC are considered to be the same entity. The default classification for multi-member LLCs (partnerships) is similar—the partnership isn’t taxed directly. Instead, each partner reports their share of LLC profits and losses on their personal income tax return.

Corporate Taxation

As we mentioned, corporations can file their business taxes separately from the personal taxes of their owners. LLCs can elect to be treated as corporations for tax purposes by filing Form 8832. Unlike pass-through taxation, LLCs that are taxed as corporations pay tax on business income and losses on the corporate level, separating the LLC taxes from the personal income taxes of the corporation’s members.

Conclusion

When it comes to separating personal and business taxes, it’s important for business owners to stay organized throughout the year. Maintaining a clear separation between business and personal taxes will ensure accuracy, compliance, and enhanced financial efficiency when it comes time to pay your tax bill.

If you’re looking for help with managing business and personal taxes, one great tool is FreshBooks accounting software. This platform helps you streamline the tax management process by tracking income, expenses, and receipts, as well as generating detailed reports tailored for tax time. If you’re ready to see how this software can help you with this year’s taxes, try FreshBooks for free!

FAQs On Filing Personal and Business Taxes

More questions about filing personal versus business taxes? Expand your knowledge with these frequently asked questions.

Can I file my LLC taxes with my personal taxes?

Yes, you can file LLC business taxes with your personal taxes unless you ask for the LLC to be treated as a corporation. LLCs can ask the IRS to treat them as a corporation, partnership, or disregarded entity by filing Form 8832, if their default status is otherwise.

Can I file my business taxes with my personal taxes?

Generally, you can only file business taxes with your personal taxes if your business is a sole proprietorship or an LLC considered a pass-through entity. In either case, there are additional forms you’ll need to complete and submit with your personal tax return.

Does a single-member LLC file a separate tax return?

Typically, single-member LLCs are treated like sole proprietorships for tax purposes. This means the LLC is considered a ‘disregarded entity’ by the IRS, and the LLCs business income or losses are reported with the member’s personal tax return on Schedule C.

Can the IRS go after my LLC for personal taxes?

Generally speaking, the IRS will only pursue an LLC for personal back taxes in cases of extreme personal tax evasion where the IRS can prove you are using the LLC as a means of sheltering funds from collection.

How much does an LLC need to make to file taxes?

If your LLC’s income exceeds $400 in one year, you are required to report that income using Schedule C. If a single-member LLC had no business activity and no deductible expenses for the year, the member doesn’t need to file any tax information for the LLC.

How much should an LLC put away for taxes?

When you consider income tax and employment tax, it’s best for LLCs to reserve about 30% of their net income (after deductions) to cover their state and federal tax obligations. You may need to save more in order to pay local taxes.

What is the federal tax rate for LLCs?

In 2025, the federal tax rate for LLCs electing to be treated as C corporations is 21%. For LLCs treated as S corporations or pass-through entities, the individual tax rate applies according to that year’s income tax brackets, which range from 10% to 37%.

How to file taxes for an LLC with no income?

File taxes for an LLC with no income by using the right form for your tax classification. Single-member LLCs attach Schedule C to Form 1040. Multi-member LLCs or partnerships file Form 1065. LLCs taxed as C or S corporations use Form 1120 or 1120-S, respectively. Then, report your expenses and file.

Reviewed by

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

What Is a Business Tax Receipt?

What Is a Business Tax Receipt? How to File an Extension for Business Taxes?

How to File an Extension for Business Taxes? Can a Small Business Get a Tax Refund? Insights and Ways

Can a Small Business Get a Tax Refund? Insights and Ways When are Business Taxes Due in 2025?

When are Business Taxes Due in 2025? Small Business Income Taxes

Small Business Income Taxes How Far Back Can the IRS Go for Unfiled Taxes?

How Far Back Can the IRS Go for Unfiled Taxes?