How To Calculate Payroll Taxes: Step-By-Step Guide

Payroll taxes are employment taxes that employers report and pay to the IRS and some state and local agencies to fund programs like Social Security and unemployment. The employer pays part of the payroll taxes, and the other part is withheld from the employees’ wages.

It’s the employer’s responsibility to correctly calculate and remit payroll taxes. Understanding how to calculate these taxes is essential for maintaining regulatory compliance. It’s also important for employees to understand payroll taxes so they can estimate their take-home wages.

We’ll explore different types of payroll taxes and take you through a step-by-step guide for calculating payroll taxes. We’ll also take a look at key deductions, employer contributions, and real-world examples of how to calculate your small business payroll taxes.

Key Takeaways

- Employers and employees pay payroll taxes.

- These taxes are used to fund a variety of government programs.

- Employers are responsible for calculating, withholding, and remitting payroll taxes.

- There are federal, state, and local payroll taxes.

- Different states have different payroll taxes with varying tax rates.

Table of Contents

- What Are Payroll Taxes?

- Types of Payroll Taxes

- How to Calculate Payroll Taxes

- Payroll Tax Calculation Examples

- Calculate Employer Payroll Taxes

- Take Control of Your Finances: Simplify Payroll Tax Calculations

- FAQs About How To Calculate Payroll Taxes

What Are Payroll Taxes?

Payroll taxes are a type of taxation paid by employees and their employers. The employer withholds these taxes from each worker’s paycheck and remits them to the U.S. Treasury and some state agencies on behalf of the employee, resulting in the employees paying their annual tax liability gradually rather than all at once.

Employers regularly submit these withheld payroll taxes, along with the company’s share of payroll taxes. Payroll taxes withholding from employee paychecks is required by law.

Types of Payroll Taxes

Payroll taxes are mandatory deductions that are used to fund different government programs. The following are different types of payroll taxes, some of which are paid by employees and others by employers.

Federal Income Taxes

Employees are required to pay federal income taxes, but it is the employer’s responsibility to calculate, withhold, and remit these taxes from the employee’s paycheck.

Each employee pays federal income taxes depending on their filing status and earning level. Employers must be aware of different tax brackets and each employee’s filing status in order to correctly calculate federal income tax withholdings.

State and Local Income Taxes

Similar to federal income taxes, employees pay state and local income taxes, but the employer must handle the withholdings and remittances.

However, not all states have income taxes. For example, Florida, Nevada, Alaska, Washington, Texas, Wyoming, South Dakota, Tennessee, and Texas don’t collect state-level income taxes based on earned wages. Tax rates vary for other states, so it’s important to check your state and local regulations when calculating these payroll taxes.

Social Security and Medicare Taxes

Social Security and Medicare taxes are funded through the Federal Insurance Contributions Act (FICA). Contributions are shared equally by employers and employees, who each pay 7.65% for a total of 15.3%.

Employers are responsible for deducting the 7.65% amount from the employee’s paycheck and remitting it to the federal government.

Federal Unemployment Tax Act (FUTA)

The Federal Unemployment Tax Act, or FUTA, outlines payroll tax withholdings to fund the federal unemployment program. This provides compensation to unemployed workers who meet the appropriate criteria.

Employers pay FUTA at a rate equivalent to 6% of the first $7,000 of each employee’s annual wages.

State Unemployment Tax Act (SUTA)

The State Unemployment Tax Act, or SUTA, is the state-level equivalent of FUTA. It’s used to fund state unemployment programs for eligible workers. Like FUTA, employers pay SUTA in most states.

Since SUTA is a state-level tax, the taxation rates and contribution levels vary from state to state. It’s important to review the regulations in your state when calculating SUTA payroll taxes.

State Disability Insurance

Like unemployment insurance, many states withhold a small percentage of employee earnings to fund state disability insurance programs. These programs provide compensation for employees who become injured or disabled and are unable to continue their employment.

Tax rates and regulations vary depending on where you live, so check your state’s rules for disability insurance payroll taxes. State disability insurance may be paid by employers or employees depending on the state.

Workers’ Compensation

Workers’ Compensation is similar to state disability insurance in that it is a state-level worker support program that provides for ill or injured workers. However, unlike disability insurance, workers’ compensation is paid exclusively by the employer.

Since this is a state-level tax, rates and regulations will vary by state. It’s important to review these before calculating and remitting your taxes.

How To Calculate Payroll Taxes

Now that you understand the different types of taxes required to be paid, we’ll explain how to calculate payroll taxes manually.

Step 1: Gather All Required Employee Documents

Before you can start calculating payroll taxes for your employees, you’ll need to obtain their W-4 tax forms and other documentation. Usually, these are filled out by employees shortly after being hired at a company, allowing the employer to get organized with payroll taxes and tax withholding as soon as possible. The required employee documents include the following.

Form W-4: Employee’s Withholding Certificate

All new employees need to submit a filled-out IRS Form W-4. This form informs employers of how to calculate the amount they’ll need to withhold in federal income tax (FIT) from that employee’s paychecks. As of 2020, Form W-4 has been reworked slightly to include a 5-step process and a new set of withholdings determination methods for determining withholding amounts.

If an employee wants to have more tax withheld or wants to request to be exempt from FIT withholdings on their paychecks, they can indicate this on their Form W-4.

State W-4 (as applicable)

Some states have their own, state-level Form W-4, which is required to calculate state and/or local income tax withholding. In states that don’t require a State W-4, the FIT Form W-4 is sufficient.

Direct Deposit Authorization Form

Though not technically required for payroll taxes, it’s still recommended that employers collect direct deposit authorization from their employees. This is done through a direct deposit authorization form (provided by the employee’s bank and filled out by the employee) and is sometimes further verified with a voided check.

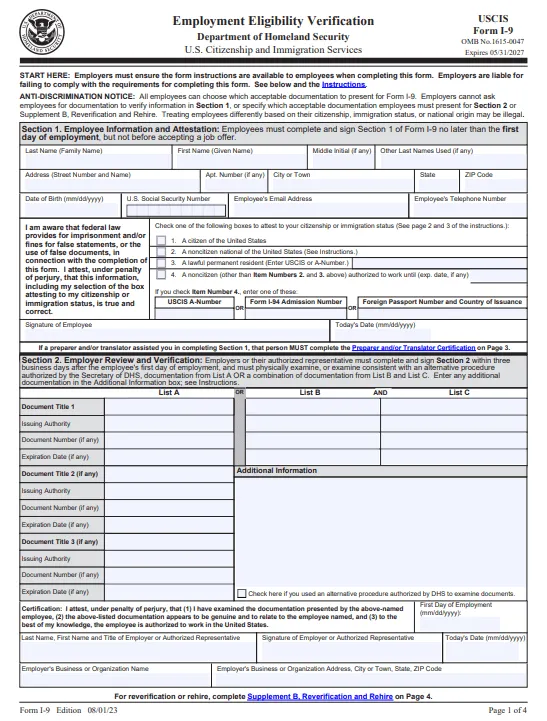

Form I-9: Employment Eligibility Verification

All new employees must fill out Form I-9, which confirms that they’re legally allowed to work in the United States, whether as a citizen, permanent resident, visa holder, or another condition. Employment eligibility is confirmed with either a U.S. passport or both their Social Security card and driver’s license.

Employers are required by law to obtain a signed copy of Form I-9 for every new employee before work begins, and Section 2 of the form must be completed within 3 business days of the employee’s first day of work.

Step 2: Calculate Gross Pay

With all tax forms completed and organized, you can begin calculating the payroll taxes. This begins by calculating gross pay for the pay period, which is the amount paid to an employee before any taxes are withheld from the paycheck. The process for calculating gross pay differs depending on whether the employee is paid hourly or with a salary, and how often (monthly, semi-monthly, biweekly, weekly) they are paid.

Hourly Employees

Gross pay for hourly wage employees is calculated by simply multiplying the hours worked during a given period by their hourly wage. So if you’re calculating gross pay for a laborer on your job site who works 40 hours a week for $38 per hour, their gross pay would be $1,520 per week.

You’ll also have to factor any overtime into this calculation. Overtime pay is usually 1.5 times the original wage—so if that same laborer worked 5 hours of overtime in a week, you would add an additional $285 to their weekly pay of $1,520, totaling $1,805 in weekly gross pay.

Salary Employees

Since salaried employees are typically exempt from rules regarding overtime pay, their gross pay should remain consistent except for when they take unpaid leave or receive a salary adjustment. To calculate gross pay for a salaried employee, just divide their yearly pay by the number of pay periods in a given year.

For example, if a manager in your store earns $65,000 per year, and they’re paid 2 times per month, you would divide $65,000 by 24 (12 months multiplied by 2 paydays per month) to arrive at a gross pay figure of $2,708.33 per pay period.

Be sure to factor any payments besides salary into your gross pay calculations. This means bonuses, tips, and commissions that the employee earns, as well as any gifts you might give them.

Step 3: Calculate Employee Tax Withholdings

With gross pay calculated for your employees, you’ll then calculate the tax withholding based on the information on their Form W-4s. These calculations include:

Federal Income Tax (FIT)

FIT is calculated based on the employee’s Form W-4 information, their taxable earnings, and the frequency of their pay periods. There are 2 ways to calculate FIT withholding for employees:

1. Wage Bracket Method

This is a straightforward approach that lets you calculate FIT withholding based on the employee’s taxable wages, marital status, allowances, and payroll period. No calculations are required for this method, but it stops at 10 allowances and limits the number of wages that can be factored in.

2. Percentage Method

This method has no wage or allowance limits, making it more versatile. You’ll have to calculate the value of each employee’s W-4 allowances based on their pay period frequency. Subtract this allowance value from their gross earnings for the pay period to get the amount of their gross pay subject to withholding.

To learn more about these methods, rates, and allowances, follow our guide titled How to Calculate Withholding Tax, which will provide you with a detailed explanation.

FICA Taxes

Federal Insurance Contribution Act (FICA) taxes cover Medicare and Social Security. These taxes must be withheld from all employees unless they are exempt.

- Medicare

A flat rate tax of 1.45% of gross pay with no annual limit. Employees with a single filing status earning more than $200,000 per year are subject to an Additional Medicare Tax of 0.9%. The limit for married filing jointly is $250,000. The employer must also pay 1.45% to Medicare, making it a combined rate of 2.9% - Social Security

A flat rate tax of 6.2% up to an annual wage limit of $176,100. Any earnings above $176,100 are exempt from this tax. In other words, employers can withhold an annual, cumulative maximum of $10,918.20 in Social Security taxes for each employee for the 2025 tax year. Employers must also pay 6.2% to Social Security. That makes a combined tax rate of 12.4%

Adding both the Medicare and Social Security rates brings you to the 15.3% FICA rate.

Bear in mind that employees only pay half of the required amount in FICA taxes, with the responsibility of paying the other 50% falling upon the employer. Essentially, you will have to match the amount you withhold from each employee when remitting FICA taxes to the government.

State and Local Taxes

While some states, such as Florida, have no state income taxes, many parts of the country do require state or local taxes to be withheld from employee paychecks.

Be sure to check the tax regulations in your area to ensure you’re compliant. The process varies depending on where you are but is generally quite similar to the methods used for calculating federal income tax withholding.

Unemployment Tax

Employers are required to pay both federal and state unemployment taxes, also known as FUTA and SUTA taxes. Therefore, these aren’t withheld from employee paychecks. However, you’ll still need to factor employee pay into these calculations.

- State Unemployment Tax (SUTA) – The state unemployment tax rate varies depending on the state you’re located in, so you’ll have to look into your state’s regulations to find out the applicable rate.

- Federal Unemployment Tax (FUTA) – 6% of the first $7,000 you pay to each employee per year. However, if your company is in a state subject to SUTA, you’ll be able to receive a tax credit of up to 5.4% for paying state unemployment taxes in a timely manner. This means your FUTA liability could effectively be as low as 0.6%.

Step 4: Handle Payroll Deductions

It’s common to make deductions beyond tax withholding on your employees’ paychecks.

There are voluntary deductions (e.g., health insurance premiums, health savings account contributions, etc.) and involuntary deductions (e.g., child support), both of which you’ll need to factor into the final net pay for each employee. 2 of the most common payroll deductions are:

401(k) Contributions

401(k) contributions are voluntary, usually pre-tax deductions. Pre-tax means that these contributions are deducted from gross income (after step 1), which means that overall taxable wages will be lower.

Wage Garnishments

Wage garnishments are involuntary deductions calculated post-tax. You’ll know that you need to deduct wage garnishments as an employer because you’ll receive an order from a judge, the state, or the IRS.

Step 5: Calculate Net Pay

Once you’ve figured out gross pay, tax withholdings, and voluntary or involuntary deductions, it’s time to do the final calculation to determine that employee’s net pay for the given pay period. This part of the process is fairly straightforward:

- Begin with the employee’s gross pay

- Subtract tax withholdings

- Subtract other deductions

- You have your net pay amount for that employee

To simplify this process, we’ll again use the example of a salaried worker who makes $50,000 per year working in Florida (where there is no state income tax withholding). The worker’s filing status is single, and we are using the wage bracket method.

- Our worker is paid twice a month, or 24 times per year: $50,000 / 24 = $2,083.33 of gross pay per pay period

- The worker owes $165 in FIT withholding per paycheck

- The worker owes $129.17 for Social Security and $30.21 for Medicare—a combined $159.38 for FICA taxes

- There were no voluntary or involuntary deductions from the worker’s paycheck

- $2,083.33 – $165 – $159.38 = $1,758.95

- The worker’s net pay after tax withholding per paycheck is $1,758.95

Payroll Tax Calculation Examples

We’ll explore examples of how to calculate payroll taxes so you can withhold the appropriate amount from employee paychecks.

FIT

To calculate federal income tax, start by reviewing the employee’s filing status and income, as well as IRS guidelines for tax brackets.

Then, calculate their gross pay for the given pay period. Next, subtract pre-tax deductions like 401k. Finally, using the IRS bracket guidelines, determine which tax bracket the employee falls into and subtract the relevant amount in federal income taxes.

FICA

FICA tax withholdings include Social Security, taxed at 6.2%, and Medicare, taxed at 1.45%. Let’s say an employee earned $2,000 this pay period. Multiply the employee’s earnings by each percentage as follows:

Social Security: 0.062 x $2,000 = $124

Medicare: 0.0145 x $2,000 = $29

Together, you would collect $153 in FICA taxes from this employee for this pay period.

Remember, FICA taxes are matched by the employer, so you would pay an additional $153 and remit a total of $306 to the government.

Calculate Employer Payroll Taxes

In addition to withholding a percentage of employee’s paychecks for taxes, employers also have certain payroll tax responsibilities. These include matching employee taxes for FICA, as well as making employer payments for FUTA and SUTA.

FICA Taxes

Employers are required to match employee contributions for Social Security and Medicare. In the example in the previous section, we calculated FICA for an employee earning $2,000 as follows:

Social Security: 0.062 x 2,000 = $124

Medicare: 0.0145 x 2,000 = $29

Together, this totals $153. As the employer, you match this and pay an additional $153, remitting a total of $306 to the government.

State Unemployment Tax (SUTA)

State unemployment tax rates vary by state—for example, California taxes new employers at a rate of 3.4% on the first $7,000 of earnings for each employee.

If a company has 2 employees and they each make $20,000 per year, the company would calculate SUTA as follows:

$7,000 x 0.034 = $238

$238 x 2 = $476

The company remits a total of $476 in SUTA taxes for the year.

Federal Unemployment Tax (FUTA)

The federal FUTA rate is 6.0% on every employee’s first $7,000 of earnings. Using the same company from the SUTA example, we would calculate:

$7,000 x 0.06 = $420

$420 x 2 = $840

Since this company has 2 employees, they would remit a total of $840 in FUTA.

Take Control of Your Finances: Simplify Payroll Tax Calculations

While payroll calculations take some time, organization, and math to get right, the process is actually fairly simple, even if you’re taking it upon yourself to calculate payroll tax manually. But if you’re looking for a simpler way to calculate payroll taxes, FreshBooks’ payroll software is a great tool for busy employers.

Skip the tedious task of adding up deductions and tax withholding and subtracting it from gross pay. FreshBooks makes it quick and easy to calculate payroll taxes, and it provides peace of mind knowing that your payroll taxes are always 100% compliant. Give FreshBooks a try for free.

FAQs About How To Calculate Payroll Taxes

Learn more about the payroll formula, percentages for federal taxes, and more with frequently asked questions about manually calculating payroll taxes.

What is the formula for calculating payroll?

The basic formula for calculating payroll is:

Net pay = Gross pay – Deductions

There are a variety of deductions, including payroll taxes. The applicable taxes in your state and municipality will influence your payroll calculations.

What percentage of my paycheck is withheld for federal tax?

The percentage of your paycheck withheld for federal taxes will depend on your filing status and income tax bracket. In addition to federal income taxes, you’ll pay 7.65% of your income in Medicare and Social Security taxes.

What’s the FICA tax rate for employers in 2025?

The FICA rate for employers filing taxes in 2025 is 7.65%. This is a combination of Medicare taxes (1.45%) and Social Security taxes (6.2%). Employees pay the same amount, meaning the total FICA tax paid to the IRS is 15.3%.

Were payroll taxes raised for 2025?

No, payroll taxes have not increased or decreased in several years. However, the wage base limit (the maximum yearly wage subject to FICA taxes) has increased from $168,600 to $176,100 for the 2025 tax year.

What’s the easiest way to calculate payroll taxes as an employer?

If you’re looking to save time on payroll tax calculations, the best way is with payroll software. This is the easiest way to avoid calculation errors and keep important tax information organized and compliant.

How often do employers need to pay their payroll taxes?

Unlike income tax, employers must send payroll taxes to the IRS either monthly or semi-monthly. This is in addition to filing quarterly federal tax returns. State payroll tax deadlines usually line up with federal deadlines, but you should double-check with your state to be sure.

How do you send payroll taxes to the IRS?

Payroll taxes are paid to the IRS via the Electronic Federal Tax Payment System (EFTPS). This is a free, paperless, online payment method that was created by the United States Treasury. State payroll taxes are sometimes required to be paid online, but other options are sometimes available too.

Reviewed by

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

What Is Form 8941? It’s a Tax Credit for Small Business Health Insurance Costs

What Is Form 8941? It’s a Tax Credit for Small Business Health Insurance Costs What Is Form 1099? It Reports Payments Other Than Regular Salaries, Wages or Tips

What Is Form 1099? It Reports Payments Other Than Regular Salaries, Wages or Tips What Is Form 4562? It’s the IRS’s Depreciation and Amortization Form for Tax Filing

What Is Form 4562? It’s the IRS’s Depreciation and Amortization Form for Tax Filing What Is a Schedule K-1 Tax Form? Easy Filing Tips for Small Businesses

What Is a Schedule K-1 Tax Form? Easy Filing Tips for Small Businesses Are My Business Tax Returns Public? Advice for Small Businesses

Are My Business Tax Returns Public? Advice for Small Businesses Tax Incentives: A Guide to Saving Money for U.S. Small Businesses

Tax Incentives: A Guide to Saving Money for U.S. Small Businesses