What Is Financial Reporting? Definition, Importance, and Types

As a business owner, you understand that success can only truly be a success when it’s indicated by measurable, comparable, and accurate figures. Financial reporting is one of the most important parts of this process. It’s used to manage the success of your business, stay on track for your goals and milestones, and help you when making important decisions in the future.

Financial reporting provides financial information about businesses that is useful to investors and other users in making decisions. Financial reporting uses financial statements and reports to disclose financial data that indicate the economic health of a company over a specific period of time. The information is vital for management to make decisions about the company’s future and provides information to capital providers like creditors and investors about the profitability and financial stability of the company.

Key Takeaways

A strong financial reporting system will help guide you and your business to new heights—provided it’s done the right way. Here’s what you need to know:

- The four main financial statements include a balance sheet, an income statement, a statement of cash flows, and a statement of changes in equity (or a statement of shareholders’ equity).

- Financial reporting isn’t just required by law; it’s essential to ensure the growth and long-term success of your company.

- Financial reporting is intended to help track a business’s income, cash flow, profitability, and overall viability in the long run—but it needs to be done correctly.

- The goal of financial reporting is to present financial information that is complete, accurate, comparable, verifiable, understandable, and timely.

- Publicly traded U.S. companies are required by law to follow GAAP (generally accepted accounting principles) in their financial reporting.

This article will also review the following areas:

Why Is Financial Reporting Important?

Benefits Of Financial Reporting

What Is the Purpose of Financial Reporting?

What Does Financial Reporting Include?

Types of Financial Reports

As a business owner, you’re likely to work in a few different formats of financial reporting, depending on your specific needs and goals at that moment. Here are a few of the most common and most important types of financial statements:

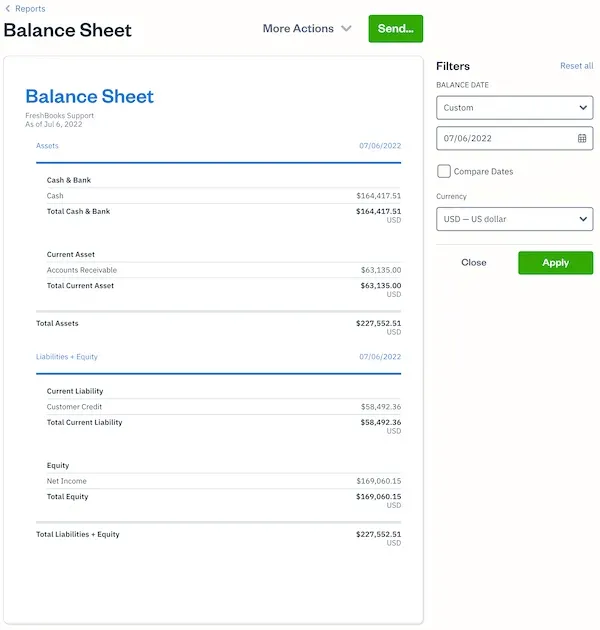

Balance Sheet

Think of a balance sheet as a snapshot of your business’s financial health at a specific date. These are often considered one of the most essential financial reports since they clearly present your business’s, and shareholder’s equity, providing a clear, overall perspective on your business’s financial status. A classified balance sheet distinguishes current and noncurrent assets and liabilities.

Income Statement

Also sometimes called a Profit & Loss Report, an income statement is a common tool to help you obtain information about your company’s revenues, expenses, gains, and losses during a particular period. Unlike the balance sheet, which provides information about a company’s financial position on a given date (for example, as of December 31, 20xx), the income statement summarizes the changes in shareholder’s equity that occurred during a period (year, quarter). Since this report focuses on profit-generating activities, it can be a very useful tool for potential investors and creditors.

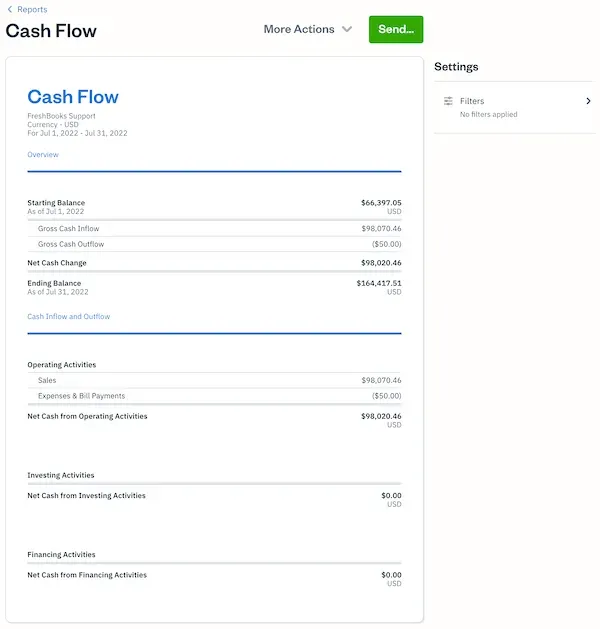

Statement of Cash Flows

This type of statement is used to analyze how much cash is generated by the business and where it is spent. This statement shows changes in cash during the period. It is often used by business owners in need of insight into their business’s insolvency and liquidity. It can be used to track and manage spending as well as to help in securing loans and other funding.

Statement of Shareholders’ Equity

This statement is intended to help business owners keep track of any changes in retained earnings after dividends are released to shareholders. Its purpose is to report changes in shareholders’ accounts during the period from investments by owners, distributions to owners, net income, and other comprehensive income. This is invaluable for providing insight to those supporting the business financially. It also provides more in-depth insight into a company’s performance thanks to reporting on equity withdrawals and dividend payments.

Notes to Financial Statements

Notes to financial statements (also called financial disclosures) refer to any other notes and information provided alongside financial statements. These notes allow other readers to better read and interpret the information provided in statements as well as evaluate the firm’s performance. The notes usually include a summary of significant accounting policies (accounting methods, depreciation methods, and inventory measurement methods, like LIFO or FIFO). For instance, a note to financial statements will often state the ‘basis for accounting’ (whether cash or accrual accounting methods were used). Other notes will explain how figures were calculated in detail, providing greater reliability and accountability to your reports.

Why Is Financial Reporting Important?

When done properly, financial reporting offers many benefits to all who are involved with a business. With that said, however, the main goal of financial reporting is to provide insight and information to stakeholders, business owners, partners, and other important roles. Using the information gained from financial reporting, these parties can make more informed decisions for the good of the business and their investments.

Financial statements provide various important financial information that helps investors, creditors, and analysts evaluate a company’s financial performance. A lot of the financial information in financial reports is also required by law or by accounting standard practices. To better understand what these statements look like in practice, you can follow our guide on financial statement sample, which demonstrates how this information is typically presented and organized.

Financial reporting helps management communicate important business events and transactions, as well as past successes and future expectations of the business.

Here are a few reasons why financial reporting is important to your business:

1. Ensuring Tax Compliance (and Optimizing Liability)

The most important reason to use financial reports is that you have to and are required by law to do so. The Internal Revenue Agency uses these reports to make sure you’re paying your fair share of taxes.

Businesses that make a lot of profit have to pay quite a lot of taxes. Accurate financial reporting helps reduce their tax burden and helps them ensure that all their resources are not depleted in a short amount of time.

2. Showing Financial Condition to Potential Investors

Potential investors want to know how well the company is doing before they invest. Investors, creditors, and other capital providers rely on a company’s financial reporting to gauge the safety and profitability of their investments. Stakeholders want to know where their money went and where it is now. Financial statements like the balance sheet address provide detailed information about the company’s asset investments and outstanding debt and equity components. Investors and creditors can use this information to better understand the company’s position and capital mix.

3. Evaluating Operations at Scale Over Longer Periods of Time

The information on a balance sheet is a snapshot of a company’s assets and liabilities at the end of a financial period. However, a balance sheet doesn’t show what operational changes might have occurred to cause changes in the financial condition of a company. Operating results during the period are also something investors need to consider. A change statement, such as an income statement, shares results about sales, expenses, and profit or losses during the period. Using the income statement, investors can both evaluate a company’s past income performance and assess future cash flow.

4. Examining and Analyzing Cash Flow

A company’s profits are reported in the income statement but provide no direct information on the company’s cash changes. A company incurs cash inflows and outflows during a period from operating activities and non-operating activities, namely investing and financing. Cash from all sources, not only revenue from operations, is what pays investors back. That’s why a cash flow statement is an important statement for an investor to review. The cash flow statement shows the changes in cash during a period of time. By reviewing this statement, investors can know if a company has enough cash to pay for expenses and purchases.

5. Examining and Distributing Information on Shareholder Equity

The statement of shareholders’ equity is important to equity investors. It shows the changes to various equity components like retained earnings during a period. Shareholder equity is a company’s total assets minus its total liabilities and represents a company’s net worth. Steady growth in a business’s shareholders’ equity because of increasing retained earnings, as opposed to expanding the shareholder base, means higher investment returns for current equity shareholders.

6. Help with Business Decision-Making, Planning, and Forecasting

When a business needs to make a decision, analyzing financial statements is crucial. Managers can look at the value of the assets that a business currently holds and decide if they can afford to purchase more to expand business operations. Conversely, when the value of assets is severely depreciated, managers can decide if they need to be sold off.

7. Mitigate Financial Reporting Errors

Accurate financial reporting can help businesses catch costly mistakes and inter errors early on in the process. There is no better way to detect illegal financial activities than through discrepancies found in financial statements. Through a reconciliation process, errors that have been made can be found. Companies spend a lot of time reconciling their books of accounts and verifying each journal entry, so they can find if an accounting error has occurred or if anyone has tampered with any part of the business.

Benefits Of Financial Reporting

Still wondering about the benefits of setting up a strong financial reporting system for your business? While it can lead to additional administrative work, good financial reporting offers countless benefits to your business as well. These include:

- Optimized debt management

- Real-time insights and tracking for quick business decisions

- Identification and forecasting of business trends

- Managing liabilities and keeping them in check with assets

- Greater ease of access and communication of important financial records

- Cash flow insights and analysis

- Providing useful information to current and potential investors and creditors

- Internal controls to prevent fraudulent activities

What Is the Purpose of Financial Reporting?

The main objective behind financial reporting is to provide business owners, shareholders, and other decision-makers with all of the information they need to make the best choices for the company. Financial reporting affects everything from cash flow to dividends and should account for all streams of profit and loss to ensure a complete, useful picture.

Generally, financial reporting provides information about the results of operations, financial position, and cash flows of a business. Readers review the statements to decide the allocations of resources.

Financial reporting is a way of following standard accounting practices to give an accurate depiction of a company’s finances, including:

- Revenues

- Expenses

- Profits

- Capital

- Cashflow

What Does Financial Reporting Include?

The process of producing statements that disclose a business’s financial status to management, investors, and the government is known as Financial Reporting.

Financial reporting includes:

- External financial statements (e.g., income statement, statement of comprehensive income, balance sheet, statement of cash flows, and statement of stockholders’ equity)

- Notes to the financial statements

- Communications regarding quarterly earnings and related information (often via press releases and conference calls)

- Quarterly and annual reports to stockholders

- Financial information and reports posted on a business’s website

- Financial reports to governmental agencies, including quarterly and annual reports to the Securities and Exchange Commission (SEC)

- Documentation pertaining to the issuance of common stock and other securities

Conclusion

Financial reporting can be a complex system to put into place, but it’s nevertheless essential to running a successful business. Though each and every company has a slightly different system to meet its unique reporting needs, you’ll find much in common from business to business.

If you’re searching for a tool to help make financial reporting simpler for your business, FreshBooks is here to help. Our cloud-based accounting services are ideal for the quick, easy filing of important financial information, and reports such as your cash flow statement, income statement, and more can be generated within just a couple of clicks. Save yourself the time, money, and margin for error that comes with hand-creating these essential financial reports—click here to try FreshBooks for free and see firsthand the difference it can make for your company’s financial health.

FAQs on Financial Reporting

More questions on setting up your financial reporting system, tracking financial performance, or tools for the perfect financial statement? Here are answers to some of the most commonly asked questions.

Is financial reporting the same as accounting?

No. While both financial reporting and accounting tend to deal with the same information, these are two very different (but interconnected processes). Financial reporting focuses on compiling and organizing financial information, whereas accounting refers to interpreting, analyzing, and making decisions based on that information to ensure a business’s financial health.

What is a financial reporting example?

Financial reporting can be internal (e.g., profit and loss statements provided to your accountant) or external (e.g., holding a press release or conference to announce annual/quarterly earnings to stockholders). If your company has shareholders, you’ll likely be doing a fair amount of both kinds of financial reporting.

Who prepares financial statements?

A company’s management is responsible for the integrity and neutrality of financial statements and needs to sign off on them. Typically, business directors will prepare financial reports. In a rigorous system, these statements would then pass through an auditor (or an audit committee), who is responsible for ensuring the information is accurate and free of any errors or discrepancies.

Also Read: How to Make Financial Statement for Small Business

How do I become a financial reporting analyst?

Reporting analysts are expected to have a minimum educational level of a bachelor’s degree in business, accounting, finance, information management, or a related major. You’ll also need demonstrable experience and a strong working knowledge of the financial analysis process. Lastly, it’s important that you know and follows the Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

What are financial reporting skills?

Certain skills can be a big help in creating better, more accurate financial reports. These include knowledge of reading and analyzing financial statements, generating reports with the help of tools like Excel or accounting software like FreshBooks, and familiarity and compliance with the Generally Accepted Accounting Principles, or GAAP, as well as the International Financial Reporting Standards (IFRS).

RELATED ARTICLES

Expense Report: What It Is and Why Is It Important?

Expense Report: What It Is and Why Is It Important? How to Handle Small Business Finances?

How to Handle Small Business Finances? What Does a Profit and Loss Summary Tell You?

What Does a Profit and Loss Summary Tell You? How to Read a Financial Report: An Extensive Guide

How to Read a Financial Report: An Extensive Guide How to Create an Expense Report: 6 Easy Steps

How to Create an Expense Report: 6 Easy Steps How to Prepare Annual Report for Your Small Business

How to Prepare Annual Report for Your Small Business