Balance Sheet vs Income Statement: Differences With Examples

Balance sheets and income statements are 2 of the most important financial documents for a small business. The balance sheet shows a company’s current assets and liabilities, while the income statement reports revenues, expenses, and profits or losses for a particular time period.

Understanding what goes into a balance sheet and an income statement helps you prepare accurate documents for developing business strategy and sharing with potential investors. In this article, we’ll cover the difference between balance sheets and income statements and detailed descriptions of what goes into each. We’ll also look at examples of balance sheets and income statements to help you prepare your small business financial documents.

Key Takeaways

- The balance sheet shows current assets and liabilities at a particular point in time.

- Balance sheets are important for demonstrating a positive asset position to investors.

- The income statement shows revenue, expenses, and profit or loss over a time period.

- Income statements are key to assessing overall financial performance.

- Balance sheets and income statements are used together to assess financial health.

Table of Contents:

- What Goes on a Balance Sheet?

- Sample Balance Sheet

- What Goes on an Income Statement?

- Sample Income Statement

- Balance Sheet vs Income Statement

- Conclusion

- Frequently Asked Questions

What Goes on a Balance Sheet?

A balance sheet reports a business’s assets, liabilities, and equity at a specific point in time. A balance sheet is broken into two main sections: assets on one side and liabilities and equity on the other side. The balance sheet format requires that the two sides balance out, meaning they should be equal to one another. It reports the following line items:

- Account Balances: The amount of money that is in your financial accounts at any given time, after debits and credits have been accounted for. This includes any long-term saving accounts or checking accounts.

- Current Assets: Assets that will be converted to cash within a year, including accounts receivable, inventory and prepaid expenses

- Long-Term Assets: Assets that won’t be converted to cash within a year, including land, buildings and equipment

- Current Liabilities: Debts owed within a year, including rent, utilities, taxes, and payroll

- Long-Term Liabilities: Long-term business loans, pension fund liabilities

- Shareholders Equity: A business’s net assets, including money generated by the business and donated capital

- Amortization Expenses: These are also called depreciation expenses and account for the accumulation of expenses taken against long-form assets

The balance sheet tells you what your business owns and what it owes to others on a specific date. It gives a snapshot of the business’s overall worth.

For a more detailed explanation of what is a balance sheet and how to interpret it, you can watch this helpful video.

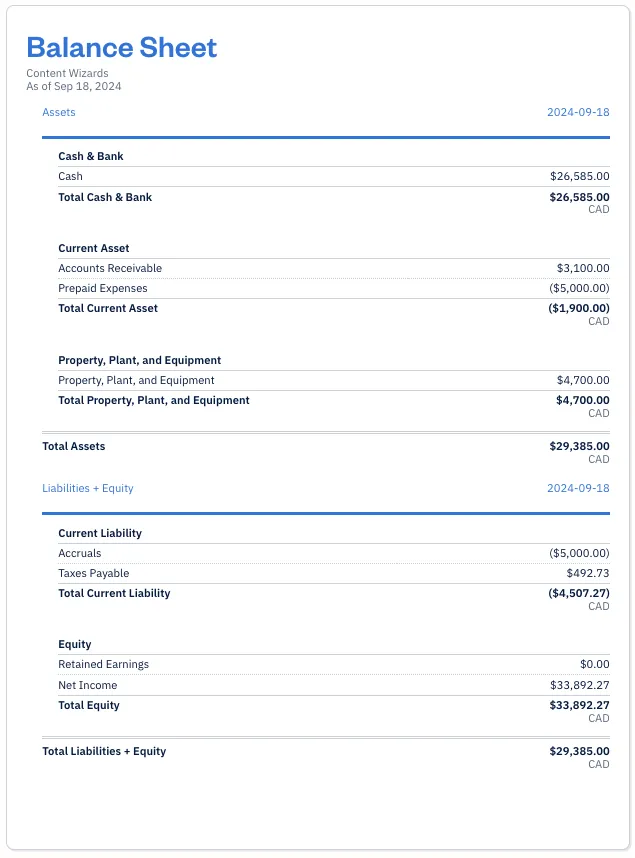

Sample Balance Sheet

The following shows an example of a balance sheet that a company might use for a reporting period.

The first section outlines the company’s assets:

- Cash & Bank: The line item for ‘Cash’ shows the cash assets that the company currently holds in the bank.

- Current Assets: This includes assets that the company expects to receive in ‘Accounts Receivable’ and the amounts already paid, but not yet incurred in ‘Prepaid Expenses’.

- Property, Plant, and Equipment: These are long-term assets that the company holds. While they’re not liquid assets, their value is still included in total assets.

The next section details liabilities and shareholder equity:

- Current Liability: This section normally includes both current and long-term liabilities, although in this case no long-term liabilities are displayed.

- Equity: This includes the total value of stock, retained earnings, and other equity.

Total assets equal the sum of liabilities and equity, balancing this company’s balance sheet. This format is helpful for small businesses who want to create an overview of their assets, liabilities, and equity for record-keeping or to compare across reporting periods.

Download a free balance sheet template for an easy way to save time and energy creating your own balance sheet.

What Goes on an Income Statement?

An income statement, also called a profit and loss statement, lists a business’s revenues, expenses, and overall profit or loss for a specific period of time. To further understand what is an income statement and its components, you can watch this video. An income statement reports the following line items:

- Sales: Revenue generated from the sale of goods and services

- Cost of Goods Sold: Including labor and material costs

- Gross Profit: The cost of goods sold subtracted from sales

- General and Administrative Expenses: Includes rent, utilities, salary, etc.

- Earnings Before Tax: Your business’s pre-tax income

- Net Income: The total revenue minus total expenses, which gives the profit or loss

The end goal of the income statement is to show a business’s net income for a specific reporting period. If the net income is a positive number, the business reports a profit. If it’s a negative number, the business reports a loss.

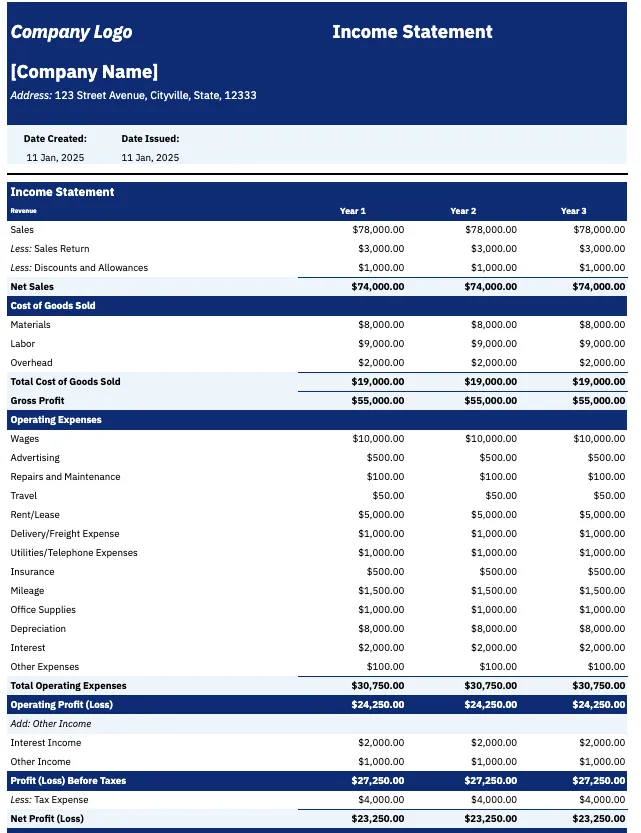

Income statement example

The following example shows a company’s income and expenses for the given fiscal period.

The statement follows a standard income statement format, clearly breaking down revenue, cost of goods sold, operating expenses, and other income/expenses to arrive at net profit.

This example illustrates a company’s income statement over three years. Crucially, the figures for Year 1, Year 2, and Year 3 are identical, which is highly unusual in real-world scenarios. This is a simplified template for clarity, not a reflection of typical business fluctuations.

Let’s break down the key sections:

1. Revenue: The Top Line

- Net Sales ($74,000): This is the actual money earned after subtracting returns and discounts from gross sales.

- Why it’s important: Shows the company’s core earning power.

- Issues to spot: Falling net sales or high returns can signal problems.

2. Cost of Goods Sold (COGS): Direct Production Costs

- Total Cost of Goods Sold ($19,000): Direct costs of producing goods/services sold (materials, labor, production overhead).

- Why it’s important: Directly impacts profitability.

- Issues to spot: COGS growing faster than sales indicates inefficiency.

3. Gross Profit: Profit Before Operating Expenses

- Gross Profit ($55,000): Net Sales minus COGS.

- Why it’s important: Measures production efficiency.

- Issues to spot: Declining gross profit margin suggests rising production costs or weak pricing.

4. Operating Expenses: Running the Business

- Total Operating Expenses ($30,750): Costs of daily business operations (wages, rent, marketing, depreciation, etc.).

- Why it’s important: Essential for business function; managing them impacts profit.

- Issues to spot: Uncontrolled expense growth can erode profits.

5. Operating Profit (Loss): Core Business Profitability

- Operating Profit (Loss) ($24,250): Gross Profit minus Total Operating Expenses.

- Why it’s important: Shows profit from core business activities.

- Issues to spot: Declining operating profit despite stable gross profit points to operational inefficiencies.

6. Other Income & Profit Before Taxes

- Interest Income & Other Income: Additional earnings outside core operations.

- Profit (Loss) Before Taxes ($27,250): Operating Profit plus other income.

- Why it’s important: Comprehensive pre-tax earnings.

- Issues to spot: Over-reliance on “other income” might mask core business weaknesses.

7. Net Profit (Loss): The Bottom Line

Issues to spot: Consistent net losses are unsustainable; shrinking net profit signals trouble.e it! The Income Statement is a vital tool to see if your business is truly thriving. Keep an eye on those numbers, and you’ll be a financial whiz in no time!

Net Profit (Loss) ($23,250): Profit Before Taxes minus Tax Expense.

Why it’s important: The ultimate measure of profitability.

Balance Sheet vs Income Statement

A balance sheet is used to display a business’s current assets at a single point in time, while an income statement shows the business’s overall financial health across a particular time period. The following table highlights the main differences between a balance sheet and an income statement:

| Balance Sheet | Income Statement | |

| Purpose | Show available financial assets | Assess overall financial performance |

| Time frame | Provides information for a given point in time | Provides information for a given period (usually a month, quarter, or year) |

| Key line items | Assets, liabilities, and shareholder equity | Revenue, expenses, and profits or losses |

| Metrics | Uses ratios including current ratio and debt-to-equity ratio | Ratios include gross margin, operating margin, and price-to-earnings |

| Format | Usually has two sides, with assets on one side and liabilities on the other | Typically lists revenue and expenses followed by net profit or loss |

Conclusion

Balance sheets and income statements are essential financial reporting documents for providing an overview of a company’s financial health. The main purpose of the balance sheet is to show current assets at a particular point in time, while the income statement shows revenue, expenses, and profits or losses over a particular time period.

The right tools can help automate your financial reporting, improving your efficiency and accuracy. FreshBooks accounting software makes it easy to generate balance sheets and income statements to share with investors and shareholders. Try FreshBooks for free to streamline your financial reporting process today.

FAQs on Balance Sheet and Income Statement

Learn more about the 3 primary financial statements including cash flow statements, and how balance sheets and income statements are connected, with frequently asked questions on the balance sheet and income statement.

What comes first, balance sheet or income statement?

When presenting financial statements, the balance sheet is usually presented first, followed by the income statement. When preparing these financial documents in-house, you can prepare them in whichever order you choose.

What are the three financial statements?

The 3 main financial statements are the income statement, the balance sheet, and the cash flow statement. The cash flow statement provides an overview of cash-based transactions. These provide an overall picture of a company’s financial health and are important for demonstrating assets and profitability to potential investors and shareholders.

What flows from balance sheet to income statement?

Depreciation is recorded on the balance sheet, then flows to the income statement and becomes an expense. It’s important to record all assets and corresponding depreciation on the balance statement so that they can also be accounted for on the income statement.

Which is more important, the balance sheet or the income statement?

The balance sheet and the income statement are equally important. Since they serve different purposes, one may be more relevant at a particular time–for example, the balance sheet is necessary for demonstrating assets to potential investors, while the income statement is necessary for overall financial health and performance in a given time period.

What does an income statement show?

An income statement shows revenue, expenses, and profits or losses in a given time period. It’s important for assessing a company’s financial health in that particular month, quarter, or year. This is used for creating business strategy and demonstrating financial performance to potential investors.

Reviewed by

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

Forecasting a Balance Sheet | The Small Business Guide to Financial Forecasts

Forecasting a Balance Sheet | The Small Business Guide to Financial Forecasts 8 Tips for Filing Taxes

8 Tips for Filing Taxes How To Price Moving Jobs: A Pricing Guide for Small Businesses

How To Price Moving Jobs: A Pricing Guide for Small Businesses What Is an Intangible Asset? A Simple Definition for Small Business (With Examples)

What Is an Intangible Asset? A Simple Definition for Small Business (With Examples) What Is Straight Line Depreciation?

What Is Straight Line Depreciation? How to Prepare Financial Statements for Small Businesses

How to Prepare Financial Statements for Small Businesses