Top 8 Receipt Scanner App Picks to Track Expenses in 2025

Are you tired of drowning in a sea of paper receipts? Do you wish there was an easier way to track your business expenses and simplify tax time?

The best receipt scanner apps can help.

These mobile applications transform your smartphone into a powerful scanning tool, using optical character recognition (OCR) technology to digitize paper documents like receipts and other financial records instantly.

In this article, we’ll explore the best receipt scanning apps of 2025, highlighting their key features, pricing, and how they can benefit your small business.

Key takeaways

- Receipt scanner apps digitize paper receipts using OCR technology, making expense tracking and management easier.

- Key features to look for in a receipt scanner app include accurate OCR, workflow automation, support for various file types, integration capabilities, expense tracking, and secure storage.

- When choosing a receipt scanner app, consider your business needs, budget, and the app’s ability to integrate with your existing accounting and finance tools.

Table of contents

- FreshBooks Receipt Scanner

- QuickBooks Online

- Expensify

- Wave

- Shoeboxed

- Veryfi

- ABUKAI Expenses

- How to Choose the Best Receipt Scanner App for Your Business

- Use the Right Receipt Scanner to Keep Your Digital Files in Order

- FAQs about the best receipt scanner app

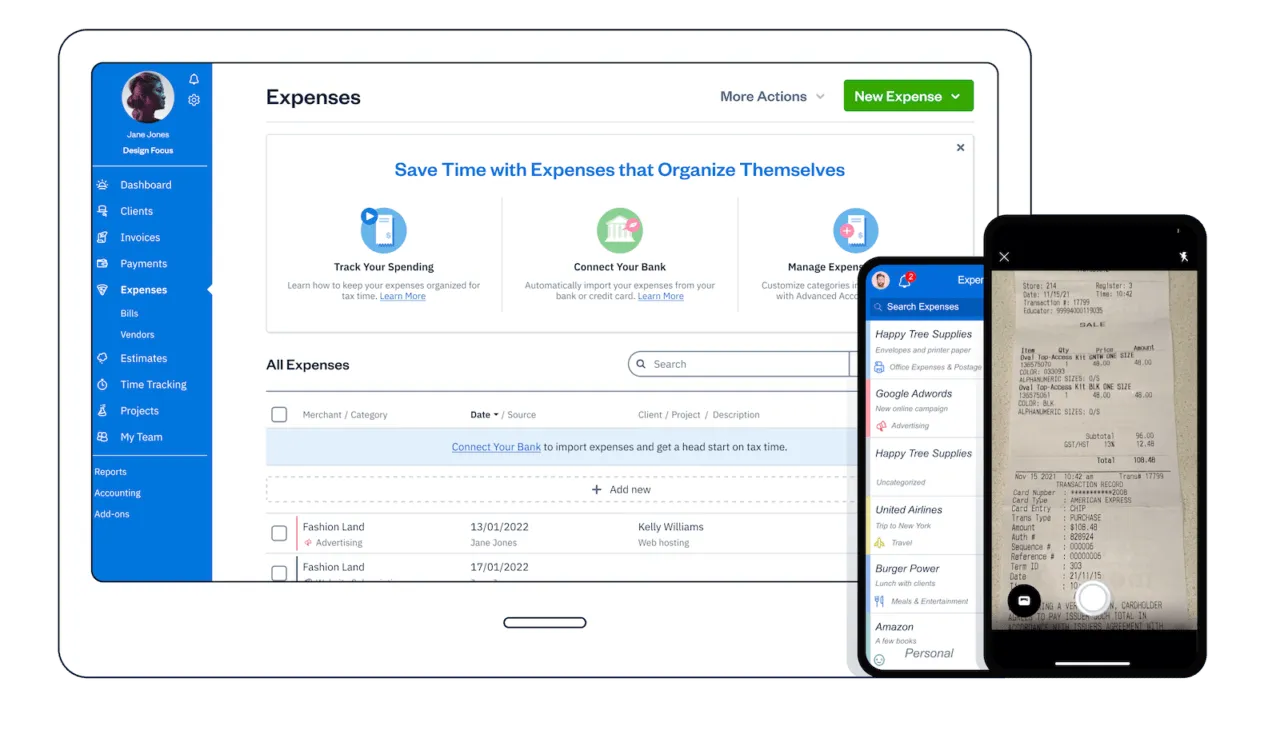

FreshBooks Receipt Scanner

The FreshBooks Receipt Scanner is a game-changing tool designed to simplify expense tracking for small businesses and self-employed professionals. It offers a user-friendly interface and powerful features that streamline the entire expense management process, from capturing receipts to categorizing expenses and generating reports. By automating these tasks, FreshBooks Receipt Scanner eliminates the need for manual data entry, reduces errors, and saves you valuable time.

Features

- Easy receipt capture: Capture receipts with your smartphone’s camera and upload them directly to FreshBooks.

- Automated data extraction: FreshBooks Receipt Scanner automatically extracts key information from receipts, such as the vendor, date, and amount, ensuring that the scanned data is accurate and reliable.

- Expense categorization: Categorize expenses for easy tracking and reporting.

- Mileage tracking: The built-in mileage tracker accurately records your business trips, helping you maximize deductions.

- Integration with FreshBooks accounting software: Seamlessly integrates with FreshBooks accounting software for comprehensive financial management.

Pricing

FreshBooks offers various pricing plans to suit different business needs. The receipt scanner feature is included in all plans, providing excellent value for your investment. Try FreshBooks for free to experience the benefits of automated receipt scanning.

QuickBooks Online

QuickBooks Online is a cloud-based accounting solution that also offers a receipt scanner app. It’s designed to help businesses manage their finances, including income and expenses, invoicing, and reporting.

Features

- Receipt capture and organization: Capture receipts with your mobile device and easily categorize them within QuickBooks Online.

- Automated data entry: The app extracts data from receipts, reducing manual entry and potential errors.

- Integration with QuickBooks Online: Seamlessly integrates with other QuickBooks Online features, such as invoicing, banking, and reporting.

- Expense tracking and reporting: Generate expense reports and gain insights into your spending habits.

Drawbacks

- Some users have reported that the app can be unresponsive at times.

- Customer support turnaround time could be improved.

Pricing

QuickBooks Online offers a range of pricing plans to accommodate different business sizes and needs. Starts from $9/month to $60/month.

Expensify

Expensify is a comprehensive expense management tool that simplifies receipt scanning, expense reporting, and financial transactions for individuals, small to medium-sized enterprises (SMEs), and large corporations.

Features

- Receipt scanning and categorization: Scan receipts, categorize expenses, and generate expense reports.

- Automated expense tracking: Expensify automates expense tracking, approval, and reimbursement workflows.

- Bank account integration: Connect your bank accounts to sync financial data and reconcile expenses.

- Currency conversion: The app supports over 150 currencies, making it ideal for businesses with international operations.

- Mileage tracking: Track mileage for accurate expense reporting.

Drawbacks

- Some users have reported occasional inaccuracies in receipt uploads and image clarity.

- The platform can be overwhelming for new users.

- Manual data entry may still be required in some cases.

Pricing

Expensify offers a free plan for individuals and paid plans for businesses. Paid plan starts from $5/month.

Wave

Wave is a free accounting and money management software that includes a receipt scanning feature. It’s designed for small businesses and offers tools for invoicing, bookkeeping, and payroll.

Features

- Receipt scanning with OCR: Wave uses OCR technology to scan and extract data from receipts, automating data entry and ensuring that the extracted data is accurate and organized.

- Invoicing and billing: Create professional invoices, automate billing for recurring customers, and track payments.

- Financial reporting: Generate financial reports to gain insights into your business performance.

- Bank reconciliation: Import bank statements and CSV files for easy reconciliation.

Drawbacks

- Customer support can be improved, particularly for users who require live assistance.

- Some small businesses may find the pro plan cost-intensive.

- Occasional errors in invoice processing have been reported.

Pricing

Wave offers a free plan with basic accounting and receipt scanning features. Pro plan is $16/month.

Shoeboxed

Shoeboxed is a dedicated receipt scanning and document management app. Shoeboxed also offers a unique ‘magic envelope’ feature that allows users to send multiple paper documents securely for scanning and organization. It helps businesses organize receipts, maximize tax deductions, and reduce paperwork.

Features

- Receipt scanning and digitization: Capture receipts with your mobile device or send them via email to create digital copies.

- Expense reports: Generate expense reports from the web or mobile app.

- Business tool integration: Integrate with accounting, finance, payroll, CRM, and HRMS tools.

Drawbacks

- OCR accuracy can be inconsistent.

- Customer support needs improvement.

- Pricing may be high for some small businesses.

Pricing

Shoeboxed offers several pricing plans with varying features and usage limits. Starts from $18/month to $54/month.

Veryfi

Veryfi is an AI-powered receipt and invoice scanner app that automates data extraction and expense management. It’s designed to eliminate manual data entry and reduce errors.

Features

- AI-powered OCR: Veryfi uses AI to extract data from receipts, invoices, and other financial documents with high accuracy, making it ideal for businesses that handle a high volume of documents.

- Receipt capture and data extraction: Capture receipts from mobile devices or desktops, and Veryfi extracts key details automatically.

- Expense management: Track expenses, control job costs, and manage travel policies.

- Integrations: Integrate with accounting software to automate bookkeeping and expense management workflows.

Drawbacks

- OCR accuracy can be inconsistent.

- Limited flexibility for managing accounts of multiple organizations.

- Users have reported occasional glitches and issues with receipt uploads.

Pricing

Veryfi offers a free plan with limited features and paid plans for businesses. Paid plan starts from $19.99/user/month.

ABUKAI Expenses

ABUKAI Expenses automates expense report creation and tracking. It allows users to upload receipts from any device and generates editable expense reports.

Features

- Automated expense reports: ABUKAI automatically generates expense reports from scanned receipts, simplifying the expense tracking process.

- Currency conversions: The app can read different currencies on receipts.

- Mileage tracking: Track mileage using mobile devices with maps or GPS.

- Smart categorization: Categorize expenses based on credit card statements and past entries.

Drawbacks

- Additional features may be difficult to understand.

- Pricing can be high, with no monthly payment options.

- Some users find the interface less intuitive for certain tasks.

Pricing

ABUKAI Expenses offers a free plan and paid plans for individuals and businesses. $99/year.

How to Choose the Best Receipt Scanner App for Your Business

Choosing the right receipt scanner app is crucial for efficient expense management, and factors such as accuracy, workflow automation, and price should be carefully considered. Consider the following factors to make an informed decision:

Accuracy of OCR technology

Look for a receipt scanner app with highly accurate OCR, preferably one that uses AI. Accurate OCR ensures that data is extracted correctly from receipts, minimizing errors and saving time.

Workflow automation

Choose an app with an intuitive interface and features that automate your expense tracking workflow. This includes easy receipt uploading, categorization, and report generation.

Support for various file types

Ensure the app can process different receipt formats, including JPEG images, handwritten receipts, and bills.

Integration capabilities

The receipt scanner app should integrate seamlessly with your existing accounting, finance, and other business tools. This enables real-time expense tracking, up-to-date financial records, and streamlined processes.

Expense tracking features

The app should provide tools for categorizing expenses, generating reports, and analyzing spending habits.

Storage capacity and security

Choose an app that securely stores your financial data with encryption and access controls.

By carefully evaluating these factors, you can select the best receipt scanner app to meet your specific business needs and streamline your expense management processes.

Use the Right Receipt Scanner to Keep Your Digital Files in Order

In today’s fast-paced business environment, efficiency and organization are paramount. The right receipt scanner app can be a game-changer, transforming the way you manage your financial documents and contributing to a more streamlined and productive workflow. The right receipt scanner app can be especially beneficial during tax season, simplifying the process of organizing and submitting financial documents.

The “best receipt scanner app” isn’t a one-size-fits-all solution; it’s the one that seamlessly aligns with your specific business needs, integrates with your existing systems, and empowers you to achieve your financial goals. If you’re seeking a user-friendly, robust, and tightly integrated receipt scanner that works in harmony with powerful accounting software, FreshBooks stands out as an excellent choice.

FreshBooks is more than just a receipt scanner; it’s a comprehensive expense management solution designed to simplify your financial life. By automating the capture, categorization, and organization of your receipts, FreshBooks eliminates the chaos of paper clutter and manual data entry.

FAQs about the best receipt scanner app

How does a receipt scanner app help your business?

Receipt scanner apps automate expense tracking, reduce paperwork, improve accuracy, and enhance convenience.

Is it safe to use a receipt scanner app?

Yes, most receipt scanner apps use security measures like encryption and password protection to safeguard your data.

Can I scan receipts on my phone?

Yes, you can use a receipt scanner app on your phone to capture and digitize receipts.

Reviewed by

Feli Oliveros is a freelance B2B fintech writer from Los Angeles who has written for companies like City National Bank, Gusto, and Brex. In 2015 she graduated from UCLA, where she earned her bachelor’s degree in English and minored in Anthropology. Visit felioliveros.com for more information.

RELATED ARTICLES

8 Best Apps for Entrepreneurs (2025 Edition)

8 Best Apps for Entrepreneurs (2025 Edition) How to Keep Track of Employee’s Hours?

How to Keep Track of Employee’s Hours? What Is a Time Log? Time Tracking Basics

What Is a Time Log? Time Tracking Basics How to Create a Training Program for Employees in 5 Easy Steps

How to Create a Training Program for Employees in 5 Easy Steps How to Measure Team Effectiveness: Top 5 Ways

How to Measure Team Effectiveness: Top 5 Ways