How to Set Up Direct Deposit for Employees

Modern employers and small businesses need options when it comes to maintaining payroll processes and paying workers. Although paper checks are still an acceptable form of compensation, digital and electronic payment methods offer increased flexibility, convenience, and security. Data shows that up to 82% of American workers receive direct deposit, making it a choice worth pursuing.

The direct deposit process is one way to deliver payment quickly and efficiently. In this guide, we’ll look at how direct deposit payments work, the steps required for setup, and the benefits of using payroll software for your business.

Key Takeaways

- Direct deposit helps maintain detailed financial records

- Direct deposit helps businesses save employee hours in preparation and streamline their payroll processes

- Employees and payees appreciate the convenience and immediacy of direct deposit

- Direct deposit is an eco-friendly office practice, saving money on checks, printing costs, envelopes, and postage

Table of Contents

- What is Direct Deposit?

- How Direct Deposit Works

- How to Set Up Direct Deposit for Employees Step by Step

- Benefits of Using Direct Deposit

- Drawbacks of Using Direct Deposit

- Employees vs. Contractors

- Simplify Direct Deposit with FreshBooks Payroll Software

- Frequently Asked Questions

What is Direct Deposit?

Direct Deposit is an electronic transfer of funds that is made from a payer directly to a payee’s bank account. It’s often used by an employer to pay the wages or commission of an employee but can also be used for regular payments of any type.

It is a safe and reliable process that can deliver funds electronically to specified bank accounts rather than using a physical check. This process depends on a stable and secure electronic network to move money from one party to another.

Standard income is not the only application for direct deposit payments. You might be able to receive direct deposit funds if:

- You have an expected tax refund and choose this method through the IRS filing process

- You expect to receive investment funds or payouts from retirement accounts

- You have incoming funds through programs such as Social Security

How Direct Deposit Works

Direct deposit works by using encrypted electronic communication between the financial institutions of the payer and the payee. If an employee would like to use direct deposit, the employer collects and saves their bank account information. On paydays, the employer sends instructions to their bank to start the payroll process.

The bank, in turn, leverages an electronic network called the automated clearing house (ACH). When banks use the term “ACH payment,” they are referring to funds that transfer electronically through this network. The ACH sorts the information and routes the transfer to the proper bank. The bank then deposits the funds into the account of the employee.

Successful transfers only happen when both the payer and payee have accurate bank routing and account information on file.

Once a payment is issued through the ACH network, funds are deposited at midnight on the business day of the payout. The transferred funds automatically clear, meaning there should not be a hold on the money after it has been transferred.

How to Set Up Direct Deposit for Employees Step by Step

Establishing the foundation for payroll transactions is a shared responsibility between the payer and payee. The former has an obligation to initiate the framework, and the latter should provide accurate bank account information.

Follow the simple steps below to initiate the deposit setup process.

1. Choose A Payroll Service Provider

A payroll service provider can be a great help in organizing and streamlining the payment of your employees. As a business or organization, you must first establish the ability to perform direct deposit through your normal software. FreshBooks accounting software packages include an easy-to-set-up payroll service that provides direct deposit as one of its core functions. Click here to learn more and get a free trial.

Alternatively, you can work directly with banks and financial institutions for setup and approval.

2. Establish A Company Payroll Account

A specific business bank account is required to make direct deposits. This account must be set up to make successful ACH transactions regularly.

Additionally, it’s crucial that the available funds are present before completing a payroll cycle.

3. Send A Direct Deposit Authorization Form To Employees

An authorization form is one that an employer sends directly to each employee, typically upon hire. At a minimum, the form should request an individual’s contact information, bank account number, and routing number. A voided check can also be attached to the authorization form.

Some authorization forms ask for a Social Security Number (SSN) for further identity verification.

4. Verify Correct Account Information

Once an authorization form or direct deposit form is received, the payroll or finance department must upload this data into the payroll software and update the direct deposit schedule. At this stage, check for any significant errors, missing numbers, or incorrect account information. Failure to do so means that the employee’s bank account or checking account won’t receive money.

5. Run standard payroll process

After completing these steps, the direct deposit setup is ready to go. The last step is running the typical payroll process based on the payment schedule of a given employer. Whether this is weekly, bi-weekly, or monthly, the direct deposit system does not change.

Benefits of Using Direct Deposit

There are many advantages to using payroll direct deposit, both for the employer and employee.

- It replaces manual processes: Having to perform compensation manually can be tedious and draining on staff resources. Preparing paper checks is also a time-consuming task, particularly for large companies. Direct deposit replaces manual options with a more hands-off system.

- Direct deposit promotes employee choice: When staff or team members choose direct deposit, they can often add bank account details for both checking and savings accounts. This allows employees to take control of their financial health by automatically sending money to savings.

- It saves money on preparation and postage: Printing physical checks and paying for letters and stamps can add up. Reduce postage and needless administrative costs with the use of direct deposit services.

- It’s eco-friendly: As more companies promote green initiatives, reducing paper use is an environmentally friendly choice.

Drawbacks of Using Direct Deposit

There are, of course, a few downsides to direct deposit. Some employers feel a loss of control and the loss of the personal satisfaction of giving their employees a check at the end of a pay period. However, as your business grows, embracing change and anything that will streamline your process and improve efficiency is important.

Although there are many perks to implementing direct deposit, there are a few negative aspects to consider.

- Potential Overdraft Fees – Careful maintenance and upkeep of the payroll bank account or savings account is required to ensure adequate funds for each payment are present. Overdraft fees are always the responsibility of the payer, not the payee.

- No Option To Stop Payment – Unlike physical paper checks, you can’t place a stop on an electronic transfer once it’s been initiated. If errors are made, they must be corrected after the deposit clears.

- Employees Must Start Over When Changing Banks – While this is a minor inconvenience for most, a new authorization form is required every time an employee wants to switch or update their account of choice.

- Possible Banking Security Risks – Although ACH is a secure method, collecting account and routing numbers is a sensitive process. It’s important to handle this data safely and securely to avoid unauthorized access to account information.

- Costs and Fees – Using direct deposit necessitates having a reliable direct deposit provider who deposits money into your bank or credit union. This service is generally an administrative investment. In addition to software and payroll provider costs, ACH transfers may incur banking fees as a small percentage of the transfer. Although minor, these can range from a few cents to a couple of dollars per check, and businesses should be aware of these charges in order to maintain accurate books.

Employees vs. Contractors

Is direct deposit different for contractors as compared to employees? Both will likely appreciate the service of this popular payment method. Both employees and independent contractors are eligible for direct deposit. There are minimal differences in the process between the two types of payments, but essentially, they are similar.

For contractors or freelancers, enrolling in direct deposit may be a simple matter of preference. For example, contractors may choose to be paid into their business account. Regardless of employment status, the ACH network transfer for each payout is the same.

The main difference is that contractors will not have a W-2 on file, so verifying identity and contact information is important when making a payment.

Simplify Direct Deposit with FreshBooks Payroll Software

Before implementing any payroll process, set aside time to understand how a payroll software works. This will help you identify the right payroll software options and learn how certain functionalities operate. Take the time to learn how a payroll software works during this onboarding process. It will allow your business to handle many different types of financial transactions easily.

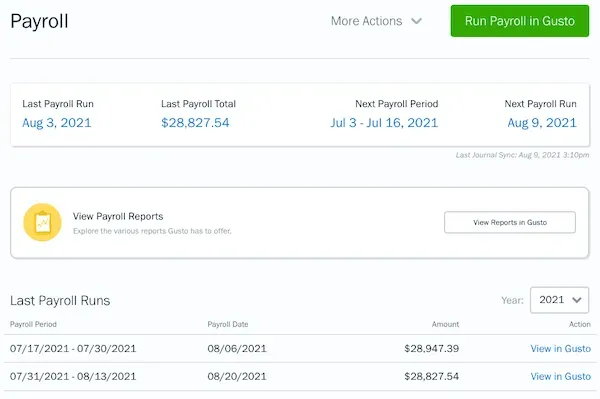

FreshBooks Payroll Software powered by Gusto simplifies payroll management for small businesses by automating direct deposit payments. With FreshBooks, you can easily set up and manage direct deposits, ensuring your employees are paid on time, every time. The platform securely handles the process, reducing errors and saving time compared to manual systems. By integrating billing, accounting, and payroll software in one place, FreshBooks streamlines your operations, helping you save time and improve efficiency.

FAQs on How to Set up Direct Deposit for Employees

Does it cost money to set up direct deposit for employees?

Yes, it does cost to set up direct deposit, but the costs can recoup in the long run. Costs include payroll software and the bank fees involved in the transfer.

Do you need anything to set up direct deposit?

Yes, a few essential items that are needed include funds in the bank account that will be debited and correct information from each payee regarding their financial institution.

Can I set up my own direct deposit?

Yes, with the help of payroll software, you can set up your own payroll process quickly and easily. Your bank can also help and steer you in the right direction.

How do small businesses do direct deposit?

Yes, many small businesses use direct deposit. The direct deposit service is the most popular payment method, so even small businesses have jumped on board.

Do jobs have to offer direct deposit?

No, employers don’t have to offer direct deposit, but they find that it’s one of the most effective ways of paying their employees, whether they have two or 200.

More Payroll Resources for Small Business Owners

- Top 5 Payroll Services for Small Businesses

- Everything Small Business Owners Need to Know About Payroll

- FreshBooks and Gusto Integration

Reviewed by

Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields.

RELATED ARTICLES

7 Best Purchase Order Software – Reviews & Pricing

7 Best Purchase Order Software – Reviews & Pricing What is the Section 199A Deduction?

What is the Section 199A Deduction? What is TAKT Time Formula & How Is It Calculated?

What is TAKT Time Formula & How Is It Calculated? Cash Disbursement Journal: Definition & Examples

Cash Disbursement Journal: Definition & Examples General Ledger: Definition, Importance, and How It Works

General Ledger: Definition, Importance, and How It Works What Is Inventory Carrying Cost & How to Calculate It?

What Is Inventory Carrying Cost & How to Calculate It?