What Is a Contactless Payment? A Complete Guide

In a post-pandemic world, contactless transactions are the norm. Here is everything you need to know about them.

Contactless card payments are the way of the future. The pandemic gave us the heebie-jeebies about touching each other’s stuff. So it was only a matter of time until contactless payments became more mainstream.

In short, contactless payment is when your debit or credit card details are read by hovering the card over the terminal. No swiping. No signatures. No PIN.

The wifi-esque symbol on a card reader lets you know that contactless payment is possible.

Here’s What We’ll Cover:

How Do Contactless Payments Work?

How Do Contactless Payments Work?

Not to get too deep in the science of it, contactless payments work like this:

The technology is called RFID (Radio Frequency Identification). The terminal can electronically read the card details without ever touching it. The chip on the back of the card transmits the signal to the PoS or Point of Sale terminal.

There is typically a beep to let the merchant and customer know that the contactless transaction has gone through.

It doesn’t need to be a physical card either. Digital wallets like Apple Pay and Google Pay can be used by tapping your smartphone or smartwatch over a terminal instead of a card.

There is no extra cost to use contactless features. Many banks are upgrading your debit card free of charge.

Is Contactless Payment Bad?

There has been a buzz around contactless transactions since the pandemic normalized it in our day-to-day lives.

The widespread use of contactless technology is quite new in the United States. But it has been well established in the UK and Europe for a few years now.

They haven’t descended into madness so we can conclude that contactless cards are not the end of the world.

That said, everything has its pros and cons. Let’s start with the bad news.

What Are the Disadvantages of Contactless Payments?

- You don’t need any personal details to use a contactless card

This boils down to the big question: is contactless payment safe?

There is the danger that someone could steal your card and use the contactless feature with reckless abandon. With no personal identification at all with physical contactless cards, this is a real issue.

By using mobile wallets, you have a little extra security. Many digital wallets need your fingerprint, facial recognition or secret PIN to access. - Fraudsters can read your card details through your wallet

A more sophisticated form of identity theft would be scanning your card without your knowledge. Hackers and thieves have found a way to read the chip on the back of your card with smartphones. This is called “host card emulation”. They can then use those details for fraudulent purchases.

You can prevent this by purchasing special holders that can block chip readers.

By measures of safety, chip and PIN cards still win.

What Are the Advantages of Contactless Payments?

- Hygiene!

This is the issue of our time. Contactless technology is only set to rise after the pandemic gave us haphephobia (That’s the fancy word for “fear of touching”). Hovering your smartphone or card over a terminal gives us peace of mind that we won’t be handling life-threatening viruses. That’s got to count for something, right? - Convenience and fast cash transactions

Paying at grocery stores, coffee shops, gas stations or restaurants has never been so easy. No signatures or long waits. It’s a simple swipe of your smart device and you’re out of there. - Maximum spend

Every country sets a maximum spend for contactless cards to lessen the likelihood of theft. The US actually has one of the highest limits in the world at $100. The UK has theirs set at £30 ($38.21). - New security policies

Mobile bank apps have now made it easier to question any fraudulent transactions. Many major credit card issuers have simpler processes to report any strange goings-on with your bank card.

Key Takeaways

Contactless payments are nothing to be scared of. While they do have some security concerns, you can protect yourself from any major issues. In a post-pandemic world, mobile wallets and contactless payment technology are here to stay. Expect wave-like symbols to appear more and more in the coming years.

Enjoyed this article? Read more on our resource guide.

RELATED ARTICLES

What Are PPP Loans? How the Paycheck Protection Program Works

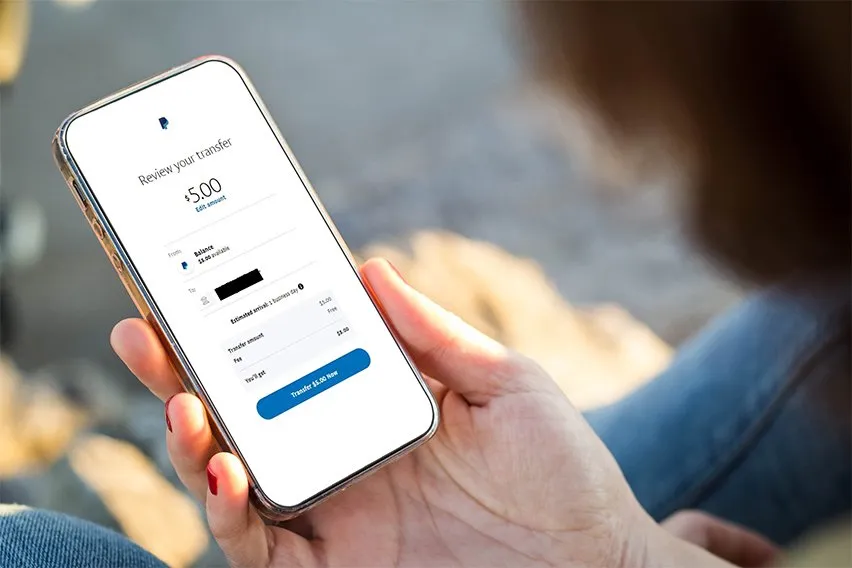

What Are PPP Loans? How the Paycheck Protection Program Works PayPal Instant Transfer: Fees, Limits, and How It Works

PayPal Instant Transfer: Fees, Limits, and How It Works What Is an eCheck? An Extensive Guide on Electronic Checks

What Is an eCheck? An Extensive Guide on Electronic Checks How To Transfer Money From PayPal to Bank: A Step-by-Step Guide

How To Transfer Money From PayPal to Bank: A Step-by-Step Guide How To Receive Money From Cash App

How To Receive Money From Cash App How to Receive Money on PayPal? Small Business Guide

How to Receive Money on PayPal? Small Business Guide