How to Write an Invoice Letter: A Small Business Guide

Small businesses need to be paid on time to maintain cash flow. It’s important to address past due accounts to maintain cash flow. Entrepreneur recommends being clear about payment schedules and costs from the beginning. Good communication sets client expectations and helps get payments to you faster.

One way to do this is to include a winning invoice letter with your invoice. A good invoice letter sets a professional but friendly tone that establishes when payment is due and who to address with any questions. After several reminders, a structured follow-up process ensures timely payments.

The format of an invoice letter should be that of a standard business letter. In this article, we’ll walk you through the steps to write one.

Need an invoice template? FreshBooks has free downloadable invoice templates for small businesses to make invoicing even easier.

Key takeaways

- An invoice letter details payment specifics and encourages timely client payment.

- It should be professional and friendly, and the due dates and contact information should be clearly stated.

- Invoice letters follow a standard business letter format and can be created using templates.

- Essential components include your address, date, recipient’s address, salutation, a concise body, a professional closing, and mention of the attached invoice.

- The letter’s body should reference the invoice, outline payment terms and methods, and mention any applicable fees or discounts.

- Always provide contact information for invoice-related questions.

- Send invoice letters for advance payments, upon purchase, at project milestones, or to follow up on late payments.

- Prevent late payments by clearly communicating policies, offering diverse payment options, and consistently following up.

- Thoroughly proofread invoice letters before sending.

- An invoice cover letter is similar to an invoice letter; it should be client-specific, concise, and clear about the payment due.

- Invoice emails are less formal but must remain professional and clearly reference the attached invoice.

Table of contents

- What is an invoice letter?

- How to write an invoice letter

- The timing and conditions for sending invoice letters

- How to avoid late payments

- Conclusion

What is an invoice letter?

An invoice letter or payment details letter is a financial letter stating the details of an invoice meant to encourage a client to pay. Invoice letters are sent with an invoice to explain the payment details and ask the recipient to complete the transaction within a clearly stated timeframe. An overdue invoice letter is often used to address overdue payments. Invoice letters are a popular communication used by many companies of all sizes in a wide range of situations.

Some companies choose to only send an invoice letter when a payment deadline is passed, while other companies always include the invoice letter to provide direct and upfront communication. It is crucial to provide clear payment instructions in the invoice letter to ensure expedient payment and reduce misunderstandings.

Take the frustration and extra work of your invoicing work. FreshBooks offers a variety of invoicing software, information, templates, and services to give you the confidence and tools you need.

Click here to get started.

How to write an invoice letter

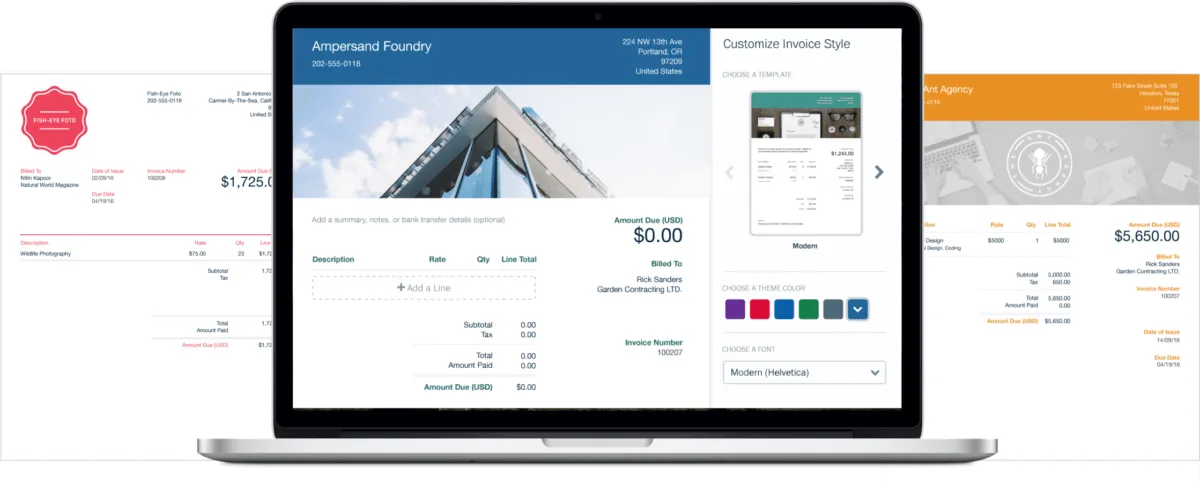

1. Get a template

To write an invoice letter for payment, you can use a blank document. Or you can download a business invoice letter template. MS Office has a simple free template for invoice letters you can download for Word. Invoice letter templates make creating invoice letters quick and easy. Invoice email templates can also improve communication regarding unpaid invoices by providing structured reminders and final notices, which can help mitigate the financial impact of late payments on your business.

Open whatever word processing software you prefer and open either your invoice letter template or create a new blank document.

FreshBooks offers a wide range of free invoice templates designed to take the guesswork out of billing and collections. Browse our selection and find the right templates for your needs to save time and energy.

2. Insert your address

Skip this step by printing your invoice on company letterhead or if you’ve plugged your address into an invoice letter template.

If you don’t have a letterhead, write your name or company name and your full address (street address, city, state, and zip code) at the top of the invoice letter. Align the text to the left.

Standard address format:

Name

Company

Street Address

City State Zip Code

For example:

Jenna Michaels

Hollywood Groomers

64 Sunnyside Road Ste 400

Beverly Hills CA 90201

This convention follows U.S. Postal Service guidelines. Please note there are no punctuation and one space between each word or number, except where there are two spaces between the state and zip code.

3. Add the date

Add either the date the invoice was written or completed if you wrote the letter over a period of several days.

Use the American date format: month, day, year.

- For example, January 1, 2020.

Write the date one line below your address. If your address is left justified, the date should also be on the left. If you’re using letterhead, center the date, says the Purdue University Online Writing Lab.

4. Include the recipient’s address

Add the recipient’s address to the invoice letter below the date. Include the recipient’s name, title, company, and address. Make sure you include the street address, city, state, and zip code. It should be left justified and one line below the date.

It’s best to include a specific name here. Entrepreneur recommends that you double-check to whom you’re supposed to send your invoice. Doing this is especially critical at larger companies where you may need to send your invoice and invoice letter directly to the finance department or a third party hired to handle payments. Ensuring the invoice reaches the correct finance teams can help avoid delays and mitigate the risks of unpaid invoices.

Contact your client to discuss who will be making the payment, who your invoice letter should be addressed to, and who, if anyone, you should copy on the invoice. Address the invoice letter to the primary person making the payment.

5. Personal titles

When adding a contact name, you may wonder what title to use. Standard personal titles are Mr., Ms., Mrs., and Dr.

Women can be addressed as Miss, Mrs., or Ms. When in doubt, use Ms.

6. Add a salutation

Now it’s time to open the invoice letter. Use the same name and personal title as included in the recipient’s address. Include a salutation under the recipient’s address.

If you know the recipient well, you can use their first name only. If not, use their title and last name. Add a colon at the end.

For example:

- Dear Anne:

- Dear Ms. Smith:

Not sure of the recipient’s gender? It’s okay to include their full name instead, such as:

- Dear Anne Smith:

7. Write the body of the letter

Single-space your letter and left justify your paragraphs. You don’t need to use a first-line indent. Include a blank line between each paragraph.

In terms of the content, the writing should be as clear and concise as possible, with a direct focus on the payment details.

First, include a friendly opening. Here’s a sample:

- I hope that you’re well.

Then, get right to the point:

- Please find attached [invoice [number]](LINK 1) for [project name].

- Your order of [order details] has been shipped. Please find attached an invoice for these items.

- Please find attached an invoice for [insert amount] as your outstanding balance.

Now add some payment details, such as:

- A reminder of my payment terms: payment is due on January 20, 2020. There’s a 5 percent discount if you submit payment in 15 days.

- Please send payment via check or direct deposit. We accept various payment methods to make the process convenient for you.

- Please note in our payment details we charge a late fee of 5 percent per week.

It’s best to list the right contact in case they have any questions:

- If you have any questions about your invoice, please contact [name] at [contact details].

- I’ll be back in the office next week if you have any questions or concerns.

- For project matters, please contact [name] at [contact details]. For billing concerns, please contact [name] at [contact details].

Now add a friendly line:

- Thank you for your business.

- It’s been a pleasure working with you.

- I look forward to continuing to work with you in the future.

- Please let me know if we can help you again in any way.

- We appreciate the opportunity to do business with you.

And finally:

- Please confirm that this invoice has been received.

8. Write the closing

The closing of a winning invoice letter is one line after the last line of the body. Only the first word should be capitalized, and a comma should be added at the end. If a signature is being added, include four blank lines between the sign-off and your name.

For example:

Thank you,

Jenna Michaels

9. Mention attachments

Attachments, in this case, your invoice, are also called enclosures. Write “Enclosures” four lines below your closing. You can either simply add the number of attachments or list them by name.

For example:

- Enclosures: 3

- Enclosures: Invoice 001, Preliminary Drawings, 3D Model

- Enclosures: Updated Invoice 002, reflecting late fees

Your invoice letter is now almost ready to go. Before sending it, be sure to proofread it thoroughly for spelling or grammar mistakes.

The timing and conditions for sending invoice letters

The timing and conditions for sending an invoice letter depend entirely on the reason it’s being sent. Some of the most common reasons for sending an invoice letter are:

Advance payments

If your company expects an advance payment prior to services being completed, it’s a great time to send an invoice letter. A well-written letter clearly states the terms of the expectations surrounding a preliminary payment and minimizes financial risk. Companies often use advance payments for large orders or projects that require substantial upfront costs.

On purchase

As soon as a customer purchases services or products from your company, you can send an invoice accompanied by a sales invoice letter. Invoice letters sent with initial invoices can induce quick payment, avoiding a complicated collection process down the line.

Project milestones

If you’re working with a client who has contracted your company long-term, payments are typically made in installments or when certain milestones are achieved. Including an invoice letter with project-based invoices is a perfect opportunity to update the client on progress and maintain cash flow.

Late payments

Invoice letters help address the uncomfortable process of requesting payments when a deadline has passed. When a client delays payment or refuses to pay, a professionally written invoice letter to the recipient’s address reminds the client of the payment terms and creates a solid paper trail of communication.

Invoice letters written for late payments often mention the potential legal consequences of not honoring the payment in an effort to portray the importance of the payment collection.

Also Read: Strong letter for outstanding payment email

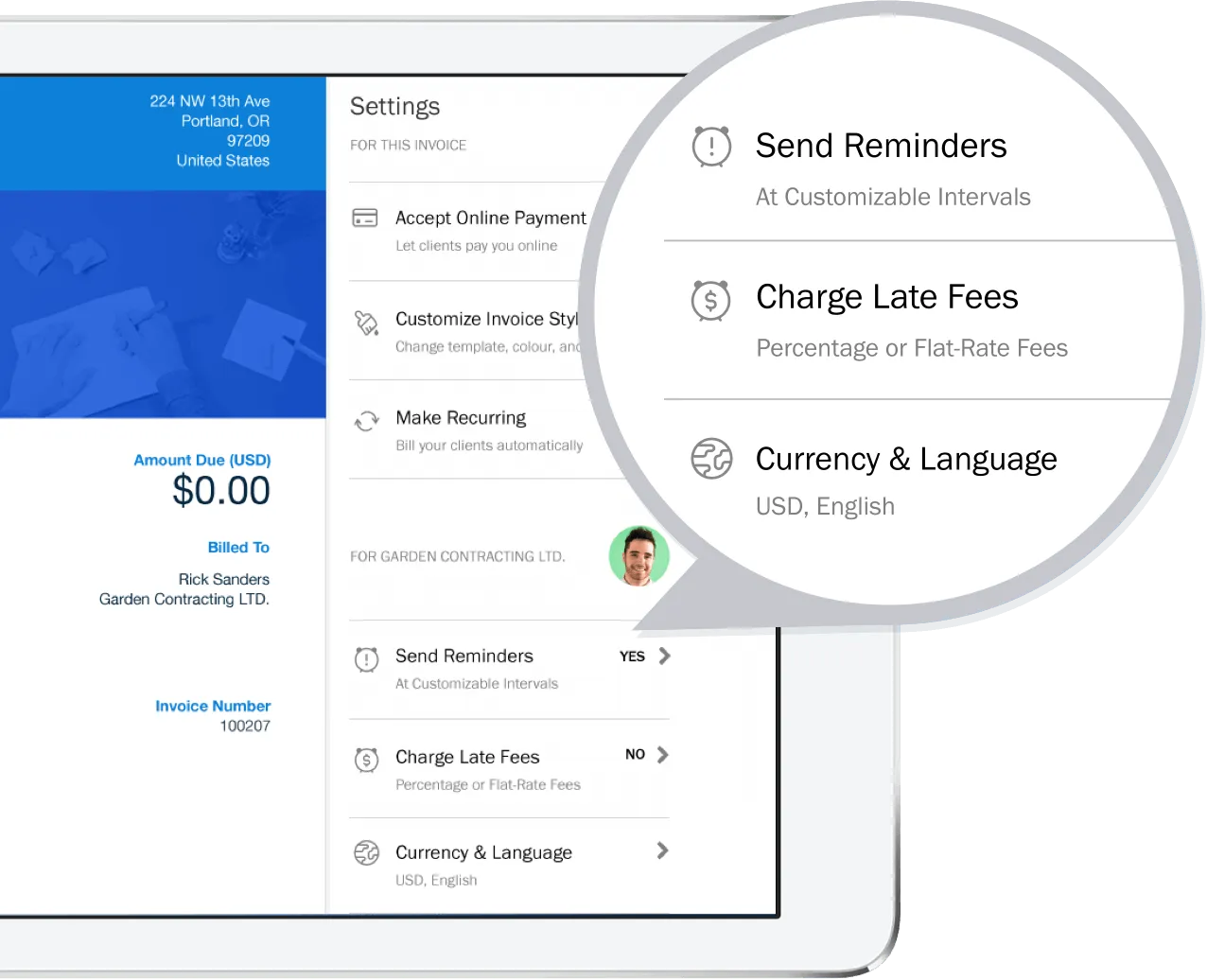

How to avoid late payments

There are many ways to set the groundwork for avoiding late payments from the start of a client relationship. A clear and direct communication of payment expectations is the best place to start, including a detailed, proper invoice letter. Other methods for avoiding late payments include the following:

- Include a clear credit policy on all bills, invoices, and statements that communicates the payment terms and consequences of late payments, encouraging timely payments.

- Make the payment process as easy as possible by providing multiple payment options and digital access to payment portals.

- Offer discounts for early payment to prompt clients into paying prior to the invoice due date.

- Create a staggered payment plan as long as it does not negatively impact your ability to provide the agreed-upon services or products. Many people are more likely to pay smaller amounts over an extended period of time rather than a large amount all at once.

- Create a reminder and follow-up schedule and stick to it for every transaction with all clients. Make sure each communication is polite and friendly while maintaining a direct message about the policies and terms of your payment agreements.

Conclusion

Creating professional invoice letters or payment detail letters is a great way to make payment details clear and concise for clients. With the added bonus of encouraging clients to pay their invoices ahead of their due date or on time, there’s a crucial step in payment processing for your small business. When creating your invoice letters, follow the guidelines, tips, and tricks in this article and elevate your client communication. Keep your language clear, direct, and friendly, and you’ll make lasting client relationships without payment hassle or confusion.

FAQs on invoice letter

Find answers below to frequently asked questions about writing invoice letters, their purpose, and related invoicing topics.

How to write a cover letter for an invoice?

A cover letter for an invoice is essentially an invoice letter. Follow the steps above to write a professional business invoice letter.

Here are some additional tips for writing a cover letter, according to the University of Wisconsin-Madison:

- It should be one page only

- Tailor your cover letter to the client. Address specific project details and timelines. Mention any further invoices to come.

- Avoid jargon. Use active voice and short sentences. Be clear. Convey respect for the client and use professionalism.

- Focus on the aim of your letter: to get paid. Include the reason for the invoice and the total due in the first paragraph of the body of the letter. Always include contact information so a client can address any concerns about the invoice immediately.

- Each paragraph of the body should be focused on a single point

- Proofread your work. Ask a trusted colleague or friend to do this.

How to write an invoice email?

Here’s how to write an email with an invoice attached. Emails are often much less formal than business letters, but they should still be professional and well-written.

Here’s an example:

Hi [insert client name],

Please find attached an invoice for [insert project name].

Thanks for your business. If you have any questions about your invoice, please contact [name] at [contact details].

Best,

[insert your name]

If you require additional email invoice templates and guidance on composing professional messages for payment requests, read our article titled How to Ask for Payment Professionally in a Message

What is the purpose of an invoice?

An invoice is an itemized commercial document that records the products or services delivered to a customer, the total amount due, and the preferred invoice payment method. Its purpose is to communicate payment expectations is a clear and direct way to avoid hassle or confusion at the time of payment.

Is an invoice a legal document?

No. An invoice is no a legal document on its own. While invoicing is an important accounting practice for your business, invoices do not serve as a legally binding document between the business and its client.

What are the rules of an invoice?

Invoices need to include the business name and address, the client name and address, a unique invoice number, the date the invoice was created, and the payment terms and due date. They also need a description of services rendered. If you want to create accurate invoices, follow our guide on invoices for services rendered. This guide provides step-by-step instructions and examples to ensure your invoices are comprehensive and professional.

Reviewed by

Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields.

RELATED ARTICLES

How To Print An Invoice? Step By Step Guide

How To Print An Invoice? Step By Step Guide What Is a Vendor Invoice?

What Is a Vendor Invoice? When to Invoice a Customer | Best Invoicing Practices for Small Business

When to Invoice a Customer | Best Invoicing Practices for Small Business How Much Interest To Charge On Overdue Invoices

How Much Interest To Charge On Overdue Invoices How to Invoice as a Contractor: Free Template and Essential Tips

How to Invoice as a Contractor: Free Template and Essential Tips How to Make an Invoice Without a Company

How to Make an Invoice Without a Company