What Is an Invoice: Purpose, Types, Elements & Example

Professional invoices are a type of legal document that is crucial for businesses of all sizes. They’re used to request payment from another party in exchange for goods or services rendered. There are many different types of invoices (more on them later) based on all the necessary information that needs to be filled out in an invoice, but all invoices are required to include some basic information, such as a description of the products/services provided, an invoice number, payment due date, and all relevant contact information.

Invoices serve an important purpose for both the business sending the invoice and the client receiving it. For small businesses, an invoice helps expedite the payment collection process by giving clients a notification of the payment that’s due. For clients, invoices provide an organized record of an expense with itemized details and can help with record keeping.

In this article, we’ll review everything you need to know about invoices, ensuring you can confidently approach the invoicing process. Let’s have a look.

Key Takeaways

- There are several different kinds of invoices, each of which has its own use.

- Certain industries will use specific invoices, while these invoice types may never be necessary for another industry.

- Invoices need to contain key information, including the date, contact information for both parties, descriptions of goods/services rendered and their prices, an invoice number, and the payment due date.

- Some key best practices surround how and when to issue an invoice to get paid as soon as possible.

- Using invoicing software can simplify the entire process and help you improve cash flow in a more efficient way.

These topics will help you understand what an invoice is so you can create small business invoices:

What Is An Invoice?

What Is an Invoice Used For?

Types Of Invoices

Invoice Elements: What Does an Invoice Look Like?

What Is an Invoice ID?

How to Assign Invoice Numbers

Invoice Example

How Do I Invoice Clients?

Simplify Your Business Finances with Our Invoicing Software

Conclusion

Frequently Asked Questions

What Is An Invoice?

An invoice is defined as a list of goods or services provided by one party to another, along with the statement of the sum owed for these. In other words, it’s a bill sent along to request payment after work has been successfully rendered.

Invoices are the backbone of the accounting system for small businesses. An invoice tells your client how much they owe you, when the payment is due, and what services you provide.

What Is an Invoice Used For?

Invoices are used as a source document for business accounting. Invoices are helpful for recording all the sales transactions a business makes with its clients. Businesses use invoices for a variety of purposes, including:

- To request timely payment from clients

- To keep track of sales

- To track inventory for businesses selling products

- To forecast future sales using historical data

- To record business revenue for tax filings

Types Of Invoices

There are several types of invoices, each with its own specific application in the business world. Some companies may only use one or two of these invoice variants, while others might use nearly all of them on a recurring invoice basis. Let’s break down the different kinds of invoices.

Pro Forma Invoice

A pro forma invoice is a kind of advanced invoice sent before any work is completed or goods are delivered. They act as an advanced estimate and a way for clients to plan for their eventual payment due date.

Interim Invoice

Interim invoices are typically used by businesses working on large projects. If a job takes months to complete, waiting until the end to invoice can lead to major cash flow problems. Interim invoices are sent periodically through a project, typically in alignment with pre-agreed-upon milestones.

Recurring Invoice

Recurring invoices are used in scenarios where work carries on consistently over a long period of time. This could involve a freelancer working on a retainer or a goods provider who makes regular deliveries to an enterprise client.

Credit Invoice

Credit invoices work the opposite of the other kinds of invoices on this list; they are used to give money to another party rather than request it. These are usually only used in the case of retroactive discounts or when correcting an invoicing error and will display a negative balance that is to be repaid to the client or for the client to apply to existing or future invoices.

Debit Invoice

Debit invoices act similarly to credit invoices, but they come from the client side instead. These are used if the client realizes they are underbilled. They will forward a debit invoice stating the amount you are owed.

Timesheet Invoice

Businesses use timesheet invoices with staff working on a project basis. They’re used to help keep track of the labor costs associated with certain projects or clients, usually to aid in the final billing of those customers.

Past-Due Invoice

Past-due invoices are only sent when clients exceed their final due date without paying their balance. They’re used as an effort to collect payment from non-paying accounts. You can send a past-due invoice with or without fees for late payments, depending on your payment policy.

Commercial Invoice

Lastly, commercial invoices. These are only used in transactions involving foreign trade as customs documents. Commercial invoices act as customs declarations and are mainly used to identify the contents of delivery and the two relevant business parties.

Invoice Elements: What Does an Invoice Look Like?

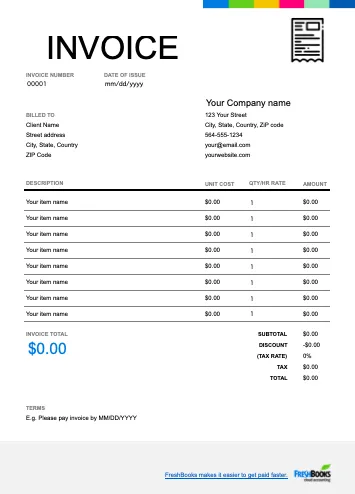

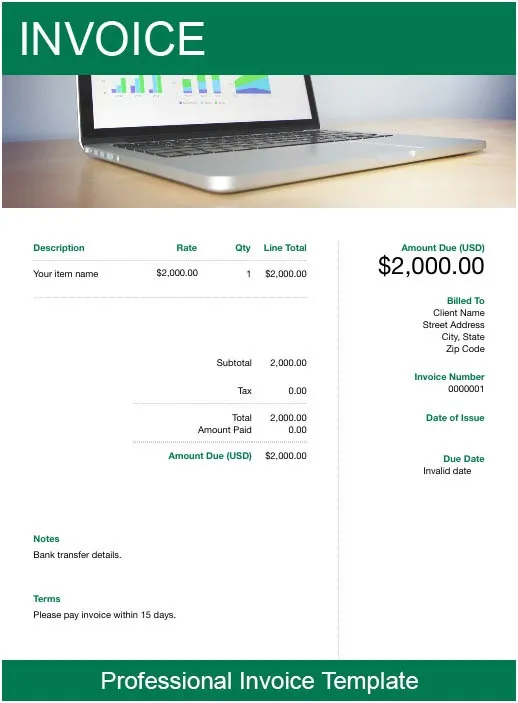

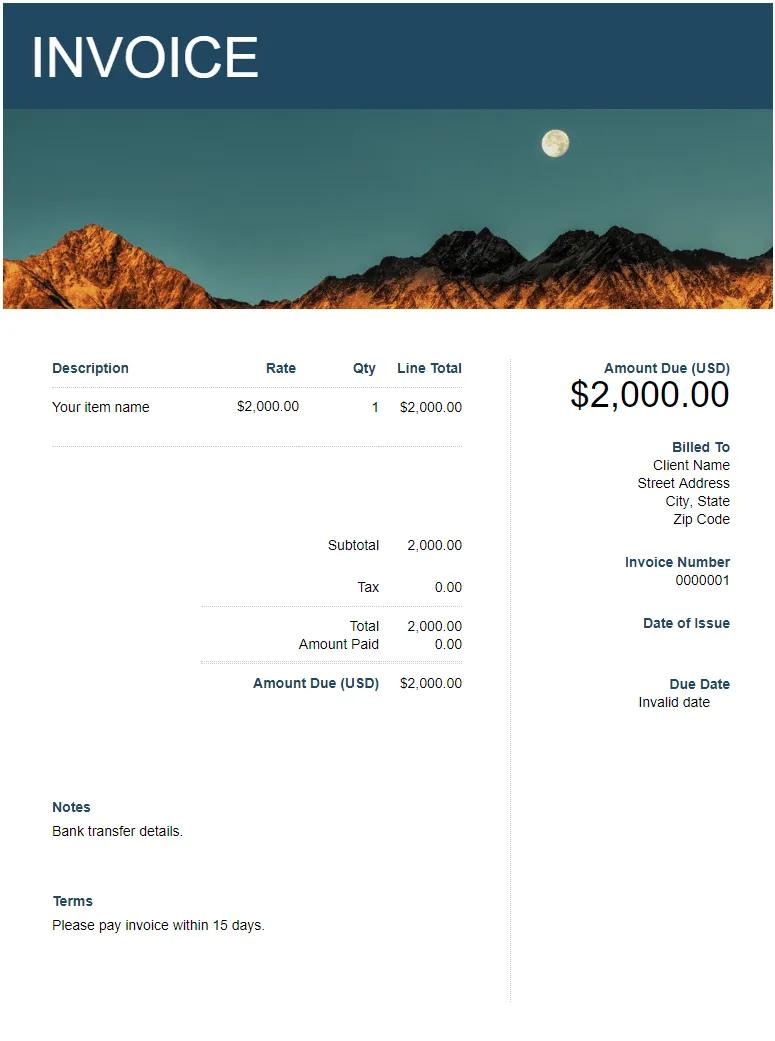

A professional invoice must look clean, readable, and simple while still providing all the details on the services and payments required by the client. A professional invoice should also always include:

- A label clearly marking the document as an invoice

- If applicable, the kind of invoice (pro forma invoice, credit invoice, interim invoice, etc.)

- Your business contact information

- Your client’s business contact information

- A unique invoice ID or number

- An invoice date

- Payment terms

- Payment due date

- An itemized list of goods or services rendered

- Subtotals for all goods or services

- The total amount due

- Any applicable taxes or fees

Are you looking for design tips to help you create professional-looking electronic invoices that stand out? Check out this small business guide on how to design invoices.

What Is an Invoice ID?

An invoice ID also referred to as an invoice number, is a unique number that’s assigned to each invoice a business generates. The invoice number is crucial because it allows a business to easily identify and refer to individual transactions with clients.

An invoice ID can include both numbers and letters. While invoices don’t necessarily need to be numbered sequentially, you’ll need to establish a consistent invoice ID system and ensure you don’t assign an invoice number more than once.

How to Assign Invoice Numbers

There are different approaches businesses can adopt to assign invoice numbers. Here are some common approaches to assigning invoice numbers.

Sequential

This is the simplest way to assign invoice numbers and is the default method most cloud-based invoicing software adopts. To assign sequential invoice numbers, you would start with any number (usually 1) and assign each proceeding invoice the next number in the sequence. For example:

Invoice #001

Invoice #002

Invoice #003

Sequential invoice numbers make it easy to stay consistent and ensure you never assign duplicate invoice IDs.

Chronological

To assign invoice numbers using the chronological method, you will sort all invoices by the date they’re generated. Therefore, the first series of numbers in the ID will always refer to the date. After the date, your invoice number will also include unique numbers assigned to that invoice. You can use any date format you like for chronological invoice numbers. For example, if an invoice is created on September 30, 2018, and the unique invoice number is 0022, you could assign this number to the invoice: 2018-09-30-0022.

By Customer ID

Some businesses assign unique customer IDs to each client, and you can use the customer ID to assign invoice numbers. The process for assigning invoice numbers by customer ID is similar to the process for chronological numbering. The invoice ID will begin with the customer ID number and then a unique number will follow. For example, if you’ve assigned your client a customer ID number of 490 and your unique number is 004, you can use the customer ID approach to assign an invoice number of 490-004.

By Project ID

If your business works on a number of projects at a time and you bill clients by project, then you may wish to assign invoice numbers by project ID. This method is common in the construction industry. To assign invoice numbers by project ID, the first part of your invoice number will refer to the project ID, and the second part will be a sequential number to differentiate between different invoices issued for this specific project. For example, if you were creating an invoice for your project 6221, you could assign your first invoice number for the project as 6221-001.

Assigning an invoice number is crucial as it makes it easy for both the issuer and the receiver to refer to the invoice in the future. However, manually issuing a new invoice number each time can be a time-consuming and tedious task. To streamline this process and remove the risk of manual errors in invoice numbering, one can use the feature of auto generated invoice numbers in Excel. This function not only saves time but also ensures consistency and accuracy in your invoicing system.

Invoice Example

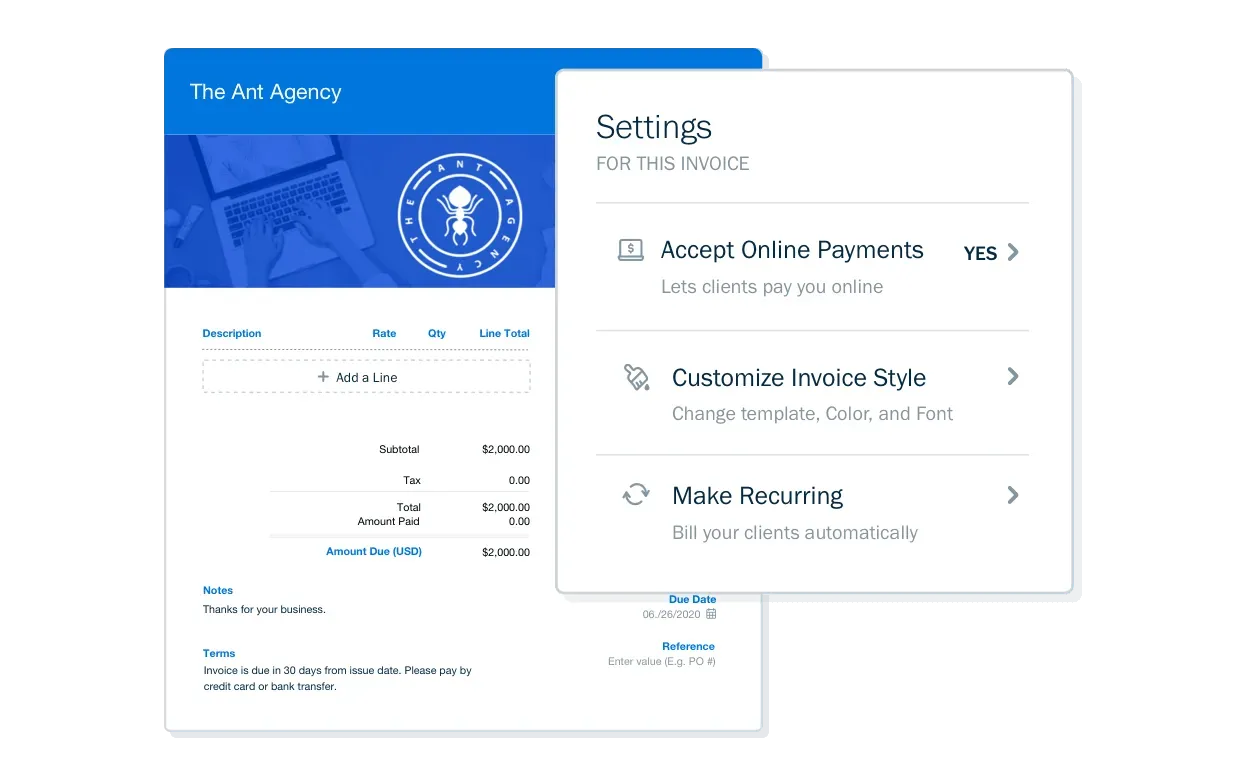

Looking for an example of a professional invoice for use in your business? Here’s a great invoice template courtesy of FreshBooks.

Notice that this example features all the important invoice details you’ll need: a field for the invoice date, payment due date, invoice ID, goods/services provided, subtotals, totals, and more.

Click here to take a look at our other free invoice templates.

How Do I Invoice Clients?

To invoice your clients, you should create an invoice and send it as soon as you’ve completed work on a project. That way, the details of the work will be fresh in your mind and you should receive payment as quickly as possible. Ensure your invoice includes all the details your clients will need to pay you, including your business name, the invoice due date, and the total amount due.

Need more help? Here’s a complete guide to the Customer Invoicing Process that will walk you through the step-by-step process.

Simplify Your Business Finances with Our Invoicing Software

As a business owner, you understand that a smooth invoicing process is essential for healthy cash flow. That’s why ensuring you use the invoicing tools at your disposal is so important: they allow you to invoice faster, receive more timely payments, and keep your finances as healthy as possible. If you’re looking for the best invoicing software for small businesses, FreshBooks is here to help. Our cloud-based invoicing solution saves you time and money on the invoicing process, all while helping to improve organization and eliminate clerical errors. Click here to give FreshBooks a try for free.

Conclusion

Understanding the details of the invoicing process—and developing your own invoicing system—is essential to running a successful business. By following these invoicing best practices, you’ll be more efficient when it comes to requesting payment, helping your business to thrive like never before.

FAQs on What Is An Invoice

More questions on how to create, send, and collect your invoices? Here are some frequently asked questions on invoicing.

What is an invoice versus a receipt?

An invoice is a document used to state the amount owed by another party and is used to request payment. On the other hand, receipts are used as proof of payment already rendered and are for the payer’s reference and records. It’s good practice to provide a receipt when a client pays their invoice.

What is an invoice for dummies?

Simply put, invoices are a document to tell someone else how much money they owe you. They are based on agreed-upon terms (such as a contract or statement of work) and require a formal structure (see above) in order to be considered valid.

What should you not put on an invoice?

As long as you’ve met the requirements of a legal invoice, it’s largely up to you what else you include. However, you should never include unclear product/service descriptions, spelling or math mistakes, or incorrect contact information for either you or the other party.

Can an invoice replace a receipt?

No. Because invoices are used to request payments, while receipts are used to confirm payment, it’s not a good idea to substitute one for the other. Doing so can lead to confusion and mistakes on your end and your client’s, so avoid doing this at all costs.

Do you invoice before or after payment?

This depends greatly on your industry and the nature of your business transaction. Some businesses will send pro forma invoices as a formal estimate and notice of payment due date, but most of the time, invoices are either sent periodically through a project (interim invoice) or after the work/product has been delivered (sales invoice or final invoice).

How long does an invoice take to process?

This can depend greatly on the invoicing process of your client. However, it’s standard to expect payment within 30 days of receipt of the invoice. Some businesses will opt for shorter or longer payment periods, which are allowed as long as they’re agreed to by both parties beforehand.

Did you find this article helpful? If so, check out our article on How to Pay an Invoice, where we have explained the process in detail, along with tips that will help you pay your invoices on time.

Reviewed by

Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields.

RELATED ARTICLES

6 Steps on How to Write a Simple Invoice

6 Steps on How to Write a Simple Invoice How to Invoice as a Freelancer: Key Components and Template

How to Invoice as a Freelancer: Key Components and Template How to Make a Sales Invoice and Get Paid Faster for Your Goods Sold

How to Make a Sales Invoice and Get Paid Faster for Your Goods Sold How to Make a PDF Invoice? Steps Explained

How to Make a PDF Invoice? Steps Explained How to Invoice as a Freelance Designer: A Step-By-Step Guide

How to Invoice as a Freelance Designer: A Step-By-Step Guide How to Make a Service Invoice and Get Paid for Your Work

How to Make a Service Invoice and Get Paid for Your Work