Proforma Invoice: Definition, Uses, and Free Template

A proforma invoice (also known as a pro forma invoice, preliminary invoice, or simply proforma) is an essential preliminary, unofficial bill of sale that you send to a client before work is completed or goods are delivered. It clearly outlines the anticipated terms of a sale, including a description of the goods or services, quantities, prices you’ll be charging, and potentially shipping details and payment terms.

Unlike a standard commercial invoice, a proforma invoice represents a commitment to providing goods or services that haven’t been delivered yet, serving as a gesture of good faith and ensuring clarity between you and your buyer. This preliminary bill of sale is sent to buyers as an initial document, allowing for the negotiation and confirmation of details before a final agreement is reached.

Importantly, while there are similarities between proforma invoices and commercial invoices, they function differently. For instance, a proforma invoice isn’t used for accounting purposes by any party and isn’t a legally binding demand or request for payment; instead, it’s best understood as a detailed quote. A proforma invoice is not a legally binding document and does not obligate either party to complete the transaction.

Key takeaways

- A proforma invoice is a preliminary bill of sale outlining terms, sent before work or delivery.

- Its purpose is to streamline sales by ensuring buyer-seller agreement on terms as a good-faith estimate.

- It’s not a payment demand, isn’t used for accounting, and isn’t legally binding for payment, unlike a commercial invoice.

- Businesses use proforma invoices for special orders, customs declarations, or when full commercial invoice details are pending.

- Send a proforma invoice after negotiations conclude but before delivery, confirming agreed terms.

- Key difference from a commercial invoice: A proforma is a pre-fulfillment quote; a commercial invoice is a post-fulfillment, legally binding payment request used for accounting.

- Clearly label it “proforma” (not a VAT invoice) and include essential seller/buyer information, an itemized list, prices, and total cost.

- Payment is generally not made on a proforma invoice; it precedes a purchase order and the final sales invoice.

- FreshBooks provides templates and software to simplify creating and managing proforma invoices.

Table of contents

- What is a proforma invoice?

- What is the purpose of a proforma invoice?

- Why do businesses use proforma invoices?

- How to create a proforma invoice with the FreshBooks template

- When should proforma invoices be sent?

- What is the difference between an invoice and a proforma invoice?

- Getting ahead of the game with proforma invoices

- Frequently asked questions

What is a proforma invoice?

A proforma invoice is a preliminary quote or estimate that outlines goods or services that haven’t been delivered yet. It’s given to a potential buyer before they become a committed buyer, ensuring the buyer and seller are both on the same page about the agreement.

Unlike a final, sales, or tax invoice, proformas are technically not completed since they don’t have a legally-required invoice number. Think of them as finalized courtesy quotes that prevent unexpected surprises or disputes down the line. They also give prospective clients a general overview of a sale, including prices, timelines, and terms. Including detail and transaction details in the proforma invoice is essential for transparency and to help the potential buyer make informed decisions.

What is the purpose of a proforma invoice?

Preliminary invoices streamline the sales process. Once negotiations have finished and all parties are in agreement, you can send a preliminary invoice as a good-faith estimate, letting your customer know exactly what to expect ahead of time regarding the proposed transaction. Your customer will then give final approval to the price and any other terms of service. Before issuing the official invoice, it’s important to confirm all final details to ensure accuracy.

You’ll provide the goods or service, then issue a final, official invoice to request payment. But there are benefits to proformas beyond a courteous heads-up. Other uses include:

- Declaring the value of goods to customs agencies, ensuring a smooth delivery process

- Providing an invoice when you don’t have all the details required for a standard commercial invoice

- Facilitating a company’s internal purchasing approval process

So, when should you use a proforma invoice? Let’s take a look.

Why do businesses use proforma invoices?

Here are just two cases where a business might choose to use a preliminary invoice. A proforma document, often used in the sales process before finalizing transactions, serves as a preliminary or estimated invoice that outlines the terms of the deal and can be used for export or customs purposes.

In both cases, the proforma invoice helps clarify the details of the transaction and provides a good-faith estimate, including any additional costs, to ensure clarity and accuracy from the start.

Special orders

For manufacturing companies, custom orders are a great opportunity for a proforma invoice. This is because you could potentially lose time and money by fulfilling an order if your buyer decides to back out last minute due to factors like the cost or delivery timeline. During negotiations, it’s important to be flexible and willing to adjust delivery dates based on buyer feedback.

If your manufacturing company receives a large order, sending a proforma is a good idea. By including information on the product, quantity, cost, delivery date, and any other details of the sale, you’ll ensure your client is aware of all terms of service. A typical proforma invoice includes these key elements, serving as a preliminary document that outlines the transaction specifics before the actual supply or payment.

International imports and trade

Many businesses use preliminary invoices for customs purposes. When shipping internationally, you must provide a detailed summary of the goods inside and ensure you have the proper documentation required by customs authorities. Most customs agencies require the value of an item, as well as details on its weight, packaging, shipping costs, and more, and you must declare the financial value of the goods for customs clearance.

Including a proforma invoice with your shipment makes international trade and imports as hassle-free as possible. It’ll also speed up the approval process and make sure you deliver to your customer on time. Be sure to include any applicable taxes in the proforma invoice for international shipments, as these may be required or estimated based on the destination country’s regulations.

How to create a proforma invoice with the FreshBooks template

How do you create proforma invoices and start using them in your day-to-day business?

One great way to create proforma invoices is with an invoicing software or online tool, such as the free proforma invoice templates created by FreshBooks. This simple, efficient tool makes invoicing easy, and you can try it for free. Here’s how it works:

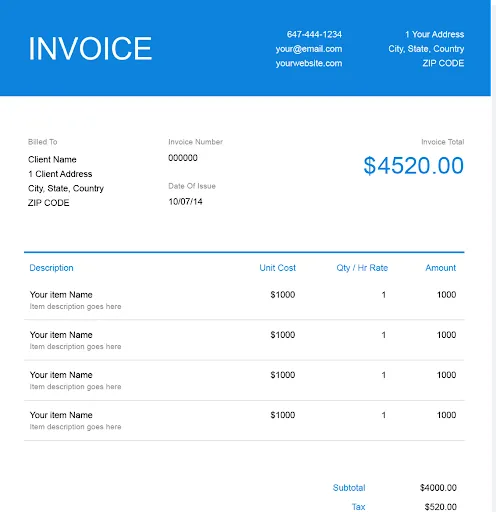

- Download your free proforma invoice template from the FreshBooks template page

- Add your company name prominently at the top of the template, along with your name and contact information

- Customize the template with your branding, colors, and logo

- Enter your customer’s name, company details, and contact information into the invoice template

- Add your invoice file number, date, and payment due date to the form

- Add an itemized list of services or goods to be provided, and the quantity, description, and price of each item

- Calculate the total cost, and enter it into the ‘total’ section of your template

- Enter your business’s payment terms (and any other important information) into the invoice

- Be sure to specify that your proforma invoice is not a VAT (Value-Added Tax) invoice

- Send your completed proforma invoice to your client by email, direct mail, or using an online accounting tool like FreshBooks

You can also use Google Docs or Microsoft Word to create your own proforma invoice. Take a look at our other templates to get ahead of the game with invoicing and get paid sooner.

When should proforma invoices be sent?

Now that you have your proforma invoice, it’s important to know when to send it. Naturally, you’ll need to ensure your customer receives the finalized proforma invoice before the work or goods are delivered, as this helps confirm the upcoming transaction. However, you don’t want to send a final proforma invoice before negotiations have concluded.

This is where a proforma invoice and a more conventional quote or estimate differ. Quotes are a great way to put an initial number on your transaction, which informs your client. A proforma invoice contains much of the same information as a final invoice, but is not legally binding. If there’s any further negotiation, you can adjust as needed.

Finally, when you shake hands on the deal and are ready to proceed, it’s good practice to send your proforma invoice. This acts as confirmation of the work or products to come and ensures you’re on the same page as your client before making the final move to fulfill your order.

What’s the difference between an invoice and a proforma invoice?

A final sales invoice (also called a commercial invoice, final invoice, or official invoice) is a business instrument that states the total amount due and requests payment. A sales invoice is a formal request for payment and also serves as a tax document, especially when it includes VAT. A proforma invoice is a declaration by the seller to provide products or services in the future and isn’t a legally binding agreement.

Here are some other key differences between proforma invoices and commercial invoices:

| Basis for comparison | Invoice | Proforma invoice |

| Definition | A commercial instrument sent to the buyer confirming that the sale occurred and requesting payment. It also serves as confirmation of a purchase agreement. | A written proposal, estimate, or quote that is sent prior to billing. It provides the particulars of the goods and services yet to be delivered |

| Issued | Issued after work or goods are ordered, delivered, and fulfilled | Issued before order placement |

| Purpose | A legally binding way to inform a buyer about the amount due for goods and services already provided. The invoice is a formal request for payment and functions as a tax document. | A non-legally binding courtesy to help a buyer know what to expect, and/or to make international imports and trade more efficient |

| Format | Commercial invoices include both businesses’ logos, contact information, billing addresses, and information, as well as a terms and conditions section, and an official invoice number | Proforma invoices include all the information a standard invoice would include (contact details, business information, etc.) ,but should be clearly labeled “proforma” and specified as not being a VAT invoice |

| Accounting use | A commercial invoice is necessary for paying a bill, and is used by your accounts receivable and/or accounts payable teams. It should have an invoice number, be filed for reference with your accounting department, and be backed up in case of an audit | It gives your business a general idea of the amount that will be due and when it must be paid. Proforma invoices are not used by accounts payable or receivable departments, but should still have a proforma invoice number for filing purposes |

Getting ahead of the game with proforma invoices

Most business owners and managers understand how challenging it is to balance invoices, estimates, proposals, and more. While the benefits of using proforma invoices are undeniable, it might seem overwhelming to manage the delivery and filing of yet another type of document.

Fortunately, there’s another way! FreshBooks has created easy-to-use Estimate and Proposal software tools that seamlessly create proforma invoices for any industry scenario. Pro forma invoices play a crucial role in international trade by providing transparency to buyers about estimated costs and terms before you ship goods, helping to facilitate customs procedures and negotiations.

But even better than that, we can also take care of all your filing and accounting details. What does that mean for you? Less time spent invoicing and more time doing the things you love.

Our complete, automated proforma package transforms your preliminary invoices from a chore to a powerful instrument. Close crucial deals, improve cash flow, and get paid faster with FreshBooks.

FAQs about proforma invoice

Do you still have questions about proforma invoices and how they differ from formal invoices? Let’s break down some of the most frequently asked questions.

Is a proforma invoice a legal document?

Preliminary invoices are not legal documents. While vital to many business operations, businesses can’t use them to demand payment.

Is a proforma invoice legally binding?

Proforma invoices are not a legally binding method to demand payment from a customer. Their legality sits between a final invoice and an informal, non-legal quote or estimate.

Can a proforma invoice be cancelled?

A proforma invoice can’t technically be canceled, because they don’t need to be. They’re not the same as a commercial invoice, a receipt, or a bill of sale and aren’t binding.

Can a payment be made on a proforma invoice?

A proforma invoice is not a comprehensive record of a transaction like a formal invoice but an estimate. As a buyer, you should wait for a bill of sale and/or a final invoice before making payments. That said, some businesses may make a partial payment in advance as a professional courtesy.

What’s the difference between a proforma invoice and a purchase order?

A purchase order is a receipt confirming the approved transaction’s details. A preliminary invoice should come before a purchase order.

Reviewed by

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

What Is a Tax Invoice?

What Is a Tax Invoice? How to Make an Invoice

How to Make an Invoice How to Invoice a Client: 10 Steps to Get Paid on Time

How to Invoice a Client: 10 Steps to Get Paid on Time What Is the Purpose of an Invoice?

What Is the Purpose of an Invoice? 13 Types of Invoices Every Business Should Know

13 Types of Invoices Every Business Should Know How to Make an Interim Invoice | Progress Billing for Small Businesses

How to Make an Interim Invoice | Progress Billing for Small Businesses