How to Invoice a Company: A Step-By-Step Guide for Businesses

Small businesses that offer credit terms for their products and services need to learn how to invoice their customers, whether the customer is an individual or a company.

These businesses send products or perform services first, letting the customer pay later. Payment is requested via a document called an invoice.

Learning how to send invoices correctly and efficiently will reduce your paperwork and help you get paid faster. This will improve the overall financial management of your small business.

Want to simplify your invoicing process? FreshBooks has easy-to-use online invoicing software that gets you paid 2x faster. Practice creating invoices with a downloadable free invoice template that you can customize with your business logo and details. Click here to try FreshBooks for free.

Table of Contents

- How to Invoice a Company Step-By-Step

- How to Invoice a Company as an Individual

- How to Invoice a Company for Contract Work

- What To Include In An Invoice

- Conclusion

- Frequently Asked Questions

How to Invoice a Company Step-By-Step

1. Select an Invoice Template

Be sure to invoice your client as soon as the work is done.

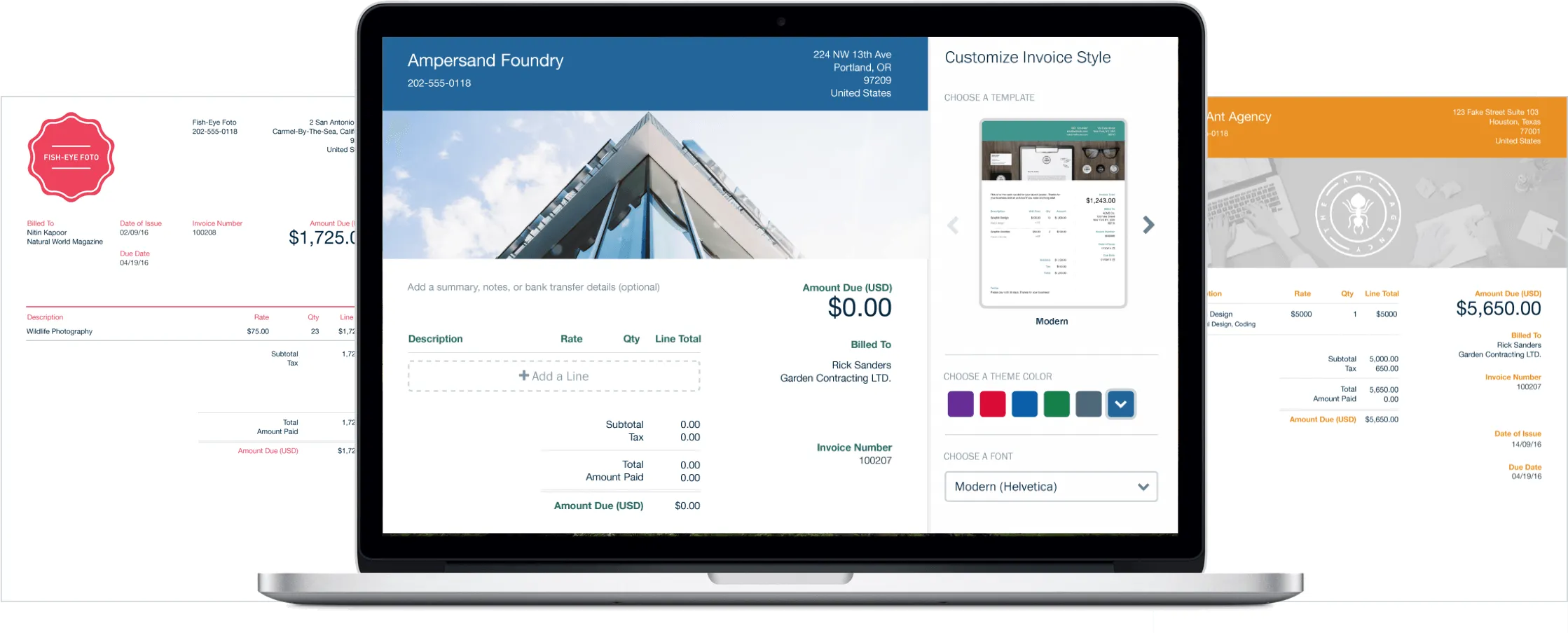

The first step in writing an invoice is to choose the perfect template. There are many free invoice templates available in formats like Word, Excel, Google Docs, and PDF. FreshBooks offers downloadable invoice templates for free, and this guide on how to create an invoice in Google Docs will assist you in creating and customizing your own templates.

2. Add Products or Services

Add a separate line item for each product or service you’re invoicing clients for. Be sure to include a thorough description, the date the product or service was provided, and quantities, if applicable

Your clients want to know exactly what they’re paying for. Don’t lump all the items together. Break out each one to reduce any confusion that might delay receiving your money.

Then add your flat fee or hourly rate per line item. For an hourly rate, also include how many hours you worked per line item and the subtotal. For more details, refer to our guide on how to write an invoice for hours worked.

3. Find the Grand Total

Find the subtotal of all your line items. Then add anything that will affect the total, such as sales tax, discounts, or an outstanding balance. Add everything together to find the grand total.

Never charge extra fees or late fees that you didn’t discuss with the client in advance. At best, your client will be confused. At worst, they won’t trust you if you charge for things they didn’t agree to.

4. Include Important Details

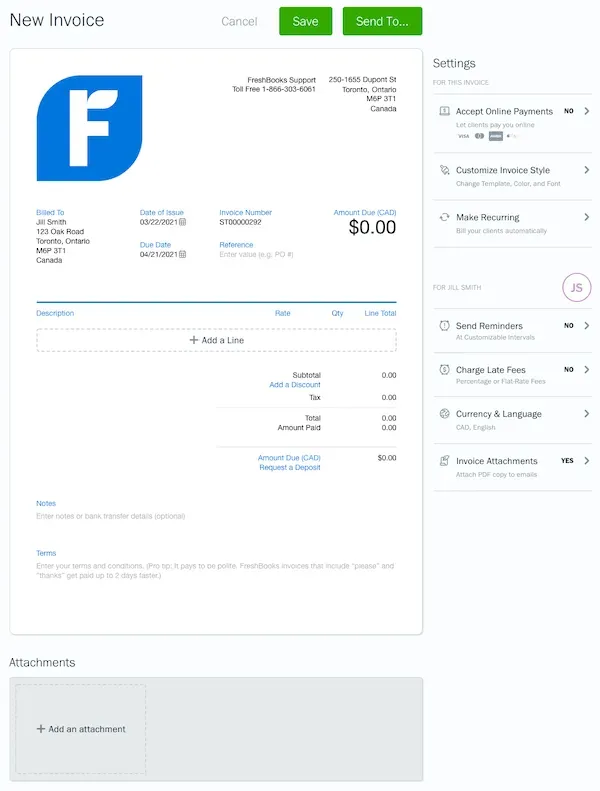

Customize the sample invoice to include your logo, the date, due date, invoice number, reference number (such as a PO#), your contact information, the company’s contact information such as an address, payment terms, and a personal message, if desired.

Personal messages like “please pay your invoice within 15 days” or “thank you for your business” can impress the company you’re billing and improve your relationship.

It’s essential to include clear payment terms, and it’s usually better to write “payment is due in 30 days” rather than “net 30,” as this eliminates potential confusion.

It’s also a good idea to ask the company you’re working with about their preferred payment method. Some companies might prefer one method over another. If your client wants to cut a check, include how to make out said check on your invoice. If they prefer to pay by credit card, include a link to process the payment.

Double-check your invoice for any spelling, grammatical, or formatting errors. Sloppy mistakes make you look unprofessional.

Below is an example of a simple invoice made in FreshBooks:

5. Send the Invoice

You have a few options for sending invoices. You can print your invoice on heavy paper, mail it, fax it, or email it. Accounting software will usually email the invoice to your clients and include payment options.

Don’t forget to include a personal message. Here’s an example of a message you could send with your invoices:

“Hello <insert client name>,

Please find attached an invoice for <insert project name and details>. Thank you for your business. If you have any questions, please don’t hesitate to contact <insert name> at <insert contact details>.

Best,

<insert your name>

If you’re unsure about how to write professional payment request emails to send to clients, follow our post on How to Ask for Payment Professionally in a Message.

Ensure that you’re sending the invoice to the right person. If you signed a contract with one person at a company, it doesn’t mean they’ll be the one handling payment. A different department may pay the invoice, or an outside agency might be contracted to handle payment. Ask your contact first so you don’t waste time.

It’s important to know when to send an invoice to a customer, as they might have different billing cycles. For example, some customers may only send payment on the first of every month. In that case, sending the invoice closer to the payment date is a good idea. Knowing the billing cycle will also help you when you follow up in step six.

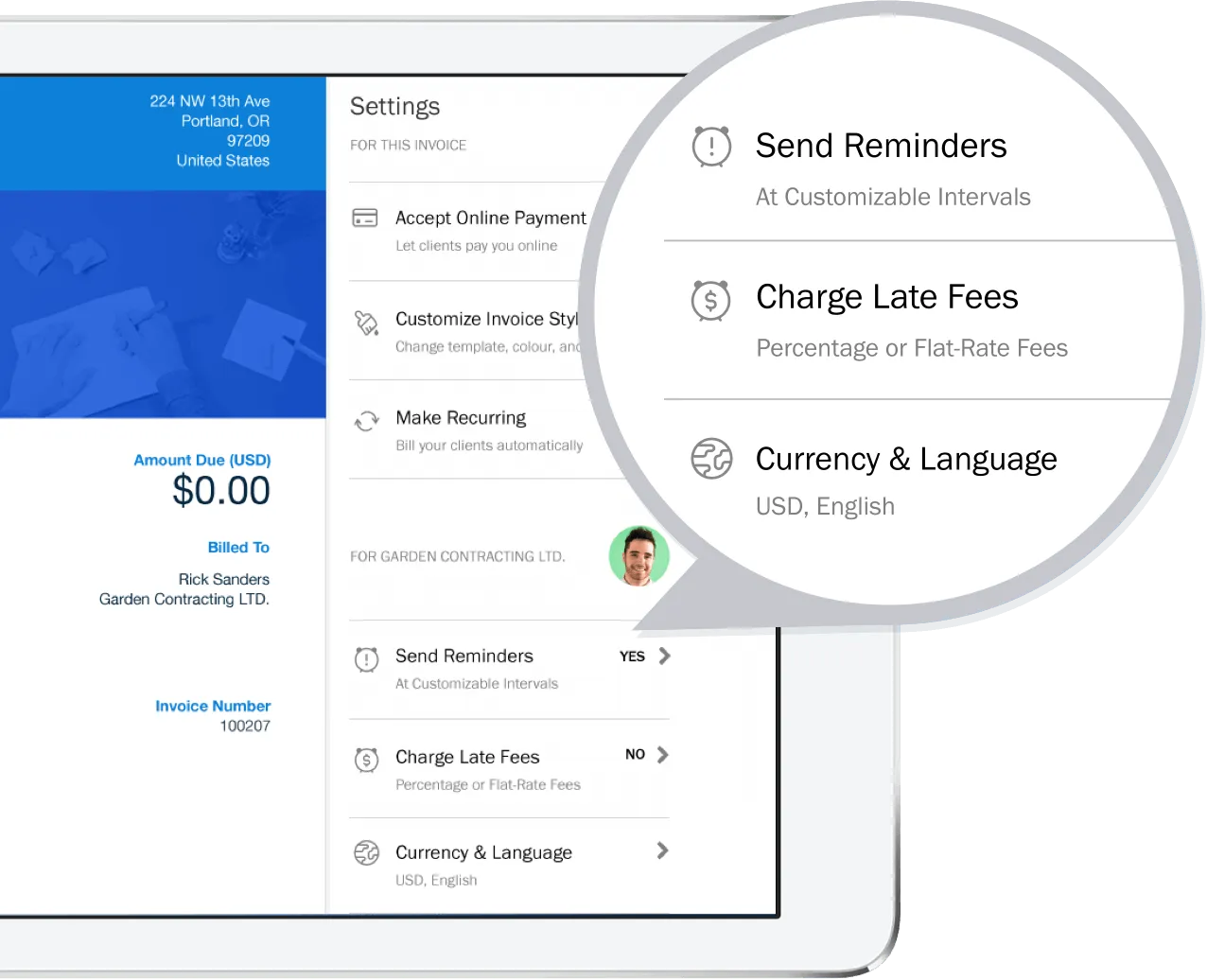

6. Follow Up

Your job doesn’t end after you send the invoice. Companies routinely lose invoices, forget about them, or are reluctant to pay them. You’ll need to follow up. Invoicing software helps you send automated reminders to cut down on the chase.

How to Invoice a Company as an Individual

Here are some tips to appear professional when you’re invoicing a company as an individual:

- Include a professional header. Use your business name or your full name and include all your contact information, so the company knows how to contact you if they have questions. Insert a logo to the left of the header if you have one.

- Use a professional template. Free invoice templates are one option, as they ensure you don’t omit any important details. Invoicing software makes you appear even more professional, as it often includes options for the company to pay online instantly.

- Bill according to the contract. Companies may want you to sign a contract before you start work. Make sure whatever you bill is already established in the agreement, as your contact won’t look favorably on surprises. This will delay receiving your money.

- Know who to invoice. Companies usually have a billing department or an external agency that handles the payment. Know who to send the invoice to.

- Send invoices according to the company’s billing cycle. Many companies send payments on the first of the month. Ask your client when they pay so you know when to send the invoice and when to follow up.

- Follow up. Well-timed reminders to pay your invoice aren’t annoying, and they signal you’re a professional who’s on the ball.

How to Invoice a Company for Contract Work

Follow these steps to invoice a company for contract work:

- Use professional invoice templates. Include an invoice number and a PO number, if there is one. Provide payment terms such as “payment is due within 30 days.”

- Include “bill to” and “ship to” addresses for the client if you did the work at a different location than where you’re billing.

- Customize your line items for the job. You may need columns for a work order number, part number, unit cost, job details, hourly rate, hours worked, and subtotal. If you received a work order, the job details on your invoice must match what’s written on the work order.

- Include anything that might affect the grand total, such as sales tax, deposits, discounts, and per diems or mileage.

- Detail what payment methods you accept and what your late fee policy is.

- Send the invoice and request the company confirm with you when they receive it. Faxes can go missing; emails are overlooked. If you don’t hear anything, follow up.

What To Include In An Invoice

Include the following to create clear and accessible invoices for your clients:

- Business details like your company name, payment address, and contact information so clients can reach you if they have any questions.

- Visual branding elements like logos. These are usually added in the top corner.

- Information about the products and services provided. Include a brief description of your work, the date, product quantities, fees, and taxes.

- Billing details, including the invoice date, invoice number, and reference number (such as a PO#).

- Information on how and when to pay. You may want to include an online payment link or a billing address if it’s different from your company address. Adding a detailed phrase like “Please pay within 30 days” rather than “net 30” can eliminate confusion and help you get paid quickly.

- An optional personal message thanking your clients and customers. Customizing your professional invoices is a great way to build a memorable connection. For guidance on creating your own customized invoice, feel free to follow our step-by-step guide, How to Make an Invoice for Your Business.

Conclusion

Same-day invoicing can create a higher chance of getting paid on time, as can making your invoices as easy to understand as possible. Highlight the total cost and the payment due date, then offer easy options like accept payments online. Back-and-forth questions slow down payment, so include a thorough explanation of services rendered and any fees in your invoice. FreshBooks has an invoice templates gallery that can simplify the invoicing process and help you stay on top of your bookkeeping.

Keep in mind that invoices help you get paid, but they can also be a powerful marketing tool. Stay memorable by including your logo and a personal message at the end.

FAQs on How To Write an Invoice

Can a private person invoice a company?

As a private individual, you can invoice a company using a FreshBooks free downloadable invoice template customized for freelancers. Bill your products or services according to your contract in the same way you would if you were incorporated. Remember to include the name and address you use for filing your business taxes. For a step-by-step process, refer to our guide on how to create an invoice without a company.

Can I invoice someone without a contract?

An invoice isn’t a legal contract, so it’s important to have both a contract and an invoice when conducting your business. Include time terms in your contract so that when it comes time to invoice, you have a legally binding document that explains how and when your client needs to pay.

How long is an invoice valid for?

Encourage your clients to pay on time by invoicing promptly and including an exact payment date in your invoice. A typical timeline is 30 days, although the legal grace period can be as much as six years, depending on your country. Avoid payment delays by outlining your time terms in your contract and invoice, and consider including fees for late payments in the contract to encourage clients to pay promptly.

What is the best way to invoice someone?

Email is the quickest and easiest way to send invoices to most clients and customers. You can practice creating an invoice with FreshBooks downloadable invoice templates and email it to your client or share the link straight from FreshBooks online invoice software. If your client prefers a hard copy, you can always print off your invoicing template and send it in the mail.

Reviewed by

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

How to Make an Invoice in OpenOffice: A Step-By-Step Guide

How to Make an Invoice in OpenOffice: A Step-By-Step Guide What Is A Shipping Invoice? A Bill Of Lading Guide For Small Businesses

What Is A Shipping Invoice? A Bill Of Lading Guide For Small Businesses What Is a Sundry Invoice? Definition & Example

What Is a Sundry Invoice? Definition & Example What Is Invoice Reconciliation?

What Is Invoice Reconciliation? Outstanding Invoice: What They Are & Tips To Handle Them

Outstanding Invoice: What They Are & Tips To Handle Them What Is a Supplier Invoice?

What Is a Supplier Invoice?