How to invoice as a freelancer: Key components and template

To invoice as a freelancer, you’ll need to create a clear document that outlines your services, rates, and payment terms. This can be achieved through software or templates.

As a freelancer, you face the unique challenge of being entirely responsible for securing payments for your business. Unlike traditional employees, you’re in charge of tracking job costs, sending invoices, and managing payments. Effective invoicing is therefore essential for freelancers. It ensures timely payments from clients, maintains consistent cash flow, and fosters strong professional relationships.

In this guide, we’ll cover everything freelancers need to know about invoicing. This includes the key details to include on your invoice, how to send it, and practical tips for saving time on this crucial task.

Key takeaways

- Invoices for freelance work should include contact information, invoice number, line item descriptions, total due, issue date, due date, payment terms, and any additional fine print.

- You can save time on the invoicing process by using a premade freelance invoice template, such as the one from FreshBooks.

- Freelance invoice software makes it easy to deliver invoices to your clients, ensuring you get paid quickly.

- By following invoice best practices, you’ll save time, preserve professional relationships, and get paid sooner.

- FreshBooks invoice software is designed to speed up invoicing for freelancers with automated tools and seamless software integrations.

Table of contents

- How to Write an Invoice for Freelance Work

- Download a Ready-to-Use Freelance Invoice Template from FreshBooks

- How to Send an Invoice as a Freelancer

- 6 Invoicing Tips for Freelancers

- How to Automate Your Freelance Invoices

- Common Invoicing Mistakes to Avoid

- Get Paid Faster with FreshBooks

- FAQs on Freelancer Invoicing

How to write an invoice for freelance work

When you invoice for freelance work, there are several key components to include ensuring clarity and professionalism. A well-structured invoice helps you get paid faster and maintains good client relations. Here’s a breakdown of what to include:

Contact information

Make sure to include your name (or freelance business name, if applicable) and address on the invoice. Include your email and phone number, in case the client needs to contact you. Adding a company logo can also make your invoice look more professional.

Your client’s contact information should also be listed. If you know the name of the person who reviews their invoices, include their name. Including your business name is important as it helps you professionally establish your brand. Your address should be where you conduct your business, whether a home office or commercial space, and it’s part of all professional-looking invoices.

- Your Name (or Business Name)

- Your Address

- Your Phone Number

- Your Email Address

- Client’s Name (or Company Name)

- Client’s Address

- Client’s Contact Person (if available)

An invoice number and invoice date

Whether you use accounting software that generates invoices or you create them manually, you should always track your invoice numbers. As a freelancer, you might have to answer client questions about your work or track down late payments. Having organized records of freelancer invoices will help you answer those questions when they come up. An invoice number will help the client and you know that you are talking about the same transaction.

The invoice date is also crucial. The date the invoice is issued is when the payment timeline starts, so it is so important to include the invoice date. If for some reason you incorrectly numbered your invoices, referring to the issue date can also help distinguish one invoice from another. To organize your invoicing system and keep track of your billing process, you must number each invoice individually. An invoice number is a unique identifier assigned to each invoice, helping to distinguish one invoice from another. By numbering your invoices, you can easily refer back to specific ones in the future if you need to review your billing history or resolve any disputes with your clients.

- Unique Invoice Number (e.g., 001, 002, etc.)

- Invoice Date (Date of Issuance)

The issue date and due date

Remember to include your due date for payment. This is the number of days payment is due after the issue date. This will depend on the payment terms you have established with your client in your contract or agreement, but common terms are: due on receipt, net 15, net 30, or net 60. A due date helps establish clear payment terms and expectations with the client, preventing misunderstandings about when payment is due. It helps ensure you receive payment on time, as the client is more likely to pay quicker if they know when the payment is due. Including a due date before sending invoices allows you to follow up freely on the client if they are already on the verge of late payment – reminding them of their obligation to pay.

- Payment Due Date (e.g., Due on Receipt, Net 15, Net 30)

Line item description and total amount due

The most important information on the invoice is the breakdown of the goods and freelance services provided. List each item separately with a description of the services rendered or the goods you provided, the quantity of that product that was provided, the rate of that product or service, and a clear total amount due.

Be specific: “Due in 30 days” can create confusion. Instead, write, “Payment due by [exact date].”

At the bottom of the services section, include a subtotal, any applicable taxes or fees, and the final total in bold. This shows the client exactly what they’re expected to pay.

- Description of Service or Product

- Quantity

- Rate

- Total Amount Due

- Subtotal

- Taxes (if applicable)

- Total

Payment methods and payment terms

Make it as easy as possible for your clients to pay you. Include options for how clients can get payments to you, along with any necessary payment terms or related information. If you accept checks, make sure to clearly indicate an address they can send that check to. Also, include any email associated with your business’s PayPal account or bank information for bank transfers. You could also use payment software that allows you to accept other payment methods like credit cards, but there’s often a fee associated with such payments.

Tell your client how they can pay you and any specific requirements. Do you accept bank transfers, PayPal, or credit card payments? Include account details or payment links to simplify the payment process. If you charge late fees, mention them here to avoid surprises.

Specifying the payment terms in your invoices is essential for freelancers to set clear expectations with clients and ensure timely and organized payment. This includes the due date, or the expected payment date, which can be chosen based on what works best for you and your business.

- Accepted Payment Methods (e.g., Check, PayPal, Credit Card)

- Payment Details (e.g., PayPal email, bank account info)

- Payment Terms (e.g., Net 30, due on receipt)

- Late Fee Policy (if applicable)

Additional fine print/notes section

Include other fees, applicable discounts, or fine print points that need clarification at the bottom of your invoice. This could be related to fees for late payments or discounts offered for early payments.

Including a notes section in your invoices as a freelancer can be beneficial in providing extra information or clarification to your clients. This section can be used to communicate any important details or special requests related to the completed work.

If needed, include notes such as a brief thank-you message or reminders about ongoing work. For example, “Thank you for your business! I’m looking forward to collaborating on the next project.”

- Late Payment Fees

- Early Payment Discounts

- Other Clarifications

- Thank You Note

Download a ready-to-use freelance invoice template from FreshBooks

One of the best ways to save time and ensure professional, consistent invoices is by using a ready-made template. The freelance invoice template from FreshBooks is a great tool for busy entrepreneurs, with all the essential fields already there in a professional invoice format.

Simply enter your contact information, your client’s information, invoice number, payment terms, payment options, and due dates, save the modified free invoice template and send it to your clients. Our invoice templates are also highly customizable, letting you add your logo and other branding elements with just a few clicks.

This freelance invoice template is a great way to spend less time on invoicing, helping to ensure prompt payment.

How to send an invoice as a freelancer

The most common way to send an invoice is by email as a PDF attachment. This is a simple and convenient option for both you and your client. However, if you need to send a more formal invoice, you can consider sending a hard copy via certified mail. Regardless of the method you choose, it’s important to keep a copy of the invoice for your records. This will help you track your payments and resolve any disputes that may arise.

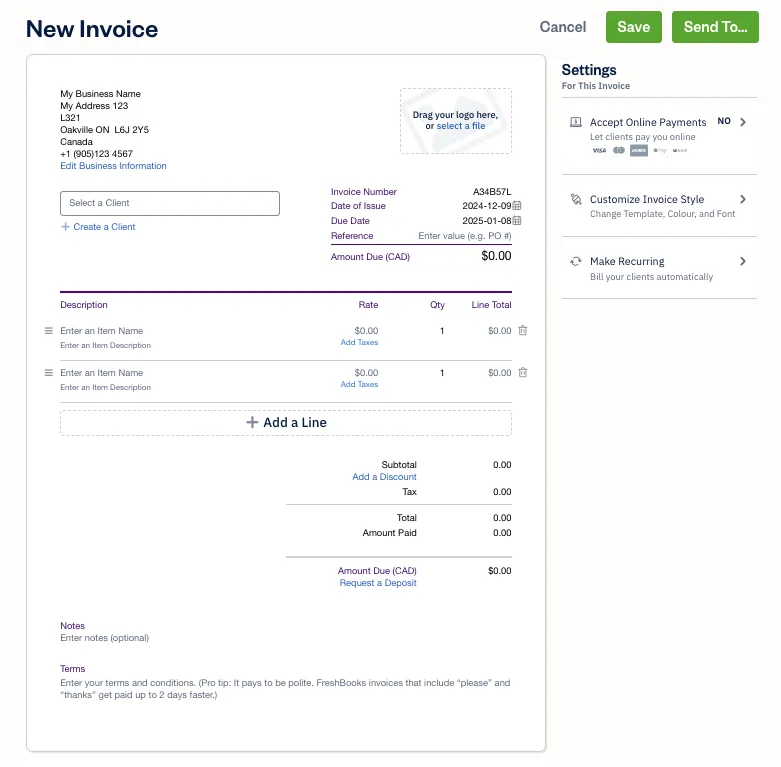

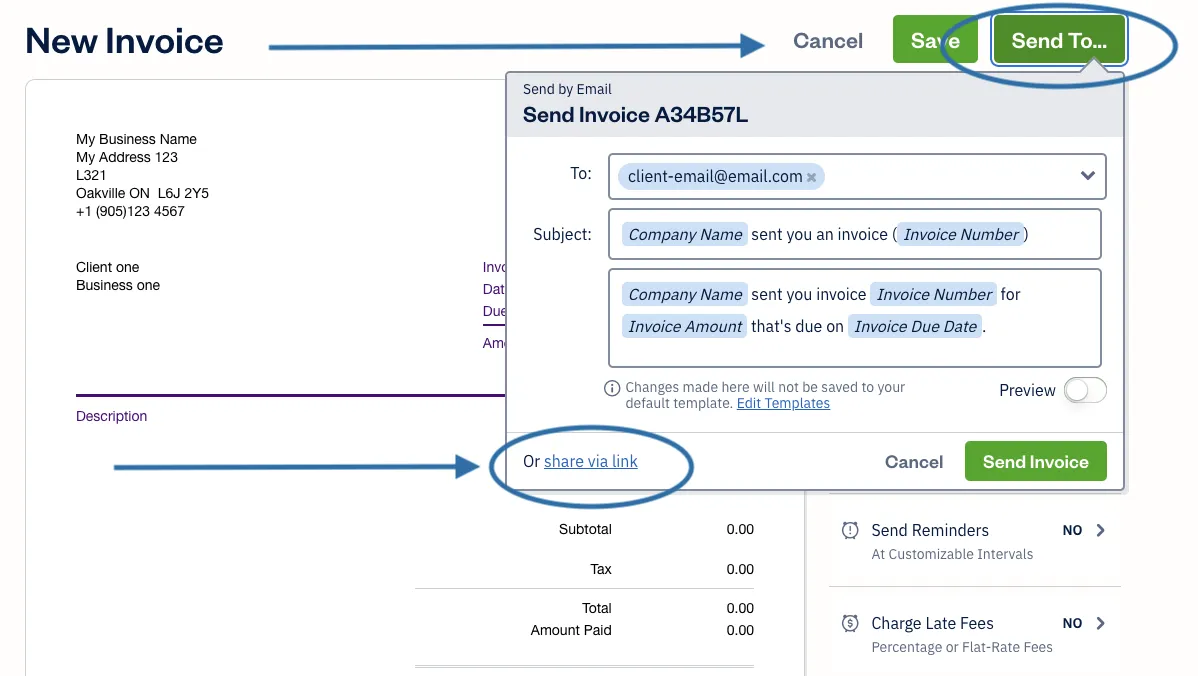

For the easiest and most organized way to send invoices, consider using accounting software. Accounting software like FreshBooks has built-in invoicing features that allow you to create, send, and track invoices electronically.

With FreshBooks invoicing software, you can simply generate the invoice, add all the necessary details, and hit the ‘Send To…’ button to either send it directly via email from within the platform or get a link that you can copy and send via other methods. This streamlined process saves you time and hassle while ensuring your clients receive invoices promptly and can begin the payment process quickly, ultimately helping you get paid faster.

The best practice before sending invoices is to export them to a PDF file. After your PDF file is ready, send it out via email and adjust the subject line to the invoice number and your company name, so the client can find it easier, and the chance of getting paid quickly increases.

6 Invoicing tips for freelancers

As a freelancer, your independence from the corporate world comes with the added responsibility of handling your own finances to make sure you are getting paid for the work you are doing. Sending invoices to your clients is a vital part of your freelance business, so here are some tips for sending a freelancer invoice to ensure you get paid:

Review your contract

Before you start work with a client you should have outlined the details of the work you were planning on doing for the client and the amount of money the client is expected to pay you for that work. This should have been outlined on a freelancer agreement, contract or work offer. One of the most common reasons that freelancers are not paid is that the request for payment did not quite match the original contract terms.

Carefully review the terms on your freelance contract and decide whether:

- You met the required deadline

- Discussed payment methods

- Discussed payment timelines

Make sure you keep track of your initial contract so that you can be sure to follow all agreed-upon terms when you are creating the invoice.

Describe your work

Your client could be dealing with multiple freelancers, so make sure you are clear in your description of the work you are providing to your client. In your invoice, provide a detailed description of the assignment and include identifiable information like your company name, the assigned date, the due date, and contact details. This will help ensure that you receive payment sooner because it will eliminate client clarification.

For tips on getting invoices paid quicker, follow our guide on How to Get Invoices Paid Faster.

Name your price

When you accept work from a client, it is important to be clear about your pricing and payment options in your freelance contract or work offer. It is also important to be transparent about potential fees for things like edits or late payments. If the initial conversation about the work request was done informally in a conversation or over text message, send a follow-up documenting the agreement and specifying your pricing.

In your invoice, make sure to clearly outline the work you have completed in itemized lines rather than grouping your work altogether as “work completed.” If your client has to get approval for your work from someone at their company, this clarity will help that happen faster.

Include taxes and fees

Some freelance contracts are more complicated and might require out-of-pocket expenses or fees on behalf of the freelancer. If you incurred additional costs, be sure to include those items on your invoice. If you charge a fee for late payments, include that information on your invoice too. Make sure to include and separately list any applicable taxes, and that you understand tax rules for freelancers.

Follow up

When you’re a freelancer, it is so important to keep the lines of communication open with your clients. After you have sent your payment request with your invoice, make sure that you make it easy for a client to contact you about any questions regarding the invoice or your payment. Deliver your invoice with a friendly email note or cover letter that includes a thank you in the body of it. This extra touch will go a long way! Open communication is also helpful when it comes to any additional follow-ups about overdue payments.

As your due date approaches, send friendly reminders and ask them if they have any questions or concerns about making the payment. In some cases, your invoice might have slipped through the cracks, so this friendly nudge is a good reminder for your client, too. To reduce late payments, include reminders or automated follow-ups a few days before the due date.

Use invoicing software

Using invoicing software can make the client billing process much easier for you. This will save you time and help you stay organized with your invoices. FreshBooks invoicing software is one great option. It enhances the entire invoicing process with several features, including automatic invoice numbering, automated payment reminders for your clients, charging late fees, and integrating seamlessly with other FreshBooks software products.

This means that your invoices can be automatically accounted for in your accounting software, and you can even accept online payments from clients using FreshBooks payments powered by Stripe. Overall, this invoicing software is designed to make life easier and more efficient for busy freelancers, helping them have more time to run their business instead of working on the administrative side.

How to automate your freelance invoices

We know that some people prefer to avoid preparing an invoice, due to the time it takes and the repetitive invoicing process. This is even more painful if you have a lot of clients that have to pay you. But wait, we have a solution that saves you hours of work by sending invoices in batches, and the best part is that client information generates itself dynamically.

Using software like Portant, you can easily automate your whole invoicing process from the free-to-use template, exporting it as a PDF, up to sending it to your client, all in a few minutes.

Here are the steps to automate your invoicing process:

- Start creating the invoicing workflow by clicking on “Add Workflow ”:

(Image of Add Workflow Button) - Select the document source where you will get your customer’s data to add to your freelance invoice template(it’s recommended that you retrieve this data from a Google Sheets document):

(Image of Google Sheets Selection) - Now, click the plus icon and choose the freelance invoice template Google Doc you already customized:

(Image of Plus Icon) - Now you are set to send your invoice using either Gmail or Outlook to connect to Portant’s platform.

Scroll to the right side of the options in the workflow screen, and under “Share document via Gmail,” click on the “Add” button

(Image of Share via Gmail) - Now, the integration mail pop-up will appear, where you can pick your preferred email account:

(Image of Integration Mail Pop-up) - After you approve the integration, you can customize your email invoice template to suit your needs.

Portant’s intuitive features let you add tags to your email template, so you can also add actual invoice data to the text of the email:

(Image of Portant’s features) - After you are satisfied with the content of your invoice email template, you can choose the desired file format to send the invoice in(PDF, via a shareable link, or attached as a Word Doc):

(Image of file format options)- Afterwards, click the “Save” button to save your email template.

Now, off we go to launch the automation. - Click on “Automate”, and then “Start”:

(Image of Automate and Start buttons) - If you want to select a specific range of your customer data to run into your automation, then in the dropdown menu, choose “custom range”:

(Image of custom range option) - To run the automation workflow automatically each time new data is added to the source document, toggle on the “Auto-Create” button at the top right side of the screen:

(Image of Auto-Create button) - The last thing you have to do is click on the “Start” button, and your freelance invoice template is now ready to be sent to your customers.

- Afterwards, click the “Save” button to save your email template.

Common invoicing mistakes to avoid

As you work on your invoice, watch out for these common mistakes and typos that can impact how quickly you get paid:

- Not clearly identifying project work and rates

Be clear about what work you’ve done, how much it cost, and what project it’s associated with. Your main contact at a client company may not be the person who actually pays the invoice, so it’s important to provide as much context as possible. - Forgetting to update the invoice number

If you use an invoice template, make sure you always update the invoice so it matches the correct client and number. - Recording the wrong total

Double check your math before sending your invoice—and if you find that you did make a mistake, work with the client to rectify it quickly by issuing a new invoice or a partial refund. - Changing or adding fees

Stick to the fees and charges that you outlined in your initial contract with the client. - Omitting payment information

Be sure to include all payment options available to your client—and make sure that you offer options that work for your client. While a very small business may be happy to pay via Venmo, large corporations will typically require bank transfers or check payments. - Forgetting to send invoices

If you want to get paid, you have to send your invoices on time!

Using invoicing software like FreshBooks can help you reduce these errors by:- Automatically assigning the next invoice number in a series

- Adding up hourly and project totals

- Keeping your payment terms and details consistent across all invoices

- Enabling automation of payment reminder emails and recurring invoices

Get paid faster with FreshBooks

Invoicing should be the easiest part of your job—after all, the work is already complete, and all that’s left is to send your bill and get paid. But for many, the invoice payment process becomes a tedious, time-consuming task that eats up hours of time each week, leading to late invoices, late payment fees, and financial uncertainty for busy freelancers.

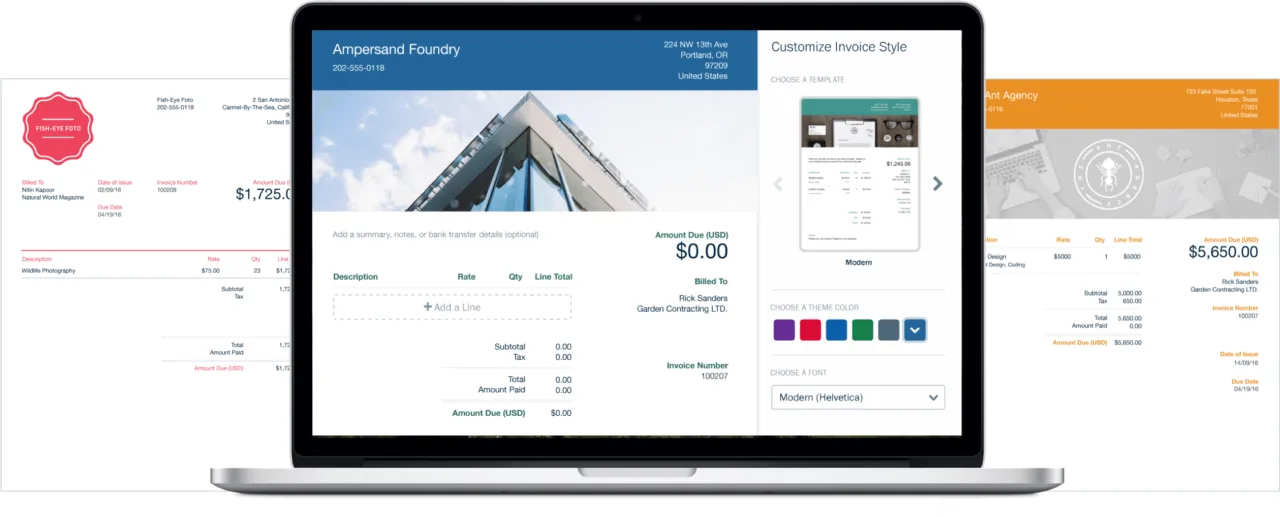

Fortunately, there’s a way to simplify professional invoices and make this task as easy as it’s supposed to be. FreshBooks streamlines the entire freelancer invoicing process from start to finish. It includes countless features, like recurring invoice capabilities, multiple payment options, the ability to send multiple invoices, easy payment tracking, and customizable, professional-looking invoices. It’s an all-in-one package designed to simplify invoicing for busy freelancers like you.

Plus, you can ensure timely payments using FreshBooks Payments powered by Stripe making it easier to manage your finances, ensure steady cash flow, and free more time for growing your freelance business.

FAQs on freelancer invoicing

Can a private person write an invoice?

Yes, you can create an invoice as a private person, even for non-professional services or products you sell to someone else. It could be selling a car or some old things in your garage.

Is it better to create an invoice in Word or Excel?

While creating an invoice in Word is more straightforward for someone that is not used to Excel, it needs the formulas that will automate your calculation, so Excel is the way to go.

Reviewed by

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

How to Make a Sales Invoice and Get Paid Faster for Your Goods Sold

How to Make a Sales Invoice and Get Paid Faster for Your Goods Sold How to Make a PDF Invoice? Steps Explained

How to Make a PDF Invoice? Steps Explained How to Invoice as a Freelance Designer: A Step-By-Step Guide

How to Invoice as a Freelance Designer: A Step-By-Step Guide How to Make a Service Invoice and Get Paid for Your Work

How to Make a Service Invoice and Get Paid for Your Work Late Payment Fee: How to Charge Late Fees on an Invoice

Late Payment Fee: How to Charge Late Fees on an Invoice Is an Invoice a Contract? How To Create a Legally Binding Contract

Is an Invoice a Contract? How To Create a Legally Binding Contract