How to Invoice as a Contractor: Everything You Need to Know

It’s a universal business truth that while everyone wants to get paid, no one wants to write the invoice.

Sending invoices – oh yes, you’re all over that.

Actually sitting down and typing in all the details – no thank you.

It’s one of the main reasons you love FreshBooks, isn’t it? The beautiful, time-saving invoice templates and automated invoice reminders.

But it’s incredibly important for every small business to understand how to invoice someone using a proper format.

When you invoice as a contractor, you’re working in your business, not doing the work. But sending invoices for services rendered is a key part of financial accounting for any contracting business.

You’re probably juggling several projects with different billing terms, timelines and invoice details. The key is to set up a process that tracks everything from the start of the job.

Some independent contractors even start new invoices at the beginning of a project, if they know it’s made up of several smaller billable tasks. That way nothing’s forgotten at the end and the invoice is good-to-go as soon as the job’s finished.

Learn how to invoices as a contractor and discover common invoicing mistakes to avoid:

- How to Bill as a Contractor

- How to Write an Invoice for Contract Work

- 7 Tips to Avoid Common Contractor Invoicing Mistakes

- Don’t Reinvent The Wheel

How to Bill as a Contractor

In many ways it would be much simpler if the IRS just issued a contractor invoice template and said, “Here you go, everyone must use this.” Then you’d be 100% certain that you’re doing it right.

But they don’t. Because there is no one-size-fits-all way to invoice as a contractor.

Independent contractors work in a variety of industries, doing all different kinds of work. So there needs to be a degree of flexibility in how you charge, how you get paid and the timing of those payments.

For example, in some sectors it’s the norm to receive half your total fee at the start of the project and half on delivery. In other jobs, you might set milestones along an agreed timeline. And your bill needs to be flexible enough to account for these differences.

Our billing statement template helps by summarizing transactions over a specific period, making it easier to track payments and outstanding balances.

And as a thoughtful contractor, you always consider things from your clients’ perspective. Most people are used to being able to choose their preferred way to pay for things. Some independent contractors increase their number of payment options to accommodate this.

There are some invoice essentials that must be included, we’ve listed these below, so you don’t miss out on anything crucial. There’s a gallery of FreshBooks’ free contractor invoice templates for you to choose from. And they all definitely include everything in this list.

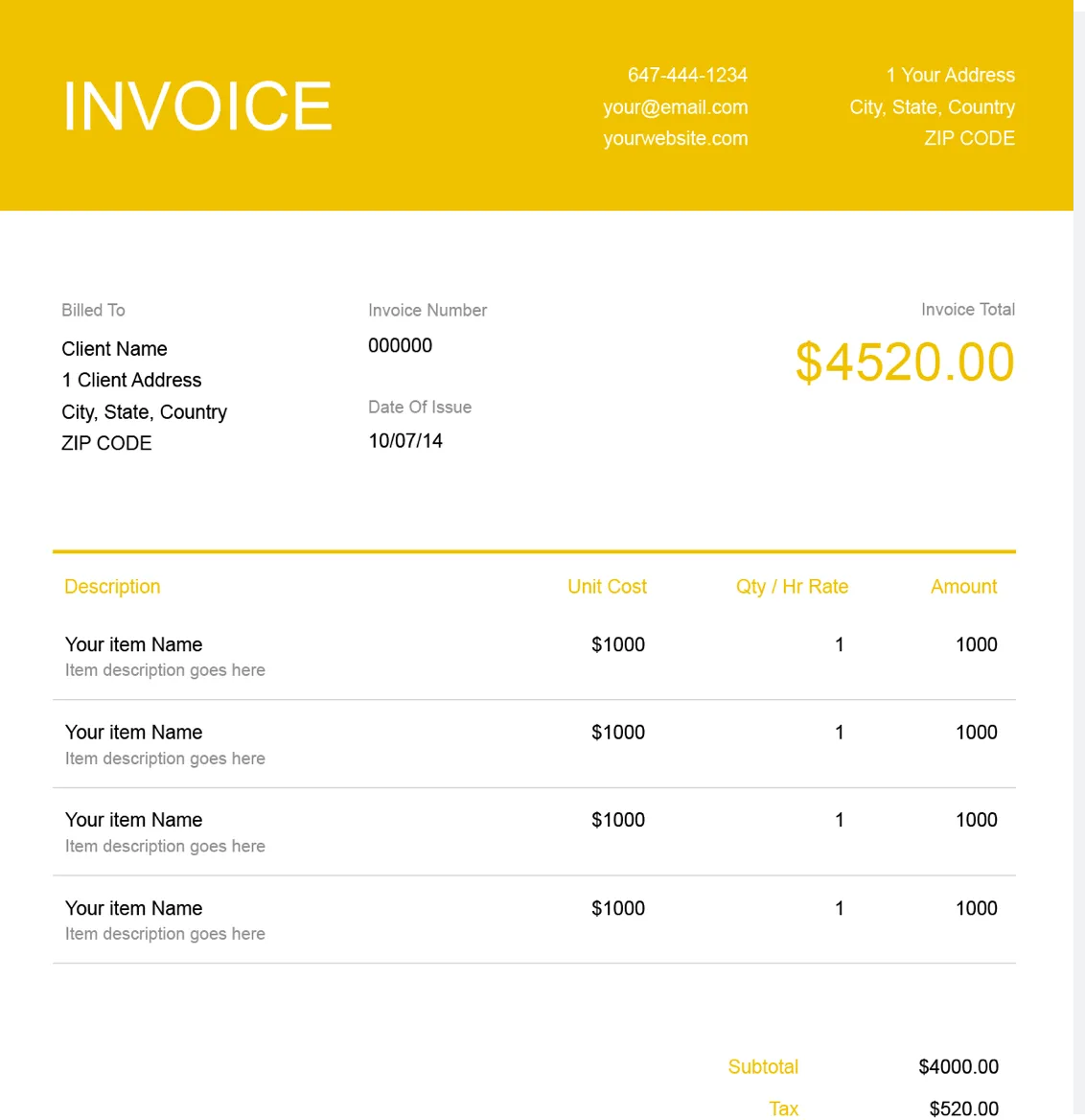

How to Write an Invoice for Contract Work

Be certain that you’re sending a professional invoice to your clients by including these details.

1. Identify the Document as an Invoice

Make sure the actual word ‘invoice’ is clearly at the top of your document. It must be completely obvious, maybe use a large bold font. You don’t want anyone to be in any doubt that they are receiving your invoice.

2. Assign an Invoice Number

When you issue an invoice, it is important to assign a unique invoice number. This number is a crucial record-keeping detail for both you and your clients. The simplest way is to assign sequential numbers to each invoice, starting with Invoice 001, Invoice 002, and so on. To streamline this process, you can use an Excel invoice number generator formula, which automates the assignment of these unique numbers. By setting up a formula in Excel, each new invoice you create will automatically be assigned the next number in the sequence. This not only saves time but also ensures that each invoice number is unique. If you ever need to discuss a specific invoice, having unique invoice numbers makes it much easier for both the contractor and their client to identify and refer to the correct document.

3. Invoice Date

You must date every invoice. Usually at the top, beside the invoice number. This is really important when it comes to enforcing payment deadlines and penalties.

4. Your Business Details

You must provide details such as: business name, address, phone number, email address. Putting your company logo onto your invoice adds a professional touch. Branding consistency builds trust!

5. Client Details

You need your client’s contact details on your contractor invoice. The same business information as your contact info, plus the name and department of your billing contact. You might be sending your invoice to a different billing department that’s completely separate from your daily business contact. Getting your invoice to the right place as quickly as possible means that you get paid in a timely manner.

6. Details of Your Services

The more details you provide on your independent contractor invoice, the less chance there is of rejection. It’s where you itemize all the individual services provided. The minimum here is:

- Brief description of what you did

- Quantity of products provided or number of hours worked

- Pay rate (Add applicable tax)

- Subtotal for each service

This is most easily understood in a table format, with one column for each piece of information. Each task or service is recorded in each row.

7. Amount Due

The final row of your table is the combined total of all the subtotals, which forms the amount owing on the invoice. Many invoice formats record this figure at the top of the document as well. It’s often the only thing clients want to know, so it’s helpful to make this visible at-a-glance.

8. Payment Terms

You need to tell clients how you want to be paid, so you should list each payment method you accept. Include all your payment information, such as bank account details for transfers, PayPal, Google Pay, and credit/debit card information. If you have a payment link, include that as well. Follow our guide on how to list payment options on an invoice to make the payment process as easy as possible for your clients.

You’ll have already discussed your payment terms at the briefing stage, but including your late payment policy terms on your invoice is a good idea. It incentivises paying on time and is a reminder that there’s consequences for delayed payment. This is why most independent contractors have the invoice date and payment due date on all their invoices.

9. State the Payment Deadline

Write the deadline for payment in a bold, easy-to-read font. Be as specific as you can be with the payment due date. Write out the full date, as in: “Payment Due February 30, 2025” rather than more vague payment terms, such as “Payment Due in 30 Days,” which can lead to confusion and delayed payments.

Each payment method will have its own processing time. So remember to be thorough in your payment options section so that it doesn’t affect the deadline.

7 Tips to Avoid Common Contractor Invoicing Mistakes

Manage invoices with confidence and get paid faster with these top invoicing tips. They’re based on common invoicing mistakes and a bit of FreshBooks added wisdom!

1. Don’t Forget to Track Your Hours

Right from the start of your very first job, you need to have a way to track how many hours you work for each client. Yes, notes in a diary counts. Or you might use invoicing software that has a time tracker function. However you do it, you must have an accurate record. Otherwise you can’t create accurate invoices. It’s important to document when you start, when you finish, and the tasks you perform. For detailed instructions on documenting your work duration and tasks, read our post How to Create an Invoice for Hours Worked.

2. Get That Invoice Sent Straightaway

If you get your invoice out to clients as soon as you finish the job you can both stay more organized. It signals to your clients that being paid on time is important to you, because you’ve sent the invoice straightaway.

As the work’s just been completed, it’s top of mind for the client, which pushes processing your invoice up the list. And it means you get paid on time, maintaining your business’s cash flow.

3. Consistent Invoice Format

Creating a standard invoice format saves you time and helps you look professional.

Start by downloading a free FreshBooks sole trader invoice template, customize it to suit your needs and use it every time. You might tweak it for each one, maybe delete an unnecessary row in your table, but the main elements all stay the same.

This also means that everything should be absolutely clear to your clients. You don’t want any questions about where to find information on your invoice. As a contractor, you want the invoice to reflect a professional image. Our guide on creating an invoice without a company will help you cover all the important aspects ensuring a seamless invoicing process.

4. Share Your Payment Terms

Talking terms and conditions is part of your onboarding process. And it doesn’t hurt to reinforce the payment terms on your invoice. They’ve already agreed to them at the start of the work by signing your contract – this is just a little reminder.

5. Chase Late Invoices

Don’t wait a month before you start chasing an overdue bill. As soon as the payment deadline has gone, send a first nudge note. Just a polite reminder of the overdue amounts and how they can pay. People do just genuinely forget. Then be diligent but pleasant in all subsequent regular follow-ups until you receive payment. The key is to act immediately. The longer you leave first contact, the more awkward it gets and the harder it is to get your invoice settled.

6. Keeping Things Straight for Tax Time

Contractor invoicing isn’t just about banking the dollars. It’s also about satisfying your tax obligations.

Your invoices form a large part of your financial records and they need to be accurate. They’re your evidence for your self-employment income tax declaration. Continuously monitoring your income, business expenses and tax deductions is how you meet your liability for healthcare, social security and income taxes. Professional invoices are one way you do this in your business.

Getting organized means you’re ahead of the game when it comes to tax time.

For example, if you accept online or third party payments the financial institution reports this income to the IRS using 1099-K forms. You get a copy of these 1099-K forms and reconcile the amounts with your own, impeccable records.

For the first time, lots of sole proprietors, independent contractors and freelancers started receiving 1099-Ks in January 2023. The rules apply to any total revenue that’s over $600. Before 2023, it only applied to businesses that made over $20,000 in sales and more than 200 transactions.

Now small businesses will need to become familiar with the 1099-K form. But you can plan this into your process. Build a way to track payment methods into your system. Then when you’re reconciling your 1099-Ks it’ll be much easier.

Your clients need detailed invoices for their records. They’ll file 1099-NECs for every client that’s paid a total of $600. If payment is made through a third-party network, they’ll also get a copy of the 1099-K filed by the payment provider. You might get two 1099s for the same amount. Identifying these small business or sole proprietor clients as part of your admin process, and understanding how to invoice as a sole trader, will make your life much easier when it comes time to reconcile the records.

7. Personalized Invoices

This won’t be for everyone. But personalizing your invoices may fit perfectly with your brand. As long as it doesn’t detract from the clarity of the information. For example, a note saying ‘This was my favorite bit’ beside the job’s description in your table. Perhaps sign off with something that reflects your last conversation with the client, or something you’ve seen on their social media, instead of just a thank-you. Just a sentence, like:

- Good luck at the convention!

- Congratulations on the new baby!

- Have a great time in Fiji!

Just a little human touch.

Personalized invoices make your business look more professional and authentic. If you want to gain a deeper understanding of How to Create a Personalized Invoice, follow our guide. It will provide you with a step-by-step process, along with fundamental design theory.

Don’t Reinvent The Wheel

No need to start from scratch with your contractor invoices. Save time with a free FreshBooks contractor invoice template. We’ve made them especially for you, so each independent contractor can easily adjust the blank invoice template to suit their business. Each new invoice will have everything you need on it, you just add the details and enjoy your timely payment.

We want every small business owner to really feel like they know how to invoice as a consultant or contractor. Every independent contractor has various tasks to do outside of their actual work. A simple invoice template is a great time and stress saver.

Bonus Tip

Templates are available to download in Word, Excel and PDF format. Whatever your software preference, you can edit your invoices the way that you want to. Most users prefer a Microsoft Word format, for easier editing. You can always save your initial template as a Word Doc in case you want to edit your invoices or add more details in later. But when you send invoices off to your clients, it’s best to send it as a PDF so that they can’t do any edits on their end.

More Useful Resources

RELATED ARTICLES

How to Make an Invoice Without a Company

How to Make an Invoice Without a Company How to Invoice a Company: A Step-By-Step Guide for Businesses

How to Invoice a Company: A Step-By-Step Guide for Businesses How to Make an Invoice in OpenOffice: A Step-By-Step Guide

How to Make an Invoice in OpenOffice: A Step-By-Step Guide What Is A Shipping Invoice? A Bill Of Lading Guide For Small Businesses

What Is A Shipping Invoice? A Bill Of Lading Guide For Small Businesses What Is a Sundry Invoice? Definition & Example

What Is a Sundry Invoice? Definition & Example What Is Invoice Reconciliation?

What Is Invoice Reconciliation?