How to Invoice as a Consultant: Tips for Consulting Businesses

Tracking billable hours and invoicing clients for your time is a key part of running a consulting business. Consultants should carefully record the time they spend working on each project and invoice their clients regularly to get paid for their work.

These topics will teach you how to invoice as a consultant and get paid faster for your services:

- How to Invoice as a Consultant

- Invoicing Tips for Consulting Services

- Free Consultant Invoice Template

How to Invoice as a Consultant

Consultants need to create professional invoices that clearly list their services, their hours worked and the amount owed for the invoice. Here’s a simple guide that shows you how to invoice clients as a consultant:

1. Track Your Hours

It’s common in the consulting industry for businesses to charge clients by the hour. If that’s the arrangement you have with some or all of your clients, it’s important that you develop a system to track your hours. Make sure the system works for you and is something you can stick with for the long term. It’s important that you capture every billable hour in your records, so that you don’t miss any potential revenue. Tracking your hours is the first step in invoicing as a consultant, so you can bill clients hourly. If you need assistance with setting and invoicing your hourly rate, check out our post on how to create an invoice for hours worked.

2. Include A Header

When writing your first consultant invoice, you’ll want to create a standard header that appears on every bill. Include the following in the header of your invoice template:

- Your company’s logo

- Your business contact information, including your name, address, phone number and email

- Include the word “Invoice” in your header so clients can see at a glance what the document is

3. Add Your Client’s Contact Details

Below the header, you’ll need a space on your invoices to fill in the client’s contact information. Make sure you list the correct point of contact on every bill you create. If your clients are larger companies, it’s likely your contact for invoicing will be someone in the billing department, rather than your day-to-day business contact. Taking the time to confirm the correct billing contact can help you get paid faster for your services.

4. Include The Invoice Date

List the date that you’re preparing the invoice below the client’s contact details. This will help both you and the client file the invoice for bookkeeping purposes.

5. Number Your Invoices

Assign a unique number to every invoice you create. Numbering your invoices makes it easy for you and your clients to refer to a specific invoice if questions ever arise. A consistent numbering system also helps you file your invoices and keep your records organized. The easiest method of numbering invoices is to do so sequentially. So, your first number can be Invoice #001, your second invoice can be Invoice #002 and so on. You can also create a numbering system that incorporates the invoicing date, if you prefer. Include the invoice number in the top portion of the invoice.

6. Clearly List Your Services

Create an itemized list of all the services you’ve provided, including:

- A brief description of each service

- The number of hours worked

- The hourly rate of pay

- A subtotal of the charges for each service

It can help to organize this information into a table, with a separate column for each piece of information.

7. State Your Payment Terms

Include your payment terms on every invoice you send. It’s also a good idea to discuss your payment terms with each client before signing a contract, so there are no surprises when you send your first bill. Your payment terms should list the payment methods you accept, which can include any of the following:

- Checks

- Cash

- Credit card

- Bank transfer

- Online payments

- Mobile payments

- Recurring payments

The payment terms section of your invoice should also lay out your late payment policy. If you intend to charge late fees for overdue payments, list the details of your late fees here.

8. List the Payment Due Date

Include the payment due date on your invoice. Make sure this portion of your invoice is highly visible, so clients can’t miss it. You can make it pop by using bold fonts or a different font color. Include the specific payment due date rather than more vague deadlines like “Payment Due in 30 Days.” Giving the actual due date can help avoid confusion and get you paid faster.

Include the total amount due on the invoice, with any applicable taxes. Much like with the payment due date, make the total due section stick out on the page, with larger, bolder or more colorful fonts.

Invoicing Tips for Consulting Services

Consultants have specific accounting needs that affect how they invoice clients. These actionable tips will help you improve your invoicing process and get paid faster for your consulting work:

1. Track Your Hours Automatically

Save time on administrative tasks wherever you can, so you can focus on more important work. One way to do this is to track your hours automatically, rather than having to watch the clock yourself and keep notes about your work tasks. You can install browser extensions that track your time for you. Or, if you use a cloud-based accounting solution, you can log your hours directly in your accounting software, to streamline your time tracking.

2. Invoice for Projects Immediately

To ensure you get paid as quickly as possible for your work, send client invoices as soon as you complete a project. Invoicing immediately doesn’t just help you get paid faster; when you send the invoice right after you finish the job, the work will be top of mind and you’ll be less likely to forget a project task and leave it off your invoice.

3. Request Deposits

For long-term projects that you anticipate will take months to complete, it’s a good idea to ask for a deposit up front, before you begin working on the job. Asking for 25 to 50 percent up front will help maintain a steady cash flow for your business. It’s also less risky, because you’re guaranteed at least partial payment for your services before you begin working on the project.

4. Be Polite

It might seem trivial, but being polite in your communications about invoices can help you get paid for your services. Including a brief thank-you note at the bottom of your invoice and always being cordial in the accompanying emails you send can increase the percentage of invoices that get paid by five percent, according to a FreshBooks study.

5. Accept Multiple Payment Methods

The more payment methods you accept as a consultant, the more convenient it is for clients to pay you. And when it’s easier for clients to send payment, they tend to pay their bills faster. It’s always a good idea to accept the most popular payment methods, such as checks, but you may want to accept online payments as well. You can even enable recurring payments for your clients so their invoices are paid automatically according to a set schedule. To set up automatic payments for your small business, you can refer to our guide Automatic Payment Service for Small Businesses and integrate it with your cloud-based accounting software.

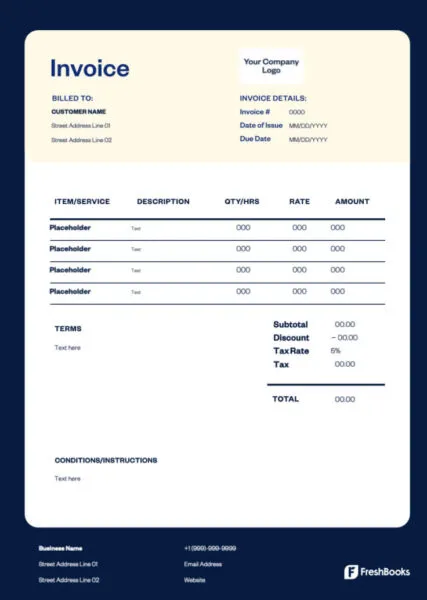

Free Consultant Invoice Template

FreshBooks offers a range of templates, including a free consultant invoice template. Download it in Word, Excel or PDF format to create professional invoices to send to your clients.

RELATED ARTICLES

How to Process an Invoice: A Guide for Small Business Owners

How to Process an Invoice: A Guide for Small Business Owners What Is the Difference Between Purchase Order and Invoice?

What Is the Difference Between Purchase Order and Invoice? 8 Ways to Get Money to Start a Small Business

8 Ways to Get Money to Start a Small Business A How-To Guide to Paying Yourself as a Small Business Owner

A How-To Guide to Paying Yourself as a Small Business Owner