6 Best Invoice Apps For Small Businesses

Invoicing and accounting software can sometimes seem like it’s confusing and too much to take on. But it can often be a challenge to track invoices, conduct expense tracking, and handle partial payments on a regular basis. So if you’re looking for the best invoicing software, where should you start?

Do you need to consider inventory tracking and time and expense tracking? Do you want to better manage invoices and cash flow? What about the need to balance recurring payments or simply manage payment processing? There is a lot to consider since every invoice app offers additional features within its core functionality.

For example, free invoice apps allow you to create branded invoices, set up automatic payment reminders and track expenses. Some apps have monthly fees or a monthly subscription. These apps provide all the features. For example, tracking software and the ability to deliver invoices to unlimited clients. As well, some apps offer a wide range of other accounting features to benefit your business.

To help, we put together this guide that breaks down the top six choices for the best invoicing app. Keep reading to learn about their invoicing features and how they can make a difference.

Table of Contents

- What’s the Best Invoicing App?

- FreshBooks

- Zoho Invoice

- QuickBooks

- Wave Invoicing

- Invoicely

- Invoice Ninja

- Conclusion

- Frequently Asked Questions

What’s the Best Invoicing App?

Finding the best invoicing app as a small business owner can depend on different factors. Do you have recurring invoices? Do you need an option with unlimited invoices? Or do you simply need regular payment reminders?

Some apps offer a free plan or free version and others have paid versions or monthly subscriptions to send invoices. But no matter where you stand, sending invoices doesn’t have to be a challenge. Below you will find the top six invoice apps for small business owners.

FreshBooks

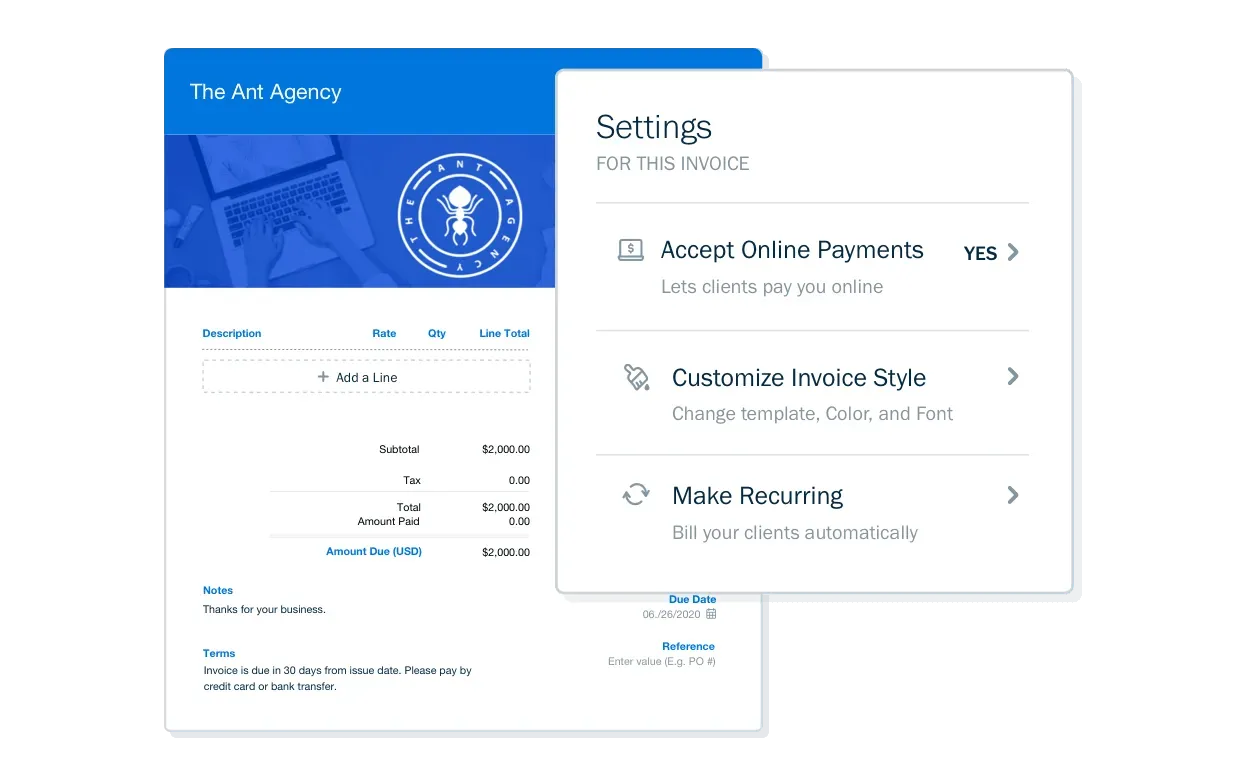

Users of FreshBooks can create customized invoices with recurring billing and automatic payments. Customers can pay using credit cards or ACH transfers. This makes it a beneficial combination for both business owners and clients.

Access to invoicing and other services is available on a desktop, tablet, or mobile device. But, the FreshBooks mobile app still allows you to send and review invoices.

A FreshBooks account also offers users access to other features. These include:

- Time and expenditure monitoring

- Project management

- FreshBooks Payments powered by Stripe

- Reporting

More than 100 third-party applications, including Gusto and Zoom, are integrated with the program. It’s an excellent choice because of its value. But also its overall scalability and accessibility. FreshBooks offers a wide range of other accounting tools to help your business get to the next level.

Zoho Invoice

In order to assist customers with everything from sales and marketing to finances, Zoho provides a range of company services. Offering customizable invoicing and payment options, Zoho Invoice is a stand-alone invoicing tool. It’s a great invoicing software for business owners who also wish to simplify and automate typical invoicing. It also helps with client relationship tasks because it has some strong automation features.

Users of Zoho can set up automated payments as well as recurring invoices. But the advantages of automation go beyond simply sending invoices. You can create process scenarios that result in email and in-app notifications and field updates. Additionally, users can use automation for other scenarios like purchase reductions or late fines.

It’s free to use Zoho Invoice since they receive payment for additional services it offers. You are only allowed 1,000 invoices from Zoho per year, which is quite a substantial amount that should be adequate for most people. Contact them to discuss your choices if you require more information.

QuickBooks

The invoicing functionality of QuickBooks lives up to its reputation as a provider of thorough accounting tools. Users who have a QuickBooks account can automate and customize invoices and add billable hours. You can even duplicate invoices that are similar to send to different clients.

The program also provides a range of bookkeeping and record-keeping services. This helps make it a good choice for business owners seeking in-depth reports. The reports offer insights into invoicing and other crucial financial metrics.

Users of QuickBooks have the option of focusing on metrics related to invoices or expanding reports. These can include a wide range of financial metrics that improve efficiency and help users make better decisions. Reports are easily accessible, making it simple to quickly obtain information.

The plan you choose determines your access to reporting, whether it be invoice-based or not. You can use the Simple Start plan at $30/month to run standard reports. These can include the likes of profit and loss, balance sheets, and cash flow.

Your access to reporting functionality will increase as you move up the subscription tiers. The most detailed reports can get made under the Essentials plan which starts at $55/month. The Plus plan starts at $85/month and the Advanced plan starts at $200/month. Discounts are frequently accessible depending on what your needs are.

Although the cost of QuickBooks may be a turnoff, if reporting is your main objective, then the expense may be well worth it. That’s especially true when you take into account the other accounting tools that QuickBooks users have access to. For 30 days, you can use the free invoicing and reporting features of QuickBooks.

Wave Invoicing

You can use Wave Accounting’s software without providing a credit card number or other payment information since it’s free. With a few integrations, it can help you manage your bookkeeping, accounting, and invoicing processes.

You can track an unlimited number of receipts using Wave’s receipt scanning and capture feature. You can also send an unlimited number of personalized invoices to your clients and manage an unlimited number of expenses.

With Wave, you can also search transactions, create accounting reports, and reconcile data. You can customize payment terms, automatically calculate sales tax, and have access to clear insights into your cash flow. Wave also includes a clean, well-organized dashboard with separate tabs. This way, you can easily access sales, purchases, accounting, banking, payroll, and reports.

Invoicely

Previously known as Invoiceable, Invoicely lets you send unlimited invoices to unlimited customers. This is one of the biggest differences compared to some other free invoice builder apps. It is therefore beneficial for newly established businesses.

It’s cloud-hosted, simple to use, and has a very reasonable pricing structure if you decide you need more features as your company expands. You can track time and expenses, set up recurring statements, and provide quotes with the $9.99/month Basic plan.

Invoice Ninja

A 100% open-sourced development invoicing company, Invoice Ninja was created to provide small business owners and freelancers with access to high-quality accounting services. And this happens without charging exorbitant prices. The business has been successful in achieving its objectives. Now, more than 200,000 businesses now rely on this special software program.

Users can set up auto-billing and recurring invoices and manage projects and tasks. You can also send unlimited invoices and quotes to 20 clients, and access a dozen other features once they’ve subscribed to this plan. Invoice Ninja is perfect for business owners with a wide range of payment gateway needs. This is because it also supports 50 currencies and 20 languages.

You can still use Invoice Ninja’s services if your company expands and you need to invoice more than 20 clients. You can do this by subscribing to one of their very reasonable paid plans. You can send an unlimited number of invoices to an unlimited number of clients with the Ninja Pro plan at $10/month. This also gives you access to other features like a custom URL.

If your needs go beyond that, the company also offers an Enterprise Plan at $14/month. It includes additional improvements like a client portal that is fully customized for you and access for multiple users.

Conclusion

It can be hard to choose the right invoicing software or accounting software for your business. There are some that offer a free plan and others with monthly subscriptions. There are also some that come with invoice templates. But no matter what you need, an app on this list will be a great invoice software choice that can help with payment processing.

If you’re looking for an invoicing app to help streamline your needs, FreshBooks offers a perfect solution. It saves you a ton of time and makes all your invoicing requirements simple. You can accept credit cards, create professional looking invoices, and establish steady cash flow. Ultimately, FreshBooks lets you get paid faster and manage timelines effectively.

FAQs on Invoicing Apps

Which is the best invoice app for iPhone?

This can all depend on your invoicing needs. But FreshBooks provides an easy-to-use app that offers everything you need. It has all the features to help you manage and track invoices. You can also create estimates, use time tracking, and keep your invoice simple. It’s one of the best invoicing software choices.

Which is the best Android invoice app?

FreshBooks is a great choice as an invoice app on Android. You can sync data to the could and customize all your invoices with your company logo. As well, you can benefit from being able to integrate the app with other third-party apps.

How can small businesses create invoices?

There are several options for small businesses to create invoices. You can use a free template or benefit from an invoicing app. FreshBooks’ app has the power to help you create and send invoices when you need to. It also provides a wide range of other accounting features you can benefit from.

How do small businesses keep track of invoices?

The best and most efficient way to keep track of invoices is by using a software program. It makes managing invoices much easier and allows you to stay on top of recurring invoices.

RELATED ARTICLES

Invoice Factoring: Definition & How It Works

Invoice Factoring: Definition & How It Works How to Write a Rent Receipt?

How to Write a Rent Receipt? Online Invoicing Portal: A Small Business Guide

Online Invoicing Portal: A Small Business Guide What is a Disputed Invoice? – How to Resolve Them

What is a Disputed Invoice? – How to Resolve Them 7 Best Invoice Management Software for 2025

7 Best Invoice Management Software for 2025 What Is a Credit Invoice?

What Is a Credit Invoice?