25 Small Business Tax Deductions (Write Offs) in 2025

A tax deduction is an expense that you can write off of your taxable income, allowing you to pay less in taxes, provided the expense meets IRS criteria. For small business owners, the tax season is one of the most pivotal times of the year. Taxes represent a major expense, which is why it’s so vital for small business owners to consider tax deductions.

When done correctly, tax deductions can greatly reduce taxable income, saving money for your business. In this guide, we’ll cover 25 essential small business deductions for the 2025 tax season, covering various expense categories such as meals, travel, office supplies, and more. Let’s take a look.

Key Takeaways

- Small businesses can claim many different tax deductions to reduce their taxable income.

- Claiming business tax deductions (also called tax write-offs) allows you to pay less in income tax.

- In order to deduct a business expense, it must be considered ordinary and necessary for business operations.

- To claim tax write-offs, you must complete form Schedule C and attach it to the relevant income tax form (1040 for sole proprietors, 1120 for corporations, and 1065 for multi-member LLCs).

- Maximizing deductions requires careful expense tracking and categorizing throughout the year, which is made easier by accounting software.

Table of Contents

- Business Meals

- Travel Expenses

- Business Vehicles

- Business Insurance

- Home Office Expenses

- Office Supplies

- Phone and Internet Expenses

- Business Interest and Bank Fees

- Depreciation

- Legal and Professional Fees

- Employee Salaries and Compensation

- Charitable Contributions

- Education

- Bad Debt

- Income Taxes

- Pension Plans

- Marketing and Advertising

- Rent Expenses

- Startup Expenses

- Moving Expenses

- Child and Dependent Care

- Energy Efficiency Expenses

- Foreign-Earned Income Exclusion

- Real Estate Taxes

- Client and Employee Entertainment

- What is a Small Business Tax Deduction?

- How to Claim Small Business Tax Deductions

- Maximize Your Small Business Deductions with FreshBooks

- FAQs on Small Business Tax Deductions

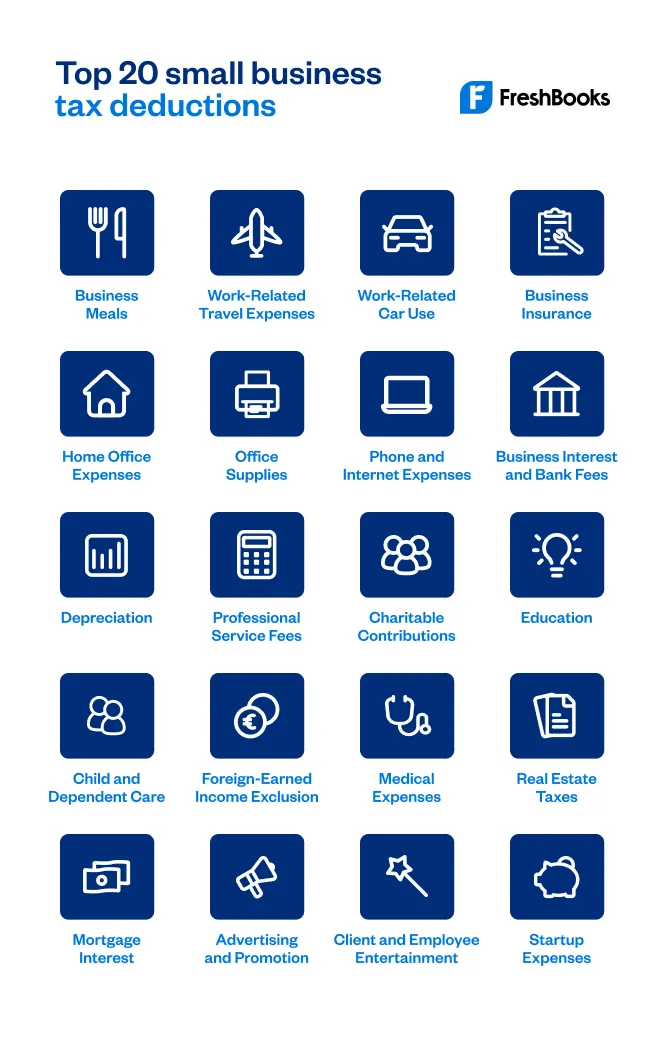

Small businesses can write off a number of expenses as tax deductions to help lower the amount they owe on their income tax. The top small business tax deductions, including tax deductions for independent contractors, include:

1. Business Meals

As a small business, you can deduct 50 percent of food and drink purchases that qualify. To qualify, the meal needs to be related to your business, and you need to keep the following documentation related to the meal:

- Date and location of the meal

- Business relationship of the person or people you dined with

- The total cost of the meal

The easiest way to track business meal expenses is to keep your receipt and jot down notes on the back about the details of the meal.

2. Travel Expenses

All expenses related to business travel can be written off at tax time, including airfare, hotels, rental car expenses, tips, dry cleaning, meals, and more. You can reference the IRS website for a full list of deductible business travel expenses. To qualify as work-related travel, your trip must meet the following conditions:

- The trip must be necessary for your business.

- The trip must take you away from your tax home, i.e. the city or area in which your company conducts its business.

- You must be traveling away from your tax home for longer than a normal workday, and it must require you to sleep or rest en route.

3. Business Vehicles

If you use your car strictly for work-related purposes, you can write off all costs associated with operating and maintaining it. If your car use is mixed between business and personal reasons, you can only deduct costs that are related to the business usage of the vehicle. You can claim the mileage you use for business driving, either by deducting the actual miles traveled for business or by using the standard mileage deduction of 0.70 per mile driven.

4. Business Insurance

You can deduct the cost of your business insurance on your tax return. If you have a home office or use a portion of your home to run your business, you can deduct your renter’s insurance costs as part of your home office write-offs.

5. Home Office Expenses

Under new simplified IRS guidelines for home office expenses, home-based small businesses and freelancers can deduct five dollars per square foot of your home that’s used for business purposes, up to a maximum of 300 square feet. To qualify as a tax deduction, your work area has to be used exclusively for business (i.e. you can’t write off the square footage of your dining room if you do your work at the table during the day), and you need to use the home office regularly as your principal place for conducting business.

6. Office Supplies

You can write off office supplies, including printers, paper, pens, computers, and work-related software, as long as you use them for business purposes within the year in which they were purchased. You can also deduct work-related postage and shipping costs. Be sure to file all receipts for office supply purchases for documentation.

7. Phone and Internet Expenses

If using the phone and internet is vital to running your business, you can deduct these expenses. If, however, you use the phone and internet for a mix of work and personal reasons, you can only write off the percentage of their cost that goes toward your business use. For example, if roughly half of your internet usage is business-related, you can write off 50% of your internet expenses for the year.

8. Business Interest and Bank Fees

If you borrow money to fund your business activities, the bank will charge you interest on the loan. Come tax season, you can deduct the interest charged both on business loans and business credit cards. You can also write off any fees and additional charges on your business bank account and credit card, such as monthly service fees and any annual credit card fees.

9. Depreciation

When you deduct depreciation, you’re writing off the cost of a big-ticket item like a car or machinery over the useful lifetime of that item rather than deducting it all in one go for a single tax year. Businesses usually deduct depreciation for long-term business investments that are more costly, so they’re reimbursed for the expense over the entire useful lifetime of the item. The 2025 tax policy brings back the 100% bonus depreciation, meaning you can write off the full cost of eligible property and equipment in the year of purchase vs. over several years. If the bonus option is not utilized. Here’s how to calculate depreciation:

Depreciation = Total cost of the asset / Useful lifetime of the asset

10. Legal and Professional Fees

Any professional service fees that are necessary to the functioning of your business, such as legal, accounting, and bookkeeping services, are deductible for tax purposes. If you use accounting or bookkeeping software for your business, that would also qualify as deductible from your business income. If you are having trouble determining whether a particular professional service expense is for work or personal use, these guidelines for legal and professional fees from the IRS can help you judge the nature of the expense.

11. Employee Salaries and Compensation

If you’re a small business owner with employees, you can write off their salaries, benefits, and even vacation pay on your tax returns. There are a few requirements for writing off salary and benefit expenses:

- The employee is not a sole proprietor, partner or LLC member in the business

- The salary is reasonable and necessary

- The services delegated to the employee were provided

12. Charitable Contributions

You can deduct charitable donations that you make to qualifying organizations. If your business is set up as a sole proprietorship, LLC or partnership, you can claim these expenses on your personal tax forms. If your company is a corporation, you claim charitable donations on your corporate tax return.

13. Education

Any educational expenses, including the educator expense tax deduction, that you incur to bring value to your business are fully deductible for tax purposes. The requirements for education-related expenses are that the course or workshop must improve your skills or help maintain your professional expertise. Educational expenses that qualify for deductions include:

- Courses and classes related to your field of work

- Seminars and webinars

- Trade publication subscriptions

- Books related to your industry

14. Bad Debt

Bad debt refers to instances when a business cannot collect payment from customers for goods or services rendered, making the debt uncollectible. In order to deduct bad debts, the amount must be previously included in your income, and it must be considered worthless. In order to consider the debt worthless, you must show that you’ve taken reasonable steps to collect it. If your bad debt meets these requirements, it is tax deductible and can be subtracted from your taxable income

15. Income Taxes

Small businesses can deduct various taxes paid, including payroll taxes, real estate taxes, and particular types of state and federal income taxes. You can only deduct taxes that are directly attributable to your business—you can’t deduct your individual taxes as a business expense. For this reason, it’s essential to keep business and personal taxes separate.

16. Pension Plans

If you make contributions to your employees’ pension plans, these amounts are tax deductible. You can write// off contributions to 401(k) retirement plans as well as SEP IRA plans and traditional IRA plans. You can also make deductions for contributions to a retirement plan that you set up through your business, helping you deduct even more from your tax bill.

17. Marketing and Advertising

You can fully deduct expenses related to promoting your business, including digital and print advertising, website design and maintenance, and the cost of printing business cards.

18. Rent Expense

If your business pays to rent its premises or for certain equipment, these expenses can be deducted from your taxes. Any rental fee you incur that is related to the operation of your business is tax deductible, whether it’s an office, warehouse, storage space, or any other kind of property. The same goes for businesses that lease property instead of renting it.

19. Startup Expenses

If you launched a new business venture in the latest tax year, you could deduct as much as $5,000 in startup expenses you incurred in 2025 in the lead-up to your business launch. That can include costs associated with marketing your new business, travel and training costs. However, there are certain conditions for writing off these expenses. To learn more about this, follow our post 13 Business Startup Costs and How to Calculate Them

20. Moving Expenses

If you move and the main reason for doing so is work-related, you might be able to fully deduct the costs associated with the move. To qualify, your move has to pass the distance test. To pass the distance test, your new job location has to be at least 50 miles farther from your former home than your old job location was from your previous home.

21. Child and Dependent Care

Costs you incur for caring for children or adult dependents are tax deductible. If your own children are 12 years old or younger, you can write off costs associated with their care. Adult dependents also qualify for deductions, including spouses and some other related adults who are unable to care for themselves because of physical or mental disability.

22. Energy Efficiency Expenses

Upgrades that you make to your home to ensure it’s more energy efficient can qualify for tax credits, such as the federal solar tax credit. You can claim 30% of the cost of alternative energy equipment for your home, including solar panels, solar water heaters, and wind turbines. The IRS site offers further details on the home energy tax credits.

23. Foreign-Earned Income Exclusion

American citizens with businesses based abroad can, under certain circumstances, leave the foreign income they’ve earned off their tax return. To qualify for the exclusion, your tax home must be based abroad. This article can help you better understand the requirements for foreign-earned income exclusion.

24. Real Estate Taxes

Real estate taxes paid at the state and local levels can be deducted from your income taxes. Property taxes are included in these deductions, and you can claim up to a total of $10,000.

25. Client and Employee Entertainment

If you take business clients out, you can deduct the expense as long as you discuss business during the meeting and the entertainment takes place in a business setting for business purposes. You can deduct 50% of the cost of these entertainment expenses. You can also deduct as much as 100% of the cost of social events held for your employees.

What is a Small Business Tax Deduction?

Small business tax deductions refer to any expense that you can deduct from your taxable income for the year, reducing your tax liability and saving you money. Tax deductions are also known as tax write-offs. In order to claim deductible business expenses, they must be directly related to your business and must be considered “ordinary and necessary” for the operation of your business. In order to make the most of your tax deductions, it’s a good idea to speak with a professional such as a CPA. These tax accountants know what tax deductions are available and can help you identify strategies to lower the tax liability of your small business.

How to Claim Small Business Tax Deductions

In order to claim tax write-offs for your business, you must complete Form Schedule C. This form determines your total taxable income for the year based on the net profits you incurred. You’ll also report your business expenses and self-employment tax deductions. From here, you report your profits and deductions on your personal Form 1040, which you then use to calculate your taxes due. These steps assume that your business is a sole proprietor LLC. For multi-member LLCs, you’ll use Form 1065, and corporations will instead use Form 1120. Either way, you’ll need to maintain accurate records of your expenses throughout the year, making sure to categorize each one correctly as you go. Accounting software can be a big help for small business owners looking to manage business expense tracking and tax deductions throughout the year.

Maximize Your Small Business Deductions with FreshBooks

Tax deductions can make a dramatic impact on your tax bill. But to make the most of them, you’ll need to stay organized, keeping meticulous, accurate, categorized records of your expenses as they’re incurred. This can be time-consuming for small business owners, which is why so many have turned to accounting software like FreshBooks.

FreshBooks transforms tax time for small business owners, helping them track expenses, generate detailed financial reports, and prepare for tax season with ease and confidence. With countless useful features, FreshBooks simplifies the tax prep process and helps you make the most of business deductions. Try FreshBooks for free!

FAQs on Small Business Tax Deductions

Still have questions about making tax deductions for your small business? Expand your knowledge with these frequently asked questions.

How much can a small business write off on taxes?

Technically speaking, there are no limits on the tax deductions you can claim for your business. Assuming your business expenses are ordinary, reasonable, and necessary for your business, you can deduct almost any amount, with certain restrictions depending on your expenses, location, and business structure.

What is the 20% tax deduction for small businesses?

Under the Tax Cuts and Jobs Act, owners of pass-through business entities (e.g., sole proprietorships, partnerships, LLCs, LLPs, and S-corporations) can deduct up to 20% of qualified business income (QBI) from their taxes. This essentially means you can reduce your taxable income by 20%.

What expenses are 100% deductible?

Certain business expenses are 100% tax deductible, including furniture purchased for office use, office equipment (e.g., computers, printers, scanners, etc.), business insurance, business travel and associated costs, gifts to clients and employees under $25 per person, per year, health premiums for people who are self-employed, and business phone bills.

What is the $5,000 tax credit for small businesses?

Businesses with 100 employees or less that earn $5,000 annually qualify for the Credit for Small Employer Pension Plan Startup Costs. This credit covers 50% of costs associated with setting up, administering, and educating employees on a plan, up to $5,000 per year for the first three years.

Can you write off car payments for LLC?

An LLC can write off the purchase of a car provided it’s used strictly for business purposes. You can make this deduction using either the mileage rate provided by the IRS for that year, or by using the actual expense method, which requires careful expense tracking throughout the year.

How much can my small business make before paying taxes?

Tax thresholds depend on business structures. C corporations are taxed at a flat rate of 21% regardless of income. Unincorporated ‘pass-through’ businesses are subject to the standard deduction rate ($15,000 for individuals and $30,000 for married couples filing jointly). This is the tax-free threshold for pass-through entities.

How many business expenses can I claim without receipts?

Some business expenses can be deducted without receipts, including self-employment taxes, home office expenses (e.g., rent/mortgage, real estate taxes, utilities, etc.), self-employed health insurance premiums and retirement plan contributions, vehicle expenses, and business cell phone expenses.

More Useful Resources

Explore our diverse tax deduction guides catering to various niches. From small businesses to real estate agents, find valuable insights to optimize your tax savings.

Reviewed by

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

6 Ways to Control Expenses In A Company

6 Ways to Control Expenses In A Company What Is Expense Analysis & How to Analyse Business Account

What Is Expense Analysis & How to Analyse Business Account What Is Amex Express Checkout & How Does It Work? A Guide

What Is Amex Express Checkout & How Does It Work? A Guide What Are IRS Mileage Log Requirements?

What Are IRS Mileage Log Requirements? Standard Mileage Vs Actual Expenses Tax Deduction

Standard Mileage Vs Actual Expenses Tax Deduction