How to Organize Receipts Electronically: 6 Best Ways

Losing track of an important receipt from a long-ago purchase is a common frustration. The endless paper chase and the risk of misplacing vital documents can be a significant time drain and cause unnecessary stress. Traditional physical storage methods like binders, folders, and shoeboxes are effective but can be very time-consuming, especially when managing a large volume of receipts. Instead of letting physical receipts pile up in a shoebox, the best and most efficient way to organize your receipts and keep them secure is to do so electronically.

Digital tools and mobile apps are excellent solutions for keeping receipts organized, making expense tracking and document management much more convenient.

To effectively organize receipts electronically, it’s helpful to use a combination of methods such as scanning paper documents, utilizing cloud storage for secure keeping, and adopting a consistent naming system for your digital files. You can also use a mobile device to quickly snap pictures of receipts and upload them directly to digital storage, streamlining the process.

This approach ensures your digital records are well-organized and easily accessible. Moving to a digital system allows you to store receipts efficiently, helps you avoid physical clutter, and makes it simple to locate them for important purposes like preparing tax returns or tracking expenses.

Digital copies are acceptable substitutes for original paper receipts as long as they are legible and stored properly, offering benefits for compliance and easy retrieval. You can turn all your paper receipts into digital receipts, allowing you to organize everything together in one manageable place.

Key takeaways

- Receipts are important documents that help you keep track of where your money is going

- Effective receipt storage can save you time and help you avoid frustration at tax time

- There are a variety of online receipt organization tools you can use to digitally store photos, scans, and electronic receipts for easy access when you need them

- Accounting software like FreshBooks can make receipt tracking even easier

Table of contents

6 Best ways to organize receipts electronically

It really comes down to personal preference. If you organize all your receipts in a shoebox and it works for you, then that’s great. However, for efficient financial management, organizing receipts electronically is essential. Creating a structured system can simplify tax preparation and improve expense tracking.

Depending on the size of your business or how often you make purchases, you could have thousands of receipts to organize. For high-volume receipt processing, using a digital receipt system or receipt management software is highly recommended, as these solutions can efficiently handle large quantities of documents and streamline your workflow.

Here are the 6 best ways for you to organize your receipts electronically.

1. Save receipts to Google Drive

Instead of letting physical copies of your receipts pile up around the home or office, you can use Google Drive to save and store receipts electronically, organizing your business expenses. Start by saving all your scanned and electronic receipts onto your desktop computer and then uploading these digital receipts into Google Drive. For added security, consider backing up your digital receipts to an external hard drive as well.

You can then go a step further and create separate file folders for specific types of receipts if needed. For example, you can organize your business receipts into a business expense folder, an office supplies folder, or an expense receipts folder. You may also use color coding for your folders to streamline the process and make organizing your receipts more efficient.

Everything can also be organized by date, the location where the items were purchased, or the type of items purchased. If you keep the folder names short and easy to read, it will make your receipt tracking so much easier later on and help with organizing your receipts for easy retrieval.

2. Use Evernote

Evernote is a program with a range of functionalities and can be a great place to store and organize files and collect notes. It can also scan receipts or take photographs to convert paper receipts into digital images and then place them into files, making tracking receipts easy. You can also use Evernote to store and retrieve old receipts, ensuring past purchases are always available for reference.

Setting up Evernote to send receipts from your email directly to the app is even possible. If you tag the receipt properly and use a good subject line, the Evernote app automatically files the email receipt into a dedicated folder. Tags can help you keep all your notebooks organized. Evernote also helps capture and organize receipt information, making it easy to reference important details when needed.

With Evernote, your receipts are readily accessible whenever you need them.

3. Use WellyBox

WellyBox is an intelligently interfaced web-based app that can generate expense reports by locating receipts and invoices throughout linked email inboxes and organizing them together. This helps you maintain accurate financial records by ensuring all receipts are digitized and properly stored. If you wish, you can even set WellyBox up to forward relevant financial information directly to your accountant or anyone you use.

WellyBox can also download receipts or invoices directly from a supplier or wherever you made your purchase. It can be integrated with other platforms like Google Drive and Microsoft Office, as well as popular accounting software such as FreshBooks, taking your receipt organization to the next level.

WellyBox can also generate comprehensive financial reports for your business, simplifying your bookkeeping and accounting workflows.

4. Scan or download to your personal computer

If you are not comfortable or do not have the time to integrate a new app or filing system into your life, you may wish to simply scan your paper receipts using a scanning app (or take a picture) and save them onto your personal or work computer. Scanning receipts helps convert physical documents into digital files, making them easier to store and retrieve for tax or expense purposes. Regularly scanning your receipts ensures your records are always up to date and accurate. You can also save digital receipts in the same way, keeping everything organized in folders that are accessible from your desktop files. For even greater efficiency, you can organize receipts digitally using cloud-based apps or receipt management software.

5. Merge your receipts into one document

For many people, the issue with looking back at the year’s receipts is that it can feel chaotic and confusing, but if you take the time to scan each receipt and save them into a single PDF or Microsoft Word document for easier readability. Depending on your small business needs, you may even wish to organize the document by purchase date, vendor, and ensure that the transaction date is clearly included for each receipt.

Keeping digital copies of your credit card statements alongside your receipts provides comprehensive record-keeping, making tax preparation, audits, and expense tracking much easier.

6. FreshBooks receipt scanning

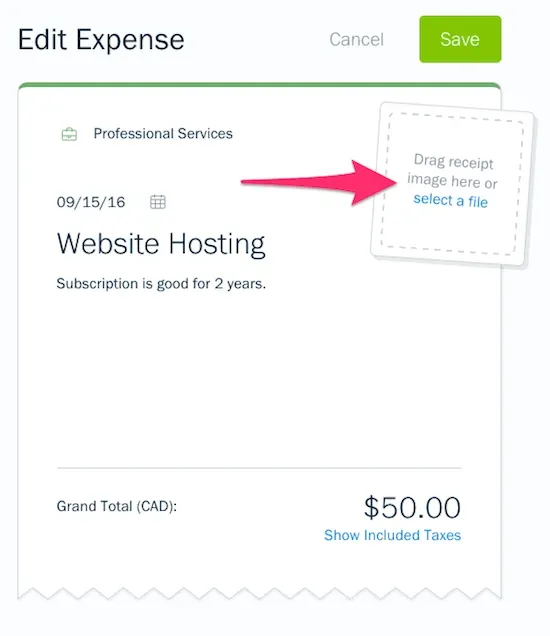

There is no longer a need to manually enter your receipts into your accounting software when you have the FreshBooks app on your phone. Learn more here about expense & receipt tracking offered through FreshBooks.

To use FreshBooks for receipt management and storage, just connect your business credit card and bank account to your FreshBooks account, and the software will track expenses electronically. Mobile receipt scanning lets you snap pictures of paper receipts for instant digitization and uses optical character recognition (OCR) to extract important details like dates, amounts, and vendors automatically. The app securely stores digital copies of your receipts in the cloud for future access, eliminating the need for paper files and time wasted doing data entry.

Summary

Organizing all your receipts electronically can keep you proactive and productive. And when you are organized, you can save time, stress, and even money in the long run. You will know exactly how much you spent, where it was spent, and when it was spent.

Plus, switching to digital records for receipt files can reduce paper clutter. Everything can be easily accessed through your mobile phone or computer at the click of a button. So when you need to do your tax return, or you need to quickly find a receipt, you will know exactly where everything is.

Did you enjoy reading this guide? Head over to our expenses category for more great content!

FAQs on organizing receipts electronically

How do small businesses keep track of receipts?

Most people who run small businesses will use accounting software or a receipt scanner app of some kind, uploading digital receipts, as well as photos and scans of paper receipts, so that all of the pertinent financial information they need is at their fingertips while managing receipts efficiently. FreshBooks accounting software has receipt reading technology and other organizational tools to keep your small business organized and ready for tax season. These tools help organize business receipts by categorizing and storing them properly, making compliance and easy retrieval simple.

Are scanned receipts valid?

Yes, scanned receipts are valid as proof of purchase as long as they are identical to the original paper receipt and show all the information on the receipt. This means you cannot have a scan of a torn receipt or a cut-off scan that does not show all of the information included in the original.

What is the best app for storing receipts?

FreshBooks’ receipt scanning app offers convenient receipt capture technology that can take information directly off a photo of your receipt, including the merchant, the total amount, and taxes. This ‘Digital Bills and Receipt Scanner’ will help you stay organized without wasting time manually filing information.

How long should I keep electronic copies of receipts?

You should keep your electronic receipts for 3 to 7 years, especially if you use them to verify your tax return information. This way, if an audit occurs, you will have proof to back up any claims you have made.

Can I use electronic receipts for tax purposes?

Yes, in most cases, you can use electronic receipts for your taxes. The IRS will accept them as long as they are legible and can be accessed reliably in case of an audit.

Reviewed by

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

Expense Reimbursement Policy: Best Practices

Expense Reimbursement Policy: Best Practices 3 Best Travel and Expense Management Software

3 Best Travel and Expense Management Software 5 Best Expense Management Software & Tools

5 Best Expense Management Software & Tools What is Medical Mileage Rate Deduction?

What is Medical Mileage Rate Deduction? What are Payroll Expenses? A Complete Payroll Expense Guide

What are Payroll Expenses? A Complete Payroll Expense Guide How to Calculate Mileage Reimbursement for Taxes

How to Calculate Mileage Reimbursement for Taxes