What Is Employee Expense Reimbursement Law & How Does It Work

It’s not uncommon for an employee to have to use their own out-of-pocket money to cover work-related expenses. You might have to travel for work for a period of time with your personal vehicle and fill up with gas, for example. There are also some other expenses you might be able to get reimbursed for, such as a standard mileage rate.

But how do you know what gets covered and what doesn’t when it comes to job duties? Does your company have a policy for employee-related expenses? Most companies do, however, the specific details aren’t always clear.

A good employee expense reimbursement policy outlines all the types of expenses that can get reimbursed. As well, there should be a way for you to submit any related expenses that you incur. Having a well-designed policy can also help when tax time comes around.

Here is everything you need to know about employee expense reimbursement and how it works.

Here’s What We’ll Cover:

What Is Employee Expense Reimbursement?

How Employee Expense Reimbursement Works

What Is Employee Expense Reimbursement?

If you have to use your own money to purchase ordinary and necessary things related to work, then you can get reimbursed for those expenses. Typically, reimbursable expenses are things like fuel, accommodation or dinners with potential clients. There can be other actual costs, but just keep in mind they need to be business-related expenses.

Not every business will cover the same range of expenses. So it’s important to understand which will get covered under your employer’s policy. Here are a few of the most common reimbursable business expenses:

- Gas and mileage

- Hotel or motel accommodation

- Meals and entertainment

- Necessary tools or supplies

- Training and development and any travel-related costs

- Certain subscriptions and licenses

Check with your employer to discuss your company policy if they have one in place. If they don’t, it could be worth your time to work with your employer to develop an accountable expense plan with common employee expenses.

Is There an Employee Expense Reimbursement Law?

The easiest way to put it is no, businesses are not legally required to offer employees expense reimbursement. However, there are a few things to know about and take into account. Your employer might not be required to reimburse you for work-related expenses. But they are required to make sure you receive proper compensation.

Basically, your employer must ensure that the expenses you do have don’t reduce your wages below the federal minimum wage. Plus, they need to make sure that those reasonable expenditures don’t reduce your overall overtime compensation.

Simply put, your employer needs to make sure that your expenses don’t cause you to spend too much out-of-pocket. If they do, they could leave themselves open to legal penalties.

What Expenses Should Get Covered?

Even though there is no legal requirement, most employers do cover work-related expenses. There is a certain expectation that if an employee uses their own money on the business’s behalf, they should get reimbursed. This is why a good employee expense reimbursement policy can be handy.

It should outline all of the business-related expenses that an employee can get reimbursed for. Those expenses can further get defined as expenses that are necessary for business operations. The most common that get covered are usually related to travel expenses. And, it can outline the reasonable period of time in which expenses can get claimed at a regular rate.

Things like gas, mileage, hotels and meals are all usually covered. But if you mostly work from home or are on the road a lot, office expenses and personal cell phones or laptops could also get covered. Take a look at your company’s policy to see what’s covered within your scope of employment.

How Employee Expense Reimbursement Works

It depends on what business expense you want to get reimbursed for. But, most reimbursement of employee expenses can be done by providing necessary documentation. Things like receipts and reservations might be needed as proof.

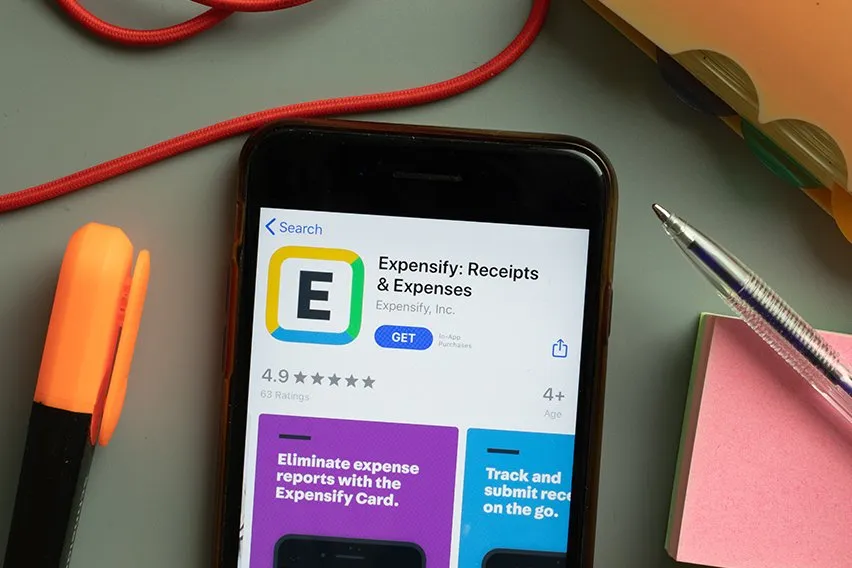

Some companies still use the method of submitting receipts after you have incurred a business expense. Others have a lump sum that they give to an employee to cover necessary expenses. And some use an expense tracking app.

That said, the method that gets used to reimburse employees doesn’t really matter. There just needs to be an outlined policy that explains which expenses can get reimbursed and how to do it. Once you know which expenses can get reimbursed, you submit the documentation and receive the outlined expense rate.

Key Takeaways

If you have to spend your own money on something business-related, you should be able to get reimbursed for it. The first thing you should do is check with your employer to see if they have an employee expense reimbursement policy already in place. From there, you can see which expenses are reimbursable.

Keep any receipts or other relevant documentation in case you need to provide any proof. These can be things like gas receipts, a mileage logbook or meal receipts. If you wanted to find out more information about business-related expenses in a specific area, check out the IRS website.

Did you enjoy reading this guide? Head over to our resource hub for more great content!

RELATED ARTICLES

What Is Expert Power? Types & Importance in Leadership

What Is Expert Power? Types & Importance in Leadership Guide to Employee Mileage Reimbursement Law

Guide to Employee Mileage Reimbursement Law How to Organize Receipts Electronically: 6 Best Ways

How to Organize Receipts Electronically: 6 Best Ways Expense Reimbursement Policy: Best Practices

Expense Reimbursement Policy: Best Practices 3 Best Travel and Expense Management Software

3 Best Travel and Expense Management Software 5 Best Expense Management Software & Tools

5 Best Expense Management Software & Tools