Why is Accounting Important?

Accounting is more than just a way to track profits and losses, it’s also a systematic process of recording, analyzing, and reporting economic events that affect a company’s business operations and financial performance.

By generating financial statements and related reports, accounting provides important information to a company’s management, potential investors, lenders, and the government. This data is essential to properly evaluate a company’s performance, file federal and state tax returns, track business expenses and revenues, and plan future business goals and operations.

In this article, we will explore the concept of accounting further, cover how accounting helps small company owners, and explain the different types of accounting.

Key Takeaways

- Accounting is the best way to track profits and losses, keep money organized, and ensure your business is tax-compliant.

- Some accounting objectives include assisting with decision-making, budgeting, and planning.

- Accounting helps businesses keep detailed records, comply with local and federal laws, and control company finances.

- A professional accountant can give you a more in-depth understanding of your business while helping you avoid mistakes, fraud, and theft.

Table of Contents

- What Is Accounting?

- Why Is Accounting Important?

- How Does Accounting Help Small Businesses?

- Types of Accounting

- Why Is an Accountant Important?

- Conclusion

What Is Accounting?

Accounting is the process of recording, analyzing, summarizing, reporting financial transactions and other events affecting a company’s financial position, and generating financial reports. Accounting involves tracking all profits and losses, analyzing transactions, and producing financial reports for regulators and tax collectors.

In the business world, accounting is one of the most necessary functions, as it gives all the information you need to know to make decisions, plan for the future, and determine whether the company is profitable.

Why Is Accounting Important For Business?

Accounting is an important process because it organizes financial data and summarizes your company’s financial performance. It’s often called the “language of business” as it communicates financial information to different users, like regulators, stakeholders, investors, creditors, oversight agencies, and government tax agencies.

The main objectives of accounting are:

1. Decision-Making

Accounting assists in many decision-making processes and helps owners develop policies to increase business efficiency. Some examples of decisions based on accounting information include product and service prices, resources used, and financing and business opportunities.

2. Budgeting and Planning

Owners of small businesses need to plan how they allocate their limited resources including labor, machinery, equipment, and cash towards accomplishing their business objectives.

Accounting is an important component of business management, budgeting, and planning as it enables business planning by anticipating the needs and resources. This helps in the coordination of different segments of an organization.

3. Recording Transactions

The primary role of accounting is to maintain a systematic, accurate, and complete record of all financial transactions of a business. These records are the backbone of the accounting system. Company owners should be able to retrieve and review the transactions whenever required.

4. Business Performance Management

Using accounting reports, business owners can determine how well a business performs. The financial reports are a reliable source of measuring the key performance indicators so that they can compare themselves against their past performance as well as against the competitors.

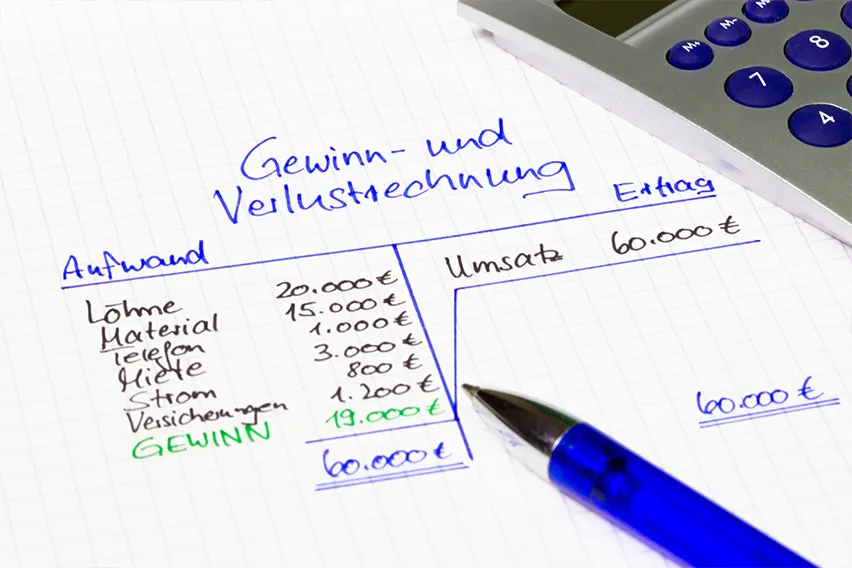

5. Financial Statements

The financial statements generated at the end of the fiscal period reflect the financial condition of a business during that period. They provide information about how much capital has been invested, the funds the business has used, revenues it generated, profits and losses, and the assets and liabilities of the business.

6. Statutory Compliance

The law requires businesses to maintain accurate financial records of their transactions and share the reports with the shareholders, tax authorities, and regulators. This information is also required for indirect and direct tax filing purposes.

7. Financial

In the business world, accounting helps organization owners prepare historic financial records like an income statement and balance sheet as well as financial projections which can be used while applying for a loan or securing investments for the business.

How Does Accounting Help Small Businesses?

Poor financial management is one of the primary reasons for small business failure, especially in the first year of the business. Since small businesses have a limited budget and other resources, accurate financial record-keeping provides information that helps them grow and develop.

For small business owners, accounting is crucial due to the reasons below:

1. Track Cash Flows

Efficient record keeping and implementing sound financial strategy are the best ways to track your business cash flow patterns. A small business owner who can create financial reports can understand the money coming and flowing out of their organization and will be better able to make smart business decisions in the future.

2. Understand Fixed and Variable Costs

Cost accounting records fixed cost and variable costs, analyzes them and generates helpful reports that help a business owner more accurately determine how much a project or product production will cost. This allows them to make better financial decisions and create a precise budget, improving the business’s net profit margins and maintaining financial stability during production.

3. Gain a Better Grasp on Your Company’s Health

Accounting gives you a better grasp of the business’s financial position, especially when you learn about preparing financial statements, and reading balance sheets, income statements, and cash flow statements. Once you know how your business is performing, you’ll be better prepared to make informed decisions.

4. Avoid Fraud and Theft

Accurate accounting helps you detect and avoid fraud and theft by customers, employees, and suppliers by creating a system of checks and balances that verifies transactions. It builds accountability by making it easier to trace any transaction. Effective internal controls are a key element of a successful accounting system.

5. Face Audits With Confidence

When you understand business finance and dealings, you are better prepared for potential audits. An accountant can help ensure your business is compliant with all tax obligations and keep you organized with detailed records, so you’ll have nothing to worry about if the IRS requests more information.

6. Attract More Funding

Bankers are more confident when dealing with company owners who have a handle on their company finances and understand the financial implications of their decisions. The overall financial health of your organization can determine future loans, which, in turn, may allow you to purchase new machinery or invest in new technology.

7. Run Your Business More Efficiently

Regularly reviewing your financial statements and establishing a detailed budget will allow you to discover operational inefficiencies. Saving a little bit in your business bank account on several expenses can add up to big results over the long run as you improve the overall health of your organization and achieve long-term success.

Types of Accounting

Different types of accountants serve different accounting needs and perform a wide range of functions. The following are 4 of the most common types you may need to utilize while managing your business.

1. Financial Accounting

Financial accounting involves tracking, recording, and categorizing financial transactions, and generating financial statements like balance sheets, cash flow statements, and income statements.

2. Managerial Accounting

Managerial accounting is the process of measuring, interpreting, and analyzing a business’ financial data. This type of accounting is for internal use, within the company, to give upper-level management insights, risk assessments, and projections that can help with operations and decision-making.

3. Public Accounting

Public accounting is done by an external business that works for multiple clients. It is the process of preparing and reviewing public financial documents, filing tax documents with the IRS, giving bookkeeping advice, and helping identify areas that could use better organization.

4. Governmental Accounting

Governmental accounting is the management, tracking, and auditing of government budgets and spending, following the strict laws of the Governmental Accounting Standards Board (GASB).

Why Is an Accountant Important?

As a small business owner, managing the business’s financial affairs yourself may be tempting, but financial matters can be delicate and may require a trained accountant to handle them correctly. Here are some of the key reasons to invest in an accountant for your small business:

- A professional accountant assists business owners in making smart, strategic fiscal decisions while adhering to compliance requirements

- They’re experienced in collecting and organizing information in a format that’s easy to understand, according to the Generally Accepted Accounting Principles (GAAP)

- They help business owners track operating costs, changing revenues, and dividends, and they can help with budgets and monitoring of cash flows

- Accountants can provide an unbiased, verifiable, and objective look at the health of your company, determine areas for improvement, and offer advice based on your unique business needs

- Tax time is easier when your accountant helps to identify potential deductions, file your tax returns, and avoid audits

Conclusion

Accounting is important for planning, making decisions, identifying cash flow patterns, and measuring your company’s economic effectiveness. Having a good accountant on your team allows you to identify, measure, and communicate your company’s economic status and helps you understand the nuances of your business finances.

Organized accounting and bookkeeping can also help stakeholders and other investors in evaluating the business’s financial performance, and ensure your business remains tax compliant. Along with hiring an accountant, small business owners increasingly use online accounting software like FreshBooks. With FreshBooks’ user-friendly cloud-based mobile interface, you can access integrated double-entry accounting features from any device, even on the go. We make it easy to take control of your business and manage your bookkeeping safely, from anywhere.

Try FreshBooks free to send professional invoices, track your finances, and keep your finances in check from your personal accounting dashboard. Let FreshBooks help you make informed decisions and keep your business growth on track.

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

How Much Do Small Businesses Pay in Taxes: A Guide to Tax Rates

How Much Do Small Businesses Pay in Taxes: A Guide to Tax Rates What is the Retail Method?

What is the Retail Method? What is Interest Expense?

What is Interest Expense? What Is a Profit and Loss Statement?

What Is a Profit and Loss Statement? What is a T Account?

What is a T Account? What Are Provisions in Accounting?

What Are Provisions in Accounting?