W-8BEN-E: Guide for Foreign Entities Doing Business in the U.S.

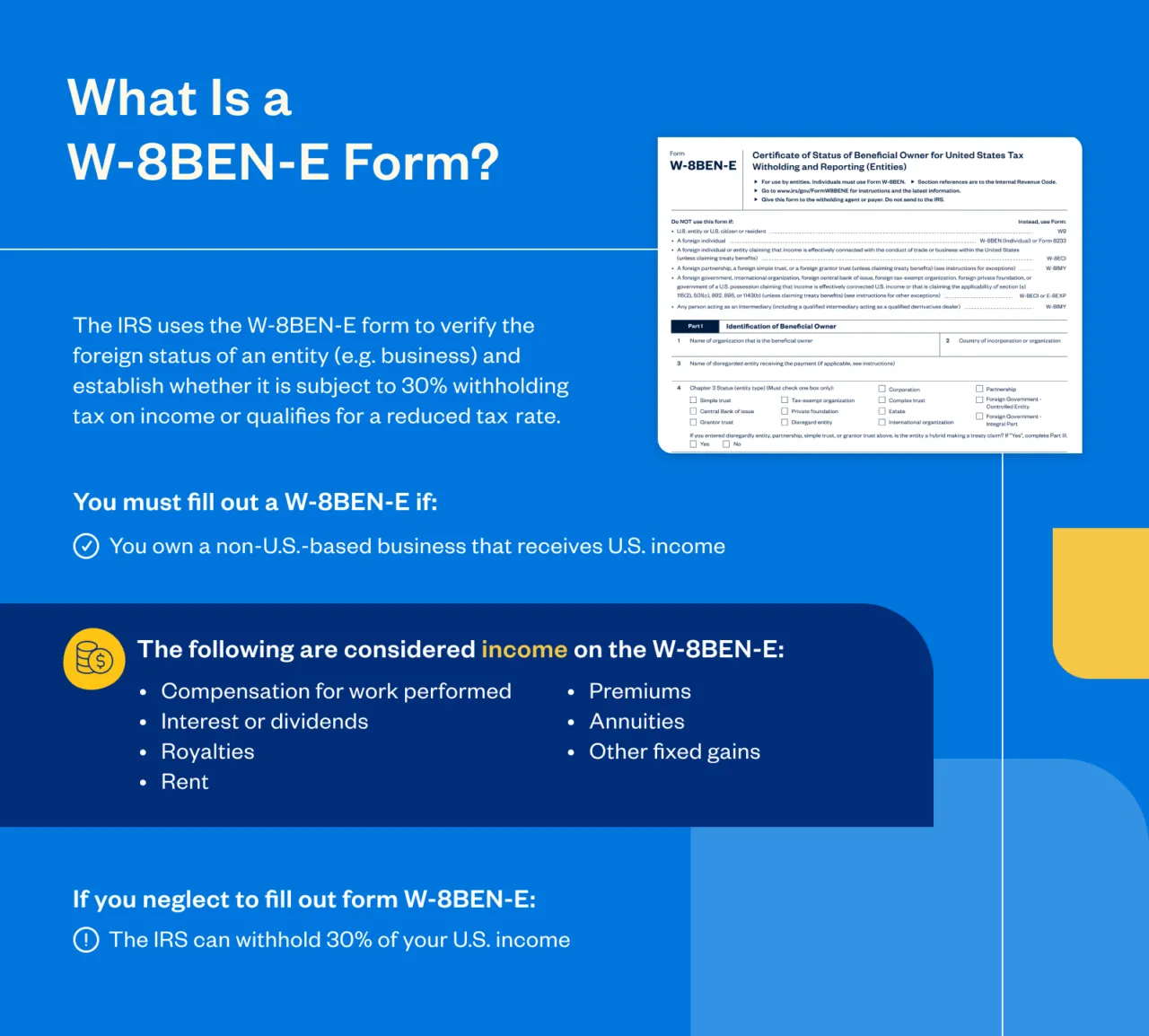

Many U.S. companies do business with foreign suppliers, so it’s essential to understand your tax obligations. Form W-8BEN-E establishes the foreign entity status and tax withholdings of foreign companies that do business in the U.S.

When U.S. companies pay a foreign entity, they’re required under U.S. tax law to withhold 30%. 1 The exception is for the transfer of interest in a partnership, which is taxed at a rate of 10%. We’ll explore the definition and uses of Form W-8BEN-E, as well as the steps for filling it out to help you understand all your tax obligations relating to Form W-8BEN-E.

Key Takeaways

- Form W-8BEN-E is an IRS form to collect taxpayer information from foreign entities.

- Form W-8BEN-E is used to establish foreign entity status and determine tax withholding and exemptions.

- U.S. companies doing business with foreign entities are required to collect Form W-8BEN-E.

- There are four key sections that most businesses must fill out.

- Automating your Form W-8BEN-E process can increase efficiency and accuracy.

Table of Contents

- What Is Form W-8BEN-E?

- What Is the W-8BEN-E Used For?

- How To Fill Out W-8BEN-E?

- Best Practices for Collecting W-8BEN-E Forms

- Benefits of W-8BEN-E Automation

- Does the W-8BEN-E Expire?

- Simplify W-8BEN-E Processes with FreshBooks

What Is Form W-8BEN-E?

Form W-8BEN-E is a form from the Internal Revenue Service that Nonresident Alien companies must use to document their status as a foreign entity operating in the United States. 2 Also known as a Certificate of Foreign Status of Beneficial Owner for U.S. Tax Withholding, the W-8BEN-E enables these businesses to apply for tax exemption on income earned in the U.S.

The W-8BEN-E is important for gathering taxpayer information for Nonresident Aliens, defined as individuals who are not U.S. nationals or U.S. citizens and who have not passed the substantial presence test or received a green card.

Difference Between W-8BEN And W-8BEN-E

The primary difference between the W-8BEN and the W-8BEN-E is that the W-8BEN is intended for foreign individuals and sole proprietors, while the W-8BEN-E is intended for foreign entities.

Foreign individuals and entities are subject to a 30% tax rate on income earned in the U.S., so both the W-8BEN and the W-8BEN-E are necessary for establishing foreign entity status. The W-BEN establishes an individual or sole proprietor as a Nonresident Alien, while the W-8BEN-E establishes a business, company, or organization as a foreign entity.

The W-8BEN-E is also longer to fill out as it requires a full description of the entity.

What Is the W-8BEN-E Used For?

The W-8BEN-E is used to collect and remit taxpayer information on foreign entities that conduct business and earn income from U.S. sources. The IRS uses this information to document Nonresident Alien status and to determine eligibility for certain tax treaty benefits.

As mentioned above, a 30% tax rate applies to certain types of income earned by Nonresident Aliens in the U.S. These income sources include:

- Interest

- Dividends

- Royalties

- Premiums

- Annuities

- Rental income

- Compensation for services provided, or expected to be provided

- Substitute payments for securities lending transactions

- Other gains, profits, or income

The W-8BEN-E form asks for information such as:

- Company name

- Where the company was incorporated or is located

- Organization status (chapter 4 status)

- U.S. or foreign TIN (taxpayer identification number)

- Claim of tax treaty benefits

Organization status refers to whether the business is a foreign government, publicly traded company, nonprofit company or otherwise.

Tax treaty benefits on income can only be claimed if there’s a tax treaty between the U.S. and the country where the business is a tax resident. The United States has tax treaties with countries such as Canada, the United Kingdom, Ireland, Mexico and Australia. A full list is available on the IRS website.

How To Fill Out W-8BEN-E?

Any non-U.S. company that earns an income in the U.S. is required to fill out Form W-8BEN-E and submit it to the IRS. The form can be found on the IRS website and downloaded for companies to fill out online or with a hard copy.

Form W-8BEN-E includes 30 sections, although not all fields are required for a foreign entity to be eligible to receive payment from U.S. sources. Requirements differ according to entity and revenue type, but in most cases, an entity is only required to fill out the following four sections:

Part I – Identification of Beneficial Owner

Identification of Beneficial Owner is an essential section for every entity filling out Form W-8BEN-E. Double-check that all sections are filled out accurately and make sure to review for any spelling errors.

Line 1. Name of the Organization

This is the name of the foreign entity that is filing the form.

Line 2. Country of Incorporation or Organization

This is the country where the business is registered.

Line 3. Name of a Disregarded Entity

This section does not need to be filled out if the foreign entity receives payment directly from the U.S. source. However, if payment goes through a third party like an accounting institution, you must fill out this section. You’re also required to fill out Part ii of the W-8BEN-E to provide further details on the third party.

Line 4. Chapter 3 Status

This section describes the Chapter 3 Status of the entity. In most cases, this will be a Corporation or Partnership. Other options include:

- Estate

- Private foundation

- International organization

- Simple trust

- Foreign government

- Tax-exempt organization

- Central Bank of Issue

Line 5. Chapter 4 Status (FATCA Status)

Chapter 4 is a section in the Internal Revenue Code, which details U.S. tax laws. Line 5 describes the entity’s Chapter 4 Status, or Foreign Account Tax Compliance Act (FATCA) Status.

Chapter 4 Status is important for categorizing individuals and entities, including U.S. residents with offshore investments and foreign entities doing business in the U.S.

Most businesses filling out the W-8BEN-E are Active Non-Financial Foreign Entities (Active NFFEs), unless they are Foreign Financial Institutions such as a bank, insurance, or investment fund. Other categories include:

- U.S. person

- Specified U.S. person

- Foreign person

- Participating foreign financial institution (FFI)

- Deemed-compliant foreign financial institution

- Non-participating foreign financial institution

- Restricted distributor

- Exempt beneficial owner

- Territory financial institution

- Acting non-financial foreign entity (NFFE)

- Passive non-financial foreign entity

Chapter 4 Status will determine which parts of the W-8BEN-E must be filled out in later sections.

Line 6. Permanent Residence Address

This is the foreign entity’s home address.

Line 7. Mailing Address

If your company’s mailing address is the same as your permanent residence address, you can skip this section.

Line 8. Tax Identification Information (Foreign TIN)

Most foreign entities do not have a U.S. tax identification number. In this case, you should fill in the tax identification number (TIN) of your home country. Consult your home tax returns to find the number that local tax authorities have assigned to your business.

Part III – Claim of Tax Treaty Benefits

Part III is intended to elaborate on Chapter 3. You’re only required to check the correct boxes and fill in basic information including country of origin. Key components in this section include:

14a

Check the correct box and fill in the country of origin.

14b

Check the correct box.

15

You’re only required to fill in part 15 if special rates and conditions apply to your entity.

Part XXV – Active NFFE

If you selected Active NFFE in Part I, section 5, you’ll need to fill in Part XXV to provide further details on your Active NFFE status. The important part is to check box 39 which confirms that:

- The entity is a foreign entity

- The entity is not a bank or financial institution

- Less than 50% of the entity’s income from the previous calendar year was passive income

- Less than 50% of the entity’s assets are held for the purpose of producing passive income

Note that Part XXV is only for Active NFFEs. Part XXVI is for Passive NFFEs and is intended for a different entity type.

Part XXX – Certification

This section is short and simple, but it’s essential. Part XXX is the certification which requires you to sign first name and last name. You must also include the date on which the form was signed.

Looking for more information? The IRS provides detailed instructions on how to correctly fill out Form W-8BEN-E.

Best Practices for Collecting W-8BEN-E Forms

If your business works with foreign entities, it’s essential to maintain accurate practices for managing international payments. Your company also has a responsibility to ensure that you have the correct IRS forms and tax paperwork for any foreign entities with which you do business.

In payments to foreign entities, the U.S. company is the withholding agent. Having a clear process for outgoing international transactions helps ensure accuracy and tax compliance. Some strategies include:

- Collecting Digital Forms: Digital tax and ID forms minimize the risk of manual error and make it easy to keep comprehensive records.

- Use Automation Tools: These can help verify data and check that all necessary tax fields have been filled.

- Leverage Tax Software: Minimize the risk of out-of-date information with tax software that automatically notifies you of changes to tax laws and regulations.

Benefits of W-8BEN-E Automation

Automating your W-8BEN-E process reduces the risk of manual error and helps ensure accuracy. It also saves you time, improving the efficiency of your tax processes.

Several key steps in the W-8BEN-E process that can be improved by automation include:

- Collecting correct W8 data on foreign entity suppliers and performing due diligence

- Capturing and filling in all necessary data, eliminating the time and effort of manual entry

- Automatically calculate withholding amounts based on different entity statuses and income types

- Ensure that all fields are filled out accurately

By employing automation in your W-8BEN-E process, you can save time and money by improving efficiency and minimizing error. Complete and accurate filing also helps reduce the risk of a tax audit.

Does the W-8BEN-E Expire?

The W-8BEN-E form can expire. It only lasts until the end of the calendar year when it was signed and then the next three years. It expires at the end of that period.

- For example, a W-8BEN-E form signed in 2022 would be valid for the rest of 2022 as well as 2023, 2024 and 2025. It would expire on January 1, 2026.

Once the W-8BEN-E form expires, a new form has to be filled out by the foreign vendor and submitted to its American employer before any more payments can be processed.

The W-8BEN-E form also expires if any information on the form changes, such as the address of the foreign vendor. Then a new W-8BEN-E has to be filled out and submitted, according to the University of Washington.

Simplify W-8BEN-E Processes with FreshBooks

Form W-8BEN-E is used to gather taxpayer information on foreign entities for use by the IRS. It’s necessary for declaring foreign entity status and for determining tax withholdings and exemptions.

U.S. companies that conduct business with foreign entities are required to collect Form W-8BEN-E, so it’s essential to have effective processes for managing your records. FreshBooks accounting software makes it easy to track and organize your expenditure information and generate detailed financial reports for accurate tax filing. Try FreshBooks free to streamline your W-8BEN-E process today.

Article Sources

- IRS. “Taxation of Nonresident Aliens – International Tax Gap Series” Accessed July 12, 2024.

- IRS. “About Form W-8 BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)” Accessed July 12, 2024.

Reviewed by

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

Accounting for Sales Tax: What Is Sales Tax and How to Account for It

Accounting for Sales Tax: What Is Sales Tax and How to Account for It Business Deductions for the Self-Employed: 12 Overlooked Tax Deduction Tips

Business Deductions for the Self-Employed: 12 Overlooked Tax Deduction Tips Billable Hours: What Are They and How to Calculate Them

Billable Hours: What Are They and How to Calculate Them Is Land a Current or Long-Term Asset? How to Classify Land on the Balance Sheet

Is Land a Current or Long-Term Asset? How to Classify Land on the Balance Sheet Accounts Receivable and Accounts Payable: What’s the Difference?

Accounts Receivable and Accounts Payable: What’s the Difference? Inventory Write-Off: How To Do It With Examples

Inventory Write-Off: How To Do It With Examples