Conversion Method: Easy Steps to Convert from Single-Entry to Double-Entry Accounting

The conversion method involves converting your accounting from a single-entry system to a double-entry system. Small businesses usually start out by using single-entry bookkeeping. This method is a simpler way to track their income and expenses.

That said, double-entry bookkeeping is a more reliable system that growing small businesses need to adopt. This system allows business owners to produce a document called a trial balance that will let you check if your entries are correct.

The conversion method requires making a statement of affairs, posting transactions in accounting software as both a debit and credit and checking your work via a trial balance and income statement. Two separate bank accounts also need to be opened for expenses and income.

- What Is the Conversion Method?

- What Is a Statement of Affairs?

- Steps to Convert Single-Entry to Double-Entry Bookkeeping

What Is the Conversion Method?

The conversion method is the process of converting a business’s accounting from single-entry to double-entry.

New small businesses often use single-entry bookkeeping as a quick and simple way to record their income and expenses. Single-entry bookkeeping only uses three accounts: bank, cash and personal. Reports like a balance sheet, Trial Balance or Income Statements can’t be produced from single-entry transactions.

Small businesses can use the conversion method to take advantage of the double-entry system’s advanced reporting capabilities.

Double-entry bookkeeping is also considered more reliable. Because double entry bookkeeping records each transaction as both a debit and credit, a Trial Balance can be produced that lets a business owner check if the transactions are correct and make sure total income and expenditure balance (match).

What Is a Statement of Affairs?

A statement of affairs is a document that shows the overall financial health of a business. It lists the assets, liabilities and capital of a business. A statement of affairs is prepared at the beginning and end of the financial year so business owners can get a sense of their opening or closing capital i.e. the money a business has to fund its day-to-day operation.

There are two sections in a statement of affairs: the left section is for current liabilities and the right section is for current assets. Opening or closing capital (also called “net assets”) is calculated by subtracting total liabilities from total assets.

Statements of affairs are usually prepared by small businesses that use a single-entry system and only use cash and credit accounts. This means they can’t produce a balance sheet, which is similar to a statement of affairs but used in double-entry bookkeeping. Assets and liabilities must balance (match) on a balance sheet for it to be accurate, which is why it’s considered a more reliable document than a statement of affairs.

Steps to Convert Single-Entry to Double-Entry Bookkeeping

Using the conversion method to take your accounts from single-entry to double-entry bookkeeping can be performed by a small business owner alone. That said, an accountant should look over your work to make sure it’s accurate and any mistakes won’t be compounded over time.

Prepare an Opening Statement of Affairs

A statement of affairs is a document that shows the assets and liabilities of a business within a certain accounting period (for example, year to date). Subtracting total liabilities from total assets determines working capital i.e. the business’ overall financial health.

Prepare your statement of affairs by making a table with two columns: current liabilities on the left and current assets on the right. Then list each.

Liabilities can include:

- Accounts payable (your unpaid invoices)

- Taxes payable

- Loans payable

- Credit cards payable

Assets can include:

- Cash on hand

- Accounts receivable (outstanding invoices)

- Equipment value

- Reimbursable expenses

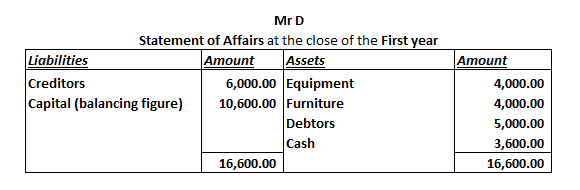

Read more about assets and liabilities to make sure you’ve included everything. You should have a chart like the below:

Your working capital is your assets minus your liabilities, which in the above example is $10,600.

Post All Transactions in a Double-Entry Journal System

Now it’s time to enter your transactions in a double-entry journal system, so go ahead and download or upgrade your accounting software.

First, enter an opening journal entry of your total assets, liabilities and resulting working capital using information from your statement of affairs.

Then, enter all your expenses and sales in your Cash Account.

You’ll also need to prepare the following accounts:

- Total Debtors Account

- Total Creditors Account

- Bills Receivable Account

- Bills Payable Account.

Nominal accounts for expenses and revenue need to be created too using information from the Cash Account. Nominal accounts are temporary accounts that are closed at year end and are restarted at the beginning of a new financial year with zero value.

Divide Your Expenses and Income Bank Accounts

Open two new bank accounts: one for expenses and one for income. This will help keep your accounts straight. Each account will have corresponding credit and debit entries in your accounting system—both in the ledgers and journal.

Run a Trial Balance

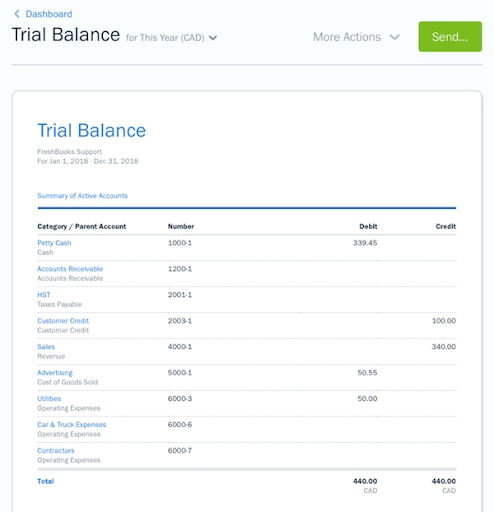

Running a trial balance of your journal and ledger lets you check if your entries are right. A trial balance shows the total of all credits and debits in your business’s accounts. The sum of the credits and debits for each account should match, otherwise you need to go back and check your entries for errors.

Source: FreshBooks

In the above example, the debits and credits are both $440, meaning the trial balance is correct.

Prepare an Income Statement

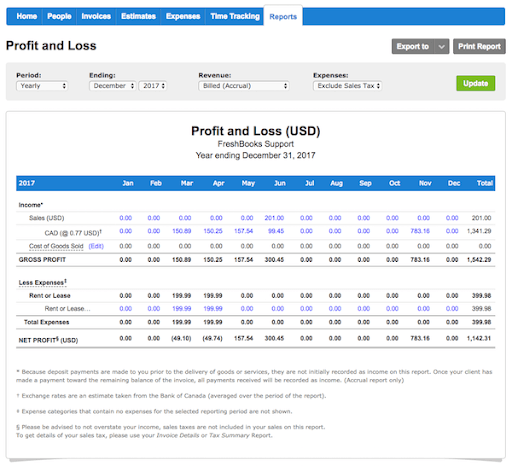

An income statement lets you compare your single-entry and double-entry balances. An income statement is also known as a profit and loss report because it displays your net profit (or net losses).

Check your net profit from your single-entry system against the number reported in your income statement. If the numbers are different, compare your gross profit and total expenses numbers with those in your single-entry system. Then dig deeper into your entries depending on what you find.

Also Read: How to Make Income Statement

The example below shows what an income statement looks like:

Source: FreshBooks

Download a free income statement template to streamline the process and save time when creating your own statement.

Prepare a Balance Sheet

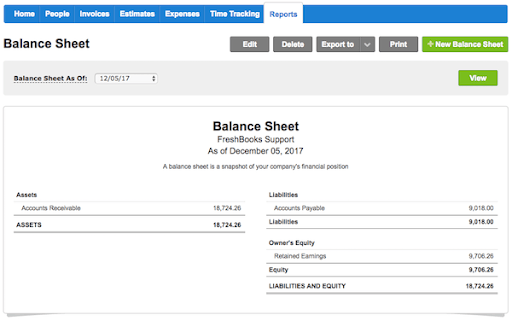

Once your income statement is correct, you can make a final balance sheet.

A balance sheet is used in double-entry bookkeeping—it’s is the equivalent of a statement of affairs (used in single-entry bookkeeping). Both list assets and liabilities but a balance sheet is derived from more complete records so it offers a better picture of a company’s financial position.

Now that you have a balance sheet (such as in the example below) you have an accurate picture of how your company’s doing. And you’ve also successfully converted to a double-entry system—though again, ask your accountant to check your work. Just in case.

Source: FreshBooks

Download a free balance sheet template to efficiently organize your financial data and gain accurate insights into your company’s financial health.

RELATED ARTICLES

What Is Accumulated Depreciation?

What Is Accumulated Depreciation? A Simple Guide to Small Business Write Offs

A Simple Guide to Small Business Write Offs How to Become a Small Business Owner in 7 Steps

How to Become a Small Business Owner in 7 Steps How to Choose the Best Accounting Software for Your Small Business?

How to Choose the Best Accounting Software for Your Small Business? Specific Identification Accounting 101

Specific Identification Accounting 101 What Is an Acid Test Ratio?

What Is an Acid Test Ratio?