How to Be Your Own Accountant in 7 Steps

All businesses, big and small, need an organized, efficient accounting process to ensure steady cash flow, an optimal tax burden, and the company’s overall financial health.

While it’s simple enough for large businesses to hire dedicated teams for their accounting system, the typical small business owner won’t have it so easy. It often falls upon business owners and solo entrepreneurs to do the bookkeeping services for their own businesses, especially when just starting.

Perhaps you’ve got a small business going, and now you’re wondering if you can handle the accounting yourself. In this article, we’ll cover 7 steps to teach you how to do your own bookkeeping, as well as handle any self employed accounting software to make the job easier.

Key Takeaways

- Good accounting comes down to your ability to create and maintain a solid system for financial management, keep organized records, and staying informed on (and compliant with) tax laws and regulations.

- For new start-ups, entrepreneurs, and small businesses of all kinds, FreshBooks is here to simplify your accounting. With boundless features, powerful functionality, and a clean, simple-to-use interface, FreshBooks is here to support the growth of your business.

Table of content

- 7 Steps To Be Your Own Accountant

- Benefits of Being Your Own Accountant

- Other Considerations for Doing Your Own Accounting

- Conclusion

- Frequently Asked Questions

7 Steps To Be Your Own Accountant

1. Learn the Basics of Accounting

First and foremost: if you’re going to be the accountant for your own business, you’ll need to grasp the basic accounting principles. While we could go on forever on various accounting topics, there are a few key points to remember.

First and foremost, understand the purpose of accounting. In essence, accounting is simply balancing your profits (assets) with your expenses (liabilities), ensuring you can make the right decisions to continue to turn a profit. We’ll go more in-depth on this in our section on choosing an accounting system.

An important note for those new to accounting: ensure you never mix business expenses and profits with personal finances—even if you’re the only one working for your company. Mixing business and personal finances can quickly lead to messy, confusing accounts, incorrect records, and potentially a tax audit.

2. Open a Business Bank Account

You want to keep your personal and business banking separate. This may not seem critical initially, but down the road, it will save you a lot of time when you have more business transactions to manage. This is where opening a business bank account becomes important. Banks offer a wide range of accounts specifically for businesses, and some are designed for small businesses with few or no employees.

Before you visit a bank to open an account, it’s best to consider your financial needs first. Look at how many monthly transactions you will have and compare that with what the bank will charge you. If you’re a small business with few deposits or expenses, considering an account that charges you per transaction may be worth considering.

Some banks have business accounts that will waive the monthly fee if you carry a minimum balance from month to month. You’ll also want to make sure you choose the overdraft protection option when needed.

In your meeting with the bank representative, don’t get distracted by offers of business credit cards with rewards or other incentives designed to get you to sign up. You can consider them but decide if they are worth the extra costs involved. What you really want to know is if this bank will offer a convenient service with easy online tools at a reasonable price and can help you in the future with loans or extra credit if you need it.

3. Establish a Bookkeeping System

Are you going to go with a single-entry system of accounting or a double-entry system?

A Single Entry System of accounting is a form of bookkeeping in which every one of a company’s financial transactions is recorded as a single entry in a log. New small businesses usually use this process because of its simplicity, cost-effectiveness, and lack of formal training.

A double-entry system requires a much more detailed bookkeeping process, where every entry has an additional corresponding entry to a different account. Consider the word “double” in “double entry” to stand for “debit” and “credit.” The two totals for each must balance—otherwise, there is an error in the recording.

A double-entry system will provide complete records and allows for the creation of proper financial statements.

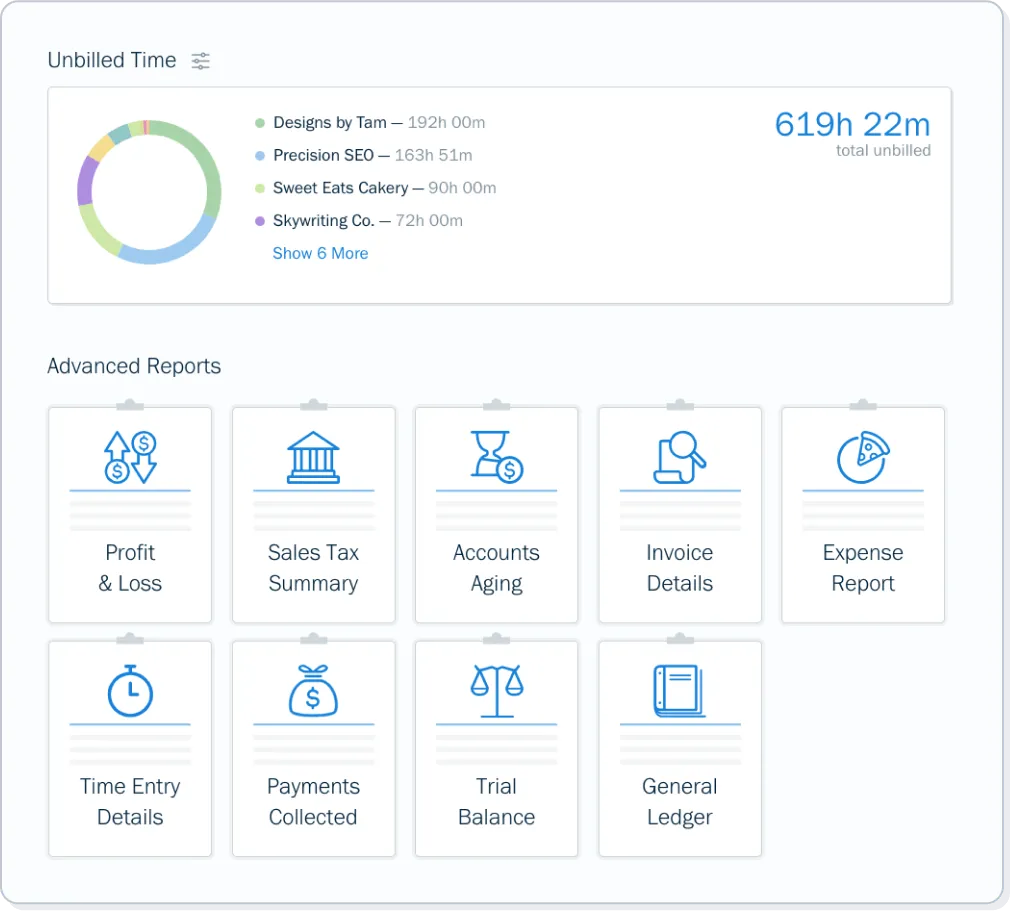

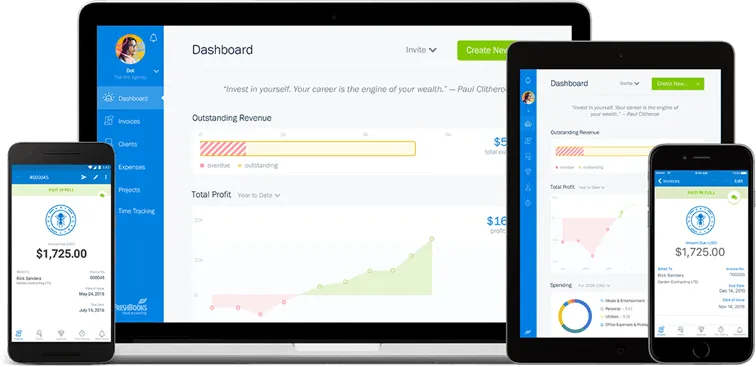

Many software options are available today that make a double-entry accounting system easier to manage. One great example is FreshBooks, which makes double-entry bookkeeping simpler, faster, and easier to stay organized. It’s a cloud-based accounting software with countless powerful features, from financial reports to assist with prepping tax returns—perfect for small businesses.

4. Categorize Your Expenses

Categorizing expenses will help keep your company organized for budgeting purposes and total the expenses you can write off at tax time.

Popular category headings you can create include:

- Advertising Expenses

- Business Vehicle(s)

- Payroll

- Employee Benefits

- Meals & Entertainment Expenses

- Office Expenses

- Office Supplies

- Professional Services

- Rent, Utilities & Phone

- Travel Expenses

Due to the introduction of the Tax Cuts, and Jobs Act by the Trump administration in late 2017, the laws regarding tax deductions for meals and entertainment expenses for businesses in the United States have changed. Business owners can still deduct 50% on meals if the expense meets certain conditions. Entertainment expenses, such as sporting events or concerts, no longer qualify. The act went into effect on January 1, 2018.

5. Establish a Budget

Now that you’ve categorized the expenses for your business determine your budget for the year. This is particularly important if you have employees authorized to make purchases for your company. This is so that they understand your expectations and don’t overspend.

Determine a total figure, then break it down and assign amounts to the categories listed in the previous section. In the first year or two of business, these numbers will likely need to change a lot. But establishing a budget at the outset gives you a great place to start, informs your staff of spending limits, and allows you to better plan for the future.

6. Use Accounting Software for Invoicing and Payroll

Invoicing and Payroll are two of your most important accounting processes. Let’s have a look in detail.

Invoicing

You will want to ensure that you have a proper system in place for invoicing. The cash your business generates from invoices paid by clients will keep your company going.

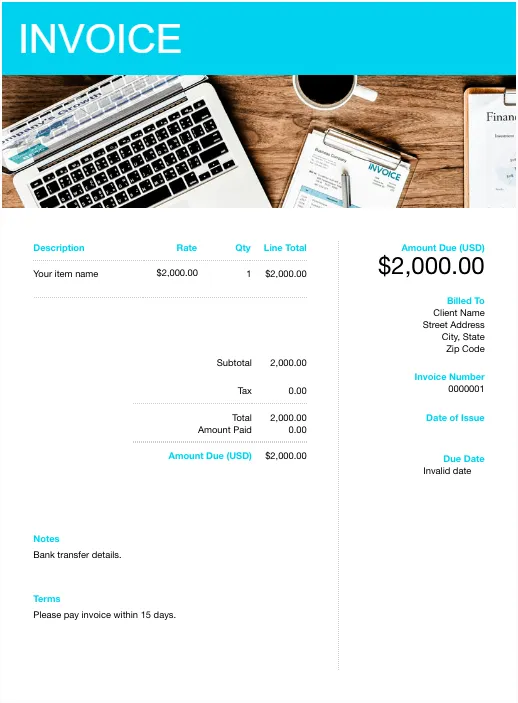

Today, software and app solutions will allow you to build an invoice template with your company’s standard information. This software automatically generates a new invoice number every time you create an invoice, set payment terms, and notifies you when a client’s payment is overdue. The top ones offer online or phone support too. Read over the first invoice you issue a few times before submitting it to the client to ensure it’s a good template going forward.

Payroll

Payroll is simply the process by which you pay your employees. A reliable payroll process is vital for two reasons. The first is that depending on the size of your business, it could be your largest regular expense. Second, a proper payroll system will satisfy the employees you hire. Employees will look for work elsewhere if you do not pay consistently and accurately. Getting a payroll system in place at the outset can save you years of grief.

Typically, a payroll system will deduct taxes from each check before the employee is paid. These taxes include Social Security, Medicare, and federal and state income taxes (some states, like Florida, do not deduct income tax).

Because payroll can be a time-consuming process, most businesses today use a software system that handles the tax deductions and directs the net amounts into employees’ bank accounts automatically. Depending on the software, some systems can also calculate wages for hourly paid staff and generate summaries based on the business owner’s needs. Some of the top accounting software options are:

- FreshBooks

Lightweight and simple, yet flexible and functional, FreshBooks is one of the most preferred professional services accounting software options for accountants working at all scopes. With features like frequently updated insights, automatic compliance checking, and a customizable Chart of Accounts, FreshBooks has everything business owners need to handle their own bookkeeping confidently.

- QuickBooks

QuickBooks is another popular accounting software option thanks to its wide range of features, deep insights, and other useful tools. Like many accounting software options, they offer automatic record organization, balance sheets, cash flow statements, and other important financial statements.

- Gusto

Unlike some of the other accounting software on this list, Gusto is a more specialized program focusing mainly on payroll rather than accounting as a whole. It’s an excellent tool for managing your payment to staff, organizing employee benefits, and coordinating with HR, but may not be the right call for small business owners looking for an all-inclusive accounting software solution.

- Paychex Flex

Like Gusto, Paychex Flex is primarily focused on employee payroll and benefits, as well as HR services. It can be a powerful option for small businesses with a growing team, particularly if you’re planning an expansion of your small business in the near future.

- OnPay

OnPay is designed to allow accountants to ‘partner’ with them, allowing them to handle employee payroll, benefits, and HR services via their online platform. As with Gusto and Paychex, this can be a useful tool if you’re a small business owner, but it may not be as useful for solo entrepreneurs or those who run a sole proprietorship.

7. Paying Your Taxes

Last but not least is keeping your records organized, accurate, and 100% compliant. The more work you put into developing an effective accounting system, the less time you’ll spend stressing out around tax season. Most accounting software (such as FreshBooks) has integrated functionality to help you keep better tax records and reduce your tax burden. It should also be noted that accounting software can save you hundreds, if not thousands, of dollars if you hand your accounts off to a third party for tax prep. Tax preparation fees can add up with disorganized records, so consider quality software an investment.

Benefits of Being Your Own Accountant

There are countless benefits of being your own accountant. These benefits for small business owners include:

- Reduced costs – First and foremost, you should consider the potential savings of doing your own bookkeeping. Accountants can be costly, even if you only hire them periodically versus using an in-house staff member. Doing your own accounting can help you save money over time, an essential consideration if you’re a small business owner.

- Work at your own pace – Accountants tend to be fast and efficient but also busy. If your accountant is swamped with other clients, your tasks might not get done as quickly as you’d like. When doing your own accounting, however, you can work at your own pace and meet your own self-imposed deadlines.

- Familiarity with the business – Lastly, you have knowledge and expertise in your industry that an accountant simply won’t. This can help out with important business decisions regarding cash flow, your business plan, and general day-to-day operations.

Other Considerations for Doing Your Own Accounting

The tasks of an accountant vary, but typically they oversee and work in the following areas: data management, financial analysis, and consultation, financial reports, and regulatory compliance. What we have outlined above is the basics for being your own small business accountant, but you may find you will need to contact and enlist the help of a professional accountant as your business grows.

Conclusion

Whether you’re a solo entrepreneur or a small business owner, you can benefit from being your own accountant. With that said, it’s vital to ensure you’re doing it the right way to avoid wasted time and money, as well as to prevent the risk of financial or legal trouble.

To be the best you can be at accounting, it’s important to use all the best tools at your disposal. Try FreshBooks if you’re looking for a powerful yet easy-to-use solution for your accounting needs. Our cloud-based accounting software has all the features you need to handle your books, saving you time, money, and stress.

Finances don’t have to be tricky when you have the right tools—click here to learn more and try FreshBooks for free!

FAQs on How to Be Your Own Accountant

More questions on being the accountant for your own business? Here are some frequently asked questions.

Do I need an accountant, or can I do it myself?

This all depends! Are you confident with numbers, math, and organization? Are your business’s finances manageable for just a single person? Do you plan to use online accounting software to take care of the accounting basics and lighten the load of financial management? If your answer to these questions is yes, then you might be able to be your own successful accountant!

Can you call yourself an accountant without a CPA?

Yes. Technically speaking, you don’t need to have formal credentials of any kind to advertise yourself as an accountant. With that said, however, the knowledge and expertise of CPAs (aka certified public accountant) are undeniable, so you should consider investing in the services of one if possible.

Is a personal accountant worth it?

This depends greatly on the volume of accounting work your business requires. If it’s becoming too much to handle on your own as a business owner, it might be time to invest in a personal accountant for the company, even if it’s just on a weekly or monthly basis.

Can an accountant be self-taught?

Yes! It’s entirely possible to learn accounting to run your own businesses and eventually pass off the responsibility when your company grows. You can be a self-taught accountant by educating yourself and using handy accounting software tools.

How much does a CPA cost?

CPA fees can range greatly depending on their location, experience, and the scope of a certain accounting job. However, the average wage for a CPA’s financial management services in the United States sits at around $175 per hour.

RELATED ARTICLES

CPA vs Accountant: What Is the Difference?

CPA vs Accountant: What Is the Difference? How Much Do Accountants Charge for a Small Business? It Depends on Your Needs

How Much Do Accountants Charge for a Small Business? It Depends on Your Needs Accounting and Finance: Why Is It Important to Your Business?

Accounting and Finance: Why Is It Important to Your Business? What Is an Unfavorable Variance and How to Avoid It?

What Is an Unfavorable Variance and How to Avoid It? Are Retained Earnings Taxed for Small Businesses?

Are Retained Earnings Taxed for Small Businesses?