Tax Wedge: Definition, Meaning & Example

Tax wedge is defined as the difference between the entire labor cost for the employer and the net (after taxes) pay of its employee.

Read on as we learn more about tax wedges, and how they’re calculated.

Table of Contents

KEY TAKEAWAYS

- A tax wedge is a difference between your gross income amount and your net income. Your net earnings are calculated after you have had any relevant taxes deducted.

- In many progressive tax systems, tax wedges may continue to increase marginally if income continues to increase at the same time.

- It has been argued that a tax wedge can create inefficiencies in the market. This happens due to an artificial shift in the true and actual price of various goods and services, as well as costs of labor.

What Is a Tax Wedge?

A tax wedge refers to the amount of difference between your before-tax and after-tax wages. Tax wedges also commonly refer to potential market inefficiencies created by new taxes getting levied on goods and services. As a result of taxes, customers pay more for goods and services and suppliers receive less in return.

New taxes can cause a shift or fluctuation in supply and demand, which leads to deadweight losses.The losses to buyers and sellers exceed the revenue raised by the government. This fall in total surplus is called the deadweight loss. Tax wedge is a way to measure the amount of money the government receives in return for taxation.

The average tax wedge will measure how much tax on labor income could potentially discourage possibilities of employment. Tax wedge on labor income is measured in a percentage of the labor’s actual cost.

The difference between before and after taxes earnings is called a tax wedge due to the fact that taxes create a “wedge” between the price consumers pay and the price producers are paid for a given good.

How Does a Tax Wedge Work?

A tax wedge is essentially any difference between before-tax and after-tax earnings. The Organization for Economic Co-operation and Development (OECD) explains the way a tax wedge as:

“It’s the sum of personal income tax rate, any employer and employee social security contributions, plus any payroll taxes, minus any relevant benefits that the employee received, as a specific percentage.”

Tax wedges can shrink as taxes start to decline and an individual’s take-home pay increases. On the other side, a tax wedge will continue to grow when an employer’s taxes increase.

How Is a Tax Wedge Calculated?

Calculating a tax wedge is simple to do as long as you have the right information. You’re going to need to know your before-tax wages as well as your after-tax wages.

- Before-tax wages — These are the wages that you earn before any deductions or taxes are taken out (gross pay)

- After-tax wages — These are the wages you have earned once all of the relevant taxes are deducted (net or take-home pay).

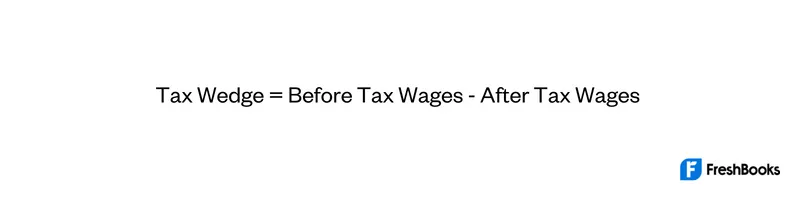

The formula to calculate the tax wedge would look like this:

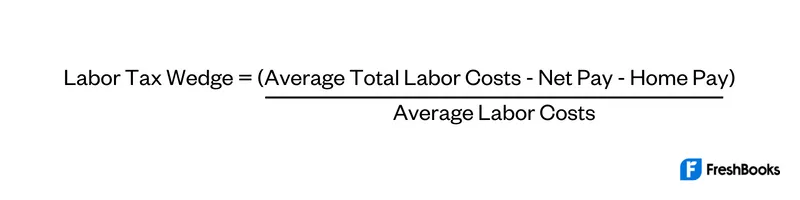

If you wanted to calculate a tax wedge based on labor costs, you can use this formula instead:

Example of a Tax Wedge

A tax wedge can increase if an employee’s income continues to increase. When this happens, it can reduce the marginal benefits, leading to an employee potentially looking for a new employment. In this instance, a tax wedge can help determine whether or not higher payroll taxes are affecting the hiring process.

Let’s take a look at an example.

Jimmy earned $200,000 in salary in the previous year. With this income level, he falls into a 20% federal tax bracket as well as a 10% state and local tax bracket. This means that he paid roughly $40,000 in federal taxes and $20,000 in state and local taxes.

If taxes increase by 10 percent and 5 percent, Jimmy would only be left with roughly $110,000 in salary. The increase in taxes and the substantial tax wedge might lead Jimmy to look for new employment somewhere else.

Summary

A tax wedge is the difference between gross and after-tax income. Understanding how the tax wedge works can provide insights into the financial implications of new taxes placed on products or services.

In some treaty countries, the tax burden grows as an employee’s income rises. As a result, due to the decreased marginal value of working, employees frequently put in fewer hours than they would have otherwise.

You can use the tax wedge information in order to evaluate how increasing payroll taxes may affect the hiring process.

FAQs About Tax Wedges

A tax wedge in economics refers to the ratio between the total amount of taxes that a single worker pays. The changes in taxes can have financial implications on supply and demand and products and services. Ultimately, this can affect the economy.

The tax wedge quizlet has questions and answers to educate you on the tax wedge.

Depending on the size of the tax wedge, income tax cuts can have a big effect on the overall gross domestic product (GDP) and investment as a whole. One percentage-point cut in the income rate of tax can increase the GDP by almost 0.80 percent.

The tax wedge and elasticity often coincide with each other.

Share: