Experience Rating: Definition & Overview

When you operate a business, there can be different types of insurance you might need to get. It can all depend on the type of business and the industry but having proper insurance in place helps protect your business and your employees.

Insurance providers take into account a wide range of circumstances when calculating policies and experience rating is one of those calculations. Read on to learn all about experience rating, including how it’s used, its benefits, and how to calculate it.

Table of Contents

KEY TAKEAWAYS

- Experience ratings take past losses and comparable policyholders into account when calculating premium rates. The higher risk an insured party is, the higher their premium will be.

- These ratings are mainly used in worker’s compensation insurance. They’re used sparingly in other forms of insurance.

- Experience modifiers are used to determine whether the premium rates will increase, decrease or stay the same based on the company’s loss history.

What Is An Experience Rating?

An experience rating is a calculation used mainly by insurance providers within worker’s compensation insurance. It compares an insured party to other insured parties with similar traits to calculate and assign a current premium. It also takes your previous claims into account. The idea behind it is that your past loss experience will determine your future loss experience.

For example, if you run a small-sized auto repair shop your business would be compared to other small-sized auto repair shops.

This helps insurance companies determine which customers are more likely to file claims which creates losses for them. To balance it out they charge a higher premium to customers that have a higher risk of filing claims. By the same principle, employers who are less likely to file a claim may see a lower insurance premium.

While experience ratings are more commonly used within worker’s compensation insurance, they’re also used in other insurance sectors such as

- General liability policies

- Professional liability

- Commercial auto liability

Not only does this method help insurance providers identify high-risk policyholders, but it also helps them ensure that they’re collecting enough of a premium to cover future claim costs without passing off the additional cost to its less risky policyholders.

How an Experience Rating Is Used

Based on the insured party’s previous loss experience the premium is adjusted through the use of an experience modifier. The experience modifier is calculated each year and is usually effective on the date you started your policy. Modifiers can be one of three values:

- Less than one

- Greater than one

- Equal to one

The experience modification factor associated with your policy determines the premium you pay. If you have an experience modifier equal to one, it indicates that your loss history is average and isn’t better or worse than other businesses like yours. So your insurance premium stays the same.

A modifier that’s less than one means that your loss history is better than other comparable businesses. Having this type of modifier is great news since it results in an annual premium reduction.

Lastly, an experience modifier that’s greater than one means that your business’s loss history is higher than average. This increase in experience rating is when you’ll see an increase in premiums.

For worker’s compensation insurance, three years of loss experience history prior to your most recent expired policy period is used to find the experience modifier for a policy.

For example, if your worker’s compensation policy ranges from July 1st, 2020/2021 then the experience modifier that applies to your policy considers the period of time from July 1st, 2017 through July 1st, 2019. Claims after that period aren’t included in the modifier since there’s a possibility that they’re still open.

Benefits of Experience Rating

Customers with a higher experience rating and subsequently a higher premium might have a hard time seeing the benefits behind an experience rating. However, the changes it can initiate within a company are helpful. Experience ratings come with the following benefits for both policyholders and insurance companies:

- High-risk companies aren’t stuck with a high premium forever. Improvements to safety policies and working conditions can help lower their premium in the future.

- It creates an incentive for employers to avoid accidents in the workplace by implementing a safety program or risk management practices.

- Encourages employers to have injured workers return to work as soon as their recovery permits.

- Premiums are charged proportionally to the estimated future claim costs. This creates a degree of fairness within the system since each insured party pays a premium proportional to their experience modifier.

- Helps the insurer collect the appropriate amount of premiums to cover the risks they’re insuring against.

Experience Rate Calculation

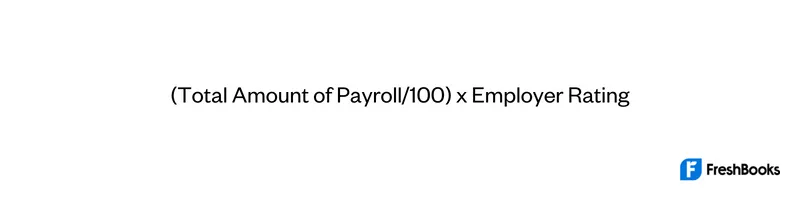

To determine the workers compensation premium the following formula would be used:

All employers are assigned an employer rating of 1 initially. This rating will change based upon factors such as number of accidents and use of the insurance overall. To calculate the rating similar companies of similar sizes are grouped together. The information is all compiled together. It is then compared to determine the average number and amount of claims. Once that is determined the ratings are assigned based on where the company lies regarding that average. If below the average when all factors considered the employer rating would fall below 1 whereas if above the average the rating would increase.

For example, let us say that payroll for the year came in at $300,000 and the company was average and maintained a 1 as the employer rating the calculation would look like this:

($300,000/100) x 1 = $3,000 in total worker’s compensation insurance premiums. Of course, this number is looked at from year to year and may be adjusted based on payroll as well as the number of claims and where the company falls within the average when determining employer rating.

Summary

Overall, experience rating is a method used by insurance providers that allows them to incentivize businesses to build strong risk management practices and safety procedures to reduce the number of worker’s compensation claims.

By using experience modifiers, the insurance company is able to issue premiums that are equivalent to the level of risk for each policyholder. This also allows them to use past losses to inform them of the potential for future costs and collect the appropriate amount of premiums to cover potential losses.

FAQs About Experience Rating

Community rating evenly distributes the risk and insurance premium across a community of people. With community rating, everyone pays the same regardless of their individual risk factors. Experience rating is the opposite. It bases the premium on the risk level of the insured party. So if you’re high risk, you would see a high premium and a low-risk policyholder would see a lower premium.

An experience rating worksheet is issued by the NCCI that breaks down how your experience modifier was calculated.

Yes, experience rating is legal and only applies to businesses that meet their state’s eligibility requirements. The practice is supported by the National Council of Compensation Insurance (NCCI) as well as state insurance bureaus.

Share: