Zero Coupon Bond: Definition, Features & Formula

When it comes to different types of investments there can be a range of important aspects to know and understand. There are so many different kinds of securities that it can be difficult to stay on top of everything. You have probably heard of bonds before, but what about a zero-coupon bond?

How do these work and is there anything important that you need to be aware of? This guide covers everything you need to know, from what it is to the formula, features, risks, and more!

Table of Contents

KEY TAKEAWAYS

- A debt security instrument that doesn’t pay interest is known as a zero-coupon bond.

- Zero-coupon bonds are traded at significant discounts and yield their entire face value (par) when they mature.

- A zero-coupon bond’s return is calculated as the difference between the purchase price and par value.

What Is a Zero-Coupon Bond?

A zero-coupon bond is a debt asset that trades at a big discount and earns money when redeemed for its full face value at maturity but does not pay interest.

A zero-coupon bond is also known as an accrual bond or a discount bond.

Some bonds are issued as zero-coupon securities right away, while others become zero-coupon securities after being decoupled from their coupons and repackaged as zero-coupon securities by a financial institution. Zero-coupon bonds are more prone to market fluctuations than coupon bonds because they deliver the entire payment at maturity.

Zero-Coupon Bond Price Formula

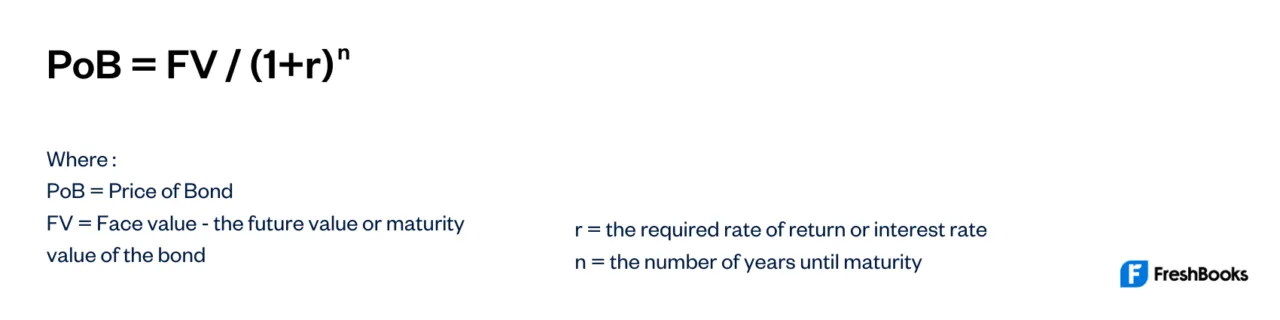

When pricing a zero-coupon bond, you can use the following formula:

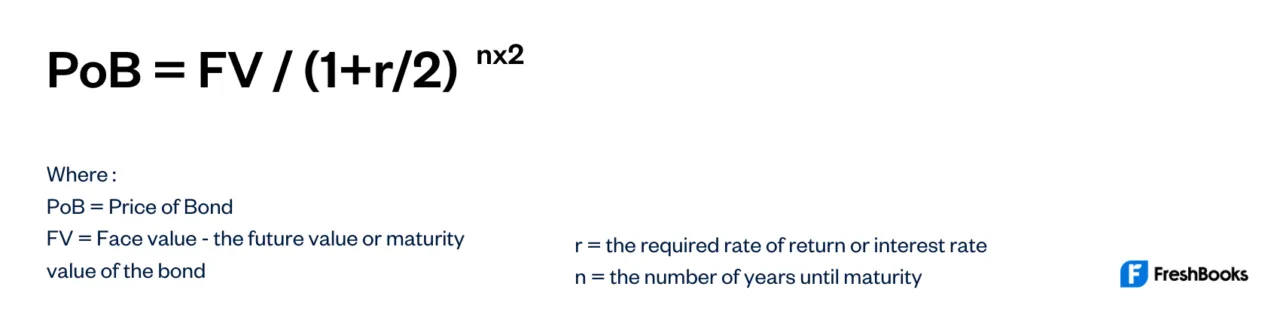

The interest rate is assumed to be compounded annually in the formula above. Zero-coupon bonds are actually compounded every two years on average. In this situation, you would want to use the following formula:

The only noticeable differences between the formulas above are the division of the desired rate of return (r) by two and the multiplication of the number of years till maturity (n) by two.

Since the bond compounds every six months, you need to double the number of years until maturity by two and divide the needed rate of return by two. This helps to account for the total number of times the bond will compound.

Zero-Coupon Bond Features

Zero-coupon bonds are debt obligations with a lending period without any mandatory interest payments or coupons. Instead, one may consider the difference between the bond’s face value and current market price to be interest earned.

A zero-coupon bondholder receives a single lump sum payment that includes the original principal and any accumulated interest whenever it matures and is due.

A corporate or governmental entity can raise capital by issuing bonds. Investors buy bonds when they are issued, effectively lending money to the issuing corporation. Throughout the bond’s existence, the investors receive a return in the form of semi-annual or yearly coupon payments.

The bondholder receives payment equal to the bond’s face value when the bond matures. A corporate bond’s par value, also known as face value, is normally set as around $1,000. A corporate bond can be purchased for less than its face value if it is issued at a discount. For instance, an investor will get $1,000 if they buy a bond at a discount of $920. The investor’s earnings or return for owning the bond is the $80 return plus any coupon payments they may have received.

Zero-Coupon Bond Risks

Zero-coupon bonds have the pricing sensitivity to the current market interest rate conditions as one disadvantage.

Interest rates and bond prices are inversely related to one another, so when there are declining interest rates, the bond prices will rise. And when interest rates rise, the bond prices drop.

The climate for interest rates at the time affects how much zero-coupon bonds cost, which tends to change for example if they are subject to greater volatility.

For example, if interest rates increased, the zero-coupon bond would lose its allure in terms of returns. The returns to the bondholder must be reduced until the bond’s yield is equal to that of roughly equivalent debt securities.

Not all bonds, however, get coupon payments. Bonds with a zero coupon are those that do not. These bonds are issued at a significant discount and, when they mature, pay back the par value. The investor’s return is calculated as the difference between the purchase price and par value. The investor will be paid the amount of their initial investment plus interest that has been accrued at a specified yield and compounded semi-annually.

Reinvestment risk is the possibility that a bondholder won’t be able to reinvest bond cash flows at a pace that matches the needed rate of return on the investment. The only fixed-income investment that is free of investment risk and does not require regular coupon payments are zero-coupon bonds.

Interest rate risk is the possibility that changes in interest rates will cause the present value of an investor’s bond to decrease. All forms of fixed-income investments are subject to interest rate risk, which is important when an investor decides to sell a bond before it matures.

Zero-Coupon vs Traditional Coupon Bonds

Traditional coupon bonds with periodic interest payments have various advantages when compared to zero-coupon bonds, including being a reliable source of income for the bondholder.

Lending is further de-risked by the interest payments from a conventional bond. This is done by raising the maximum possible loss floor. Traditional bonds also offer reliability and. punctual interest payments

In contrast, the return to the bondholder for zero-coupon bonds is equal to the difference between the face value and the bond’s purchase price. Zero-coupon bonds are bought at significant discounts from their face value due to the lack of coupon payments.

Because the rate of return must be high enough to offset the risk of capital loss, the discount on the purchase price is based on the “time value of money.”

When the zero-coupon bond matures, or when it is due, the bondholder is entitled to a lump-sum payment that is equal to the principal invested plus interest that has accrued. Therefore, the purchase price and face value are the only two cash flows that are present with zero-coupon bonds.

Example of a Zero-Coupon Bonds

Let’s say that Investor X is looking to purchase a zero-coupon bond with a face value of $10,000. This bond has 5 years to maturity and an interest rate of 5% which is compounded annually.

Using the annual formula above, let’s take a look at what price Investor X will pay for the bond:

PoB = $10,000 / (1+0.05)5 = $7,835.30

So the price that Investor X will pay for the bond is $7,835.30

Let’s now use the same example but instead, use the semi-annual compounding formula:

PoB = $10,000 / (1+0.05/2)5 x 2 = $7,812.00

So using this formula, the current price Investor X will pay today for the bond is $7,812.00.

Summary

Zero-coupon bonds do not pay interest and are traded below their face value. Zero-coupon bonds are similar to other bonds in that they do contain various types of risk because they are vulnerable to interest rate risk if they are sold before maturity.

FAQS About Zero-Coupon Bond

Bonds with zero coupon rates do not accrue interest throughout the course of their lifetime. Instead, buyers of zero-coupon bonds pay a significant discount over the bonds’ face value, which is the sum they will get when the bond matures or is due.

Any investor can purchase the many different kinds of zero coupon bonds in the secondary markets.

The payment of interest – also referred to as coupons – is what distinguishes a regular bond from a zero-coupon bond. A zero-coupon bond does not pay interest to bondholders, in contrast to a conventional bond that does.

Due to the average maturity of zero-coupon bonds being around 10 years or more, a sizable portion of the investor base has longer-term expected holding periods.

The holding term must be consistent with the investor’s objectives because the profit to the investor is not realized until maturity. This is when the bond is redeemed for its full face value

Share: