Z-Score: Definition, Formula & Importance

In 1986, American finance professor Edward Altman developed a model that was used to predict whether a business will go bankrupt in the next two years.

This model became known as the Z-score.

But what exactly is the Z-score? And what is the formula used to calculate it?

Read on as we find out.

Table of Contents

KEY TAKEAWAYS

- A score’s connection to the mean within a group of scores is statistically measured by a Z-Score.

- In finance, a Z-score can show a trader whether a value is normal for a given data collection or not.

- Generally speaking, a Z-score that is below 1.8 indicates that a business may be on the brink of bankruptcy. While a number that is around 3 indicates that a business is in good financial standing.

What Is a Z-Score?

A Z-score is an indicator of how closely a value relates to the mean of a set of values. Z-score is quantified by the standard deviations from the mean. The mean score and the data points score are equal when the Z-score is zero. A Z-score of 1.0 indicates a result that is one standard deviation from the mean. Z-scores are binary, with a positive value denoting a score above the mean and a negative value denoting a score below the mean.

Z-scores within the financial sector can be described as measures of the variability of an observation that traders can use to gauge market volatility.

The Z-score can also be known as the Altman Z-score model.

Formula to Calculate Z-Score

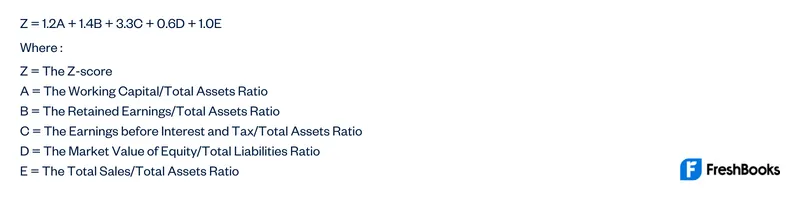

The formula that is used to calculate Z-score is based on five different key financial ratios. It relies on the information that can be found in the 10-K report. It improves the model’s accuracy when calculating a company’s financial health and the likelihood of bankruptcy.

The formula can be written as follows:

Why Is Z-Score Important?

The Z-score is important because it lets statisticians and traders know whether a score falls within the norm for a given data set or deviates from it. Analysts can also modify scores from multiple data sets using Z-scores to create scores that are more accurately comparable to one another.

Because they allow for a comparison between two scores that do not belong to the same normal distribution, z-scores are significant. They are also employed to determine the likelihood that a z-score will occur inside a normal distribution. A negative z-score indicates that the raw data is smaller than the mean. The raw score is higher than the average if the z-score is positive.

Among Z-scores benefits are:

- A z-score transformation takes into account the mean value as well as the variability of a group or raw scores.

- Even though the raw data came from various tests, it is still possible to compare them.

How Does Z-Score Work?

The Z-score method was created and published by New York University professor Edward Altman in the late 1960s. It was brought in as an alternative to the lengthy and occasionally perplexing procedure investors had to go through to ascertain how close to bankruptcy a company was.

The Z-score works by being the result of a credit-strength test that is used to predict whether a publicly traded firm will file for bankruptcy. Five important financial ratios that may be found and calculated from a company’s annual 10-K report form the basis of the Z-score.

What Are the Methods to Calculate a Z-Score?

The method that is used to calculate a Z-score is by using the formula that we have laid out above.

You may find out how many standard deviations you are from the mean by looking at the z-value. When it comes to interpreting the results of this calculation, you can use this as a marking measure:

- A z-score of zero indicates that a value is on the mean. This would indicate that the business is neither heading for bankruptcy or thriving.

- A greater raw score than the mean average is indicated by a positive z-score. A z-score of +1, for instance, indicates that the value is one standard deviation above the mean and is in a healthy financial position.

- A low z-score indicates that the raw score is under the mean average. A z-score of -2, for instance, indicates that the value is two standard deviations below the mean and is in financial trouble.

What Are the Financial Ratios of the Z-Score?

The five financial ratios that are used in the calculation of the Z-score are as follows:

- Working Capital/Total Assets

- Retained Earnings/Total Assets

- Earnings Before Interest and Tax/Total Assets

- Market Value of Equity/Total Liabilities

- Sales/Total Assets

Example of Z-Score

Let’s say that an investor wants to gauge the financial stability of Company X to determine whether or not they will invest. The investor would use the five financial ratios that make up the Z-score calculation and put them into the Z-score formula.

Once this is done, the investor sees that Company X has a Z-score of -1. This would indicate to the investor that there is a greater than average chance that Company X will file for bankruptcy in the near future. Meaning an investment may be unwise.

Summary

The Z-score is a useful financial stability measure that can be used by investors, stakeholders, as well as business owners.

It’s crucial to remember that the Z-score needs to be calculated and evaluated carefully. This is because the metric is susceptible to dishonest accounting techniques and can be changed by owners who want to hide or falsify their financial data.

As with any ratio, the Z-score should be used alongside other measures to get a clearer picture.

FAQS on Z-Score

In data analytics, the Z-score is a statistical indicator that indicates how disconnected a data item is from the rest of the dataset.

0 is used as the mean and indicates average Z-scores. Any positive Z-score is a good, standard score. However, a larger Z-score of around 3 shows strong financial stability and would be considered above the standard score.

A negative Z-score value is a bad sign. Negative scores will indicate that there is a greater than average chance that the company will file for bankruptcy within the next two years.

Share: