Sustainable Growth Rate (SGR): Definition, Formula & Example

Sustainable Growth Rate is a measurement that indicates how fast an organization can continue growing without overextending its resources. It’s an indicator of the potential of a business to grow in the long term without negative impact on employees, customers, suppliers, and other stakeholders.

The SGR calculation helps businesses monitor their growth rate so they know when it’s time to make changes or pause to reassess. A high growth rate for your business can be a good thing.

But it could also indicate that your company is overextending its resources and risking negative impact in your future life cycle.

Read this article to learn more about sustainable growth rate (SGR) and how you can use it to assess your business’s current state and future potential growth.

Table of Contents

KEY TAKEAWAYS

- Choosing the right SGR can help ensure that your business maintains the right level of growth and doesn’t overextend itself.

- If your growth rate is too high, your business may face challenges in the future.

- If your growth rate isn’t high enough, your business may not be able to keep up with the competition.

- A mix of sales and a mixture of debt can sometimes provide a good balance for sustainable growth.

What Is the Sustainable Growth Rate (SGR)?

A sustainable growth rate is the rate at which a company’s sales or revenues can grow without increasing its expenses or negatively impacting its resources.

In other words, a sustainable growth rate is the rate of growth that a company can sustain for an extended period of time without exhausting its resources.

The sustainable growth rate is calculated as a percentage—in other words, the percentage amount that your sales or revenues increase each year. This can give you an idea of how fast your business is growing.

A sustainable growth rate is important because it helps you gauge whether your business is growing too quickly or too slowly.

A higher rate typically indicates health revenue growth and a good rate of earnings. Your sales level and return on equity should be good. It’s also likely that you have high-margin products. Return on equity refers to dividing shareholder equity by your business’s net income.

If you have a lower sustained rate, it could mean you need additional financing to sustain future growth. If you have to take on additional debt, your financial health could be in jeopardy.

You need to go back to the drawing board and map out some long-term planning. While you can’t account for future economic conditions, you can adjust your sales efforts to be sustainable.

Why Is Sustainable Growth Rate Important?

A sustainable growth rate is an important indicator of the health of your business. A high sustainable growth rate shows that customers are responding to your products and services, and that your organization is efficient.

A low growth rate, on the other hand, could indicate that your customers are uninterested in your offerings, or that you’re inefficiently managing your organization. A low growth rate could eventually result in reduced revenue or even bankruptcy.

Sustainable Growth Rate (SGR) Formula

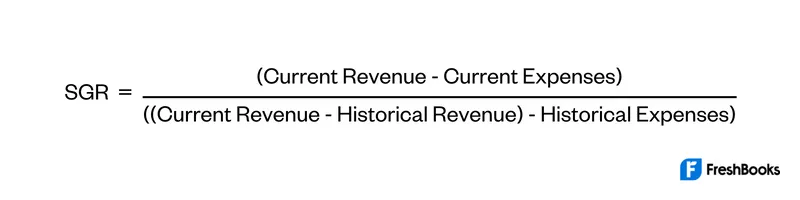

The sustainable growth rate formula is a ratio that compares your current growth rate against your historical growth rate. The ratio is calculated as the percentage difference between your current revenues and expenses and the percentage difference between your current revenues and historical revenues.

Example of Sustainable Growth Rate

For example, let’s say your company’s current total revenues are $2 million and your current total expenses are $1.6 million. Your historical revenues are $1.8 million, and your historical expenses are $1.5 million.

This gives you the following numbers:

Current revenue – current expenses = $2,000,000 – $1,600,000 = $400,000

Current revenue – historical revenue = $2,000,000 – $1,800,000 = $200,000

Current expenses – historical expenses = $1,600,000 – $1,500,000 = $100,000

Plug these figures into the sustainable growth rate formula and you’ll get a sustainable growth ratio of 19%.

SGR = (Current Revenue – Current Expenses) / ((Current Revenue – Historical Revenue) – Historical Expenses) SGR = ($2,000,000 – $1,600,000) / (($2,000,000 – $1,800,000) – $1,500,000) SGR = $400,000 / $200,000 SGR = 19%

Limitations of Using the SGR

Using the SGR to measure your growth rate is useful, but it’s not perfect. The sustainable growth rate formula is based on averages for a given sector. This means that it might not be entirely accurate for every company within that sector.

The SGR formula is also based on three factors that may or may not accurately reflect your organization’s current situation. It’s important to remember that the sustainable growth rate formula is based on averages for a given sector.

This means that it might not be entirely accurate for every company within that sector. The SGR formula is also based on three factors that may or may not accurately reflect your organization’s current situation.

Summary

The sustainable growth rate (SGR) is a formula that measures a company’s growth rate and predicts whether they can sustain that rate in the long term.

The formula uses three factors to determine a company’s SGR: current revenue, current expenses, and historical revenue.

SGR isn’t perfect and is based on averages, but it can be a helpful indicator of how quickly your business is growing and whether it can sustain that growth in the long term.

FAQs About Sustainable Growth Rate

SGR can vary depending on the company. One way to understand what a healthy rate for your company is to compare it to the industry average.

There’s no set formula for figuring out what a sustainable growth rate for a business is but you can look at your competitors and industry average to get an idea.

A negative SGR could be an indication that your business is growing too fast and needs to slow down. There are a few different reasons why your business may have a negative SGR.

Negative growth is usually a result of a deficit in cash flow or a low profit margin. A low profit margin could indicate that you’re trying to sell at a price that is lower than what the market will pay.

Internal growth rate (IGR) is a measurement of how quickly your company can grow internally without adding any new employees or expanding the business.

Sustainable growth rate (SGR) is a measurement of how quickly your company can grow without overextending its resources.

Share: