Solvency Ratios Definition, Formula & Examples

There are a number of key metrics and financial ratios that are important to keep an eye on as a small business owner.

These key bits of information help you to keep track of anything from your income to your best selling products. They say that knowledge is power, and it is certainly true in the business world.

One of the most important metrics for small business owners is the solvency ratio.

But what exactly is the solvency ratio?

Read on as we take a closer look at everything to do with solvency in our handy guide.

Table of Contents

KEY TAKEAWAYS

- A solvency ratio determines a business’s capability of being able to meet its long-term obligations as well as debts.

- Most solvency ratios will include a debt-to-assets ratio and an interest coverage ratio.

- They also include the debt-to-equity ratio as well as the equity ratio.

- Solvency ratios are used by lenders when evaluating whether to offer credit to a company.

What Is a Solvency Ratio?

A solvency ratio is one of the many metrics used to measure a company’s capability of being able to meet its long-term debt obligations. It is a form of financial ratio analysis. It is often used by potential business lenders, as well as potential bond investors.

The solvency ratio will indicate whether the cash flow is enough to meet the business’s long-term liabilities. This is different to the liquidity ratios which show the capability of being able to meet short-term liabilities. It is therefore used as an accurate indicator of the business’s overall financial health.

If a company has a bad solvency ratio, it can mean that it would be more likely that it will default on its debt obligations.

The 4 Types of Solvency Ratios

Many people will try and find the perfect solvency ratio for them. But realistically there is no one-size-fits-all solvency ratio.

When looking to measure your solvency, there are four different commonly accepted solvency ratios. Read on to find out along with some examples of solvency ratios:

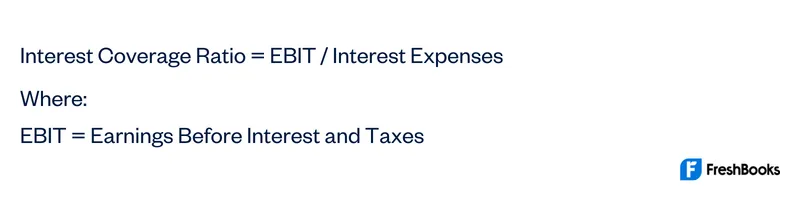

1. Interest Coverage Ratio

The interest coverage ratio is used to measure how many times a company can cover its interest payments. This is used for current interest payments with its available earnings.

Essentially, it’s used to measure the margin of safety that a company has for paying interest on its debts over a given period of time.

The higher the ratio is, the better the result is. If the ratio falls below 1.5, then this may indicate that the company would struggle to meet its interests on its debts. Therefore they may not be able to take out the loan.

The interest coverage ratio can be calculated as follows:

Example of Interest Coverage Ratio

Let’s say a company’s EBIT is $10,000 and there interest expenses amount to $4,000:

Interest Coverage Ratio = 10,000 / 4,000

Here the ICR would be 2.5 – which indicates the financial health of a company that can easily meet its debt interests.

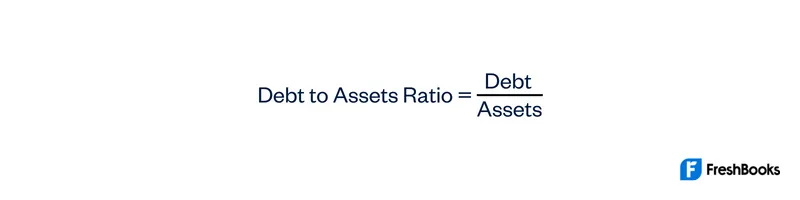

2. Debt-to-Assets Ratio

The debt-to-assets ratio is used to measure a company’s total debt against its total assets. It measures the company’s leverage and shows how much of the company is funded by debt versus assets. Therefore, it shows the company’s ability to pay off its debt with the assets it has available.

Any ratio that is around 1.0 would indicate that the company is majorly funded by debt. This would mean it would struggle to meet its obligations.

The debt-to-assets ratio can be calculated as follows:

Example of Debts-to-Assets Ratio

Let’s say a company has a total debt of $25,000 and its assets amount to $18,000.

Debts to Assets Ratio = 25,000 / 18,000

Here the ratio would calculate to 1.38 – meaning the company is significantly funded by debt.

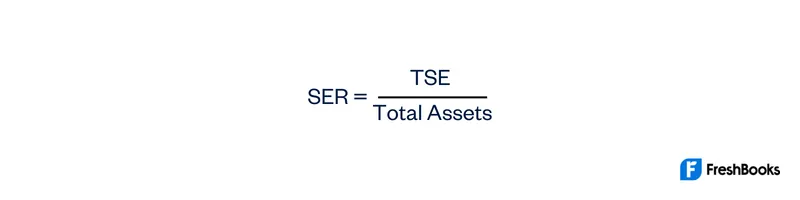

3. Shareholder Equity Ratio

The shareholder equity ratio is otherwise known as the equity-to-assets ratio. It shows how much of a company is funded by equity instead of debt.

The higher the calculated number is, the healthier the financial position of the company is. The lower the number is, the more the company is in debt in relation to its equity.

The shareholder equity ratio can be calculated as follows:

Where:

SER = Shareholder equity ratio

TSE = Total shareholder equity

Example of Equity Ratio

Let’s say a company has a total shareholder equity of $68,000 and their total assets equate to $45,000.

SER= $68,000 / $45,000

This would show that the company has a health ratio of 1.51.

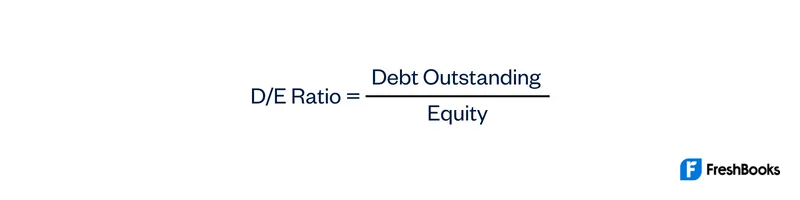

4. Debt-to-Equity Ratio

The equity ratio debt, or D/E ratio, is a leverage ratio. It is relatively similar to the debt-to-assets ratio. It shows how a business is funded by debt. This ratio is used to see how much of the debt can be covered by equity. It would be considered when a company needs to be liquidated.

The higher the ratio is, the more debt the company has on its books. This would mean that the chances of default is higher.

The shareholder equity ratio can be calculated as follows:

Example of Debt-to-Equity Ratio

Let’s say a company has a total debt outstanding of $20,000 and their equity equates to $45,000.

D/E Ratio = $20,000 / $45,000

This ratio of 0.44 would show that the company has a low chance of defaulting.

What Is the Difference Between Solvency Ratios and Liquidity Ratios?

It is a common mistake to mix up solvency ratios with liquidity ratios. This is because they are both about a similar thing. Which is the ability of a company to meet its obligations. However, there is a key difference between the two ratios.

The difference between liquidity ratios is that a solvency ratio will analyze the impact on a business’s capability of being able to meet its long-term obligations. Whereas liquidity ratios take a look at the company’s ability to pay for short-term obligations. It also refers to the business’s ability to quickly sell assets in order to raise a certain amount of cash.

Both of these ratios are important for the financial health of a business. This is because it’s just as important to be able to pay your long term obligations as it is to meet your short term obligations.

Summary

It’s vital for business owners to know what a solvency ratio is. It’s also imperative that they know exactly how to calculate their own. This is so they can easily make educated decisions on the company’s long-term health. As well as show the value of their company to potential investors and their capability of being able to meet their long-term liabilities.

FAQs on Solvency Ratios

It depends on which formula you use. If you went with perhaps the most common interest coverage ratio, then anything about 1.5 would be considered a solid solvency ratio.

The lower your solvency ratio is, the more likely it is that your business will default. Anything below a 1.0 ratio would be considered a risk.

Having a high solvency ratio means that your business is considered less likely to default. This would mean your business is in a strong financial position.

Share: