Shareholder Equity Ratio Definition & Formula

What type of business structure do you operate under as a business owner? Is it a sole proprietorship or a partnership? What about a limited liability company or a corporation?

Corporations are a type of business structure that have shareholders. These can also get known as stakeholders. But they’re a company, person, or an institution that owns company stock. When you own a share in a company’s stock, it’s what is known as equity.

But what exactly does the shareholder equity ratio mean and how is it calculated? You have come to the right place to find out. Keep reading to find out how the shareholder equity ratio works and the formula to calculate it.

Table of Contents

KEY TAKEAWAYS

- If a company has a shareholder equity ratio close to 100%, they finance assets with stock instead of debt.

- The shareholder equity ratio expresses the number of assets a company funds. This is through issuing stock instead of borrowing money.

- Higher or lower equity ratios will indicate the financial stability of a company.

What Is Shareholder Equity Ratio?

The shareholder equity ratio is going to tell you more about a company’s assets. It indicates how many of the assets get generated by issuing equity shares. And this is instead of taking on new levels of debt.

Basically, having a lower shareholder equity ratio means a company uses more debt to pay for assets. As well, it highlights the amount shareholders can receive if the company goes into liquidation.

To put it into the simplest terms, the shareholder equity ratio breaks down company assets. It goes into detail about how many assets get funded by issuing stock. And it’s also expressed as either a percentage or a number.

Any figures that get used to calculate the shareholder equity ratio get recorded on the balance sheet of the company.

How to Calculate Shareholder Equity Ratio

When it comes to calculating the equity shareholder ratio, it can be either a positive or a negative value. A positive value of equity means the company owns enough assets to outweigh any liabilities.

A negative value of equity means the value of liabilities exceeds how many assets the company has. When this is the case, it usually means that the company is a high risk for investment.

So, how do you calculate the shareholder equity ratio, and what is the formula? Let’s take a closer look.

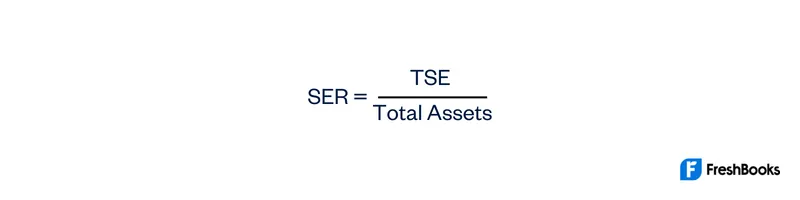

The formula to calculate shareholder equity ratio would look like this:

Calculating it this way shows how much of the business is financed by equity instead of borrowed money.

The total assets are going to equal the total of your current and noncurrent assets. It’s then equal to the total of a shareholder’s total liabilities and equity.

Determining the shareholder equity ratio is a great way to compare a company with others in the same industry. You can basically generate an inside look into the relative performance of a company.

A leveraged company is a company that has a shareholder equity ratio that falls below fifty percent. On the flip side, a conservative company is a company that has a ratio higher than fifty percent.

But what does this actually mean? Think of it in terms of a comparison between companies.

A company that is highly leveraged is going to carry more risk. This is since it will typically pay off debt obligations by using more cash. When this is the case, shareholders might not have much left after the debts get paid off.

Example of Shareholder Equity Ratio

Let’s say that you’re looking into investing in a particular company. Wanting to get a better sense as to its debt situation and financial strength, you can calculate its shareholder equity ratio.

Since the total shareholder’s equity will come from the balance sheet, you can start there.

For example, maybe the company has $3,000,000 in total assets. It also has total liabilities of $500,000. Plus, you learn the total shareholder equity value is $2,500,000. Knowing these pieces of information, you can calculate the ratio like this:

Shareholders Equity / Total Assets = Shareholder Equity Ratio

$2,500,000 / $3,000,000 = 0.83 or 83%

Doing this calculation tells you that the company is financing 83% of its assets using shareholder equity.

So, what does this mean if the company was forced into liquidation? In this case, shareholders would end up retaining 83% of the financial resources of the company.

Summary

The shareholder equity ratio relates to the number of assets a company finances using the owner’s equity. It’s a way to break down how much of the shareholder’s funds have been used to finance the assets. It can be expressed as both a percentage and a number.

Potential investors look into the shareholder equity ratio to determine the performance of a company. Having a lower shareholder equity ratio means the company uses debt to pay for assets. A higher shareholder equity ratio means the company finances assets using shareholder equity.

It’s a way to look into the financial health and long-term debt of a company. The financial ratio is considered from the income statements. As well, it’s a good financial metric to determine current liabilities and financial obligations of a company.

Having a negative value of equity likely shows that a company would be a high-risk investment. This is since negative equity means liabilities exceed the number of assets the company owns. Short-term debt isn’t always a bad thing, but having additional debt or a bad debt ratio might not be what investors want.

Frequently Asked Questions

Having a shareholder equity ratio that’s .50 or below means you will likely be considered a leveraged company. If the ratio is .50 or above, then it’s considered to be more conservative. This means that the company likely has more funding from equity compared to debt.

Having higher shareholder equity typically indicates the company’s finances are more stable and they have more flexibility. This is good to have in case there ends up being some type of economic or financial downturn.

They’re similar, but shareholder’s equity refers to how much an owner can claim on the assets of a company once debts are settled. Share capital is the total amount invested by a company.

It shows an investor the total residual value that a shareholder receives after any debts and liabilities get settled. This is good information for an investor to know when looking into a specific company.

It all depends on the percentage of a company’s total debt to total assets. For example, if a company has 30% of its debts financed by creditors, then this means the shareholder’s equity finances 70%.

Share: