Return on Invested Capital (ROIC) Definition, Formula & Calculation

It’s important for business owners and investors to understand certain concepts. One of these is return on invested capital, or ROIC. This metric measures how efficiently a company is using its money to generate profits.

In this article, we’ll define ROIC, explain how to calculate it, and discuss some of its limitations. We’ll also look at the difference between the return on capital and ROIC, some frequently asked questions, and more.

Table of Contents

KEY TAKEAWAYS

- Return on invested capital (ROIC) is a metric used to measure a company’s profitability.

- ROIC measures how efficiently a company is using the money it has invested in its operations.

- The metric can be used to compare companies in different industries.

- ROIC can have a positive or negative impact on a company’s cash flow.

What Is Return on Invested Capital (ROIC)?

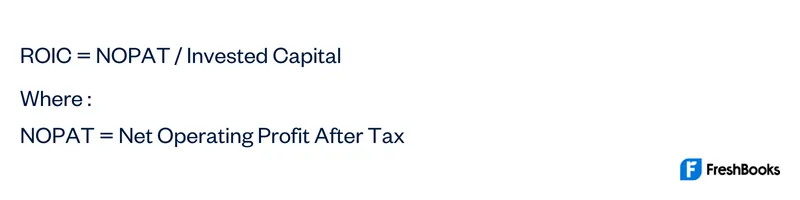

Return on invested capital (ROIC) measures how profitable a company is relative to the amount of money it has invested in its operations. It’s calculated by dividing net operating profit after tax (NOPAT) by the company’s invested capital.

Invested capital includes both debt and equity. This is why ROIC can be used to compare different companies that have different capital structures. ROIC has been used as a tool to evaluate the efficiency of a company’s management and it’s important for investors looking at potential investments.

ROCl gives investors a sense of how well a company is using its money to generate profits. It is often used to help determine if a company has an unsustainable business model.

Formula and Calculation of ROIC

When you calculate the ROIC, you do it by assessing the value of the total capital, which is the total debt and equity that a company has. Here is the formula to calculate ROIC:

There is more than one way to try and calculate this value, however. Another way is to subtract any cash and non-interest-bearing current liabilities (NOBCL). These can include things like accounts payable and certain tax liabilities.

That said, you need to make sure that they’re not subject to any specific types of fees or other interest. Once you have all of this data, you subtract it from your total assets.

Another method that you can use to calculate invested capital is by considering the book value of a company’s debt and the book value of its total equity. You would then subtract any of the non-operating assets.

For example, these could include things like marketable securities, cash and cash equivalents, and assets from operations that are discontinued.

As well, you can calculate invested capital by determining the working capital figure. You do this by subtracting any current liabilities from any current assets. Once you have this information, you would determine the non-cash value of working capital in the next step.

All you need to do is subtract cash from the working value capital that just got calculated. Finally, any non-cash working capital gets added back to a company’s fixed assets.

Limitations of ROIC

There are a few limitations to consider when using ROIC.

- The metric doesn’t take into account the company’s debt levels. This means that a company with a lot of debt can have a high ROIC even if it’s not very profitable.

- It also doesn’t consider the time value of money. This means that a company with a short-term investment horizon can have a higher ROIC than a company with a longer-term investment horizon.

- The metric can be misleading if it’s used to compare companies in different industries. For example, a company in the technology industry might have a lower ROIC than a company in the utility industry.

One common example is that different industries require different levels of fixed expenses. Businesses required to buy expensive real estate or machinery will often have more money invested, which is a good profitability measure. - The metric can also be affected by accounting choices made by management. For example, a company might choose to depreciate its current assets over a longer period of time in order to boost its ROIC. This can add additional risk to core business operations.

What Is the Difference Between Return on Capital and ROIC?

There are two main ways to measure a company’s profitability: return on capital (ROC) and ROIC. They both measure how well a company is using its money but they use different metrics to calculate that number.

ROIC measures how profitable a company is relative to the amount of long-term debt and equity it has. It also measures how efficiently a company is using the operating capital it generated from active investments or previous investment choices.

Both metrics are important for investors. ROIC can be used to compare companies with different levels of debt and to find new investment opportunities. As well, it can be used to compare companies in different industries and their financial assets.

Both can help assess the effectiveness of management, the company’s processes, growth rates, and company profits.

How Does ROIC Affect a Company’s Cash Flow?

A company’s cash flow is an important indicator of its financial health. ROIC can have a positive or negative impact on a company’s cash flow, balance sheet, and income statement. This can affect things like shareholder equity and future investment decisions.

A company with a high ROIC will see an increase in its cash flow. This is because the company is using its money efficiently to generate profits. A company with a low ROIC will see a decrease in its cash flow. This is shown by the NOPAT percentage.

It’s important to remember that ROIC is just one metric used to measure a company’s financial health. It should be used in conjunction with other metrics to get a complete picture and help gain a competitive advantage. Doing this will benefit future growth and will allow you to turn capital into profits.

Summary

Implementing the use of ROIC helps measure how profitable a company is compared to the amount they have invested. It gets calculated by dividing your net operating profit after tax (NOPAT) by your invested capital.

In regards to invested capital, this includes both debt and equity. It’s an effective tool to evaluate how efficiently management has been investing the capital they have. ROIC is also an important metric for investors to determine whether it would be a good investment or not.

Frequently Asked Questions

One of the biggest things to consider with ROIC is that you always want to create as much value as possible. While things can fluctuate, a good rule to follow is to aim for an ROIC that’s above two percent.

Basically, ROIC is a way to find out how efficiently a company is able to turn capital into profitable projects or investments. It gives insights into how well a business uses any money raised to generate profitable investments.

At a glance, they might seem quite similar but ROI measures how efficient a particular investment or set of investments are. Whereas Invested Capital Return (ROIC) shows how effectively a company distributes capital under its control to profitable investments.

ROIC is important since it represents business performance in relation to its invested capital. In addition to this, it provides a strong indication of how well management operates in a company.

Share: