R-Squared: Definition, Interpretation & Calculation

When analyzing stock, ETF, or mutual fund performance, you may see an indicator called R-squared. This statistical measure helps determine the degree a stock’s price movements link to broad market performance.

It can also gauge how well a stock or portfolio’s past performance predicts its future returns. For example, suppose you have an R-squared statistic of 0.25. This implies that the stock responds to 25% of changes in the wider market.

R-squared can help you identify potential risks and opportunities when you analyze investments. This guide details the necessary steps to calculate R-squared. It also discusses the limitations of R-squared and more.

Table of Contents

KEY TAKEAWAYS

- R-squared measures stock to determine how its price movements correlate with the broader market.

- An R-squared statistic of 1 indicates that a stock’s price movements match the market perfectly.

- A 0 reading indicates no relationship between a stock’s movements and the market as a whole.

- Investors use R-squared to look for potential risks and opportunities when analyzing investments.

What Is R-Squared?

Also known as the coefficient of determination, R-squared is a useful tool. You can use this statistical measure to help you determine how a stock’s price movement links to broader market performance.

The R-squared statistic measures on a scale from 0 to 1. A reading of 0 indicates that no relationship exists between a stock’s movements and the market as a whole.

A reading of 1 indicates that a stock’s price movements are perfectly correlated with the broader market.

It can take you a while to get a good grasp of model statistics. R-squared measures aren’t always the same. What you consider a “good” R-squared value might not be good to another investor.

So try to keep in mind that bad and high R-squared values are subjective in many circumstances.

How to Calculate R-Squared

There are a few different ways to calculate the coefficient of determination, or “R-squared.” The most common method is to use the “person” function in R.

This function takes two vectors as arguments and it returns the correlation coefficient between them. Another way to calculate R-squared is to use the “lm” function in R.

This function fits a linear model to a set of data and returns the coefficient of determination for that model.

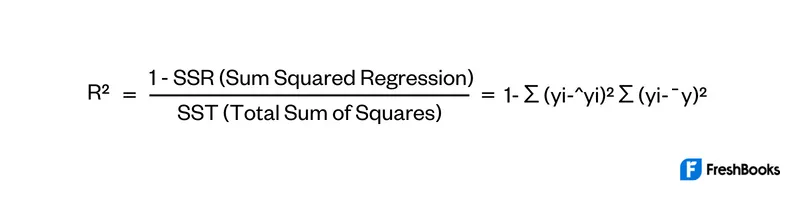

Finally, you can also calculate R-squared manually using the following formula:

Where the sum of squared errors is a sum of the squared differences between the predicted values and the actual values. The total sum of squares is a sum of the squared differences between the mean value and the actual values.

Keep in mind that R-squared is only a measure of how well a model fits data, not how accurate the predictions are. Thus, a high R-squared value does not necessarily mean the model is accurate.

Now that you know how to calculate R-squared, you can use it to assess the fit of your linear models.

For the exact formula, check the section below. We will also discuss further the action of calculation. How you calculate the formula makes a big difference in its complexity or simplicity.

Scholars agree that you shouldn’t use Excel’s outdated Data analysis toolpak. Instead, download the free RegressIt add-in tool for Excel. This will make your calculations easier.

Formula for R-Squared

R-squared gets calculated as a percentage. It’s based on the regression between a stock’s performance and the broader market’s performance.

First, take the average price change for the stock over a given period and the average price change for the market over the same period.

Then, take the difference between these two sets of values and the standard deviation of price changes for the stock.

Finally, divide the difference by the standard deviation and multiply by 100 to get the R-squared reading.

Key Limitations of R-Squared

R-squared only measures the degree to which a stock moves in line with the markets, not the degree to which a stock moves in a favorable or unfavorable way.

Even if a stock’s R-squared reading is high, it may not be a good investment if its price is too high relative to the rest of the market.

Thus, R-squared can mislead you if a stock’s price has little correlation to the broader market.

R-Squared vs. Adjusted R-Squared

R-squared is a raw measurement that does not take into account the size of a stock or portfolio.

Adjusted R-squared, on the other hand, measures the degree to which a stock’s price movements link to broader market performance. It also takes into account the size of the company.

R-squared is the default measurement used to gauge the degree of correlation between a stock’s price movements and the market. But you can use adjusted R-squared to compare the performance of different stocks or portfolios in the same sector.

You can calculate adjusted R-squared like R-squared, but it is then adjusted by the size of the stock or portfolio.

Summary

Now that you know how to calculate the coefficient of determination, or “R-squared,” you can use it to assess the fit of your linear models.

For example, if you have a model with an R-squared value of 0.9, it means the model explains 90% variation of data. Many investors consider this to be a good fit.

Keep in mind that R-squared is only a measure of how well a model fits data, not how accurate the predictions are. Therefore, a high R-squared value does not necessarily mean the model is accurate.

Therefore, use caution when comparing investments. It is always best to use additional calculations to gain a comprehensive analysis.

FAQs About R-Squared

That depends on the context. In general, a value of 0.5 or higher is a good fit, but it can be higher or lower depending on the circumstances.

The coefficient of determination, or “R-squared,” is a measure of how well a linear model fits data. It ranges from 0 to 1, with higher values indicating a better fit. Thus, R-squared tells you how much of the variation of data the model explains.

R-squared is a measure of how well a linear model fits data, while correlation is a measure of the linear relationship between two variables.

Essentially, correlation tells you how closely two variables relate. R-squared tells you how well one variable explains variation in the other variable.

No. The coefficient of determination, or “R-squared,” can be negative. This happens when the linear model does a worse job of fitting the data than a simple mean value.

An increased R-squared value means the new variable is significantly related to the dependent variable.

Share: