Price to Earnings (PE) Ratio: How it Helps You Value Stocks

Investors and analysts have many different kinds of strategies they implement to gain more information about an investment. They do this to be as well-informed as possible, hoping to maximize their return on investment.

Various ratios are often used to find this information and they’re common when weighing the risks of purchasing stocks. The price-to-earnings (PE) ratio is one of the most effective metrics that investors and analysts use. Continue reading to learn all about how the PE ratio works.

Table of Contents

KEY TAKEAWAYS

- The PE ratio is a comparison between the current stock price of a company and the company’s current earnings.

- A high PE ratio could mean that the stock is overvalued. A low PE ratio might mean that the stock is undervalued.

- There are three different methods to calculate the price-to-earnings ratio. The forward method, TTM, and Shiller’s PE ratio. Each provides different information for investors analyzing stock valuation.

- The PE ratio shouldn’t be the only tool used to decide on stocks. Always pair it with other information like growth levels and financial analysis to make well-informed decisions.

What Is the Price to Earnings (P/E) Ratio?

The price to earnings ratio is a comparison of a company’s stock price to its earnings per share. The result of this comparison helps investors decide what to do with the stock. Buy, sell, or hold.

The price-to-earnings ratio is also referred to as the earnings multiple or price multiple. It’s one of many important metrics for investors to use in their research when making a stock purchase decision on an individual company, an industry sector, or a major market index.

Although the P/E ratio is helpful as a part of researching stock valuation, it shouldn’t be the only factor in your decision-making process. Its usefulness is enhanced when combined with other important details like historical trends, growth comparisons, and future earnings guidance for a complete picture.

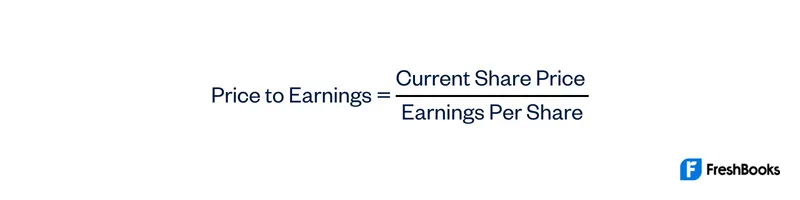

PE Ratio Formula and Calculation

The price-to-earnings formula is fairly simple. With certain investment firms, you may not even need to make the calculation yourself. It still helps to know how to do it though. You’ll need to know two things to get the right ratio estimation.

- EPS or earnings per share

- Market value per share

The current share price is easy to find. Simply search for the stock ticker symbol on an investment site and the value comes up. EPS can be a little harder to find though.

If you can’t find the earnings per share, you can calculate that too. The earnings per share formula is done by dividing the net profits for the company by the number of shares outstanding for its common stock. Once you have the EPS, then you can move to the P/E formula.

Looks simple enough, right? Time to try it out in a quick example. Let’s say Willow Company has a current share price of $220 and their EPS is listed as $10. Divide $220 by $10 and the P/E ratio would be 22.

One way to interpret this is that investors are paying $22 for each dollar of earnings Willow Company brings in.

Understanding The PE Ratio

Once you’ve calculated the PE ratio, there are three different ways you could interpret the number you’ve come up with. Each perspective provides you with a different understanding.

- It’s a comparison between public opinion and the actual price of the stock.

- How much investors are willing to pay for each dollar of a company’s earnings.

- How many years it will take to cover the stock price if earnings stay the same.

The first is the standard definition of the P/E ratio. What the public thinks the stock is worth versus what the stock is worth based on the company’s current earnings. Many times this comes into play when you have mass panics, bubbles, or market hype at play. Any of these can influence stock price movements and dramatically inflate the value of a stock. On the flip side, a negative outlook could undervalue the stock.

Under the second perspective, you’re able to see how much people are willing to pay for $1 of the company’s earnings. If this is a higher amount, it’s usually because the investors believe there’s potential for future earnings power to be even higher.

Lastly, the PE ratio could be seen as how many years it takes to break even on the stock price if earnings levels stay flat. A helpful perspective to have when considering the level of risk on a certain stock.

You’ll want to keep in mind that these are relative to the companies or industries you’re comparing. Average PE ratios vary widely across the stock market.

High PE Ratio

A high price-to-earnings ratio often hints that investor expectations for future earnings growth are high. The goal is for future earnings to outpace the current stock price which will result in a high return on investment. This typically defines a growth stock.

The other reason for a high PE ratio could be that the stock is overvalued. While it might be a big deal to buy in due to a major company event or other buzz in the stock market, it could lead to a potential loss in the future. Telltale signs of this include:

The stock’s PE ratio is much higher than its competitors.

The stock’s PE ratio is much higher compared to historical PE ratios.

Earnings have fallen but the stock price has stayed the same.

Perhaps the overall market sentiment is positive. That’s an entirely possible explanation for a high price to earnings. To get a better grasp on the situation, you should ask yourself– is it because of market hype, or do investors truly see big future returns?

Low PE Ratio

A low PE ratio might look like an opportunity to get in on a stock before anyone notices and win big once earnings take off. Because a low PE ratio could mean that the stock is undervalued.

Stocks in this category are seen by investors as a chance to buy low with expectations that the earnings will rise to surpass the current stock price. This is a major principle of value investing.

These types of situations create a low PE ratio:

- Stock price stays the same while earnings go up

- Company earnings fall due to negative investor projections for future earnings

- The business is in a state of decline

A lower ratio is considered to be a more affordable investment decision for investors since it means they’ll have less risk if the company doesn’t perform well on the stock market. While a low PE ratio might look like a bargain, it’s important to use other forms of analysis to determine if the stock is a good deal or if it’s not worth your time.

Why Use the Price Earnings Ratio?

The P/E ratio is a useful comparative tool that helps investors analyze similar companies, and sectors. The P/E ratio can be used to compare stocks within a sector, or it can be used to compare stocks in different sectors. It can also be used to compare companies with different capital structures, such as debt-heavy businesses versus those that are not.

There are a few benefits that come with using the price-earnings ratio:

- Acts as a price tag for stocks and helps you decide which ones are worth it to buy or sell.

- Provides a logical way of assessing a company’s stock prices without getting caught up in market hype, panic, or bubbles. When you know how to tell which stocks are being overvalued, you’ll know when it’s a bad idea to invest.

- Use it to compare different sectors or different companies.

- It’s an easy investment valuation metric to calculate.

- It creates equalized stock prices so investors can better understand and compare stocks across different earning levels and prices.

Overall a very useful tool as long as you’re using it with other metrics to get the complete story on a company’s financial health.

Three Variants of the PE Ratio

There are three different ways to use the PE ratio. One depends on historical earnings data, another is based on future earnings projections and the third approach uses earnings over a period of time. Each calculation method gives you certain information about the stocks you’re comparing.

Trailing Twelve Month (TTM)

The TTM method for PE ratios considers an individual company’s historical earnings information compared with the current market value of the stock. It’s the same formula that we covered earlier. This uses earnings from the most recent 12-month fiscal period.

When you’re using past earnings as part of the calculation there’s an added benefit of relying on earnings that have already been accounted for. So you can base your decisions on factual trends instead of projections. That’s why this method is often used in the evaluation of companies.

There are several finance companies that use this method, including Google Finance, and Yahoo Finance. For example, these sites list Disney (DIS) at a PE ratio of about 68 as of April 2022. While the TTM P/E ratio provides valuable information, there’s common investment advice to keep in mind: past performance doesn’t guarantee future results.

Forward

The forward method uses a future earnings estimate of company earnings to calculate the PE ratio. Instead of having solid historical data, you’re using investor financial projections and forward-looking guidance to predict how the market is expecting the company to perform. This comes with the benefit of investor guidance that can sometimes be spot on when it comes to projecting future growth prospects.

However, it’s almost akin to counting your chickens before they’ve hatched when not used properly. Because you’re relying on earnings that haven’t happened yet. Like the TTM method, the forward method is also based on in-depth research and investor analysis. That doesn’t mean it can’t turn out to be wrong. Use caution when depending on this factor to make decisions.

Shiller PE Ratio

The Shiller PE ratio is also referred to as the CAP/E ratio because it uses the average earnings over a period of time. CAP/E stands for cyclically adjusted price-earnings ratio. To find this ratio, you’d divide the price of the stock by annual earnings over the past ten years. It’s important to adjust these average earnings for inflation.

Investors like this method of calculating PE ratio because–

- It makes considerations for inflation

- Minimizes the effect of short-term market events on the data.

- Accurately measures stock market indexes by focusing on long-term earnings.

What’s a Good PE ratio?

There’s no such thing as a “good” or bad P/E ratio. What determines a good ratio is based on the comparison between similar companies and where their stock price and earnings stand. It’s not designed to set the bar across the board. It’s just used as a comparison tool.

The Drawbacks of PE Ratio Analysis

Although this is a helpful tool for investors to use, there are plenty of limitations to using this ratio.

PE ratios used in certain market conditions can be misleading. At the start of a bull market, high PE ratios could make it seem like a company or sector is overvalued when in reality, the earnings will take off even more.

On the flip side, economic turmoil tanks company earnings, and stock prices are in constant flux. So a PE ratio that speaks toward a stock listed at a fair price could result in a loss from stock prices that drop further.

In addition, other ratios account for other important factors. The potential earnings growth rate or PEG ratio for example considers growth rates and dividend yields. Without the bigger picture, only using the PE ratio could make you think you’re getting a good deal when you’re not.

Summary

All in all, the PE ratio is a valued metric used by investors to help research potential stocks. There are three different methods that each provide a different outlook on the stock price. By using a PE ratio to inform your investment decisions you could avoid being caught up in huge market swings due to panic buying or major company events.

While it doesn’t provide a full picture of the overall health of an individual company, it does provide some insight into how it’s doing compared to its peers.

FAQs About Price to Earnings Ratio

Investors look at the PE ratio in conjunction with other information to help them determine if a stock is overpriced, underpriced, or accurately priced. This informs their decision to buy, sell or hold that stock.

A good investor can trust the PE ratio but often they choose more complex versions of it to suit their needs. These metrics are also paired with other important factors like financial analysis,

The average PE ratio depends on which sector or company you’re comparing. For example, the average PE ratio for the auto & truck sector is 996 and the average current PE ratio for air transport is 7 according to the latest report from NYU.edu.

A high price-to-earnings ratio would be based on which company or sector you’re comparing. For example, if you’re comparing computer services companies with a PE ratio of 52, 49, 54, and 51, a high ratio in this comparison might be a PE ratio of 60. Keep in mind that the PE ratio doesn’t speak toward the overall health of a company.

Share: