Net of Tax: Definition, Overview, Formula & Example

Your income is taxable regardless of whether you receive a salary as an individual or make sales as a business owner.

The amount that is left over after deducting any associated tax charges is referred to as “net of tax.” Calculating the sum of money a business or an individual organization actually receives to keep is made easier by fully comprehending how net of tax works.

Read on as we take a look at exactly what net of tax is, what the formula is, how its calculated, and the importance of net of tax.

Table of Contents

KEY TAKEAWAYS

- After you adjust for the certain effects of taxes, the net of tax is how much is left.

- Net of tax can play an integral role in various asset purchases, income taxes, and before- and after-tax contributions. This is the case for both businesses and individuals.

- Analyzing the net of tax can be an important process to undergo when there are tax implications involved.

What Is the Net of Tax?

After you adjust for the effect certain taxes can have, the net of tax refers to how much will be left. You can consider net of tax in any type of taxation situation. Analyzing before- and after-tax values can play an important role in making more informed purchasing and investment decisions.

Net of tax is a business term that takes into account the estimated amount of tax on an investment or business transaction. All you need in order to calculate the net of tax is to consider the gross income from a specific transaction and subtract the tax paid.

It can be common to refer to the term net off tax as purchasing power or after-tax. This is because the tax can provide a reduction in the amount you can spend.

How Does the Net of Tax Work?

Investment and business transactions that result in generating income should always get considered as net of tax. However, how you calculate the net of tax is going to be different based on the type of income that’s generated.

- Ordinary or earned income — This type of income comes from various business activities, such as product sales or income earned from services.

- Capital gains — This type of income is profits earned from business assets getting sold. These can include the business as a whole, equipment, or vehicles for example. It can also come from investments.

Let’s say that you earned an income of $75,000 and must pay income tax as a freelance business owner. Since you own the business you’re not going to have any payroll tax withholding. Estimated taxes get paid throughout the year.

What Is the Formula for Net of Tax and How to Calculate It

The good news is that calculating net of tax is fairly straightforward to do. All you need to know is the gross income generated from a business or investment transaction and the tax that was paid.

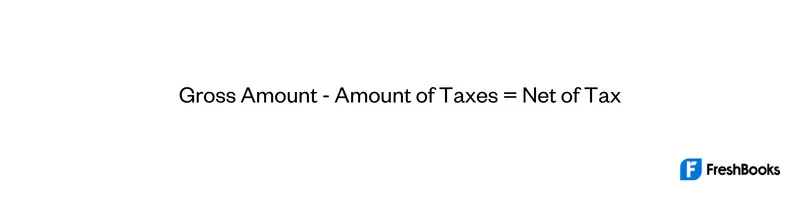

The formula to calculate net of tax would look like this:

Now with all of that said, it’s important to recognize that calculating net of tax can vary depending on the type of income. For example, you might generate ordinary income or generate income from capital gains. The taxes that get subtracted could include self-employment tax and income tax.

Importance of Calculating Net of Tax

The importance of calculating net of tax can vary depending on the specific situation. For example, you might be exploring the possibility of selling business assets and want to know the optimum time to do this.

Calculating the net of tax will provide you with insights into the most beneficial time for a lower tax effect. Essentially, you can explore ways to reduce your taxes. You might have certain investments in stocks and bonds or IRAs. Taking into consideration the net of tax shows the most opportune time to sell.

Example of Net of Tax

The amount of money left over after taxes get accounted for is the net of tax. For example, let’s say that Company X generated $1 million in gross sales but will need to pay $150,000 in taxes. Subtracting the tax from the gross sales gives you the net of tax.

The calculation would look like this:

$1,000,000 – $150,000 = $850,000

Company X, therefore, would have an income net of tax of $850,000

Summary

Net of tax relates to how much money remains once the amount of taxes is subtracted from generated income. Tax rates can affect the net of tax and these rates get determined based on several factors. Filing status and income thresholds are considered, for example. Both businesses and individuals can benefit from analyzing before- and after-tax values.

The analysis can provide actionable insights to help make better purchasing and investment decisions in the future. Net of tax can depend on the type of income, such as ordinary or earned income and capital gains. To calculate net of tax, simply subtract the amount of tax from the generated profits.

FAQs About Net of Tax

Net income relates to gross income minus taxes and paycheck deductions. Essentially, it’s what you would take home and deposit into your bank on payday.

The simplest way to define net tax owing is that it refers to the tax you owe. It includes net provincial and federal taxes, income tax withheld at the source, CPP contributions, and EI premiums.

Gross tax refers to all of the tax in its entirety before any deductions occur. Net tax is part of the whole number after deductions occur.

Share: