Monte Carlo Simulation: Definition & Overview

The business world is full of risk, uncertainty, and educated guesswork.

Whether you’re trying to gauge stock prices or asset prices, or trying to figure out the chances of success of a project. A lot of time is spent trying to determine possibilities.

That’s why models of probability are so widely used in business.

The Monte Carlo simulation is one of the most accurate and widely used models across a number of different industries and sectors. But what exactly is it? And why is it so accurate?

Read on as we take you through everything you need to know about the Monte Carlo simulation.

Table of Contents

KEY TAKEAWAYS

- The Monte Carlo simulation is a model of probability used to determine likelihood.

- It is a useful technique for understanding the impact of uncertain variables. As well as values in forecasting and prediction models.

- It is named after the popular gambling destination in Monaco.

- The simulation was created by a World War II mathematician that also worked on the infamous Manhattan Project.

What Is a Monte Carlo Simulation?

A Monte Carlo simulation is a model of probability. It is used to model the likelihood of different outcomes within a process. This tends to only be related to processes that can’t be easily predicted due to a number of random variables.

The technique is useful for understanding the impact of an uncertain event. As well as the impact of risk in prediction and forecasting models.

What Is a Monte Carlo Simulation Used For?

Also known as a multiple probability simulation, there are a number of different uses for a Monte Carlo simulation. It can be used to tackle a wide range of problems in almost every field. That includes finance, engineering, science, and supply chain management.

For example, let’s say a business is faced with a large amount of inherent uncertainty when making an estimation or a forecast. It can make use of the Monte Carlo simulation to provide a solution by using a number of values. This is rather than just taking the uncertain variable and replacing it with a single average value.

The business and finance world is inundated with random variables. This provides a large potential for using the Monte Carlo simulation within this field. It can be used to estimate the probability of a project running over its cost budget or judge whether the price of an asset will move in one way or another.

It is also a common technique to be used by insurers and oil well drillers to estimate certain scenarios. But it isn’t just used within business and finance. Particle physicists, astronomers, and meteorologists also make use of the technique.

How Does the Monte Carlo Simulation Work?

The Monte Carlo simulation works by performing risk analysis through building models of possible results. It does this by substituting a range of values for any factor that has an inherent level of uncertainty. It will then calculate the results continually, each time using a different set of random variables and values.

Depending on the number of variables, this can involve tens of thousands of recalculations. All will be processed until the simulation has run its course.

What Is the Formula for the Monte Carlo Simulation?

The Monte Carlo simulation can be recreated using Excel or another similar spreadsheet program.

For example, an asset’s price movement can be broken down into two components, drift and random input. Drift is a constant directional movement. And the random input represents the volatility of the market.

In order to determine the drift, you can analyze historical price data. You can also use this to determine the standard deviation, variance, and the average price movement of a particular security.

With these bits of information at hand, we have the building blocks to perform a Monte Carlo simulation.

In order to project one possible trajectory of price, you can use the historical price data of an asset. This is to generate a number of periodic daily returns. This is by using the natural logarithm. This can be shown as follows:

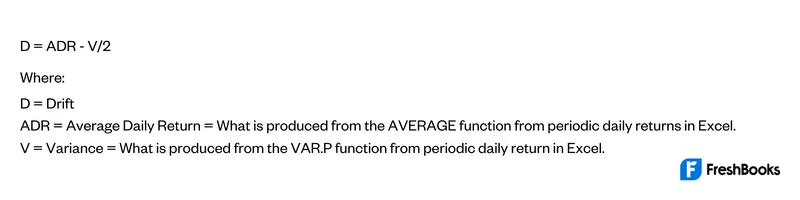

Next, you would use the Excel functions AVERAGE, STDEV.P, and VAR.P on the entire resulting series. This is to obtain the average daily return, the standard deviation, and the variance inputs. The drift is equal to the following formula:

Alternatively, you can set the drift to be 0. This would not make a huge difference for shorter time frames. But it would reflect a certain theoretical orientation.

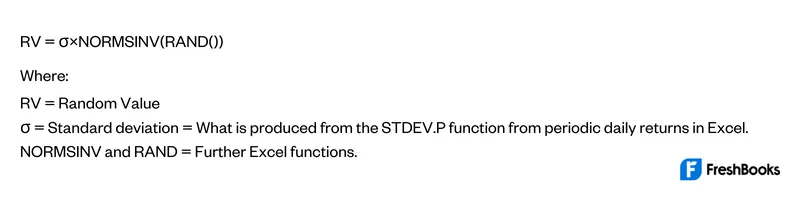

The next step is to obtain a random input:

Finally, the equation that would be used to calculate the next day’s price is as follows:

A Short History of the Monte Carlo Simulation

The Monte Carlo simulation was first developed by a mathematician, Stanislaw Ulam. This mathematician had also worked on the infamous Manhattan Project.

The story goes that Stanislaw was recovering from brain surgery after World War II. He kept himself entertained by playing solitaire thousands of times. During this time he became interested in trying to figure out the outcomes of each game and observe their distribution. This was in order to try and determine the probability that he would win any particular round.

He then shared this idea with Hungarian-American mathematician John von Neumann. From there, the two mathematicians went on to develop what is now known as the Monte Carlo simulation.

What Are the 5 Steps in a Monte Carlo Simulation?

While most Monte Carlo methods will vary to some degree, there are 5 main steps that will tend to remain consistent among any Monte Carlo Simulation. They are as follows:

Step 1: Generate two random numbers. These numbers must be between -1 and 1. Do this 100 times.

Step 2: Calculate the circumference equation. Follow this criteria:

- If the value of the number is less than 1, then the case will be inside the circle.

- If the value of the number is more than 1, then the case will be outside the circle.

Step 3: Calculate the proportion of points that are inside the circle. Multiply this number by four. This will give you an approximate π value.

Step 4: Repeat this experiment one thousand times. This will give you different approximations to π.

Step 5: Calculate the average of the previous 1000 experiments. This will give you a final value estimate.

Advantages and Disadvantages of Monte Carlo Simulation

Advantages

The main advantage of using the Monte Carlo simulation is that it is easy to implement. It can provide you with statistical sampling for any numerical experiments by using a computer to calculate a large number of results. It can also be used for both deterministic problems as well as stochastic problems.

Disadvantages

The main disadvantage of using the Monte Carlo simulation is that it is somewhat limited. Specifically this means that it cannot account for financial crisis that may impact the potential results. For example, recessions, bear markets, or any other form of financial crisis.

The process is also quite time consuming as there are a large number of samples to generate to get to the end output. Also, the results that come from this method are only the approximation of the actual value, not the exact value.

Summary

The Monte Carlo simulation is an accurate and popular probability distribution model. By accounting for random factors and variables, it can give a very accurate spread. This is a probability distribution that can greatly help with a number of causes.

The simulation can be used for a number of reasons within the financial sector. It can be used in things like options pricing or corporate finance. It works especially well for personal finance planning and portfolio management.

FAQs on the Monte Carlo Simulation

The name of the simulation comes from the popular destination for gambling. This is in the sovereign city-state and microstate on the French Riviera, Monaco. Given the chances and random outcomes, they were compared to popular casino games that are played in Monte Carlo. Such as roulette, slot machines, and dice.

The Monte Carlo simulation can be used in a wide variety of ways in a wide range of fields. Any situation where you need to obtain an accurate estimate when working with a number of uncertainties would benefit from using the simulation.

The entire process of a Monte Carlo simulation is a complex process. It doesn’t attempt to eliminate complicated risks or individual risks. Instead, it uses thousands or millions of different permutations of random variables and values. This is to calculate every single possible outcome. This means that the normal distribution ranges it generates is very accurate. Thereby making it one of the most popular methods of forecasting.

Share: