Merton Model: Definition & Overview

There are a number of analytical models used in the financial industry.

One of the more important models is the Merton model. But what exactly is the Merton model? We’ll take a closer look and give you the definition and formula used for this analysis model.

Table of Contents

KEY TAKEAWAYS

- Robert Merton introduced a model in 1974 for calculating a company’s credit risk by simulating its stock as a call option on its assets.

- Merton extended upon the Black-Scholes model. This was a pricing model for a financial instrument.

- The Merton model offers a structural connection between a company’s assets and default risk.

What Is the Merton Model?

The Merton model is an analysis model. It is employed to evaluate the credit risk associated with a company’s debt. The Merton model is used by both investors and analysts. This is to understand the capability of a company to meet its financial obligations. As well as its ability to service its debt, and weigh up the possibility that the business will go into credit default.

History of the Merton Model

The Merton model was first proposed in 1974 by Robert C. Merton. Robert Merton created it to assess the structural credit risk of a company. He did this by modeling the company’s equity as a call option. This was on the company’s assets.

Merton’s financial model was later extended by Fischer Black and Myron Scholes. They develop the model into a Nobel-prize winning pricing model for options. This was aptly named the Black-Scholes pricing model.

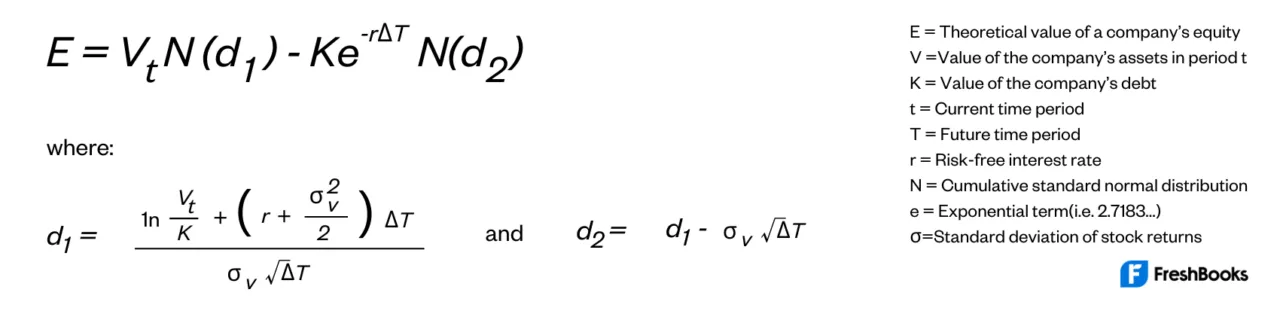

What Is the Formula for the Merton

An Example of the Merton Model

Let’s say that Company X is selling their shares for $210.59. The volatility of the stock price is at 14.04%, while the interest rate is going along at 0.2175%. The strike price is currently $205, and there are four days for the expiration time.

With all of these values, you can calculate that the call option value that is produced by the Merton model is shown at -8.13.

What Assumptions Does the Merton Model Make?

The Merton model makes a number of basic assumptions. They are as follows:

Lognormal Distribution

The Merton model assumes that the stock prices follow a lognormal distribution. This is based on the principle that the asset price cannot take a negative value. Meaning that they are bounded by zero.

No Dividends

The model assumes that any stock that is involved does not pay any returns or dividends.

No Arbitrage

It runs under the assumption that there is no arbitrage. Meaning it avoids the opportunity that a riskless profit can be made.

Expiration Date

The options can only be exercised on their maturity date, or the date of expiration. That means that it does not accurately price any American options. This means that it is extensively used in the European options market.

Frictionless Market

The model assumes that there are no transaction costs. And this includes things such as commission and brokerage.

Random Walk

A state of random walk is assumed. This is because the stock market is highly volatile, and the direction can never be accurately predicted.

Normal Distribution

The volatility of the market is implied as being constant over time. So stock returns are normally distributed and there is more of a standard deviation.

Risk-Free Interest Rate

The underlying asset is risk-free. This is because the interest rates are assumed by the model to be constant.

What Is Merton Distance to Default?

The failure of a firm to meet its debt obligations is explicitly defined as a default-triggering event in the structural model, also known as the Merton distance to default (DD) model. This is based on Merton’s bond pricing model.

This is done by modeling the equity value of the firm as a call option on its value with the firm’s face value of the debt as a strike price.

Merton Model vs Black-Scholes Model

The Merton Model and the Black-Scholes Model are the same thing.

The crucial understanding that systematic risk is eliminated by hedging an option was developed by Black and Scholes while Merton was a student at MIT.

Merton later created a derivative that demonstrated how hedging an option would completely eliminate risk. Merton’s report, which clarified the derivative of the formula, was incorporated by Black and Scholes in their 1973 work, “The Pricing of Options and Corporate Liabilities.”

Later, Merton modified the formula’s name to the Black-Scholes model, although it is still commonly referred to as the Merton Model.

Summary

The Merton model is an effective pricing model. However, it is limited in the fact that it only works efficiently for European option prices. It also makes assumptions that are rarely the reality.

FAQs on the Merton Model

The limitations of the Merton model are:

- It’s limited to the European market.

- Risk-free interest rates are a rarity.

- The market is almost never frictionless.

- No returns are assumed which isn’t the case in the actual trading market.

The Merton model handles bankruptcy by treating it as a continuous probability of default. So on the occurrence of default, the stock price is assumed to go to zero.

The spot price is the current market price of a security, currency, or commodity. This is not to be confused with the options strike price.

The BSM model is used to figure out the fair prices of stock options.

Share: