Marginal Benefit: Definition, Formula & Calculation

They say you can never have too much of a good thing.

When a consumer enjoys a product, they would be willing to pay for another one, right?

Marginal benefit takes a look into consumer habits. It considers the maximum amount that a consumer would be willing to pay for an additional good or service.

Read on as we take a closer look at the marginal benefit and marginal cost, and show you how to calculate the marginal benefit of a product.

Table of Contents

KEY TAKEAWAYS

- The marginal benefit is the maximum additional cost that a consumer is willing to pay for an additional purchase of the unit of product.

- The marginal benefit often decreases as consumption increases of the good or service. This is known as the law of diminishing marginal benefits.

- When a consumer is happy to pay more than the market price for an extra unit, it is known as consumer surplus.

- Marginal benefit of necessities such as medicine doesn’t decrease over time.

What Is Marginal Benefit?

A marginal benefit is a maximum amount that a consumer would be willing to pay. This would be for an additional good or service. It’s also the additional utility or satisfaction that a consumer gets when the additional good or service is bought. The marginal benefit that a consumer receives will often decrease as consumption of the good or service increases.

In the world of business, the marginal benefit for a producer is commonly referred to as marginal revenue. It is also used commonly in public services. This is because governments often have to weigh the incremental benefits whilst using minimal resources. These incremental benefits can help a decision maker with the decision making process.

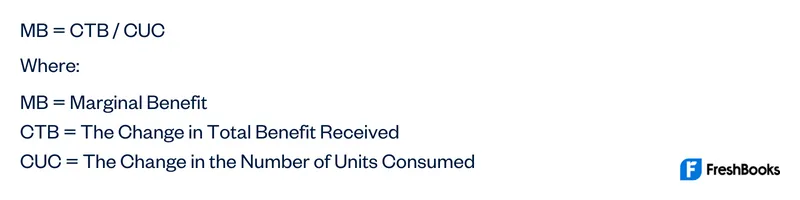

Marginal Benefit Formula

When looking to calculate the marginal benefit, you can use the following formula:

Companies use this formula so that they can analyze the marginal cost average and achieve economies of scale. If a company can capture economies of scale, the dollar cost input of producing a product decreases as the company creates more of it.

Types of Marginal Benefits

There are three main types of marginal benefit. They are as follows:

- Positive marginal benefit

- Negative marginal benefit

- Zero marginal benefit

Let’s take a look at each of these three types in a bit more detail.

1. Positive Marginal Benefit

The positive marginal benefit happens when the consumption of more units of a product brings more happiness to the customer. For example, if someone goes to a cafe and has a coffee, having a second coffee would bring them additional happiness. Therefore, the marginal benefit of consuming a second coffee is positive. This creates a positive relationship between consumer and product.

2. Negative Marginal Benefit

A negative marginal benefit is the exact opposite of a positive marginal benefit. When a customer has too much of a certain product, the additional unit will have negative consequences. Going back to our coffee analogy, if the customer has a third coffee, then they may have consumed too much caffeine. This could lead to negative effects. Therefore the third coffee had a negative marginal benefit. This leads to a negative relationship between the consumer and the product.

3. Zero Marginal Benefit

The third and final main marginal benefit is zero marginal benefits. This is what happens after a customer has more of a product that doesn’t bring any positive or negative effects. For example, if a customer knows that after two coffees they may feel ill, they know that there is zero marginal benefit.

Marginal Benefit vs. Marginal Cost

Marginal benefit and marginal cost are both measures of how the cost of product or service can change. But while marginal benefit will look at how this impacts the customer, marginal cost relates to the producer. When a company is calculating the details of manufacturing, marketing, and pricing, both of these measures can play a key role.

The marginal benefit relates to the maximum amount of money a consumer would be willing to part with for an additional good or service. While marginal cost is the change in the fixed cost when an additional unit of a good or service is produced.

By looking at both the marginal benefit and the marginal cost, companies can find the optimal levels for products. These optimal levels can help increase sales through incremental cost per unit to create an efficient level as well as increase customer satisfaction.

Example of Marginal Benefit

Let’s say that Company X wants to find out their marginal benefit. They know that the total benefit received from owning five production machines is $100,000. Now let’s say that the total value of the benefit received from owning six production machines is $120,000.

With this information, we can use the marginal benefit formula to figure out the marginal benefit of the sixth machine.

MB = (120,000 – 100,000) / (6 – 5)

So in this case, the marginal benefit of the sixth machine would be $20,000.

Summary

The marginal benefit plays a key role when a company is manufacturing, pricing, and marketing a product or service. By being able to understand consumer habits and the psychology behind the service, businesses can strategize accordingly.

When considering the marginal benefit, it is also important to consider the marginal cost. When put together, these measures can help determine a number of benefits for the producer, as well as consumer satisfaction.

FAQs About Marginal Benefit

Marginal benefits can be calculated by taking the number of units produced and dividing it by the change in total cost of the unit price.

Yes, when a consumer consumes too much of a certain good or service, then the additional unit would have negative consequences.

Marginal benefits decrease as the quantity that is consumed increases. This is because consumers commonly receive less satisfaction from consumption. This is as more and more units are being consumed. Consumers will tend to purchase certain units as long as the marginal benefit is higher than the marginal cost.

Net marginal benefit is equal to the total benefit minus the total cost.

Share: