Liquidation Value Definition, Formula, and Example

A difficult truth of business is that it doesn’t always work out.

Thousands of companies go out of business each year for a variety of reasons. Whether it’s because of a shift in the market, poor management, or just simply running out of money.

When a business owner decides to close the doors of their business, they will liquidate their business. That’s where liquidation value comes into play.

But what exactly is the liquidation value? And why is it so important to know?

In this article, we’ll take a closer look at the definition, formula, and an example of liquidation value.

Table of Contents

KEY TAKEAWAYS

- A company’s liquidation value is the net value of all of its physical assets. This is if they were to go out of business and have their assets sold.

- It is a financial instrument used to simulate the worst-case scenario of a company going bankrupt and having to liquidate its assets.

- It can also be used by a financially healthy company. For example when a company is considering a merger or applying for credit from investors.

- It is calculated by subtracting liabilities from the value of assets.

What Is Liquidation Value?

A company’s liquidation value is the net value of all of its physical assets. This is if they were to go out of business and have their assets sold. When calculating a company’s liquidation value, intangible assets are excluded.

It is a financial instrument used to simulate the worst-case scenario of a company going bankrupt and having to liquidate its assets. It can also be used by a financially healthy company. For example when a company is considering a merger or applying for credit from investors.

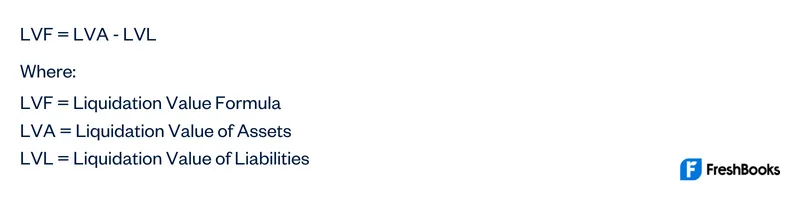

The Liquidation Value Formula

When looking at a company’s liquidation value, it can be worked out using the below formula.

Example of the Liquidation Value

Let’s say that Company X has a listed market capitalization of $50 million on the stock exchange. This company also has liabilities that they have reported which total $15 million. As well as a book value of $40 million. The appraiser has estimated the value of Company X’s assets at $38 million in the auction market.

By using the above formula, we can now work out Company X’s liquidation value.

LV = $38 million – $15 million

So:

LV = $23 million

This is found by taking the auction value of $38 million and subtracting the liabilities of $15 million.

The Three Types of Valuation

There are three different types of valuation used when liquidating a company:

- Book value

- Salvage value

- Market value

Let’s take a closer look at each type.

What Is Book Value?

As you can see in the example above, to figure out the liquidation value it’s important to know the book value.

The book value of assets is the value of an asset in a company’s book of records. This is the value at any given time. It can be calculated as the original cost of the asset. But then minus the impairment costs and accumulated depreciation.

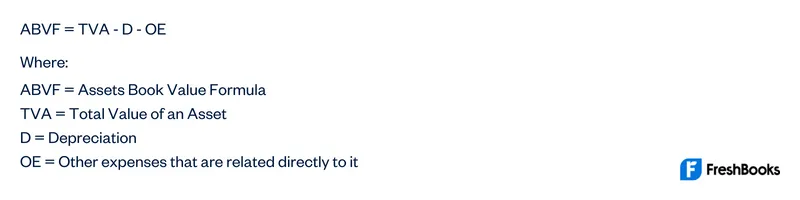

The Book Value Formula

In order to figure out the book value, you have to follow the book value formula. This can be calculated as such:

Book Value Example

Let’s say that Company Y invested in a motor generator for $2,000 in 2017. If Company Y wanted to know the book value of this generator in 2022, then they would first have to figure out the depreciation.

$2,000 / 5 years = $400

If we then assume that there are no other costs involved for the generator, then we can use the book value formula to figure out the book value of the generator in 2022.

ABV = $2,000 – $400 – $0

So:

ABV = $1,600

This is the process that a company would have to do for all of their current assets when they are figuring out their liquidation value.

What Is Salvage Value?

When calculating the liquid value of a company, you also have to take the salvage value of assets into account.

The salvage value is the estimated value of an asset at the end of its useful life. So if a company is being liquidated and they have assets that can no longer be used for their original purpose, they would be valued as salvaged assets.

Salvage Value Formula

The formula used to calculate the salvage value of an asset is as follows:

Salvage Value Example

Let’s say that Company Z bought an asset worth $1 million. They calculated that the useful life of this asset would be around 20 years. The depreciation rate on which they would place on the asset was calculated to be 20%.

To figure out the salvage value of the asset at the end of the 20 years, we would use the salvage value formula:

SV = $1 million (1 – 0.20)20

So:

SV = $11,529.22

This would mean that the salvage value of the now useless item after 20 years would be $11,529.22.

What Is Market Value?

Market value can be defined as the price that a company’s asset would fetch in the marketplace. It can also be the value that investors give to a particular business or equity.

It is perhaps the simplest of the three as it requires no formula. It is merely the price that the marketplace puts upon the item. The market value is typically the highest valuation of an asset. But this can fluctuate depending on market demand.

Liquidation Value Assets

When calculating the liquidation value of a company, you have to figure out the value of its assets. There are two types of assets that a company may have.

- Tangible assets

- Intangible assets

Tangible Assets

Tangible assets are typically assets with a physical form that have a finite monetary value. They are normally the main form of assets for most companies across many industries. They are also the easiest to value and understand.

Examples of tangible assets include:

- Cash

- Inventory

- Vehicles

- Equipment

- Buildings

- Investments

Intangible assets

Intangible assets are not physical in nature and have a floating value. While there is no obvious physical value towards intangible assets, they do provide value for a business.

Examples of intangible assets include:

- Brand recognition

- Intellectual property

- Patents

- Trademarks

- Goodwill

- Computer software

- Licenses

Summary

Knowing your liquidation value is an important part of running your business. It shows you how much you can raise by shutting down your business but also conveys value to investors and creditors.

FAQs About Liquidation Value

When a company is in liquidation, it means that its assets are being liquidated. This is when assets are turned into cash for payment to a company’s creditors.

The majority of the time, a company that’s being liquidated needs to collect funds as quickly as possible. This means that during the process, assets may be sold at a loss and under their market value.

Your net liquidation value is the total value of your portfolio if you were to liquidate all of your business assets. It would be calculated via the current market price.

Common assets that can be easily liquidated are:

- Vehicles

- Real estate

- Raw materials

- Equipment

- Machinery

- Investments

Liquidated cash is the cash you gain from liquidating assets.

Liquidating stocks is the process of selling your stock portfolio in an effort to raise capital.

Share: