Expense Ratio: Definition & Examples

Expense ratio measures the cost of running an investment fund. It is typically expressed as a percentage of assets and reflects operating expenses, such as management fees, accounting costs, and marketing expenses.

Expense ratios are also known as management fees or net expense ratios. An expense ratio can be either positive or negative (i.e., a cost rather than savings).

A positive average expense ratio indicates that you expect to pay more to invest in the fund than its returns will be worth.

A negative average for expense ratio means you can expect to get more from your investment than you pay for it. Depending on the type of fund you’re investing in, the expense ratio may be very important or not very useful in evaluating your investment.

Table of Contents

KEY TAKEAWAYS

- The expense ratio is a ratio used to measure the operating costs of mutual funds relative to the assets.

- There can be various forms of expense ratios. These can include net expense ratio, gross expense ratio, and after reimbursement expense ratio.

- Investors in particular pay attention to the expense ratio to gain insights into whether or not the fund is a good investment.

What Is Expense Ratio?

An expense ratio is a measurement of the operating costs associated with a mutual fund or other types of potential investment. It is sometimes referred to as a management fee, management expense ratio (MER), or net expense ratio.

Expense ratio represents the portion of your investment that is going towards paying ongoing expenses, as opposed to generating returns. It is reported as a percentage that shows how much a fund’s management company is charging you for running the fund.

The vast majority of mutual funds have expense ratios, but there are a few no-load funds that do not charge an expense ratio.

Expenses for mutual funds can include management fees, administrative costs, brokerage commissions, and other miscellaneous expenses that are not directly tied to a specific investment.

Mutual funds are usually required to disclose their expense ratio, but other types of investment funds may not be required to report their expense ratio.

Why Is Expense Ratio Important?

Expense ratio is perhaps the most important piece of information in a fund prospectus. It’s the single greatest determinant of a fund’s performance.

An expense ratio is also the single most important factor when comparing the performance difference in expense ratios. It reflects the cost of running a fund.

A fund manager’s salary, research team, computers, rent, and all the other expenses associated with managing your money are deducted from the fund’s assets.

If a fund has a 1% expense ratio and it has $1 billion in assets, then $10 million will be deducted from those assets to cover the fund’s expenses.

Expense ratio is reported as a percentage. It tells you the amount of money that’s being deducted from your investment each year to cover the fund’s expenses.

How Expense Ratios Work

Expenses come in many forms. Fund managers often receive a salary, research teams may be required to report on companies they are invested in, computers and software may be needed to track investment goals, and employees may be hired to handle paperwork related to the fund.

Other expenses may include rent, travel-related costs, and more. The expenses that are deducted from a fund’s assets are the fund’s expenses.

To calculate expense ratio, take the total expenses for the fund for the most recent fiscal year and divide it by the total assets in the fund. The result is expense ratio.

Let’s assume that a fund has $500 million in assets and it incurred $10 million in expenses during the fiscal year. Expense ratio for the fund would be 0.02%.

Expense Ratio Formula and How to Calculate

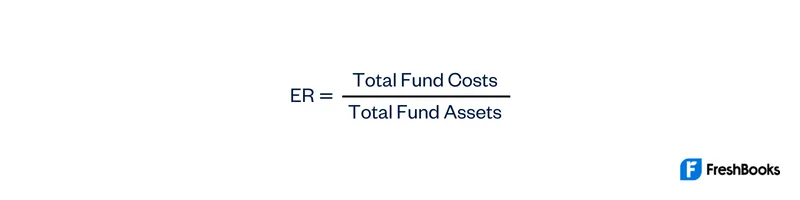

The good news is that using the expense ratio only requires a few bits of information. You’re going to need to know the total fund costs and the total fund assets. From here, you divide the total fund costs by the total fund assets to determine expense ratio.

The formula would look like this:

To calculate expense ratio, take the total expenses for the fund for the most recent fiscal year and divide it by the total assets in the fund.

The result is expense ratio. Let’s assume that a fund has $500 million in assets and it incurred $10 million in expenses during the fiscal year.

Expense ratio for the fund would be 0.02. Expense ratio can also be calculated by taking the annual operating expense and dividing it by the fund’s average net assets.

Components of an Expense Ratio

Expense ratio is made up of a variety of expenses, including management fees, administrative fees, brokerage commissions, and other miscellaneous expenses that are not directly tied to specific investment decisions.

If you’re trying to balance portfolio management, you should hire a portfolio manager to assist you. They can help with fund documentation and manage your fund expenses.

Regardless of the kinds of funds you deal in, an investment manager will serve you well. Especially if you work in one of the larger investment firms.

Just remember that you need to pay management fees to the fund managers. They oversee the fund. They’re typically a percentage of the fund’s assets, ranging from 0.5% to 2%. Administrative fees cover the cost of keeping the fund running.

These expenses can include office supplies, employee salaries, rent, and a variety of other costs. Administrative fees are typically less than 0.5% per year and are the second largest component of expense ratios.

Brokerage commissions are the fees that a fund manager may pay to execute a trade. A fund manager may use a brokerage firm to buy and sell some holdings, as well as to buy and sell shares in the fund itself.

Other miscellaneous expenses can include auditing and legal expenses, marketing costs, and investment advisory fees.

Examples of Expense Ratios

If a fund’s expense ratio is 1%, it will have to generate returns of at least 1% more than expense ratio before the fund can make a profit. The following examples illustrate this point.

Fund A expense ratio is 1%. You must generate a return of 1.11% before the fund can make a profit. Fund B expense ratio is 0.5%. You must generate a return of 1.11% before the fund can make a profit.

Fund C expense ratio is 0.2%. You must generate a return of 1.32% before the fund can make a profit. The higher expense ratio, the more difficult it is for the fund to generate a profitable return. The higher the return, the easier it is for the fund to make a profit.

Summary

An expense ratio helps measure the amount of a mutual fund’s assets that are used for various expenses. Essentially, the expense ratio is a measure of total operating costs compared to assets.

Investors regularly use the expense ratio to gain additional insights into whether or not a fund would be a sound investment. It’s important to note, however, that operating expenses are going to vary depending on the stock or fund. Since an expense ratio will reduce assets, it can also reduce investor returns.

FAQs About Expense Ratio

The best expense ratio is zero. No one likes paying for anything, especially fees. On the other hand, an excessive expense ratio indicates that a fund manager may be charging too much for managing your money.

Since fees are paid from the fund’s assets, an excessively high expense ratio could lead to lower fund returns for investors. Conversely, the lowest expense ratios could result in higher returns.

An excessively high expense ratio is a red flag, especially if it is significantly higher than other funds in the same category. This could indicate that the funds’ manager is charging too much for managing the fund.

Expense ratio is an annual cost, not a daily or monthly cost, so you will be charged the same amount each year. The annual amount charged is recorded in the fund’s prospectus.

Depending on the type of fund you’re investing in, expense ratio may be very important or not very useful in evaluating your investment.

Expense ratio is an annual fee that fund companies charge investors to cover the cost of running the fund. While an expense ratio is often expressed as a percentage of the fund’s assets, it is primarily a measurement of how much a fund management company charges investors to manage their money.

Share: