Equity Multiplier: Definition, Formula & Calculation

Financial ratios allow you to learn more about several areas of a business. You can use the price-per-share ratio, the earnings-per-share ratio, or the price-to-earnings ratio, for example. Each one provides a different range of valuable information.

But what about when you want to find out more about equity? We put together this guide to cover everything you need to know about the equity multiplier and how to use it. Read on to learn more.

Table of Contents

KEY TAKEAWAYS

- The equity multiplier is a measurement of financial leverage, which is the amount of debt used to finance a company’s assets.

- A high equity multiplier means a company’s using a lot of debt to finance its assets, which can make the company more risky and less profitable.

- A low equity multiplier means a company’s using less debt to finance its assets, which can make the company less risky and more profitable.

- The equity multiplier can be used to compare the financial leverage of two companies.

What Is Equity Multiplier?

Equity multiplier is a financial ratio that measures the extent to which a company is financed by debt or equity. High equity multiplier indicates a company is highly leveraged. This means it has borrowed a great deal of money to finance its operations. Low equity multiplier, on the other hand, indicates that a company is less leveraged and has more equity financing.

Equity multiplier can assess a company’s financial risk. High equity multiplier indicates a higher degree of financial risk, since the company is more reliant on debt financing. Low equity multiplier indicates a lower degree of financial risk, since the company is more reliant on equity financing.

Equity multiplier can also compare the financial structure of different companies. A company with a higher equity multiplier is usually considered to be more leveraged than a company with a lower equity multiplier.

Let’s take a closer look at this metric. We will provide some examples and explain the formula in more detail, so stick around to learn more.

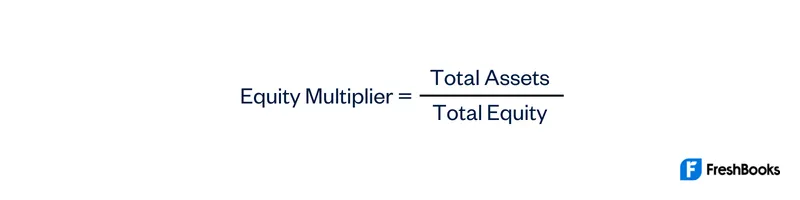

Equity Multiplier Formula

Equity multiplier formula is relatively simple. It’s calculated by dividing a firm’s total assets with total equity.

Total assets are on a company’s balance sheet, while total equity is on a company’s balance sheet or in its shareholder’s equity section.

How to Calculate Equity Multiplier?

Now that we know the equity multiplier formula, let’s take a look at how to calculate it.

As we mentioned earlier, equity multiplier ratio is calculated by dividing a firm’s total assets with total equity.

Total investment in assets is on a company’s balance sheet. Total equity is on a company’s balance sheet or in its shareholder’s equity section.

To calculate the current equity multiplier ratio, you will need to gather the following information:

Total Assets: Assets through equity are on a company’s balance sheet.

Total Equity: This is on a company’s balance sheet or in its shareholder’s equity section.

Once you have all of the necessary information, you can plug it into equity multiplier formula as shown below:

Equity multiplier = Total assets / Total equity

For example, let’s say Company XYZ’s total assets are $1 million and total equity of $500,000. Equity multiplier would be calculated as shown below:

Equity multiplier = $1 million / $500,000 = 2.0x

This means that for every $1 of equity, Company XYZ has $2 of debt ratio or other liabilities. In other words, the company is highly leveraged.

It’s important to note that equity multiplier only provides a snapshot of a company’s financial leverage at a single point in time. To get a more complete picture of a company’s leverage, you would need to calculate equity multiplier over multiple periods of time.

You can use an equity multiplier calculator or manual equity multiplier calculation. Once you have the equity percentage, you can see financing between equity.

The proportion of equity reflects the level of debt. Thus, investors can determine if it’s a healthy company.

Pros and Cons of Equity Multiplier

Equity multiplier is a useful tool for assessing a company’s financial leverage. However, it has its pros and cons.

Some of the pros of the debt ratio equity multiplier include:

- It is a relatively simple ratio to calculate.

- It provides a snapshot of a company’s financial leverage at a single point in time.

- It can compare the financial leverage of different companies.

Some disadvantages of equity multiplier include:

- It only provides a snapshot of a company’s financial leverage at a single point in time. To get a more complete picture of a company’s leverage, you would need to calculate equity multiplier over multiple periods of time.

- It does not take into account the interest payments on debt burden.

- It does not take into account the different types of debt levels a company has.

- It does not take into account the different types of equity a company has.

High vs Low Equity Multiplier

We now know what equity multiplier is and how to calculate it. So let’s take a look at what high equity multiplier and low equity multiplier might mean.

High equity multiplier is a high risk indicator since the company is more reliant on debt financing.

Low equity multiplier is a low risk indicator, since the company is more reliant on equity financing.

Equity multiplier can also compare the financial leverage of different companies. Businesses with a higher equity multiplier generally are more leveraged.

Example of an Equity Multiplier

Let’s look at an example. Assume ABC Company has an equity multiplier of 2. This means that for every $1 of equity, the company has $2 of debt. XYZ Company, however, has an equity multiplier of 1.5. This means that for every $1 of equity, the company has $1.50 of debt.

ABC Company is more leveraged than XYZ Company, and therefore has a higher level of risk. This is because a greater portion of ABC Company’s financing comes from debt, which must be repaid with interest. If ABC Company is unable to generate enough revenue to cover its interest payments, it may default on its debt obligations.

But XYZ Company is less leveraged than ABC Company, and therefore has a lower degree of financial risk. This is because a smaller portion of XYZ Company’s financing comes from debt, which must be repaid with interest. It’s evident that ABC Company is the least appealing of the two companies.

While equity multiplier is a useful tool for assessing financial leverage, it is important to keep in mind its limitations.

As we mentioned above, equity multiplier only provides a snapshot of a company’s financial leverage at a single point in time. To get a more complete picture of a company’s leverage, you would need to calculate equity multiplier over multiple periods of time.

Equity multiplier does not take into account interest payments on debt, types of debt a company has, or types of equity a company has.

Despite its limitations, the asset to equity ratio is a useful tool for assessing a company’s financial leverage. Moreover, it lets investors see what day-to-day operations look like. If business operations are good, the company’s financial leverage will also be good.

This is the sign of a healthy business. Such companies have predictable cash flows and optimal operations. These things are highly appealing to investors.

Summary

The equity multiplier is a great way to calculate the value of an equity investment. It is calculated by dividing the company’s valuation by the number of shares you own.

The equity multiplier is just a calculation, so it doesn’t consider the risk of the investment or your personal situation.

In order to calculate the equity multiplier, you must know the valuation of the company, the amount of money you invested, and the percentage of ownership. It’s an easy way to see how valuable your equity investment is compared to others.

FAQs About Equity Multiplier

There is no one answer to this question. Equity multiplier can compare the financial leverage of different companies. A company with a higher equity multiplier is more leveraged than a company with a lower equity multiplier.

The equity multiplier is a financial ratio that measures the debt-to-equity ratio of a company. This ratio is used by creditors to determine the financial risk of lending money to a company.

There are two ways to increase the equity multiplier: by increasing debt or by decreasing equity.

1) To increase the equity multiplier through increasing debt, a company can take on more debt. This will increase the numerator of the equity multiplier equation, while keeping the denominator (equity) constant. As a result, the equity multiplier will increase.

2) To increase the equity multiplier through decreasing equity, a company can buy back shares of stock or issue a special dividend. This will decrease the denominator of the equation, while keeping the numerator (debt) constant. As a result, the equity multiplier will increase.

No, equity multiplier cannot be negative. This is because it is calculated by dividing total assets with total equity. Since both total assets and total equity are positive numbers, equity multiplier will always be a positive number.

Share: